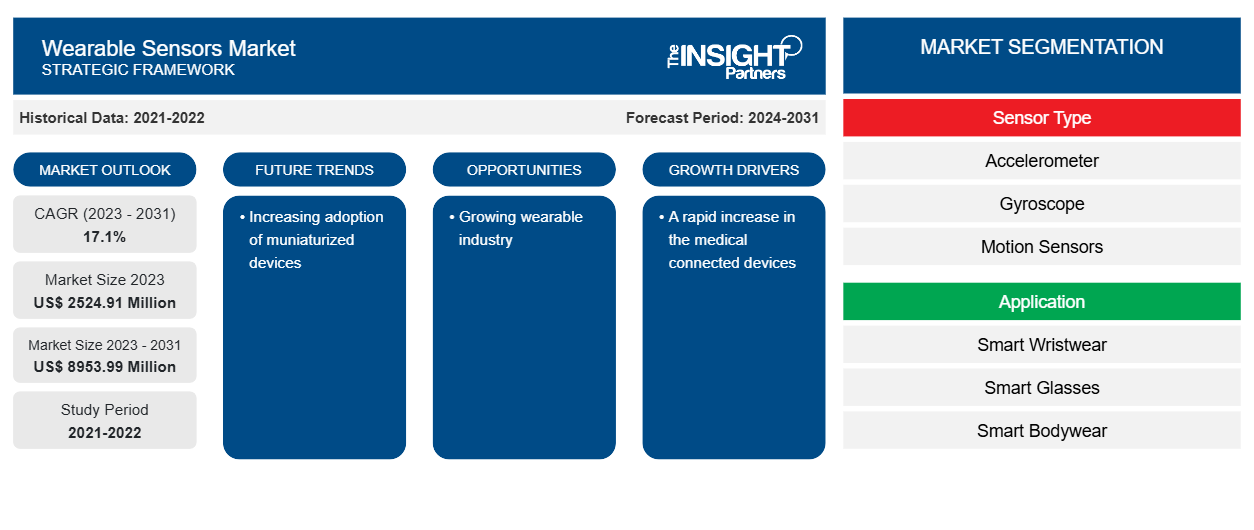

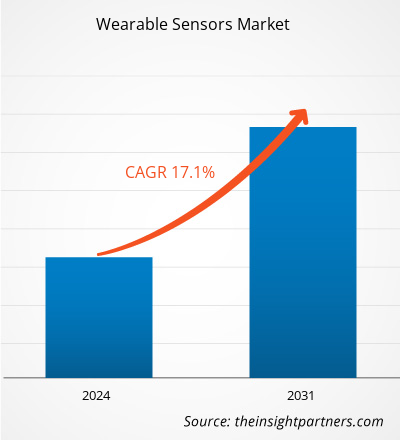

Si prevede che la dimensione del mercato dei sensori indossabili raggiungerà 8953,99 milioni di dollari entro il 2031, rispetto ai 2524,91 milioni di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 17,1% nel periodo 2023-2031. È probabile che l'adozione crescente di dispositivi miniaturizzati rimanga una tendenza chiave nel mercato.

Analisi di mercato dei sensori indossabili

Un rapido aumento nell'uso di dispositivi connessi e smartphone e la crescente necessità di sensori a basso consumo, più leggeri e più piccoli con prestazioni sviluppate sono i fattori che stabiliscono la tendenza della miniaturizzazione. I progressi nelle tecnologie di microfabbricazione e nanotecnologia hanno accelerato il progresso del processo di miniaturizzazione, ancorando così l'emergere di tessuti intelligenti e rendendo i sensori intelligenti convenienti. Future, Abbott Laboratories ha dimostrato il sistema Libre 3, un sistema di monitoraggio del glucosio , nel gennaio 2022. Pertanto, la crescente domanda di dispositivi indossabili guida il mercato globale dei sensori indossabili.

