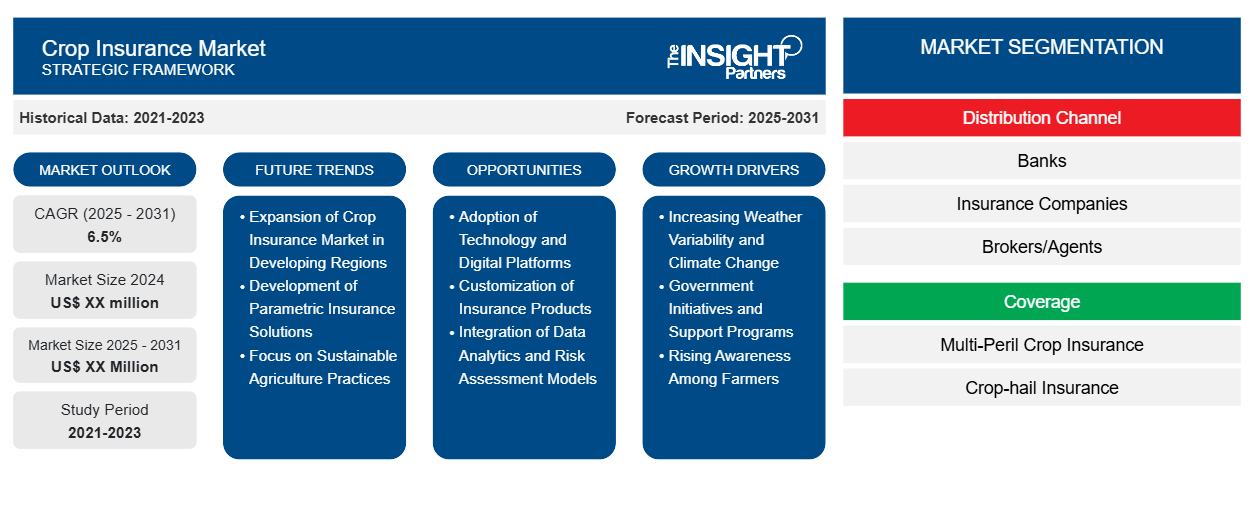

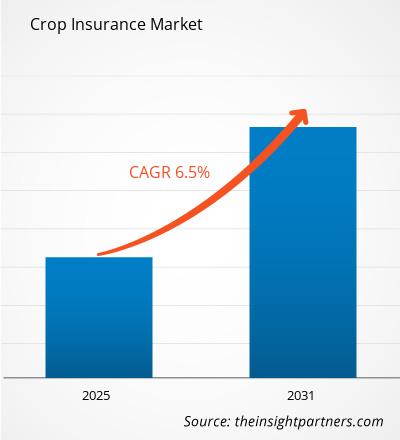

The Crop Insurance Market is expected to register a CAGR of 6.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Distribution Channel (Banks, Insurance Companies, Brokers/Agents, and Others). The report further presents analysis based on the Coverage (Multi-Peril Crop Insurance (MPCI) and Crop-hail Insurance). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Crop Insurance Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Crop Insurance Market Segmentation

Distribution Channel

- Banks

- Insurance Companies

- Brokers/Agents

Coverage

- Multi-Peril Crop Insurance

- Crop-hail Insurance

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCrop Insurance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Crop Insurance Market Growth Drivers

- Increasing Weather Variability and Climate Change: One of the significant drivers of the crop insurance market is the rising concern over weather variability and climate change. Farmers are increasingly facing unpredictable weather patterns, including droughts, floods, and extreme temperatures, which can severely impact crop yields. As a result, there is a growing awareness of the need for crop insurance to mitigate these risks. Insurers are responding by developing tailored policies that provide coverage for a wide range of climate-related risks, thereby driving the demand for crop insurance products.

- Government Initiatives and Support Programs: Government initiatives and support programs are playing a crucial role in driving the crop insurance market. Many countries have recognized the importance of crop insurance in securing food production and stabilizing farmers' incomes. As a result, governments are implementing subsidies, incentives, and awareness campaigns to promote crop insurance among farmers. These initiatives not only increase the uptake of insurance products but also create a more stable agricultural economy, encouraging insurers to expand their offerings in the crop insurance sector.

- Rising Awareness Among Farmers: The increasing awareness among farmers regarding the importance of risk management strategies, including crop insurance, is another key driver in the market. Educational programs, agricultural extension services, and outreach efforts have contributed to farmers' understanding of how crop insurance can protect their livelihoods from unforeseen events. As farmers become more informed about the benefits of insurance, they are more likely to invest in coverage, thus stimulating growth in the crop insurance market.

Crop Insurance Market Future Trends

- Expansion of Crop Insurance Market in Developing Regions: There is a significant opportunity for growth in the crop insurance market through expansion into emerging markets. Many developing countries have vast agricultural sectors that are currently underserved by insurance products. As these nations experience economic growth and agricultural modernization, the demand for crop insurance is expected to rise. Insurers can capitalize on this opportunity by partnering with local stakeholders, offering accessible insurance products, and providing education on the benefits of crop insurance to farmers in these regions.

- Development of Parametric Insurance Solutions: The development of parametric insurance solutions presents a unique opportunity in the crop insurance market. Unlike traditional insurance, which compensates based on actual losses incurred, parametric insurance pays out predetermined amounts based on specific triggers, such as rainfall levels or temperature thresholds. This model reduces the complexity and time involved in claims processing, providing quicker financial relief to farmers after adverse events. As understanding and acceptance of parametric insurance grow, it can significantly enhance risk management for agricultural producers.

- Focus on Sustainable Agriculture Practices: As sustainability becomes a priority in agriculture, there is an opportunity for the crop insurance market to align its offerings with sustainable farming practices. Insurers can develop products that incentivize farmers to adopt environmentally friendly practices, such as crop rotation, organic farming, and water conservation measures. By providing premium discounts or rewards for sustainable practices, insurers can not only promote responsible agriculture but also mitigate risks associated with climate change and resource scarcity, creating a win-win scenario for both farmers and insurers.

Crop Insurance Market Opportunities

- Adoption of Technology and Digital Platforms: A notable trend in the crop insurance market is the adoption of technology and digital platforms to enhance service delivery and efficiency. Insurers are increasingly leveraging digital tools such as mobile apps and online portals to facilitate policy purchases, claims processing, and customer support. This technological shift not only streamlines operations but also improves accessibility for farmers, making it easier for them to obtain and manage their crop insurance policies. As technology continues to evolve, it is expected to play a transformative role in the industry.

- Customization of Insurance Products: Another significant trend in the crop insurance market is the customization of insurance products to meet the specific needs of different agricultural sectors. Insurers are recognizing that a one-size-fits-all approach may not effectively address the diverse risks faced by various crops and farming practices. Consequently, there is a movement towards developing more personalized insurance solutions, including tailored coverage for specific crops, regions, and farming methods. This trend is likely to enhance customer satisfaction and encourage a wider adoption of crop insurance.

- Integration of Data Analytics and Risk Assessment Models: The integration of data analytics and advanced risk assessment models is emerging as a key trend in the crop insurance market. Insurers are increasingly utilizing big data and predictive analytics to assess risks more accurately and price their products competitively. By analyzing historical weather patterns, soil conditions, and other relevant data, insurers can develop more precise underwriting models and offer policies that better reflect the actual risks faced by farmers. This trend not only improves risk management but also enhances the overall sustainability of crop insurance offerings.

Crop Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Distribution Channel

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Crop Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Crop Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Crop Insurance Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Crop Insurance Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For