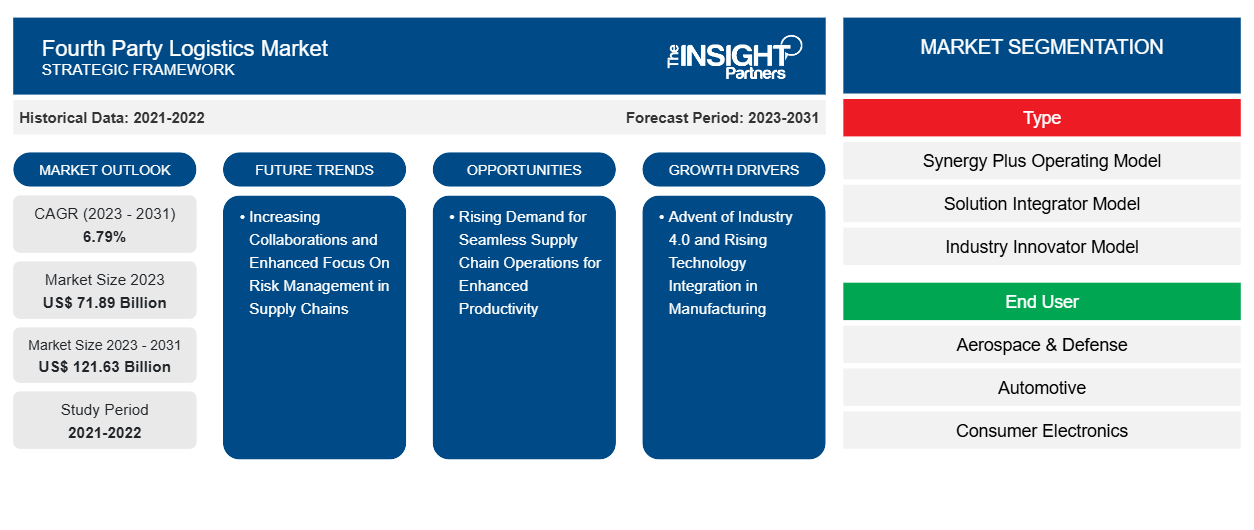

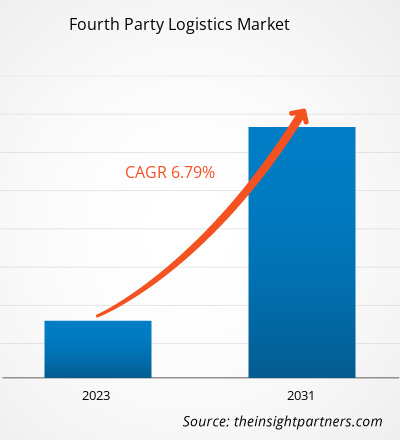

Se proyecta que el tamaño del mercado de logística de cuarta parte alcance los 121.630 millones de dólares estadounidenses para 2031, desde los 71.890 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 6,79 % entre 2023 y 2031.

La llegada de la Industria 4.0 ha dado lugar a la transformación digital del sector manufacturero. Diversos actores están aprovechando el poder de estas sofisticadas tecnologías digitales, lo que ofrece una ventaja competitiva a sus empresas clientes al agilizar diversos procesos de la cadena de suministro.

Análisis del mercado de logística de cuarta parte

Se ha observado que la demografía regional también ha desempeñado un papel vital en el crecimiento del mercado de servicios 4PL. Como ejemplo, la adopción de 4PL se observa en el sector minorista, que a su vez se ha fortalecido debido a la llegada del comercio electrónico. El atractivo del mercado para la industria del comercio electrónico es muy alto en la región, ya que la región APAC cuenta con más de un tercio de la población mundial. Además, las economías en desarrollo y el aumento de los ingresos disponibles de los individuos han impulsado aún más el crecimiento de la industria del comercio electrónico.

La creciente diversidad de la demanda debido a la diversidad demográfica observada en la región contribuye a las complejidades de la cadena de suministro. Esta compleja cadena de suministro contribuyó a la creciente necesidad de que las empresas navieras implementaran servicios 4PL. Desde la última década, la demanda en diferentes industrias de usuarios finales se ha acelerado significativamente con la creciente adopción de tecnologías digitalizadas y otras mejoras tecnológicas. A medida que los principales actores de este mercado continúan expandiendo su mercado potencial, ampliando las carteras de productos actuales, diversificando las bases de clientes y desarrollando nuevas aplicaciones y mercados, todos los actores destacados enfrentan un intenso nivel de competencia.

