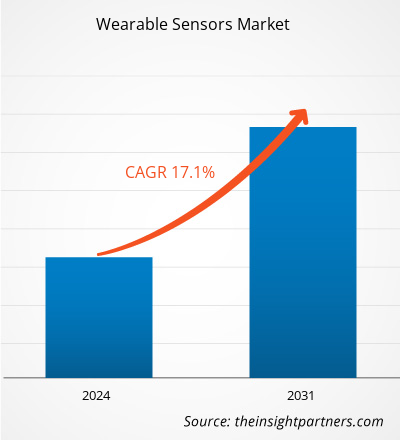

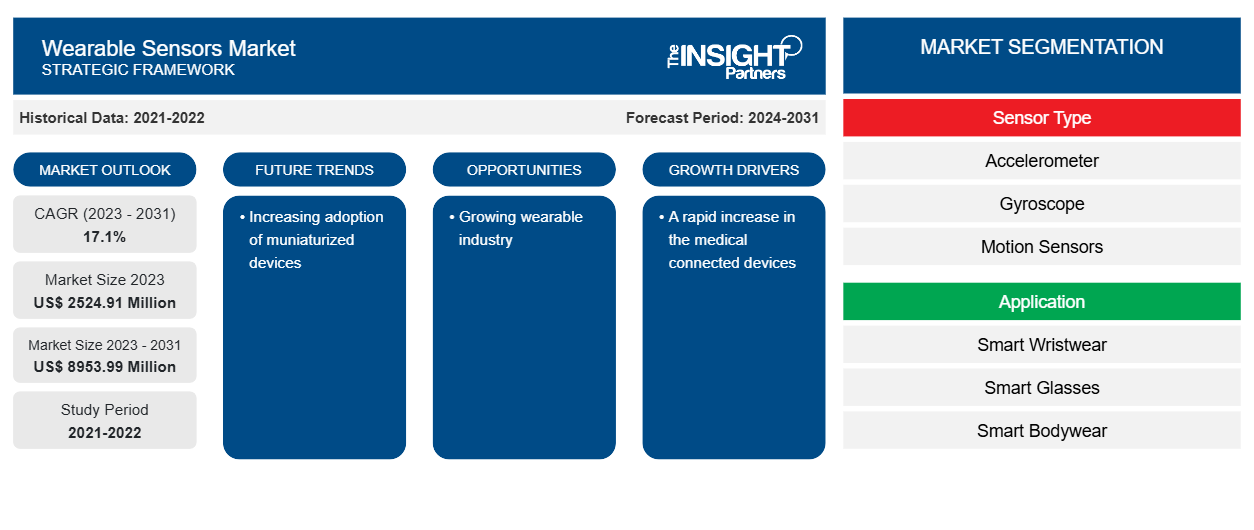

Se prevé que el tamaño del mercado de sensores portátiles alcance los 8953,99 millones de dólares estadounidenses en 2031, frente a los 2524,91 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 17,1 % durante el período 2023-2031. Es probable que la creciente adopción de dispositivos miniaturizados siga siendo una tendencia clave en el mercado.

Análisis del mercado de sensores portátiles

El rápido aumento del uso de dispositivos conectados y teléfonos inteligentes y la creciente necesidad de sensores de bajo consumo, más ligeros, más pequeños y con un rendimiento desarrollado son los factores que establecen la tendencia a la miniaturización. Los avances en las tecnologías de microfabricación y nanotecnología han impulsado el progreso del proceso de miniaturización, consolidando así la aparición de tejidos inteligentes y haciendo que los sensores inteligentes sean rentables. En el futuro, Abbott Laboratories demostró el sistema Libre 3, un sistema de monitorización de la glucosa , en enero de 2022. Por lo tanto, la creciente demanda de dispositivos portátiles impulsa el mercado mundial de sensores portátiles.

