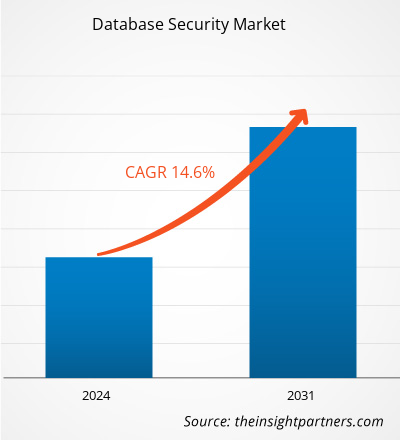

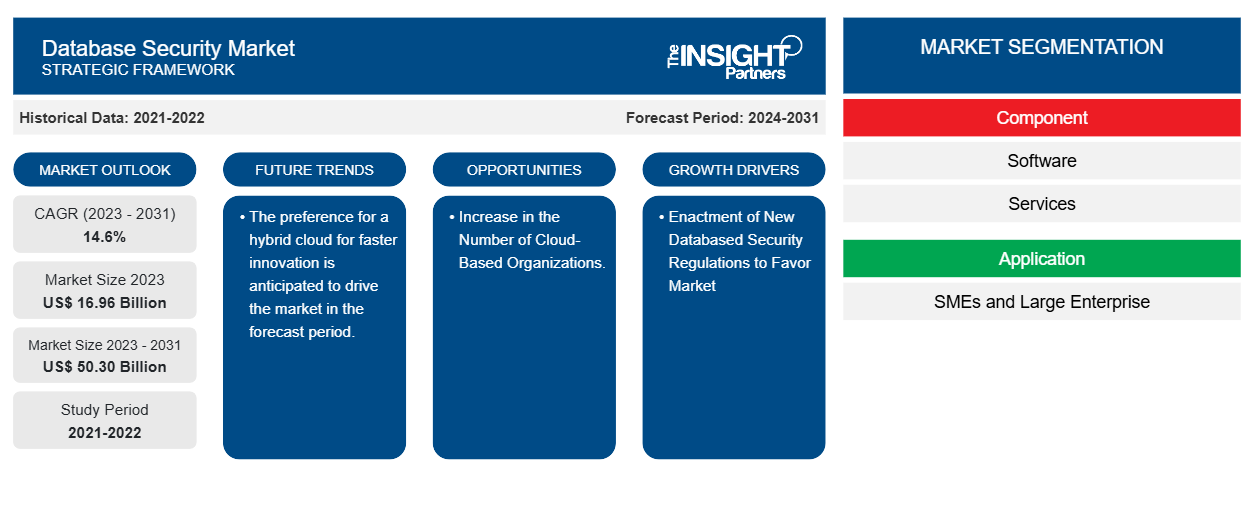

Se prevé que el tamaño del mercado de seguridad de bases de datos alcance los 50.300 millones de dólares en 2031, frente a los 16.960 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 14,6 % durante el período 2023-2031. La promulgación de nuevas normas de seguridad de bases de datos, los crecientes volúmenes de datos empresariales y el aumento exponencial del potencial de ciberataques con la popularidad de la IoT probablemente sean los principales impulsores y tendencias del mercado.CAGR of 14.6% during 2023–2031. The enactment of new database security regulations, growing volumes of business data and exponential rise in potential for cyberattacks with the popularity of IoT are likely to be the key drivers and trends of the market.

Análisis del mercado de seguridad de bases de datos

El mercado de seguridad de bases de datos está experimentando un crecimiento significativo a nivel mundial. Este crecimiento se atribuye a factores como la promulgación de nuevas regulaciones de seguridad de bases de datos, los crecientes volúmenes de datos comerciales y el aumento exponencial del potencial de ciberataques con la popularidad de IoT. Además, se prevé que la proliferación de tamaños y servicios de organizaciones basadas en la nube y la preferencia por la nube híbrida para una innovación más rápida impulsarán el crecimiento del mercado en los próximos años.

Descripción general del mercado de seguridad de bases de datos

La seguridad de las bases de datos se considera como el conjunto de controles, herramientas y procedimientos diseñados para garantizar y salvaguardar la integridad, la confidencialidad y la accesibilidad. Las leyes de seguridad de datos son importantes para fines que van más allá del mero cumplimiento normativo . Entre ellos se incluyen los siguientes:

- Garantizar la confidencialidad de la información personal de las personas cuyos datos sean objeto de tratamiento

- Minimizar los riesgos de violaciones de datos y amenazas cibernéticas

- Mantener la fiabilidad y precisión de los datos

- Construyendo un ambiente de negocios saludable con mayor confianza del cliente

- Promover el compromiso con la ciberseguridad.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de seguridad de bases de datos

Aprobación de nueva normativa de seguridad de bases de datos para favorecer al mercado

Las normas de seguridad de las bases de datos son estándares establecidos por los organismos reguladores o el gobierno, que guían a las organizaciones hacia la protección de la confidencialidad, integridad y disponibilidad de los datos. Su objetivo principal es salvaguardar los activos de información de la empresa contra la destrucción, la manipulación, el acceso no autorizado y otros riesgos de seguridad. Además, existen costos por no cumplir con las regulaciones internacionales como la Ley Sarbanes-Oxley (SAO) o el estándar de seguridad de datos de la industria de tarjetas de pago (PCI DSS) específicas para las regulaciones de la industria sobre privacidad de datos, como HIPAA o leyes de privacidad regionales como el Reglamento General de Protección de Datos (GDPR) de la Unión Europea, que podrían ser un problema clave con multas en el peor de los casos de más de varios millones de dólares por cada violación.Sarbanes-Oxley Act (SAO) or payment card industry data security standard (PCI DSS) specific to industry regulations on data privacy, like HIPAA or regional privacy laws like the European Union's General Data Protection Regulation (GDPR) could be a key problem with fines in worst cases in excess of many million dollars for each violation.

