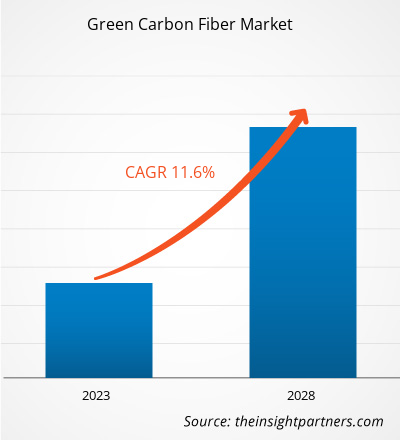

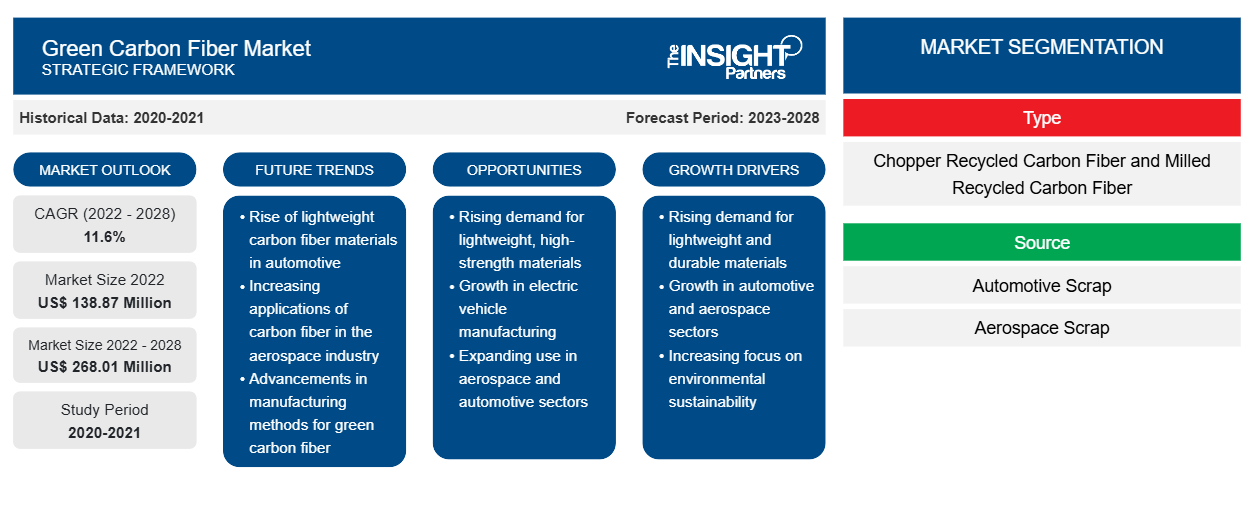

[Informe de investigación] El mercado de fibra de carbono verde se valoró en US$ 138,87 millones en 2022 y se proyecta que alcance los US$ 268,01 millones en 2028; se espera que registre una CAGR del 11,6% de 2022 a 2028.

La fibra de carbono verde es una fibra de carbono reciclada. El reciclaje de fibra de carbono es una recuperación de fibras de compuestos reforzados con fibra de carbono (CFRC). Hay dos tipos de desechos de fibra de carbono. El primer tipo de desechos es la fibra de carbono virgen: recortes del producto generado a partir de fibra seca y el material caducado no utilizado, que también se denominan desechos. La fibra de carbono verde o reciclada se utiliza para fabricar piezas nuevas de alto rendimiento en varios sectores de uso final. Los beneficios de la fibra de carbono verde, junto con la creciente demanda de materiales livianos y rentables de varias industrias de uso final, como la automotriz, la aeroespacial, la energía eólica, los artículos deportivos, etc., están impulsando el crecimiento del mercado de fibras de carbono verde.

