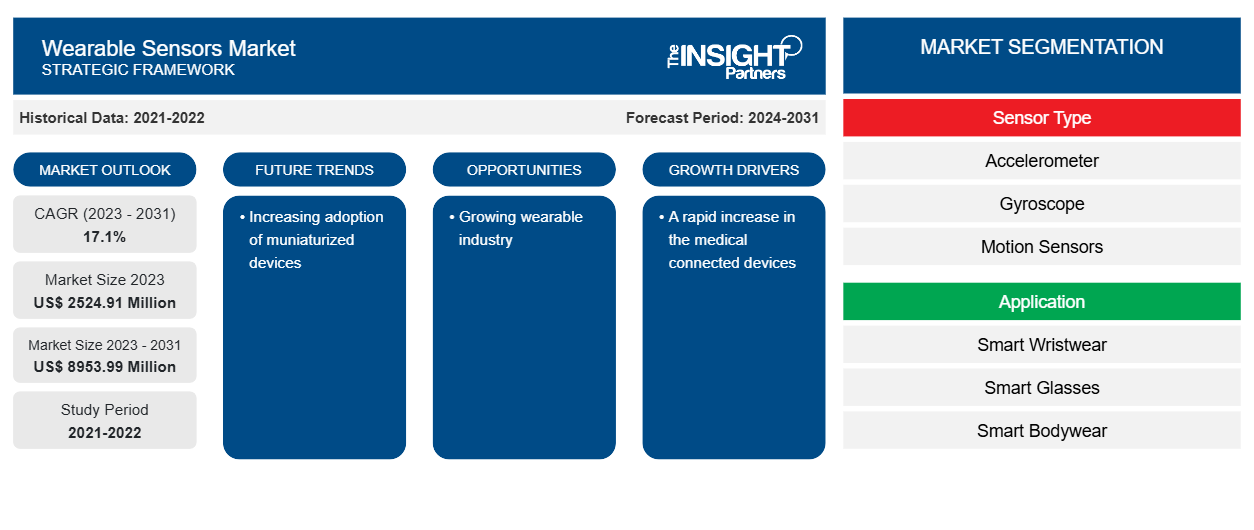

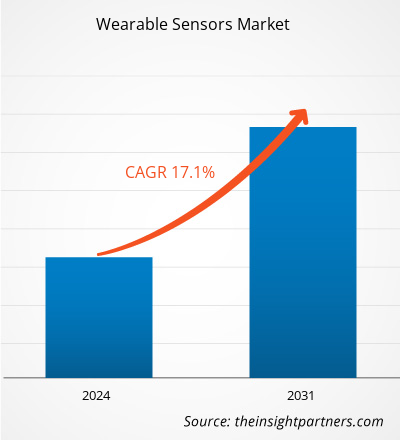

La taille du marché des capteurs portables devrait atteindre 8 953,99 millions USD d'ici 2031, contre 2 524,91 millions USD en 2023. Le marché devrait enregistrer un TCAC de 17,1 % au cours de la période 2023-2031. L'adoption croissante d'appareils miniaturisés devrait rester une tendance clé du marché.

Analyse du marché des capteurs portables

L'augmentation rapide de l'utilisation des appareils connectés et des smartphones et le besoin croissant de capteurs à faible consommation, plus légers et plus petits avec des performances développées sont les facteurs qui établissent la tendance à la miniaturisation. Les progrès des technologies de microfabrication et de nanotechnologie ont stimulé les progrès du processus de miniaturisation, ancrant ainsi l'émergence de tissus intelligents et rendant les capteurs intelligents rentables. À l'avenir, Abbott Laboratories a présenté le système Libre 3, un système de surveillance du glucose , en janvier 2022. Ainsi, la demande croissante d'appareils portables stimule le marché mondial des capteurs portables.

