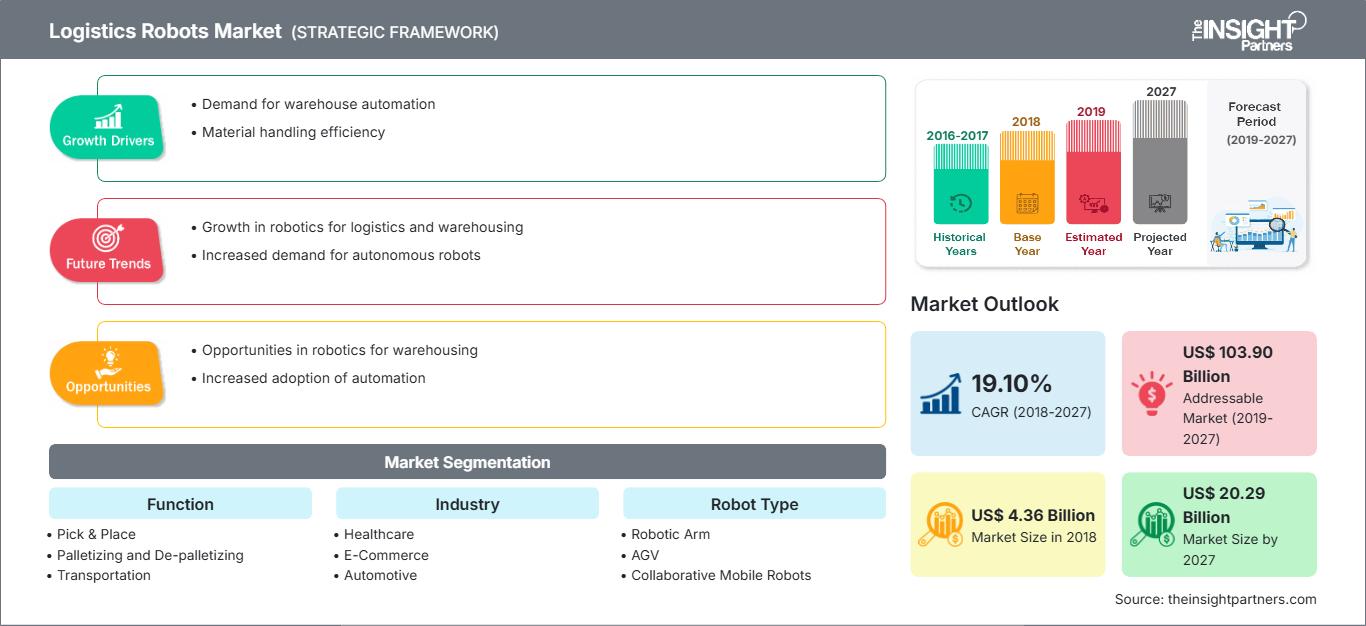

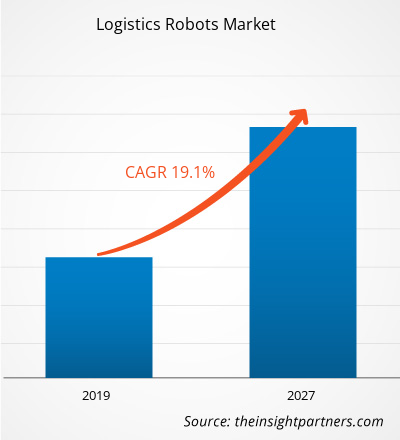

El mercado de robots logísticos se valoró en US$ 4.356,2 millones en 2018 y se espera que crezca a una CAGR del 19,10% entre 2019 y 2027 para alcanzar los US$ 20.293,4 millones en 2027.

El aumento en el número de empresas de logística y almacenamiento que se centran firmemente en la incorporación de robots para obtener los beneficios de mayor eficiencia, velocidad y mayores ganancias para mantenerse competitivos en un mercado. La adopción de tecnología avanzada como las tecnologías robóticas de almacenamiento y logística está creciendo para mejorar la eficiencia operativa a un precio asequible. El mercado global de robots logísticos está impulsado por factores como un porcentaje creciente de la población que envejece a nivel mundial, lo que conduce a la escasez de mano de obra y al aumento de las redes de la cadena de suministro a nivel mundial. Sin embargo, se anticipa que la alta inversión de capital para el despliegue de robots logísticos frenará el crecimiento del mercado de robots logísticos durante el período de pronóstico. Sin embargo, es probable que el aumento de la automatización de almacenes y el mercado bien establecido en los países de APAC y Europa brinden oportunidades de crecimiento sustanciales para mejorar la participación de mercado para los actores de la industria en el futuro cercano.