En 2022, Asia Pacífico tuvo la mayor participación del mercado mundial de fibra de carbono verde , y se estima que Europa registrará la CAGR más alta durante el período de pronóstico. El mercado de fibra de carbono verde de Asia Pacífico está segmentado en China, Japón, India, Corea del Sur, Australia y el resto de Asia Pacífico. La industria aeroespacial y de defensa en Asia Pacífico ha estado creciendo significativamente en los últimos años. En Asia Pacífico, China es uno de los mayores fabricantes de aeronaves y uno de los mayores mercados de pasajeros aéreos nacionales.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado de fibra de carbono verde

Los países de Asia Pacífico, como China, India y Japón, enfrentaron desafíos significativos debido al cierre de unidades de fabricación, la interrupción de las cadenas de suministro y la escasez de materias primas durante la pandemia de COVID-19; esto resultó en una enorme caída en la fabricación y distribución de productos. No obstante, la pandemia también trajo algunas oportunidades lucrativas para los actores clave que operan en el mercado de fibra de carbono verde en Asia Pacífico. Muchas empresas en el mercado de fibra de carbono verde comenzaron a implementar protocolos y normas gubernamentales para vender sus productos durante o después de la segunda ola de COVID-19 para aprovechar esta oportunidad y aumentar las ventas. Por lo tanto, el respaldo de los gobiernos tiende a aumentar la demanda de fibras de carbono sostenibles, lo que impulsa el crecimiento del mercado de fibra de carbono verde.

Perspectivas del mercado

El aumento del uso de fibra de carbono verde en la industria de la energía eólica impulsa el mercado de fibra de carbono verde

La demanda de turbinas eólicas está aumentando rápidamente a medida que varios países de todo el mundo están pasando de los combustibles fósiles no renovables y dañinos para el clima a fuentes de energía limpia y renovable. Además, el aumento de la tarifa eléctrica está impulsando la necesidad de fuentes de energía renovables. El mercado de la energía eólica está creciendo a medida que los gobiernos de varios países, como Estados Unidos, Alemania, Arabia Saudita y China, están tomando iniciativas para producir energía renovable. Un aumento en la demanda de fuentes de energía renovables, especialmente energía eólica, y los esfuerzos para reducir la dependencia de la generación de energía basada en combustibles fósiles son factores significativos para el crecimiento del segmento de energía eólica, que eventualmente impulsan el crecimiento del mercado de fibra de carbono verde.

Los polímeros reforzados con fibras de carbono vírgenes (VCF) se utilizan para fabricar tapas de largueros de palas de turbinas eólicas, y los polímeros con fibras de vidrio se utilizan para fabricar revestimientos de los componentes de las palas. Sin embargo, la fibra de carbono verde se utiliza ahora ampliamente en turbinas eólicas, ya que las palas híbridas de fibra de carbono reciclada ofrecen un rendimiento medioambiental entre un 12 y un 89 % mejor. Los tiempos de recuperación de la energía y el carbono para las palas híbridas de fibra de carbono reciclada fueron entre un 5 y un 13 % inferiores a los de los operadores del mercado. El uso de fibras de carbono recicladas para las piezas de las palas de turbinas eólicas puede ser mecánicamente factible y ofrecer importantes beneficios medioambientales en comparación con las fibras de vidrio. Estas propiedades características de la fibra de carbono han ayudado a producir mejores turbinas eólicas y una mayor producción de energía. Por lo tanto, el uso creciente de fibras de carbono verdes en la industria de la energía eólica está impulsando el crecimiento del mercado.

Perspectivas basadas en tipos

Según el tipo, el mercado de fibra de carbono verde se divide en fibra de carbono reciclada triturada y fibra de carbono reciclada molida. El segmento de fibra de carbono reciclada molida tuvo una mayor participación en el mercado en 2022. La fibra de carbono reciclada molida se fabrica moliendo fibra triturada hasta obtener un polvo (molido). La longitud habitual de la fibra de carbono reciclada molida es de 80 a 100 micrómetros. Estas fibras ofrecen disipación electrostática y resistencia.