Descripción general del mercado de sensores portátiles

Los sensores portátiles son sensores que se adhieren directamente a la piel o la ropa humana para recopilar señales biológicas con el fin de brindar atención médica personal . Se depositan películas delgadas y flexibles de MNP sobre los sustratos adecuados para el control de la temperatura y la presión como señales de salud. Con la introducción de la tecnología de Internet de las cosas (IoT), todo tipo de cosas se están conectando a Internet. Como parte de esta tendencia, se está avanzando en la creación de mecanismos para recopilar datos de dispositivos portátiles y utilizar inteligencia artificial (IA) para analizar estos datos. Los dispositivos portátiles, como gafas, relojes de pulsera y pulseras, ya están disponibles. Sin embargo, los desarrollos recientes incluyen artículos que se pueden usar todos los días, como camisetas, y dispositivos flexibles altamente sensibles, multifuncionales y livianos hechos con películas delgadas y elastómeros.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de sensores portátiles

Un rápido aumento de los dispositivos médicos conectados

La atención médica digital es un concepto expansivo que incluye conceptos que están conectados entre la atención médica y la tecnología. Los dispositivos médicos conectados son un factor importante cuando se debe monitorear a un paciente de forma remota. Estos dispositivos están transformando verdaderamente la industria de la atención médica al conectar sin problemas a los pacientes y los proveedores de atención médica con información médica. Durante aproximadamente una década, el avance tecnológico ha sido testigo del comienzo de los dispositivos de atención médica digitales que permiten a los pacientes y proveedores reducir la brecha de comunicación. Las aplicaciones para teléfonos inteligentes, como Connected BP, monitorean los niveles de oxígeno, realizan un seguimiento y generan datos importantes. La mayoría de los dispositivos conectados están equipados con diversas capacidades, como monitoreo en tiempo real e imágenes de alta resolución . Esto contribuye a mejorar la salud del paciente. Con la tecnología de salud digital, los pacientes pueden recibir atención desde cualquier área del mundo. Los sensores portátiles se utilizan ampliamente en dichos dispositivos, lo que impulsa el crecimiento del mercado de sensores portátiles.

Creciente industria de wearables

Los dispositivos móviles inteligentes y la Internet de las cosas (IoT) han mejorado el desarrollo de los wearables, ya que ofrecen muchos beneficios a los usuarios y crean nuevas oportunidades en el mercado. Desde wearables para consumidores que fomentan un estilo de vida más saludable hasta wearables médicos que ayudan a controlar los signos vitales de un paciente, los componentes de detección ayudan a dar vida a estas tecnologías wearables, ofreciendo a los usuarios productividad, una sensación de seguridad e incentivos de salud. A medida que la industria de los wearables continúa creciendo, la necesidad de tecnologías de detección más compactas, precisas y confiables se vuelve necesaria para una funcionalidad adecuada a largo plazo en los wearables.

Análisis de segmentación del informe de mercado de sensores portátiles

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de sensores portátiles son el tipo de sensor, la aplicación y la vertical.

- Según el tipo de sensor, el mercado de sensores portátiles se divide en acelerómetros, giroscopios, sensores de movimiento, sensores de imagen, sensores de presión y fuerza, sensores táctiles, sensores de posición y otros. El segmento personalizado tuvo una mayor participación de mercado en 2023.

- Por aplicación, el mercado está segmentado en pulseras inteligentes, gafas inteligentes, ropa corporal inteligente, calzado inteligente y otros.

- Por vertical, el mercado está segmentado en electrónica de consumo, atención médica e industrial y empresarial.

