Medical Injection Molding Market Growth, Trends, and Forecast by 2031

Medical Injection Molding Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material [Polyvinyl Chloride (PVC), Poly(Methyl Methacrylate) (PMMA), Polyether Ether Ketone (PEEK), Metals, and Others], Type (Plastic Injection Molding, Overmolding, Liquid Silicone Molding, and Others), End User (Medical Device Companies, Pharmaceutical Drug Packaging Companies, Surgical Instruments Companies, and Others), Product Type (Medical Equipment Components, Consumables, Patient Aids, Orthopedic Instruments, Dental Products, and Others), System (Hot Runner and Cold Runner), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2024-2031- Report Date : Mar 2025

- Report Code : TIPRE00009102

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 181

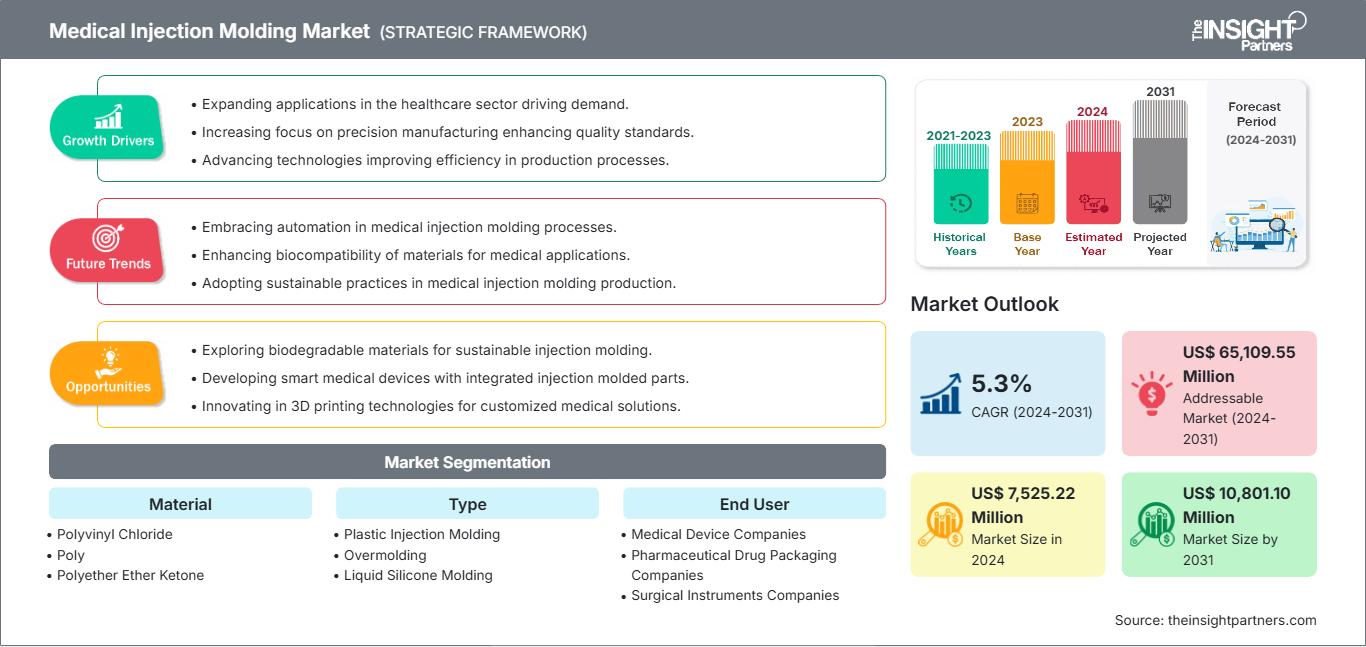

The medical injection molding market size is projected to reach US$ 10,801.10 million by 2031 from US$ 7,525.22 million in 2024. The market is expected to register a CAGR of 5.3% during 2024–2031. The combination of 3D printing with injection molding is likely to bring new trends in the medical injection molding market in the coming years.

Medical Injection Molding Market Analysis

The factors driving the medical injection molding market include the increasing demand for medical devices and equipment and advancements in molding technologies. Moreover, demand for personalized and customized medical devices is expected to create ample opportunities in the coming years.