Perspectivas basadas en fuentes

Según la fuente, el mercado de fibra de carbono verde se segmenta en chatarra automotriz, chatarra aeroespacial y otros. Se espera que el segmento de chatarra automotriz registre la CAGR más alta durante el período de pronóstico. Las fibras de carbono recicladas se pueden obtener a partir de un volumen de chatarra de aproximadamente el 40 al 60 % de la fabricación de plástico reforzado con fibra de carbono (CFRP) para automóviles. El uso de fibra de carbono reciclada puede ayudar a los fabricantes de automóviles a lograr un mayor kilometraje del vehículo.

Perspectivas basadas en aplicaciones

Según la aplicación, el mercado de fibra de carbono verde se segmenta en los sectores aeroespacial, automotriz, de energía eólica, de artículos deportivos y otros. El segmento automotriz representó la mayor participación de mercado en 2022. La industria automotriz utiliza con frecuencia fibras de carbono recicladas para fabricar paneles de chasis, pisos, paneles de techo, huecos de rueda de repuesto e interiores de maleteros o capós.

La empresa utiliza un proceso de circuito cerrado para reciclar fibras de carbono secas. El coste de producción de automóviles que utilizan fibra de carbono reciclada es comparativamente menor que el coste de producción del acero. Además, la fibra de carbono reciclada se puede moldear en diferentes formas, algo que no ocurre con el acero. Estas propiedades de la fibra de carbono reciclada están impulsando su demanda en el sector de la automoción.

Los principales actores que operan en el mercado de fibra de carbono verde incluyen Procotex Corp SA, Vartega Inc, Sigmatex (UK) Ltd, Shocker Composites LLC, Carbon Conversions Co, SGL Carbon SE, Toray Industries Inc, Gen 2 Carbon Ltd, Catack-H Co Ltd e Innovative Recycling. Estas empresas se están centrando en lanzamientos de nuevos productos y expansiones geográficas para satisfacer la creciente demanda de los consumidores en todo el mundo. Tienen una amplia presencia global, lo que les permite atender a un gran conjunto de clientes y, posteriormente, aumenta su participación de mercado. Estos actores del mercado se centran en gran medida en los lanzamientos de nuevos productos y las expansiones regionales para aumentar su gama de productos en carteras especializadas.

Perspectivas regionales del mercado de fibra de carbono verde

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de fibra de carbono verde durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de fibra de carbono verde en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de fibra de carbono verde

Alcance del informe sobre el mercado de fibra de carbono verde

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2022 | US$ 138,87 millones |

| Tamaño del mercado en 2028 | US$ 268,01 millones |

| CAGR global (2022-2028) | 11,6% |

| Datos históricos | 2020-2021 |

| Período de pronóstico | 2023-2028 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de fibra de carbono verde: comprensión de su impacto en la dinámica empresarial

El mercado de fibra de carbono verde está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de fibra de carbono verde son:

- Procotex Corp. SA

- Vartega Inc

- Sigmatex (Reino Unido) Ltd

- Shocker Composites LLC

- Co. de conversiones de carbono

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de fibra de carbono verde

Informe Destacado

- Tendencias progresivas de la industria en el mercado de fibra de carbono verde para ayudar a las empresas a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por los actores del mercado en países desarrollados y en desarrollo

- Análisis cuantitativo del mercado de 2022 a 2028

- Estimación de la demanda mundial de fibra de carbono verde

- Análisis de las cinco fuerzas de Porter para ilustrar la eficacia de los compradores y proveedores en el mercado de fibra de carbono verde

- Avances recientes para comprender el escenario competitivo del mercado

- Tendencias y perspectivas del mercado, factores impulsores y restricciones del crecimiento en el mercado de fibra de carbono verde

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial.

- Tamaño del mercado de fibra de carbono verde en varios nodos

- Una descripción detallada y dinámica de la industria de la fibra de carbono verde

- Tamaño del mercado de fibra de carbono verde en varias regiones con prometedoras oportunidades de crecimiento

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de fibra de carbono verde

Obtenga una muestra gratuita para - Mercado de fibra de carbono verde