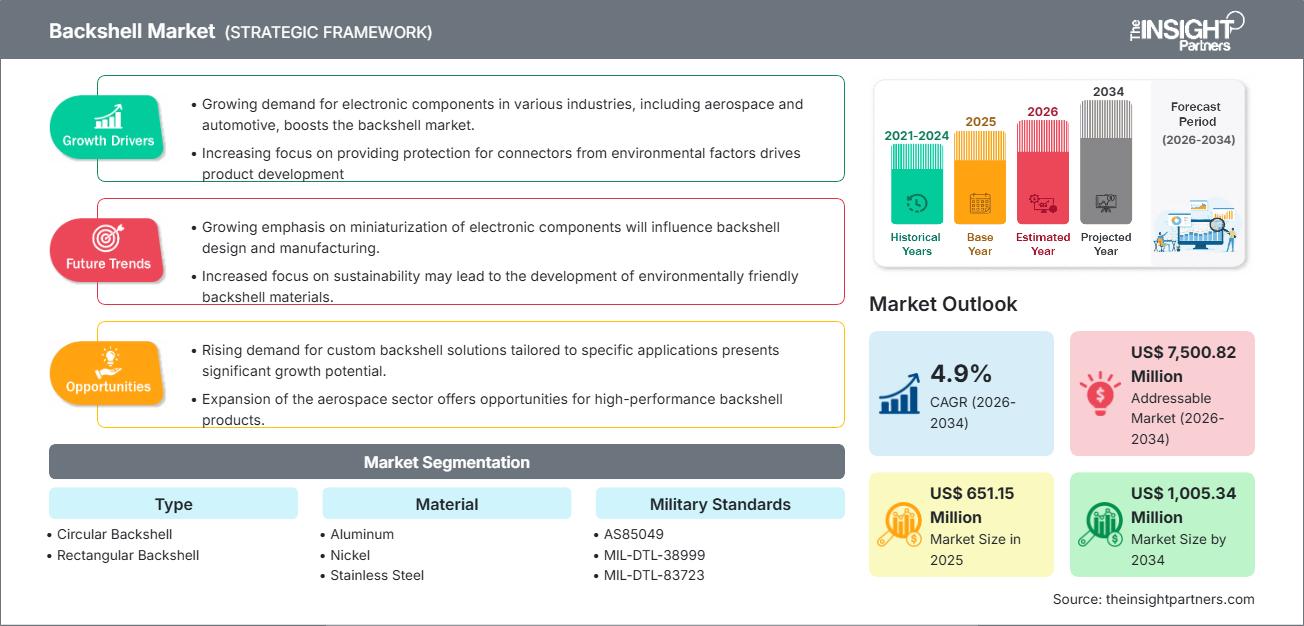

Se espera que el tamaño del mercado de carcasas traseras alcance los US$1.005,34 millones para 2034, desde los US$651,15 millones en 2025. Se anticipa que el mercado registre una tasa de crecimiento anual compuesta (CAGR) del 4,9 % durante el período de pronóstico de 2026 a 2034.

Análisis del mercado de carcasas traseras

El análisis del mercado de carcasas traseras indica un crecimiento constante y sostenido, impulsado principalmente por programas de modernización de defensa a gran escala y el aumento de la producción de aeronaves comerciales y militares a nivel mundial. Los requisitos críticos de protección EMI/RFI en sistemas electrónicos sensibles que operan en entornos hostiles allanan el camino para el crecimiento del mercado. Además, el aumento de los requisitos regulatorios, en particular las estrictas normas militares como la AS85049, exige el uso de carcasas traseras de alto rendimiento y que cumplan con las normativas. El mercado también está experimentando una aceleración gracias a la adopción de materiales compuestos ligeros, ya que los sectores aeroespacial e industrial priorizan la reducción de peso sin comprometer la protección.

