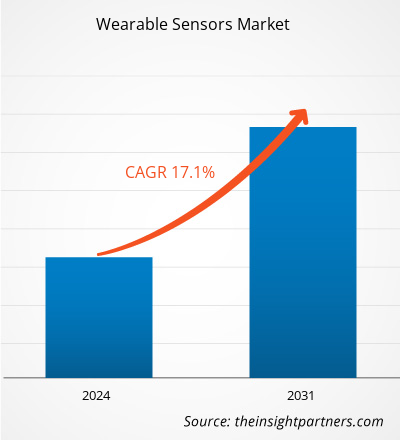

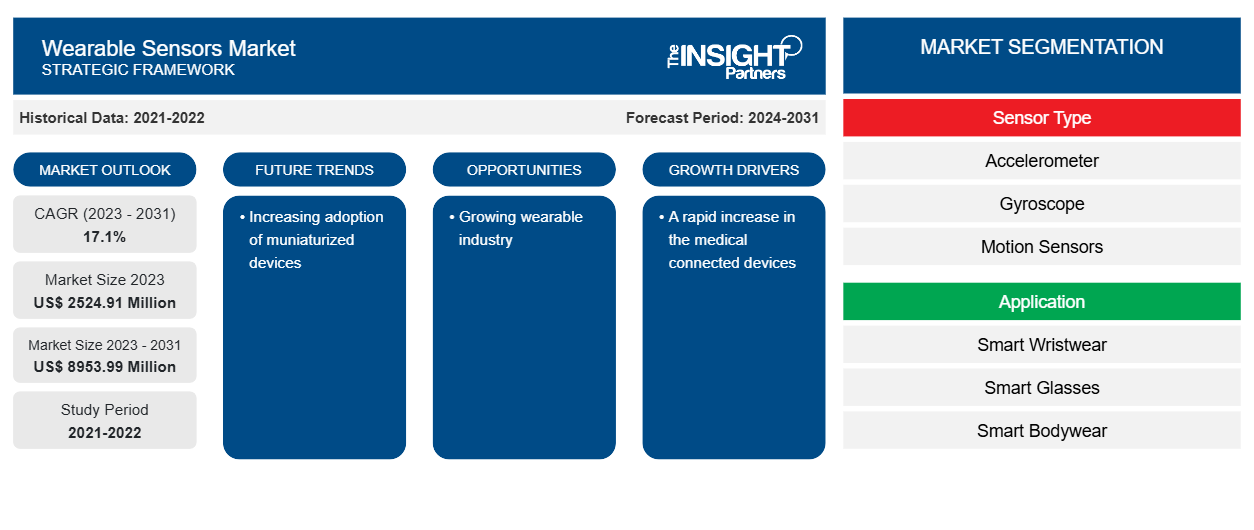

Der Markt für tragbare Sensoren soll von 2524,91 Millionen US-Dollar im Jahr 2023 auf 8953,99 Millionen US-Dollar im Jahr 2031 anwachsen. Der Markt wird im Zeitraum 2023–2031 voraussichtlich eine durchschnittliche jährliche Wachstumsrate von 17,1 % verzeichnen. Die zunehmende Verbreitung miniaturisierter Geräte dürfte ein wichtiger Trend auf dem Markt bleiben.

Marktanalyse für tragbare Sensoren

Ein rasanter Anstieg der Nutzung vernetzter Geräte und Smartphones sowie der wachsende Bedarf an stromsparenden, leichteren und kleineren Sensoren mit ausgereifter Leistung sind die Faktoren, die den Trend zur Miniaturisierung begründen. Fortschritte in der Mikrofertigung und Nanotechnologie haben den Fortschritt des Miniaturisierungsprozesses vorangetrieben und damit die Entstehung intelligenter Stoffe vorangetrieben und intelligente Sensoren kostengünstig gemacht. Im Januar 2022 stellte Abbott Laboratories das Libre 3 System vor, ein System zur Glukoseüberwachung . Die steigende Nachfrage nach tragbaren Geräten treibt also den globalen Markt für tragbare Sensoren an.