Panoramica del mercato dei sensori indossabili

I sensori indossabili sono sensori che vengono direttamente attaccati alla pelle umana o ai vestiti per raccogliere segnali biologici allo scopo di fornire assistenza sanitaria personale . Film sottili flessibili di MNP vengono depositati sui substrati appropriati per il controllo della temperatura e della pressione come segnali di salute. Con l'introduzione della tecnologia Internet of Things (IoT), tutti i tipi di cose vengono connesse a Internet. Come parte di questa tendenza, si stanno facendo progressi nella creazione di meccanismi per raccogliere dati da dispositivi indossabili e utilizzare l'intelligenza artificiale (IA) per analizzare questi dati. Dispositivi indossabili come occhiali, orologi da polso e braccialetti sono già disponibili. Tuttavia, gli sviluppi recenti includono articoli che possono essere indossati ogni giorno, come magliette e dispositivi flessibili altamente sensibili, multifunzionali e leggeri realizzati utilizzando film sottili ed elastomeri.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato dei sensori indossabili: approfondimenti strategici

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei sensori indossabili

Un rapido aumento dei dispositivi medici connessi

L'assistenza sanitaria digitale è un concetto espansivo che include concetti che sono collegati tra assistenza sanitaria e tecnologia. I dispositivi medici connessi sono un fattore importante quando un paziente deve essere monitorato da remoto. Questi dispositivi stanno davvero trasformando il settore sanitario collegando senza soluzione di continuità pazienti e operatori sanitari con informazioni mediche. Per circa un decennio, il progresso tecnologico ha assistito all'inizio di dispositivi sanitari digitali che consentono a pazienti e operatori di ridurre il divario di comunicazione. Le app per smartphone come Connected BP monitorano i livelli di ossigeno, tengono traccia e generano dati significativi. La maggior parte dei dispositivi connessi è dotata di diverse capacità, come il monitoraggio in tempo reale e l'imaging ad alta risoluzione . Ciò contribuisce a migliorare la salute del paziente. Con la tecnologia sanitaria digitale, i pazienti possono ricevere cure da qualsiasi area del mondo. I sensori indossabili sono ampiamente utilizzati in tali dispositivi, aumentando la crescita del mercato dei sensori indossabili.

Crescita del settore indossabile

I dispositivi mobili intelligenti e l'Internet of Things (IoT) hanno migliorato lo sviluppo dei dispositivi indossabili poiché offrono molti vantaggi agli utenti e creano nuove opportunità sul mercato. Dai dispositivi indossabili per i consumatori che supportano uno stile di vita più sano ai dispositivi indossabili medici che aiutano a controllare i segni vitali di un paziente, i componenti di rilevamento aiutano a dare vita a queste tecnologie indossabili, offrendo agli utenti produttività, un senso di sicurezza e incentivi per la salute. Man mano che il settore dei dispositivi indossabili continua a crescere, diventa necessaria la necessità di tecnologie di rilevamento più compatte, accurate e affidabili per una corretta funzionalità a lungo termine nei dispositivi indossabili.

Analisi della segmentazione del rapporto di mercato dei sensori indossabili

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato dei sensori indossabili sono il tipo di sensore, l'applicazione e il settore verticale.

- In base al tipo di sensore, il mercato dei sensori indossabili è suddiviso in accelerometri, giroscopi, sensori di movimento, sensori di immagine, sensori di pressione e forza, sensori tattili, sensori di posizione e altri. Il segmento personalizzato ha detenuto una quota di mercato maggiore nel 2023.

- In base all'applicazione, il mercato è segmentato in dispositivi da polso intelligenti, occhiali intelligenti, indumenti sportivi intelligenti, calzature intelligenti e altri.

- In base al settore verticale, il mercato è segmentato in elettronica di consumo, sanità, industria e impresa.