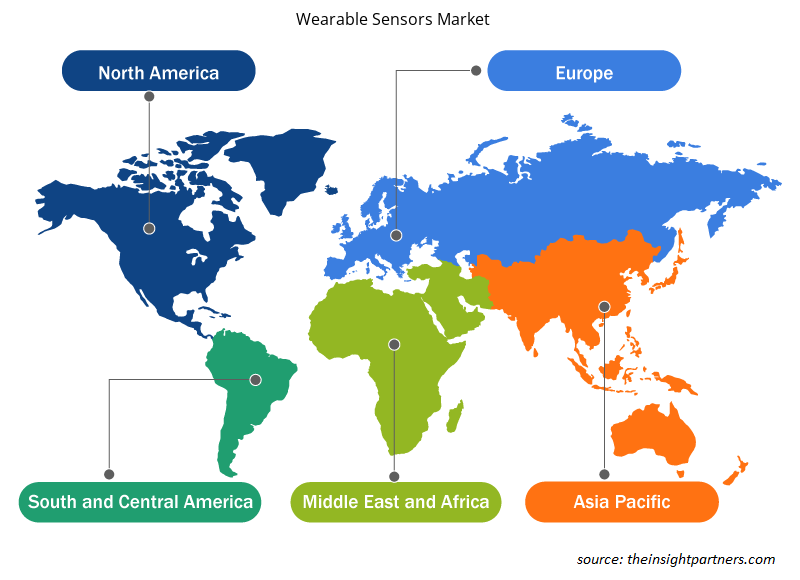

Análisis de la cuota de mercado de sensores portátiles por geografía

El alcance geográfico del informe del mercado de sensores portátiles se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

América del Norte domina el mercado de sensores portátiles. Según la Asociación GSM, se proyectó que la tasa de penetración de teléfonos inteligentes en América del Norte fue de alrededor del 81% en 2021. La asociación también afirmó que ~329 millones de personas se han suscrito a servicios móviles. La telefonía móvil sigue contribuyendo a la economía, y las tecnologías móviles generaron el 4,2% del PIB en 2021 en América del Norte. Esta alta tasa de penetración se puede atribuir a varios factores, incluido el acceso generalizado a Internet, la infraestructura de telecomunicaciones avanzada y un alto nivel de vida. Por lo tanto, la demanda de sensores portátiles está aumentando en la región.

Perspectivas regionales del mercado de sensores portátiles

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sensores portátiles durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sensores portátiles en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sensores portátiles

Alcance del informe de mercado de sensores portátiles

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 2524,91 millones |

| Tamaño del mercado en 2031 | US$ 8953,99 millones |

| CAGR global (2023 - 2031) | 17,1% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de sensor

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sensores portátiles: comprensión de su impacto en la dinámica empresarial

El mercado de sensores portátiles está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sensores portátiles son:

- Texas Instruments Incorporated

- Semiconductores NXP

- Dispositivos analógicos Inc.

- STMicroelectrónica

- Tecnologías Infineon AG

- Sensirion AG

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sensores portátiles

Noticias y desarrollos recientes del mercado de sensores portátiles

El mercado de sensores portátiles se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de investigaciones primarias y secundarias, que incluyen publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de sensores portátiles:

- Signify anunció la instalación de iluminación LED en el túnel Ahmed Hamdy 2, inaugurado recientemente. Signify utiliza los sistemas de iluminación más modernos que cumplen con las especificaciones internacionales para permitir el control remoto de la iluminación y, al mismo tiempo, ofrecer un ahorro energético de hasta el 70 %. (Fuente: Signify, comunicado de prensa, octubre de 2021)

- El Grupo Tungsram firmó en diciembre un acuerdo para instalar la iluminación del Túnel de Tresponts en España. El proyecto supone el sexto contrato de iluminación de túneles que la empresa con sede en Budapest ha conseguido en España en 2020, un logro considerable a la luz de las dificultades económicas provocadas por la pandemia del coronavirus. (Fuente: Grupo Tungsram, Nota de prensa, septiembre de 2022)

Informe sobre el mercado de sensores portátiles: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sensores portátiles (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de sensores portátiles y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de sensores portátiles, así como dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado de sensores portátiles que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Panorama de la industria y análisis de la competencia que abarca la concentración del mercado, análisis de mapas de calor, actores destacados y desarrollos recientes para el mercado de sensores portátiles

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sensores portátiles

Obtenga una muestra gratuita para - Mercado de sensores portátiles