Descripción general del mercado de logística de cuarta parte

La externalización de toda la funcionalidad de la cadena de suministro a un socio con más conocimientos en el ámbito de la gestión de la cadena de suministro reduce las complejidades asociadas con las entregas de última milla. Algunos de los beneficios intangibles que se obtienen mediante la externalización de la logística incluyen ahorros de costos, ahorros de capital humano, no tener que depender del capital de trabajo y un mejor acceso a las redes de clientes.

El surgimiento del concepto de logística de cuarta parte ha sido esencialmente un paso hacia la eliminación de todos los cuellos de botella mencionados anteriormente en el entorno cada vez más complejo de la cadena de suministro. Los servicios de logística de cuarta parte (4PL) también se denominan cadena de suministro como servicio, donde el proveedor de 4PL se integra con el departamento de logística de la empresa cliente. Esto le otorga al proveedor de servicios 4PL un enfoque práctico para todas las operaciones involucradas en una cadena de suministro que van desde la gestión de pedidos hasta el almacenamiento y las regulaciones de cumplimiento y la gestión de proveedores. Un proveedor de servicios 4PL actuaría como el único vínculo de interfaz entre los numerosos proveedores de la cadena de suministro y la organización del cliente. Con esto, el proveedor 4PL administra todas las operaciones con recursos sofisticados para optimizar y brindar valor a sus clientes.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de logística de cuarta parte: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de logística de cuarta parte

La llegada de la Industria 4.0 y la creciente integración de la tecnología en la fabricación

Las tecnologías digitales emergentes, como el software avanzado , la computación en la nube y el Big Data, podrían ser muy útiles para que los proveedores de servicios 4PL mantengan la visibilidad en toda la cadena de suministro, mejorando la visibilidad, la transparencia, las operaciones y la productividad. Además, a medida que tecnologías como la Internet de las cosas (IoT), la automatización y la robótica adquieran más importancia, se prevé que las necesidades de implementación de 4PL por parte de las organizaciones se acentúen rápidamente.

Demanda creciente de operaciones fluidas en la cadena de suministro para una mayor productividad

En una cadena de suministro, las partes móviles a veces están sujetas a circunstancias imprevisibles, como desastres naturales, tensiones geopolíticas, problemas ambientales, complicaciones relacionadas con aranceles y regulaciones, así como fluctuaciones en el cumplimiento de las normas. Además, la naturaleza fragmentada de las cadenas de suministro conduce a una falta de comunicación y transparencia entre las entidades involucradas. Las demandas actuales de los consumidores son muy dinámicas, e incluso una pequeña insatisfacción por parte del consumidor podría tener un gran impacto en los resultados de la empresa. El ascenso meteórico de la entrega de productos a pedido ha impulsado a las empresas actuales a pasar de los modelos logísticos internos convencionales a un modelo logístico subcontratado o basado en contratos más avanzado y rentable.

Análisis de segmentación del informe de mercado de logística de cuarta parte

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de logística de cuarta parte son el tipo y el usuario final.

- Según el tipo, el mercado se ha dividido en un modelo operativo de sinergia más un modelo de integración de soluciones y un modelo de innovación industrial. El segmento del modelo de integración de soluciones tuvo una mayor participación de mercado en 2023.

- Según el usuario final, el mercado está segmentado en aeroespacial y defensa, automoción, electrónica de consumo, alimentos y bebidas, industria, atención sanitaria, comercio minorista y otros. El segmento minorista tuvo la mayor participación del mercado en 2023.