Aperçu du marché des capteurs portables

Les capteurs portables sont des capteurs qui sont directement fixés sur la peau humaine ou sur les vêtements pour recueillir des signaux biologiques dans le but de soins de santé personnels . Des films minces flexibles de MNP sont déposés sur les substrats appropriés pour contrôler la température et la pression en tant que signaux de santé. Avec l'introduction de la technologie de l'Internet des objets (IoT), toutes sortes d'objets sont connectés à Internet. Dans le cadre de cette tendance, des progrès sont réalisés dans la création de mécanismes de collecte de données à partir d'appareils portables et d'utilisation de l'intelligence artificielle (IA) pour analyser ces données. Des appareils portables tels que des lunettes, des montres-bracelets et des bracelets sont déjà disponibles. Néanmoins, les développements récents incluent des articles qui peuvent être portés tous les jours, tels que des chemises, et des appareils flexibles très sensibles, multifonctionnels et légers fabriqués à partir de films minces et d'élastomères.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

Marché des capteurs portables : informations stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des capteurs portables

Une augmentation rapide des appareils médicaux connectés

La santé numérique est un concept vaste qui comprend des concepts liés aux soins de santé et à la technologie. Les appareils médicaux connectés sont un facteur majeur lorsqu'un patient doit être surveillé à distance. Ces appareils transforment véritablement le secteur de la santé en connectant de manière transparente les patients et les prestataires de soins de santé aux informations médicales. Depuis une dizaine d'années, les progrès technologiques ont vu le début des appareils de santé numériques qui permettent aux patients et aux prestataires de réduire le fossé de communication. Les applications pour smartphone telles que Connected BP surveillent les niveaux d'oxygène, assurent le suivi et génèrent des données importantes. La plupart des appareils connectés sont équipés de capacités variées, telles que la surveillance en temps réel et l'imagerie haute résolution . Cela contribue à améliorer la santé du patient. Grâce à la technologie de la santé numérique, les patients peuvent recevoir des soins depuis n'importe quelle région du monde. Les capteurs portables sont largement utilisés dans ces appareils, ce qui stimule la croissance du marché des capteurs portables.

Croissance de l'industrie des objets connectés

Les appareils mobiles intelligents et l'Internet des objets (IoT) ont favorisé le développement des objets connectés, car ils offrent de nombreux avantages aux utilisateurs et créent de nouvelles opportunités sur le marché. Des objets connectés grand public qui favorisent un mode de vie plus sain aux objets connectés médicaux qui aident à contrôler les signes vitaux d'un patient, les composants de détection contribuent à donner vie à ces technologies portables, offrant aux utilisateurs productivité, sentiment de sécurité et incitations en matière de santé. À mesure que l'industrie des objets connectés continue de croître, le besoin de technologies de détection plus compactes, plus précises et plus fiables devient nécessaire pour un bon fonctionnement à long terme des objets connectés.

Analyse de segmentation du rapport sur le marché des capteurs portables

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des capteurs portables sont le type de capteur, l’application et la verticale.

- En fonction du type de capteur, le marché des capteurs portables est divisé en accéléromètres, gyroscopes, capteurs de mouvement, capteurs d'image, capteurs de pression et de force, capteurs tactiles, capteurs de position et autres. Le segment personnalisé détenait une part de marché plus importante en 2023.

- Par application, le marché est segmenté en montres intelligentes, lunettes intelligentes, vêtements de corps intelligents, chaussures intelligentes et autres.

- Par secteur vertical, le marché est segmenté en électronique grand public, soins de santé, industrie et entreprise.