Medical Injection Molding Market Overview

North America is expected to dominate the medical injection molding market in terms of revenue share, and Asia Pacific is expected to register a significant CAGR in the market during the forecast period. The projected market growth in Asia Pacific is attributed to the rapidly expanding healthcare infrastructure, increasing demand for affordable disposable medical devices, and a growing aging population. China accounts for a major share of the market in APAC, and India is estimated to register a significant CAGR during the forecast period. The rapid growth of the market in China is due to the country's advanced manufacturing capabilities and cost-efficient production processes. The increasing global demand for high-quality medical components further drives the market players in the country to bolster their production capabilities. Leading companies such as Seaskymedical, Silver Basis, BSM Group, and JMT Mould are at the forefront of this expansion, leveraging state-of-the-art technologies and ISO-certified cleanroom facilities to produce precision medical-grade plastic parts. The thriving injection molding industry, supported by a robust supply chain and competitive pricing, has also made it a preferred destination for domestic and international medical device manufacturers.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Injection Molding Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Injection Molding Market Drivers and Opportunities

Increasing Demand for Medical Devices and Equipment Favors Market Growth

The demand for medical devices is growing continuously due to the increasing prevalence of chronic diseases and the aging population. Chronic conditions such as diabetes, and cardiovascular and respiratory diseases are becoming more prevalent, contributing to the need for medical equipment in diagnoses, treatments, and management. According to the World Health Organization (WHO), chronic diseases account for 71% of global deaths, highlighting the urgency of expanding medical device production. Per PubMed, the burden of multiple chronic conditions is also notable. Globally, approximately one in three adults suffer from multiple chronic conditions, leading to increased healthcare needs and the demand for medical devices. Moreover, the global population is aging rapidly, with significant implications for healthcare systems. As per WHO data, 1 in 6 people worldwide would be aged 60 years or over by 2030, and the number of individuals aged 80 years or older is expected to triple from 2020 to 2050, reaching 426 million. Thus, the aging population worldwide requires more healthcare devices to manage age-related conditions.

Various governments are implementing policies that support healthcare expansion, such as subsidies for healthcare equipment and funding for research into medical devices. Moreover, governments are investing in public health infrastructure, which further drives the need for new and upgraded medical devices. Globally, health expenditure has been on the rise, reflecting increased governmental commitment to healthcare. As stated by the WHO in 2024, global health spending reached US$ 9.8 trillion in 2021, accounting for 10.3% of global GDP. In the US, the federal government has significantly increased funding for medical research and development. Further, under the Tracking Accountability in Government Grants System (TAGGS), the US Department of Health and Human Services (HHS) allocated US$ 686.41 billion in fiscal year 2021 to support initiatives directed toward the development of medical devices and healthcare infrastructure, indicating a substantial increase from US$ 466.24 billion in fiscal year 2019. The HHS also allocated US$ 130.1 billion in discretionary funding for health programs, marking a 3% increase from the previous fiscal year, as stated by the National Association of County and City Health Officials 2025.

Demand for Personalized and Customized Medical Devices to Create Ample Opportunities for Market Growth

As healthcare systems continue to focus more on patient-centric care, there is a rising demand for medical devices designed to meet individual needs, especially in areas such as orthopedics, dental implants, hearing aids, and drug delivery systems. As per the Personalized Medicine Coalition 2025, the US FDA approved 16 new personalized treatments for rare diseases in 2023, up from 6 in 2022. Further, an article published in the American Journal of Managed Care (AJMC), a peer-reviewed journal under MJH Life Sciences, states that the number of personalized medicines on the market more than doubled during 2016–2020, increasing from 132 to 286. Medical injection molding plays a crucial role in this shift by enabling the production of customized, detailed components. This technology excels at creating parts with precise geometries essential for tailored treatments. When combined with 3D printing, injection molding allows for the development of patient-specific implants and prosthetics, providing a better fit and performance than traditional solutions. The ongoing advancements in materials and manufacturing processes further accelerate the production of custom medical components, making them more cost-effective and highly accurate.