Marktübersicht für tragbare Sensoren

Tragbare Sensoren sind Sensoren, die direkt auf der menschlichen Haut oder Kleidung befestigt werden und zum Zweck der persönlichen Gesundheitsfürsorge biologische Signale erfassen . Flexible dünne Filme aus MNPs werden auf die entsprechenden Substrate aufgebracht, um als Gesundheitssignale Temperatur und Druck zu regeln. Mit der Einführung der Technologie des Internets der Dinge (IoT) werden alle möglichen Dinge mit dem Internet verbunden. Im Rahmen dieses Trends werden Fortschritte bei der Entwicklung von Mechanismen zum Sammeln von Daten von tragbaren Geräten und zur Nutzung künstlicher Intelligenz (KI) zum Analysieren dieser Daten gemacht. Tragbare Geräte wie Brillen, Armbanduhren und Armbänder sind bereits erhältlich. Zu den jüngsten Entwicklungen gehören jedoch auch Gegenstände, die täglich getragen werden können, wie etwa Hemden, und hochempfindliche, multifunktionale und leichte flexible Geräte aus dünnen Filmen und Elastomeren.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Treiber und Chancen auf dem Markt für tragbare Sensoren

Ein rasanter Anstieg der vernetzten Medizingeräte

Digitale Gesundheitsfürsorge ist ein weit gefasster Begriff, der Konzepte umfasst, die die Bereiche Gesundheitsfürsorge und Technologie miteinander verbinden. Vernetzte medizinische Geräte sind ein wichtiger Faktor, wenn ein Patient aus der Ferne überwacht werden soll. Diese Geräte verändern die Gesundheitsbranche grundlegend, indem sie Patienten und Gesundheitsdienstleister nahtlos mit medizinischen Informationen verbinden. Seit etwa einem Jahrzehnt ist der technologische Fortschritt Zeuge der Einführung digitaler Gesundheitsgeräte, mit denen Patienten und Anbieter die Kommunikationslücke schließen können. Smartphone-Apps wie Connected BP überwachen den Sauerstoffgehalt, behalten den Überblick und generieren wichtige Daten. Die meisten vernetzten Geräte sind mit unterschiedlichen Funktionen ausgestattet, wie Echtzeitüberwachung und hochauflösender Bildgebung . Dies trägt zur Verbesserung der Gesundheit des Patienten bei. Mit digitaler Gesundheitstechnologie können Patienten von jedem Ort der Welt aus versorgt werden. Tragbare Sensoren werden in solchen Geräten häufig verwendet, was das Marktwachstum für tragbare Sensoren ankurbelt.

Wachsende Wearable-Industrie

Intelligente Mobilgeräte und das Internet der Dinge (IoT) haben die Entwicklung von Wearables vorangetrieben, da sie den Benutzern viele Vorteile bieten und neue Marktchancen schaffen. Von Consumer Wearables, die einen gesünderen Lebensstil unterstützen, bis hin zu medizinischen Wearables, die dabei helfen, die Vitalfunktionen eines Patienten zu kontrollieren – Sensorkomponenten erwecken diese Wearable-Technologien zum Leben und bieten Benutzern Produktivität, ein Gefühl der Sicherheit und gesundheitliche Anreize. Da die Wearable-Industrie weiter wächst, wird der Bedarf an kompakteren, genaueren und zuverlässigeren Sensortechnologien für eine ordnungsgemäße Langzeitfunktionalität von Wearables notwendig.

Segmentierungsanalyse des Marktberichts für tragbare Sensoren

Wichtige Segmente, die zur Ableitung der Marktanalyse für tragbare Sensoren beigetragen haben, sind Sensortyp, Anwendung und Vertikale.

- Basierend auf dem Sensortyp ist der Markt für tragbare Sensoren in Beschleunigungsmesser, Gyroskope, Bewegungssensoren, Bildsensoren, Druck- und Kraftsensoren, Berührungssensoren, Positionssensoren und andere unterteilt. Das kundenspezifische Segment hatte im Jahr 2023 einen größeren Marktanteil.

- Nach Anwendung ist der Markt in Smart-Armbänder, Smart-Brillen, Smart-Bodywear, Smart-Schuhe und andere unterteilt.

- Nach Branchen ist der Markt in die Bereiche Unterhaltungselektronik, Gesundheitswesen sowie Industrie und Unternehmen segmentiert.

Marktanteilsanalyse für tragbare Sensoren nach Geografie

Der geografische Umfang des Marktberichts über tragbare Sensoren ist hauptsächlich in fünf Regionen unterteilt: Nordamerika, Asien-Pazifik, Europa, Naher Osten und Afrika sowie Süd- und Mittelamerika.