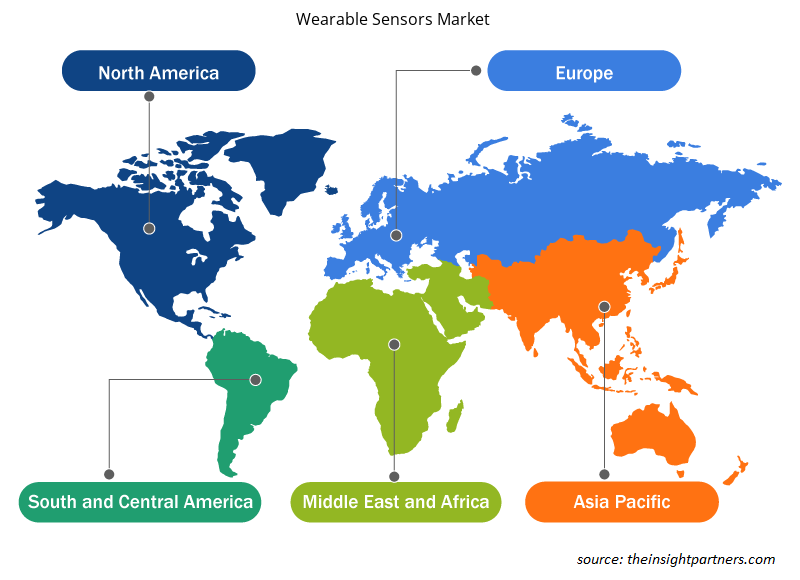

Analisi della quota di mercato dei sensori indossabili per area geografica

L'ambito geografico del rapporto sul mercato dei sensori indossabili è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, Sud e Centro America.

Il Nord America domina il mercato dei sensori indossabili. Secondo la GSM Association, si prevedeva che il tasso di penetrazione degli smartphone in Nord America fosse di circa l'81% nel 2021. L'associazione ha anche affermato che circa 329 milioni di persone si sono abbonate a servizi di telefonia mobile. Il mobile continua ad aumentare l'economia, con servizi di telefonia mobile e tecnologie che generano il 4,2% del PIL nel 2021, in Nord America. Questo elevato tasso di penetrazione può essere attribuito a vari fattori, tra cui un accesso diffuso a Internet, infrastrutture di telecomunicazioni avanzate e un elevato tenore di vita. Pertanto, la domanda di sensori indossabili è in aumento nella regione.

Approfondimenti regionali sul mercato dei sensori indossabili

Le tendenze regionali e i fattori che influenzano il mercato dei sensori indossabili durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dei sensori indossabili in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America centrale e meridionale.

- Ottieni i dati specifici regionali per il mercato dei sensori indossabili

Ambito del rapporto di mercato sui sensori indossabili

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 2524,91 milioni di dollari USA |

| Dimensioni del mercato entro il 2031 | 8953,99 milioni di dollari USA |

| CAGR globale (2023-2031) | 17,1% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo di sensore

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato dei sensori indossabili: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei sensori indossabili sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei sensori indossabili sono:

- Società per azioni Texas Instruments

- Semiconduttori NXP

- Dispositivi analogici Inc.

- STMicroelettronica

- Infineon Technologies AG

- Sensirion AG

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei sensori indossabili

Notizie di mercato e sviluppi recenti sui sensori indossabili

Il mercato dei sensori indossabili viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato dei sensori indossabili:

- Signify ha annunciato l'installazione di illuminazione a LED nel tunnel Ahmed Hamdy 2 inaugurato di recente. Signify utilizza i più recenti sistemi di illuminazione che soddisfano le specifiche internazionali per consentire il controllo remoto dell'illuminazione, offrendo al contempo fino al 70% di risparmio energetico. (Fonte: Signify, comunicato stampa, ottobre 2021)

- A dicembre, Tungsram Group ha firmato un accordo per installare l'illuminazione del "Túnel de Tresponts" in Spagna. Il progetto segna il sesto contratto di illuminazione di tunnel che l'azienda con sede a Budapest si è aggiudicata in Spagna nel 2020, un risultato notevole alla luce delle difficoltà economiche causate dalla pandemia di coronavirus. (Fonte: Tungsram Group, comunicato stampa, settembre 2022)

Copertura e risultati del rapporto sul mercato dei sensori indossabili

Il rapporto "Dimensioni e previsioni del mercato dei sensori indossabili (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dei sensori indossabili a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato dei sensori indossabili e dinamiche di mercato come driver, sistemi di ritenuta e opportunità chiave

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- analisi di mercato dei sensori indossabili che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato dei sensori indossabili

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei sensori indossabili

Ottieni un campione gratuito per - Mercato dei sensori indossabili