Descripción general del mercado de carcasas traseras

Las carcasas traseras son componentes de protección esenciales que se utilizan en conectores eléctricos para gestionar y proteger el punto crítico donde un cable termina en un enchufe o receptáculo. Estos componentes proporcionan alivio de tensión, sellado ambiental (contra humedad, polvo y fluidos) y un blindaje robusto contra interferencias electromagnéticas (EMI/RFI). Se utilizan ampliamente en sectores clave, como el militar, el aeroespacial y la industria pesada, garantizando la durabilidad a largo plazo y la integridad de la señal, cumpliendo con los estándares operativos más estrictos. La carcasa trasera proporciona una excelente protección contra amenazas externas como altos niveles de vibración, temperaturas extremas y agentes corrosivos, y es un componente importante para mantener la fiabilidad y el rendimiento del sistema.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de carcasas traseras: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de carcasas traseras

Factores impulsores del mercado:

- Aumento de los programas de modernización de la defensa a nivel mundial: el aumento de los programas de modernización de la defensa en todo el mundo impulsa el interés en varios conectores y carcasas traseras blindadas de alta confiabilidad instaladas en aeronaves militares, buques de guerra y vehículos terrestres modernizados, que se utilizan para gestionar sistemas complejos de guerra electrónica y comunicación.

- Creciente demanda de protección EMI/RFI: el uso creciente de componentes electrónicos y sistemas en red en aplicaciones aeroespaciales e industriales aumenta la demanda de soluciones de blindaje efectivas, que ayudarán a evitar la degradación de la señal y garantizarán la funcionalidad del sistema.

- Crecimiento de la aviación comercial y la exploración espacial: el aumento del tráfico aéreo mundial y la expansión de los programas espaciales (tanto gubernamentales como privados) impulsan la demanda de soluciones de interconexión duraderas, livianas y de alto rendimiento.

Oportunidades de mercado:

- Desarrollo de materiales livianos y resistentes a la corrosión: enfatizar los compuestos avanzados y las aleaciones especiales de aluminio para lograr un rendimiento superior, ahorro de peso y una vida útil prolongada en entornos extremadamente hostiles o marinos.

- Integración de carcasas traseras inteligentes con sensores: las oportunidades futuras en el desarrollo de carcasas traseras "inteligentes" equipadas con sensores en miniatura para monitorear la temperatura, la vibración y la efectividad del blindaje ayudarán a predecir el mantenimiento y la detección de fallas en tiempo real.

- Expansión en los mercados emergentes: la rápida industrialización y los crecientes presupuestos de defensa en los países de Asia-Pacífico y Medio Oriente ofrecen un potencial sin explotar para los actores clave del mercado.

Análisis de segmentación del informe de mercado de carcasas traseras

El mercado de carcasas traseras está segmentado exhaustivamente por tipo, material, cumplimiento de normas militares y aplicación final, lo que proporciona una visión detallada de la dinámica del mercado y las áreas de crecimiento. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por tipo:

- Carcasa trasera circular: Este segmento lidera la cuota de mercado gracias a la adopción generalizada de conectores circulares, como el MIL-DTL-38999, en la industria aeroespacial y de defensa. Esto proporciona un blindaje y sellado de 360 grados, lo que lo convierte en la opción habitual cuando se busca una alta fiabilidad.

- Carcasa trasera rectangular: Este segmento se centra en sistemas industriales y militares específicos donde el espacio y el formato exigen el uso de conectores rectangulares. La demanda se concentra en equipos especializados e instalaciones fijas.

Por material:

- Aluminio: El segmento más común, que ofrece un excelente equilibrio entre resistencia, peso y rentabilidad. El aluminio se utiliza ampliamente en las principales aplicaciones y suele niquelarse para ofrecer resistencia a la corrosión y una mejor conductividad.

- Níquel/acero inoxidable: estos materiales son los preferidos para aplicaciones que requieren una resistencia superior a la corrosión, tolerancia a altas temperaturas y una durabilidad excepcional, como entornos navales o de motores de alta temperatura.

- Compuesto: Este material es el segmento de más rápido crecimiento, impulsado por la necesidad de una reducción de peso significativa en los aviones modernos, ofreciendo un rendimiento mecánico y un blindaje comparables cuando está metalizado adecuadamente.

Según los estándares militares:

- AS85049

- MIL-DTL-38999

- MIL-DTL-83723

- MIL-DTL-5015

- MIL-DTL-26482

Por aplicación:

- Tierra (vehículos y equipos): vehículos terrestres militares, maquinaria pesada, automatización industrial; carcasas traseras extremadamente resistentes y selladas que resisten golpes extremos, vibraciones y polvo.

- Naval (marino y marítimo): requiere carcasas traseras de acero inoxidable o aluminio de grado marino altamente especializadas y resistentes a la corrosión debido a la exposición constante al agua salada y a la alta humedad.