Aumento del número de organizaciones basadas en la nube.

En el mercado hay una gran cantidad de organizaciones basadas en la nube, entre las que se incluyen AWS, VMWare, Oracle, NetApp, Salesforce, Google, IBM y muchas más. Estas organizaciones comprenden grandes cantidades de bases de datos. Teniendo en cuenta esto, el riesgo de violaciones de datos y phishing de datos aumenta. Una amenaza específica para las bases de datos es la introducción de SQL falso, así como otros ataques de cadenas no SQL en las consultas de bases de datos entregadas por aplicaciones basadas en la web y encabezados HTTP. Las empresas que no siguen prácticas de codificación seguras para aplicaciones web y realizan pruebas de exposición periódicas son susceptibles a ataques que las utilicen.VMWare, Oracle, NetApp, Salesforce, Google, IBM, and many more. These organizations comprise large amounts of databases. Considering this, the risk of data breaches and data phishing is increased. A specific threat to databases is the introducing of untrue SQL as well as other non-SQL string attacks in queries for databases delivered by web-based apps and HTTP headers. Companies that do not follow safe

Análisis de segmentación del informe del mercado de seguridad de bases de datos

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de seguridad de bases de datos son los componentes, las aplicaciones y los sectores industriales.verticle.

- Según los componentes, el mercado de seguridad de bases de datos se divide en software y servicios. Se prevé que el segmento de software ocupe una cuota de mercado significativa en el período de pronóstico.

- Según la aplicación, el mercado de seguridad de bases de datos se divide en pymes y grandes empresas. Se prevé que el segmento de pymes ocupe una cuota de mercado significativa en el período de previsión.SMEs and large enterprises. The SME segment is anticipated to hold a significant market share in the forecast period.

- Por sector industrial, el mercado está segmentado en BFSI, TI y telecomunicaciones, manufactura, atención médica, gobierno, comercio minorista y otros. Se prevé que TI y telecomunicaciones tengan una participación de mercado significativa en el período de pronóstico.verticle, the market is segmented into BFSI, IT and telecom, manufacturing, healthcare, government, retail, and others). The IT and telecom is anticipated to hold a significant market share in the forecast period.

Análisis de la cuota de mercado de seguridad de bases de datos por geografía

El alcance geográfico del informe del mercado de seguridad de bases de datos se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

América del Norte ha dominado el mercado de seguridad de bases de datos. Las tendencias de adopción de alta tecnología en varias industrias de la región de América del Norte han impulsado el crecimiento de este mercado. Factores como el creciente número de organizaciones basadas en la nube y el fuerte énfasis en la investigación y el desarrollo en las economías desarrolladas de los EE. UU. y Canadá están obligando a los actores norteamericanos a llevar soluciones tecnológicamente avanzadas al mercado. Además, los EE. UU. tienen una gran cantidad de actores del mercado de seguridad de bases de datos que se han centrado cada vez más en el desarrollo de soluciones innovadoras. Todos estos factores contribuyen al crecimiento del mercado de seguridad de bases de datos en la región.fuelled the growth of the database security market. Factors such as the increasing number of cloud-based organizations. Moreover, a strong emphasis on research and development in the developed economies of the US and Canada is forcing the North American players to bring technologically advanced solutions into the market. In addition, the US has a large number of database security market players who have been increasingly focusing on developing innovative solutions. All these factors contribute to the region's growth of the database security market.

Perspectivas regionales del mercado de seguridad de bases de datos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de seguridad de bases de datos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de seguridad de bases de datos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de seguridad de bases de datos

Alcance del informe sobre el mercado de seguridad de bases de datos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 16,96 mil millones |

| Tamaño del mercado en 2031 | US$ 50.30 mil millones |

| CAGR global (2023 - 2031) | 14,6% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de seguridad de bases de datos: comprensión de su impacto en la dinámica empresarial

El mercado de seguridad de bases de datos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de seguridad de bases de datos son:

- Empresa

- SAP SE

- Cuadrícula de escala

- MICRO ENFOQUE

- Tales

- Corporación Oracle

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de seguridad de bases de datos

Noticias y desarrollos recientes del mercado de seguridad de bases de datos

El mercado de seguridad de bases de datos se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de investigaciones primarias y secundarias, que incluyen publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de seguridad de bases de datos:

- Microsoft Corp. y Oracle están ampliando su colaboración para satisfacer la creciente demanda de Oracle Database@Azure por parte de los clientes en todo el mundo. Oracle Database@Azure se expandirá a cinco regiones más, lo que eleva la disponibilidad multicloud total planificada a 15 regiones a nivel mundial. (Fuente: sitio web de Oracle Company, marzo de 2024)

- CrowdStrike y Cloudflare, Inc., la empresa líder en conectividad en la nube, están ampliando su alianza estratégica para conectar sus plataformas y mejorar la seguridad desde el dispositivo hasta la red, acelerar la transformación del Centro de operaciones de seguridad (SOC) y detener las infracciones antes de que se produzcan. (Fuente: sitio web de la empresa CrowdStrike, junio de 2024)

Informe sobre el mercado de seguridad de bases de datos: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de seguridad de bases de datos (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de seguridad de bases de datos y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de seguridad de bases de datos, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado de seguridad de bases de datos que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de seguridad de bases de datos

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de seguridad de bases de datos

Obtenga una muestra gratuita para - Mercado de seguridad de bases de datos