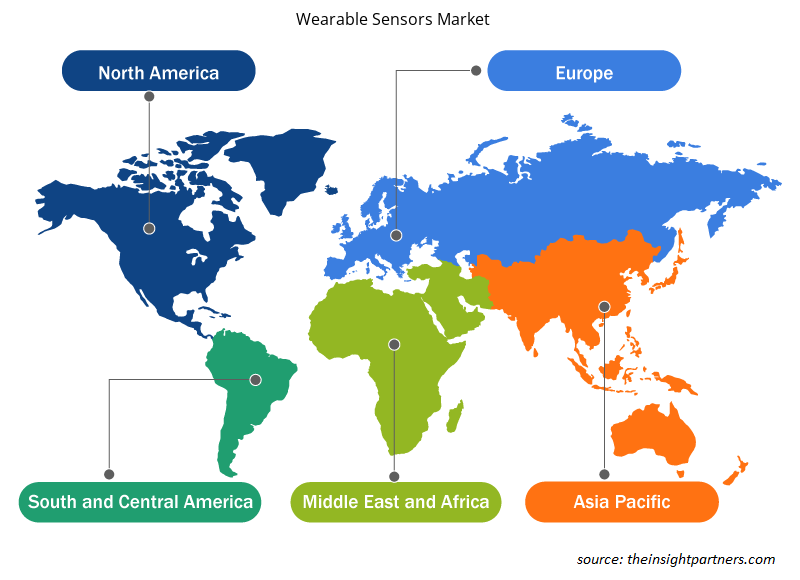

Analyse des parts de marché des capteurs portables par zone géographique

La portée géographique du rapport sur le marché des capteurs portables est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

L'Amérique du Nord domine le marché des capteurs portables. Selon la GSM Association, le taux de pénétration des smartphones en Amérique du Nord devrait être d'environ 81 % en 2021. L'association a également déclaré qu'environ 329 millions de personnes se sont abonnées à des services mobiles. La téléphonie mobile continue de contribuer à l'économie, les services mobiles et technologiques générant 4,2 % du PIB en 2021 en Amérique du Nord. Ce taux de pénétration élevé peut être attribué à divers facteurs, notamment un accès généralisé à Internet, une infrastructure de télécommunications avancée et un niveau de vie élevé. Ainsi, la demande de capteurs portables augmente dans la région.

Aperçu régional du marché des capteurs portables

Les tendances régionales et les facteurs influençant le marché des capteurs portables tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des capteurs portables en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des capteurs portables

Portée du rapport sur le marché des capteurs portables

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 2 524,91 millions de dollars américains |

| Taille du marché d'ici 2031 | 8 953,99 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 17,1% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type de capteur

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des capteurs portables : comprendre son impact sur la dynamique commerciale

Le marché des capteurs portables connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des capteurs portables sont :

- Texas Instruments Incorporated

- Semi-conducteurs NXP

- Appareils analogiques Inc.

- STMicroelectronics

- Infineon Technologies AG

- Sensirion AG

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des capteurs portables

Actualités et développements récents du marché des capteurs portables

Le marché des capteurs portables est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements du marché des capteurs portables sont répertoriés ci-dessous :

- Signify a annoncé l'installation d'un éclairage LED dans le tunnel Ahmed Hamdy 2 récemment inauguré. Signify utilise les derniers systèmes d'éclairage conformes aux spécifications internationales pour permettre le contrôle à distance de l'éclairage tout en réalisant jusqu'à 70 % d'économies d'énergie. (Source : Signify, communiqué de presse, octobre 2021)

- Le groupe Tungsram a signé en décembre un accord pour l’installation de l’éclairage du « Túnel de Tresponts » en Espagne. Ce projet marque le sixième contrat d’éclairage de tunnel remporté par l’entreprise basée à Budapest en Espagne en 2020, une avancée considérable au vu des difficultés économiques causées par la pandémie de coronavirus. (Source : Groupe Tungsram, communiqué de presse, septembre 2022)

Rapport sur le marché des capteurs portables : couverture et livrables

Le rapport « Taille et prévisions du marché des capteurs portables (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des capteurs portables aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché des capteurs portables ainsi que dynamique du marché telles que les moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- analyse du marché des capteurs portables couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents du marché des capteurs portables

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des capteurs portables

Obtenez un échantillon gratuit pour - Marché des capteurs portables