Perspectivas del mercado

El creciente porcentaje de población que envejece a nivel mundial conduce a una escasez de mano de obra

El creciente porcentaje de población envejecida a nivel mundial es uno de los principales factores que contribuyen a la reducción de la mano de obra en diversas industrias. Todos los países del mundo están presenciando un aumento en el número de personas mayores en sus comunidades. El envejecimiento poblacional se ha convertido en un factor sustancial de las transformaciones sociales del siglo XXI en todos los sectores, tanto laborales como financieros. Sin embargo, varios países como Italia, Japón y muchos más son los que registraron la mayor proporción de población envejecida, considerando que un porcentaje sustancial de su población tiene más de 65 años. Según la OMS, se espera que aproximadamente 2 millones de personas en todo el mundo tengan más de 60 años para el año 2050, lo que representa el triple de la cifra del año 2000. El aumento en el número de personas mayores explica la escasez de mano de obra. La implementación de robots logísticos en diversas industrias desempeña un papel importante, ya que reduce el costo total del proceso, aumenta la productividad, mejora la seguridad y reduce el error humano. Los rápidos avances tecnológicos en los almacenes a nivel mundial se centran en las necesidades relacionadas con las dificultades que enfrenta el proceso de la cadena de suministro y en garantizar que la tecnología utilizada se ajuste a los objetivos comerciales. La implementación de robots en diferentes unidades, funciones y etapas del ciclo de vida del producto ha sido un desafío clave para los almacenes en su trayectoria de crecimiento, lo que, a su vez, impulsará el mercado de robots logísticos en el futuro cercano.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de robots logísticos: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Información sobre los tipos de robots

El segmento de robots móviles colaborativos captó la mayor participación en el mercado global de robots logísticos. Se están implementando en diversas industrias para realizar diversas tareas, como empaquetado, atención de maquinaria y manejo de materiales, ya que estos cobots son capaces de manejar operaciones tanto pesadas como ligeras. Son altamente precisos, flexibles y precisos. Además, son fáciles de mantener y más fáciles de reconfigurar y reprogramar. Estos robots también pueden realizar trabajos delicados; además, se ajustan automáticamente según las inconsistencias que ocurren durante los procesos de fabricación. Los cobots son capaces de recopilar métricas críticas para proporcionar análisis integrados, junto con informes, para simplificar el proceso de toma de decisiones, lo que impulsa el mercado general de robots logísticos.

Información sobre funciones

El segmento de transporte captó la mayor participación en el mercado global de robots logísticos. Las mercancías se paletizan y existe una ligera variación en las formas y tamaños de los productos, lo que ha requerido la automatización de la carga y descarga de estas mercancías. La visión láser 3D está integrada con el nuevo software robótico, lo que ayuda a los usuarios a visualizar los diferentes productos en los contenedores, determinar la secuencia ideal de carga y descarga y ejecutar el proceso con alta precisión. La robótica logística, empleada para mover estanterías objetivo, extraer y levantar cestas, extender la horquilla en la estantería y devolverla a la posición objetivo, impulsa el mercado global de robots logísticos.

Perspectivas de la industria

El segmento de logística externalizada captó la mayor participación en el mercado global de robots logísticos. Estos proveedores de servicios logísticos ofrecen diversos servicios, como almacenamiento, gestión de inventario, transporte, distribución, cumplimiento de pedidos y consolidación de carga. La creciente demanda de una gestión puntual de las entregas, así como la reducción de los costos de envío, refuerzan el enfoque en el control del inventario de materiales, y se prevé que la reducción de la actividad principal de la empresa impulse el mercado de robots logísticos durante el período de pronóstico.

Las empresas suelen adoptar diversas estrategias de iniciativa de mercado para expandir su presencia global y satisfacer la creciente demanda. Esta estrategia se observa principalmente en Europa y Asia-Pacífico. Los actores del mercado de robots logísticos adoptan la estrategia de expansión e inversión en investigación y desarrollo para ampliar su base de clientes a nivel mundial, lo que también les permite mantener su marca a nivel global.

Perspectivas regionales del mercado de robots logísticos

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de robots logísticos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de robots logísticos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de robots logísticos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2018 | US$ 4.36 mil millones |

| Tamaño del mercado en 2027 | US$ 20.29 mil millones |

| CAGR global (2018-2027) | 19,10% |

| Datos históricos | 2016-2017 |

| Período de pronóstico | 2019-2027 |

| Segmentos cubiertos |

Por función

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de robots logísticos: comprensión de su impacto en la dinámica empresarial

El mercado de robots logísticos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de robots logísticos

Mercado de robots logísticos: por tipo

- Brazo robótico

- Vehículos guiados automáticos (AGV)

- Robots móviles colaborativos

- Otros

Mercado de robots logísticos: por función

- Recoger y colocar

- Paletizado y despaletizado

- Transporte

- Embalaje

Mercado de robots logísticos: por industria

- Cuidado de la salud

- Comercio electrónico

- Automotor

- Subcontratar logística

- Minorista

- Bienes de consumo

- Alimentos y bebidas

- Otros

Mercado de robots logísticos: por geografía

-

América del norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- Rusia

- Resto de Europa

-

Asia Pacífico

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

-

Oriente Medio y África

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

-

Sudamerica

- Brasil

- Argentina

- Resto de Sudamérica

Perfiles de empresas

- AGV Internacional

- Robótica Clearpath

- Daifuku Co. Ltd.

- Corporación Fanuc

- Fetch Robotics Inc.

- Grupo Kion AG

- KNAPP AG

- Kollmorgen

- KUKA AG

- Corporación Toshiba

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de robots logísticos

Obtenga una muestra gratuita para - Mercado de robots logísticos