Manufacturers specializing in producing small, intricate, and functional parts are well-positioned to expand their share in the market for personalized medical devices, thereby grabbing new revenue opportunities while establishing themselves as leaders in a competitive industry. Statista data suggests that global spending on precision medicine treatments stood at approximately US$ 32 billion in 2022. This figure is projected to increase to nearly US$ 124 billion by 2027, indicating a significant rise in investment and adoption of personalized treatment approaches. In 2022, Plastic Omnium and Faurecia merged to form a globally leading venture in injection molding technologies for the automotive and medical device industries. The merger aimed at leveraging their combined resources to develop more innovative, customized medical solutions, including personalized drug delivery devices and biosensors. In 2021, WestFall Technik acquired TUNAP Technologies, a move that enabled the company to expand its capabilities in medical injection molding. This acquisition allowed WestFall Technik to enhance its ability to offer highly customizable plastic components for medical devices such as syringes, implants, and diagnostic equipment, which are critical for patient-specific treatments. Thus, the demand for personalized and customized medical devices presents significant growth opportunities for the medical injection molding market.

Medical Injection Molding Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical injection molding market analysis are material, type, end user, product type, and system.

- Based on material, the medical injection molding market is segmented into polyvinyl chloride (PVC), poly(methyl methacrylate) (PMMA), polyether ether ketone (PEEK), metals, and others. The others segment held the largest share of the market in 2024 and is expected to register a higher CAGR in the market during 2024–2031.

- By type, the medical injection molding market is segmented into plastic injection molding, overmolding, liquid silicone molding, and others. The plastic injection molding segment held the largest share of the market in 2024, and the liquid silicone molding segment is expected to register the highest CAGR in the market during 2024–2031.

- By End User, the medical injection molding market is segmented into medical device companies, pharmaceutical drug packaging, surgical instruments companies, and others. The medical devices companies segment held the largest share of the market in 2024; it is expected to register the highest CAGR in the market during 2024–2031.

- In terms of product type, the medical injection molding market is segmented into medical equipment components, consumables, patient aids, orthopedic instruments, dental products, and others. The medical equipment components segment dominated the market in 2024 and is anticipated to register the highest CAGR during 2024-2031.

- In terms of system, the medical injection molding market is bifurcated into hot runner and cold runner. The hot runner segment dominated the market in 2024 and is anticipated to register a higher CAGR during 2024–2031.

Medical Injection Molding Market Share Analysis by Geography

The geographical scope of the medical injection molding market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2023. The region's robust healthcare infrastructure and increasing demand for high-quality medical devices, such as syringes, catheters, and diagnostic tools, are several key factors driving the market's growth. Additionally, advancements in medical technologies and the rise in chronic diseases require precise, cost-effective manufacturing processes. The growing adoption of minimally invasive surgeries and personalized medicine further fuels the need for innovative, high-performance medical products in the North American market. In the US, the expansion of the medical injection molding market is driven by the growing demand for medical devices and components, which are essential for diagnosing, treating, and monitoring various health conditions. The aging population and the rising incidence of diabetes, cardiovascular diseases (CVDs), respiratory disorders, and other chronic conditions are the main factors driving the demand for medical devices in the country. The Centers for Disease Control and Prevention (CDC) reports that approximately 60% American adults suffer from at least 1 chronic disease, while ~40% adults have two or more diseases. Such elevated incidence rates of chronic diseases result in the need for various medical devices and components in disease management. According to the CDC’s National Diabetes Statistics Report for 2022, ~37.3 million Americans were living with diabetes as of 2022; this has led to a higher demand for insulin delivery devices, such as pens and syringes, which are often produced using medical injection molding techniques. Medical injection molding is employed in the manufacturing process to produce precise and complex components essential for various medical applications. This process is particularly valuable for creating single-use medical devices.

Medical Injection Molding

Medical Injection Molding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 7,525.22 Million |

| Market Size by 2031 | US$ 10,801.10 Million |

| Global CAGR (2024 - 2031) | 5.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Injection Molding Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Injection Molding Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Medical Injection Molding Market News and Recent Developments

The medical injection molding market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the medical injection molding market are listed below:

- Sanner Group, a leading global healthcare packaging manufacturer and medical device contract development and manufacturing organization (CDMO), has acquired Springboard, a specialist in the design and development of medical devices for regulated markets. Springboard’s extensive capabilities will substantially boost Sanner Group’s in-house medical device development capabilities and see the establishment of a new Design Center of Excellence in the UK. (Source: Sanner Group, Company Website, January 2024)

- HTI Plastics received EU MDR (European Union Medical Device Regulation) certification, which allows the sales of its products in European markets (including the UK). (Source: HTI Plastics, Company Website, February 2024)

Medical Injection Molding Market Report Coverage and Deliverables

The “Medical Injection Molding Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Medical injection molding market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical injection molding market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Medical injection molding market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical injection molding market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For