- Aire (Aeroespacial y Aviación): El segmento más grande, que abarca aeronaves comerciales, jets militares, helicópteros y vehículos espaciales. Esta aplicación exige soluciones extremadamente ligeras, altamente confiables y con protección contra interferencias electromagnéticas (EMI).

Por geografía

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de carcasas traseras

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de carcasas traseras durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de carcasas traseras en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de carcasas traseras

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 651,15 millones |

| Tamaño del mercado en 2034 | US$ 1.005,34 millones |

| CAGR global (2026-2034) | 4,9% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de Backshell: comprensión de su impacto en la dinámica empresarial

El mercado de carcasas traseras está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado Backshell

Análisis de la cuota de mercado de Backshell por geografía

Se prevé que Asia-Pacífico experimente el mayor crecimiento en los próximos años. Los mercados emergentes de América del Sur y Central, Oriente Medio y África también presentan numerosas oportunidades de expansión sin explotar para los proveedores de componentes de carcasa trasera. El mercado de carcasa trasera muestra una trayectoria de crecimiento diferente en cada región debido a factores como el gasto en defensa, la actividad manufacturera aeroespacial, la inversión en automatización industrial y el cumplimiento de estrictos estándares militares. A continuación, se presenta un resumen de la cuota de mercado y las tendencias por región:

1. América del Norte

- Cuota de mercado: Posee la mayor cuota de mercado debido a su industria de defensa avanzada y su base de fabricación aeroespacial comercial establecida.

- Factores clave: alto gasto en I+D, adopción generalizada de estándares militares estrictos y programas de modernización de aeronaves en curso en Estados Unidos y Canadá.

- Tendencias: Cambio continuo hacia sistemas de interconexión complejos y de gran ancho de banda que requieren tecnologías avanzadas de protección EMI/RFI y soluciones compuestas livianas.

2. Europa

- Cuota de mercado: Posee una participación significativa, impulsada por los principales actores aeroespaciales regionales (por ejemplo, Airbus) y sectores de automatización industrial sólidos, particularmente en Alemania y Francia.

- Factores clave: digitalización de la automatización industrial, fuerte crecimiento en los sectores ferroviario y automotriz y proyectos de defensa colaborativos que requieren componentes estandarizados.

- Tendencias: creciente enfoque en la miniaturización y la conectividad de alta densidad, junto con demandas regulatorias para una protección ambiental confiable en aplicaciones industriales.

3. Asia-Pacífico

- Cuota de mercado: Se espera que sea la región de más rápido crecimiento durante el período de pronóstico, debido a la rápida industrialización y al aumento de los presupuestos de defensa.

- Factores clave: importante inversión gubernamental en la fabricación de defensa nacional (por ejemplo, China, India), rápido crecimiento en la fabricación de productos electrónicos y expansión de la flota comercial.

- Tendencias: Adopción de estándares militares occidentales y un aumento en la demanda de soluciones de carcasa trasera rentables y de alta calidad para respaldar nuevas líneas de producción.

4. América del Sur y Central

- Cuota de mercado: Representa un mercado emergente con crecimiento gradual.

- Factores clave: Expansión de los sectores industriales (minería, petróleo y gas) y aumento de las inversiones en infraestructura de telecomunicaciones, que requieren componentes de conectividad confiables.

- Tendencias: Los conectores y carcasas industriales rentables y basados en la nube están ganando terreno, principalmente entre los proveedores industriales de tamaño pequeño a mediano.

5. Oriente Medio y África

- Cuota de mercado: Un mercado en desarrollo con un fuerte potencial de crecimiento debido al creciente gasto en infraestructura militar.

- Factores clave: Iniciativas estratégicas nacionales de infraestructura y salud electrónica, junto con la expansión de la infraestructura de atención de salud.

- Tendencias: Implementación de carcasas traseras especializadas y resistentes para soportar temperaturas extremas y entornos desérticos hostiles típicos de las aplicaciones militares y energéticas regionales.

Densidad de actores del mercado de Backshell: comprensión de su impacto en la dinámica empresarial

Alta densidad de mercado y competencia

El mercado de carcasas traseras es altamente competitivo, caracterizado por la presencia de grandes corporaciones multinacionales y fabricantes especializados en nichos de mercado. Este panorama se debe en gran medida a la importancia técnica y crítica de garantizar la integridad de la señal, el sellado ambiental y el apantallamiento EMI/RFI en aplicaciones exigentes como la aeroespacial y la defensa.