Nordamerika dominiert den Markt für tragbare Sensoren. Laut der GSM Association wurde prognostiziert, dass die Smartphone-Penetrationsrate in Nordamerika im Jahr 2021 bei etwa 81 % liegen wird. Der Verband gab außerdem an, dass etwa 329 Millionen Menschen Mobilfunkdienste abonniert haben. Der Mobilfunk ist weiterhin ein Wirtschaftsfaktor, wobei mobile Dienste und Technologien im Jahr 2021 in Nordamerika 4,2 % des BIP erwirtschaften. Diese hohe Penetrationsrate ist auf verschiedene Faktoren zurückzuführen, darunter weit verbreiteter Internetzugang, fortschrittliche Telekommunikationsinfrastruktur und ein hoher Lebensstandard. Daher steigt die Nachfrage nach tragbaren Sensoren in der Region.

Regionale Einblicke in den Markt für tragbare Sensoren

Die regionalen Trends und Faktoren, die den Markt für tragbare Sensoren während des gesamten Prognosezeitraums beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie für tragbare Sensoren in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Holen Sie sich die regionalen spezifischen Daten für den Markt für tragbare Sensoren

Umfang des Marktberichts über tragbare Sensoren

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2023 | 2524,91 Millionen US-Dollar |

| Marktgröße bis 2031 | 8953,99 Millionen US-Dollar |

| Globale CAGR (2023 - 2031) | 17,1 % |

| Historische Daten | 2021-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente |

Nach Sensortyp

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für tragbare Sensoren: Deren Auswirkungen auf die Geschäftsdynamik

Der Markt für tragbare Sensoren wächst rasant, angetrieben durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Markt für tragbare Sensoren tätigen Unternehmen sind:

- Texas Instruments Incorporated

- NXP Semiconductors

- Analog Devices Inc

- STMicroelectronics

- Infineon Technologies AG

- Sensirion AG

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für tragbare Sensoren

Marktnachrichten und aktuelle Entwicklungen zu tragbaren Sensoren

Der Markt für tragbare Sensoren wird durch die Erhebung qualitativer und quantitativer Daten nach Primär- und Sekundärforschung bewertet, die wichtige Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken umfasst. Nachfolgend sind einige der Entwicklungen auf dem Markt für tragbare Sensoren aufgeführt:

- Signify gab bekannt, dass im kürzlich eingeweihten Ahmed Hamdy 2 Tunnel LED-Beleuchtung installiert wird. Signify verwendet die neuesten Beleuchtungssysteme, die internationalen Spezifikationen entsprechen, um eine Fernsteuerung der Beleuchtung zu ermöglichen und gleichzeitig bis zu 70 % Energieeinsparungen zu erzielen. (Quelle: Signify, Pressemitteilung, Oktober 2021)

- Die Tungsram Group unterzeichnete im Dezember einen Vertrag zur Installation der Beleuchtung des „Túnel de Tresponts“ in Spanien. Das Projekt ist der sechste Tunnelbeleuchtungsauftrag, den das in Budapest ansässige Unternehmen im Jahr 2020 in Spanien erhalten hat, was angesichts der durch die Coronavirus-Pandemie verursachten wirtschaftlichen Schwierigkeiten eine beachtliche Leistung darstellt. (Quelle: Tungsram Group, Pressemitteilung, September 2022)

Marktbericht zu tragbaren Sensoren – Abdeckung und Ergebnisse

Der Bericht „Marktgröße und Prognose für tragbare Sensoren (2021–2031)“ bietet eine detaillierte Analyse des Marktes, die die folgenden Bereiche abdeckt:

- Marktgröße und Prognose für tragbare Sensoren auf globaler, regionaler und Länderebene für alle wichtigen Marktsegmente, die im Rahmen des Berichts abgedeckt sind

- Markttrends für tragbare Sensoren sowie Marktdynamik wie Treiber, Einschränkungen und wichtige Chancen

- Detaillierte PEST/Porters Five Forces- und SWOT-Analyse

- Marktanalyse für tragbare Sensoren, die wichtige Markttrends, globale und regionale Rahmenbedingungen, wichtige Akteure, Vorschriften und aktuelle Marktentwicklungen umfasst

- Branchenlandschaft und Wettbewerbsanalyse, einschließlich Marktkonzentration, Heatmap-Analyse, prominenten Akteuren und aktuellen Entwicklungen auf dem Markt für tragbare Sensoren

- Detaillierte Firmenprofile

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für tragbare Sensoren

Kostenlose Probe anfordern für - Markt für tragbare Sensoren