Análisis del mercado de logística de cuarta parte por geografía

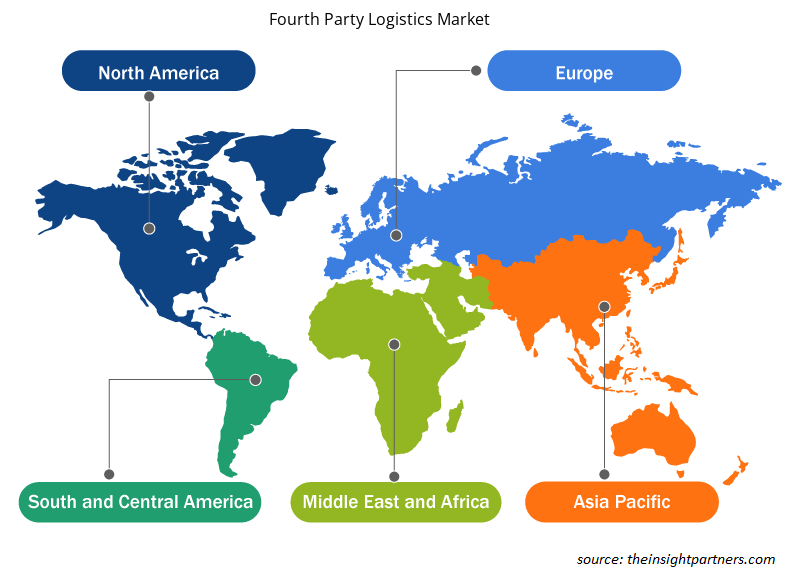

El alcance geográfico del informe del mercado de logística de cuarta parte se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

El alcance del informe del mercado de logística de cuarta parte abarca América del Norte (EE. UU., Canadá y México), Europa (España, Reino Unido, Alemania, Francia, Italia y el resto de Europa), Asia Pacífico (Corea del Sur, China, India, Japón, Australia y el resto de Asia Pacífico), Oriente Medio y África (Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos y el resto de Oriente Medio y África) y América del Sur y Central (Brasil, Argentina y el resto de América del Sur y Central). En términos de ingresos, APAC dominó la participación de mercado de logística de cuarta parte en 2023. Europa es el segundo mayor contribuyente al mercado global de logística de cuarta parte, seguida de América del Norte.

La región económicamente próspera de América del Norte está formada por las economías altamente avanzadas de los Estados Unidos y Canadá. La industrialización ha seguido siendo una alta prioridad en las economías avanzadas de los Estados Unidos y Canadá, que también ha sido el principal factor que ha impulsado la economía a lo largo de los años. Se dice que los Estados Unidos cuentan con los sectores automotriz, de atención médica, aeroespacial y de defensa, así como de electrónica de consumo más avanzados tecnológicamente del mundo. La fabricación de alto volumen y los intercambios comerciales con otras naciones del mundo hacen de la región de América del Norte un centro estratégico para el transporte y los servicios basados en la logística. Al ser económicamente avanzadas, las empresas de América del Norte tienen grandes presupuestos para gastar en actividades basadas en el transporte y la logística y, por lo tanto, contribuyen al desarrollo del mercado de logística de terceros. La presencia de una infraestructura digital establecida en América del Norte acentúa aún más las expansiones en los horizontes relacionados con los servicios de aprovisionamiento logístico. Tipo (modelo operativo Synergy Plus, modelo integrador de soluciones y modelo innovador de la industria); Usuario final (aeroespacial y defensa, automotriz, electrónica de consumo, alimentos y bebidas, industrial, atención médica, venta minorista y otros)

Perspectivas regionales del mercado de logística de cuarta parte

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de logística de cuarta parte durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de logística de cuarta parte en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de logística de cuarta parte

Alcance del informe de mercado de logística de cuarta parte

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 71.89 mil millones |

| Tamaño del mercado en 2031 | US$ 121.63 mil millones |

| CAGR global (2023 - 2031) | 6,79% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de logística de cuarta parte: comprensión de su impacto en la dinámica empresarial

El mercado de logística de cuarta parte está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de logística de cuarta parte son:

- Servicios internacionales de Allyn

- Cª

- Servicio de paquetería unificado

- Cª

- Grupo GEFCO

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de logística de cuarta parte

Noticias y desarrollos recientes del mercado de logística de cuarta parte

El mercado de logística de cuarta parte se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de logística de cuarta parte y sus estrategias:

- En diciembre de 2023, XPO (NYSE: XPO), un proveedor líder de transporte de carga LTL en América del Norte, anunció que el Tribunal de Quiebras de los Estados Unidos para el Distrito de Delaware aprobó la oferta de la empresa para adquirir 28 centros de servicio que anteriormente operaba Yellow Corporation. XPO comprará 26 centros de servicio y asumirá los contratos de arrendamiento existentes de los otros dos centros. Se espera que la transacción se cierre a fines de 2023. (Fuente: XPO, comunicado de prensa/sitio web de la empresa/boletín informativo)

Informe de mercado de logística de cuarta parte: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de logística de cuarta parte (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles de empresas detallados con análisis FODA

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de logística de cuarta parte

Obtenga una muestra gratuita para - Mercado de logística de cuarta parte