La competencia se está intensificando debido a la presencia de grandes actores especializados en soluciones de interconexión completas, como Amphenol Corporation y TE Connectivity, junto con fabricantes de componentes especializados como Glenair, Inc., que suministran productos de carcasa trasera básicos y de alta confiabilidad.

Este entorno competitivo impulsa a los proveedores a diferenciarse mediante:

- Integración perfecta: desarrollo de carcasas traseras que ofrecen un ensamblaje más rápido, un ajuste garantizado y una integración robusta con series de conectores específicas y de alta demanda (por ejemplo, D38999).

- Innovación de materiales: inversión en soluciones termoplásticas avanzadas y compuestas livianas para aplicaciones sensibles al peso en aeronaves modernas y plataformas de defensa.

- Personalización y cumplimiento: ofrecemos soluciones altamente personalizadas y mantenemos un cumplimiento estricto y actualizado con las especificaciones militares y aeroespaciales en evolución (por ejemplo, AS85049) para garantizar la aceptación regulatoria global.

- Gestión térmica y ambiental: Especializados en diseños que mejoran la disipación térmica y proporcionan un sellado superior contra temperaturas extremas, presión y fluidos corrosivos.

Oportunidades y movimientos estratégicos

- Asociarse con Aircraft and Defense Primes: colaborar con los principales OEM (fabricantes de equipos originales) para desarrollar conjuntamente arquitecturas de interconexión de próxima generación y diseños de carcasa posterior optimizados para nuevas plataformas.

- Incorpore tecnologías de blindaje avanzadas: integre recubrimientos y materiales especializados para una mejor mitigación de EMI/RFI en rangos de frecuencia más amplios, abordando la complejidad de los sistemas digitales modernos.

Las principales empresas que operan en el mercado de carcasas traseras son:

- Corporación Amphenol

- Conectividad TE

- Glenair, Inc.

- Collins Aerospace

- Corporación Curtiss-Wright

- Banco solar de Souriau (Eaton)

- PEI-Génesis

- Isodyne Inc.

- Electrónica Arrow

Descargo de responsabilidad: Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Noticias del mercado de Backshell y desarrollos recientes

- Amphenol Corporation lanzó las carcasas traseras AlumaLite: Amphenol Corporation presentó su serie de carcasas traseras AlumaLite, que ofrece hasta un 50 % de ahorro de peso en comparación con los diseños tradicionales. Estas carcasas traseras ofrecen un blindaje EMI superior y resistencia a la corrosión, ideales para aplicaciones aeroespaciales y de defensa.

- TE Connectivity amplía su portafolio de carcasas traseras AMPSEAL 16: TE Connectivity anunció nuevas variantes de carcasas traseras AMPSEAL 16, incluyendo configuraciones de 90° y 180° con clasificación de resistencia al fuego UL94 V‑0. La compañía también presentó las carcasas traseras de codo curvado Tinel‑Lock, que reducen el peso en un 20% para conectores aeroespaciales y militares.

- Glenair destaca la entrega rápida de carcasas traseras con especificaciones MIL: Glenair destacó su amplio catálogo de carcasas traseras que cumplen con la norma AS85049, con disponibilidad inmediata para conectores circulares y rectangulares. La compañía promociona las carcasas traseras con bandas de la serie QT para una instalación rápida y una mejor protección contra interferencias electromagnéticas.

- Collins Aerospace firma un acuerdo de mantenimiento predictivo con Qatar Airways: Collins Aerospace se asoció con Qatar Airways en la implementación de su solución de análisis Ascentia en las flotas de Boeing 787, lo que demuestra aún más su compromiso con los sistemas aeroespaciales avanzados y las soluciones de confiabilidad.

- Curtiss-Wright obtiene contratos de defensa y mejora sus previsiones: Curtiss-Wright anunció múltiples contratos de defensa, incluyendo sistemas de estabilización de torretas para vehículos de combate XM30 y registradores de vuelo encriptados para aeronaves Bell Textron MV-75. La compañía también elevó sus previsiones financieras para todo el año.

Informe de mercado de Backshell: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de carcasas traseras (2021-2034)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de Backshell y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de Backshell, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

-

Análisis PEST y FODA detallado

Análisis del mercado de Backshell que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado - Análisis del panorama de la industria y la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes en el mercado de Backshell.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de carcasas traseras

Obtenga una muestra gratuita para - Mercado de carcasas traseras