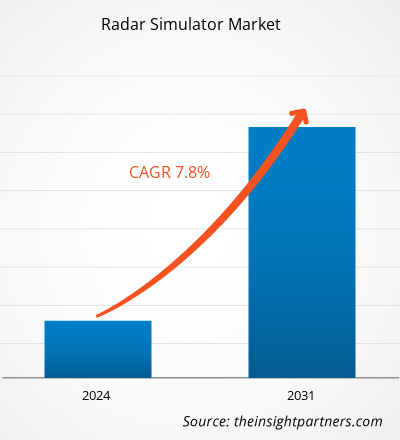

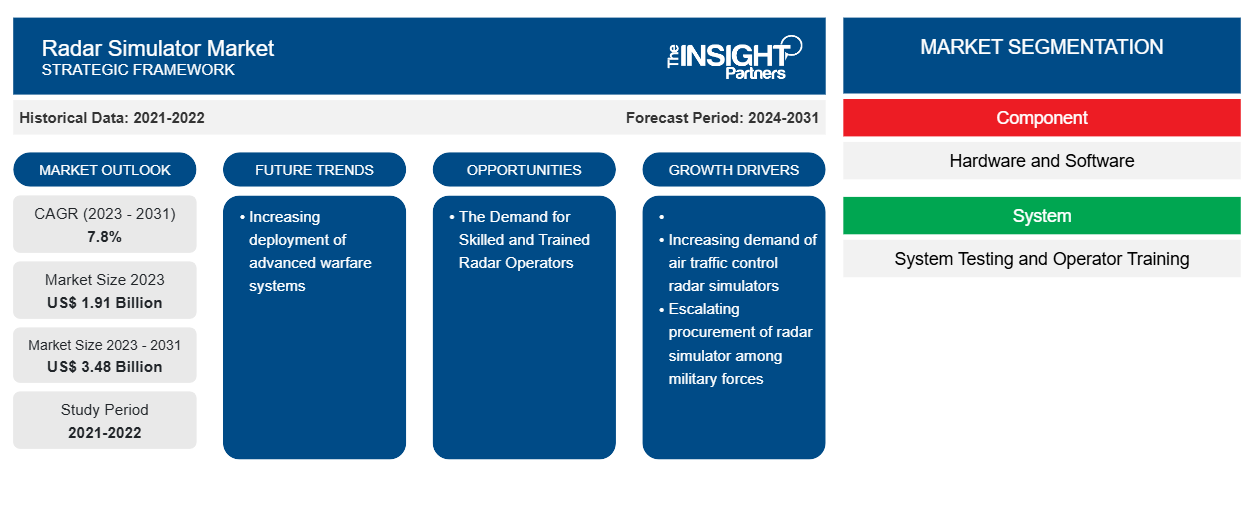

Se prevé que el tamaño del mercado de simuladores de radar alcance los 3.480 millones de dólares en 2031, frente a los 1.910 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 7,8 % durante el período 2023-2031. Es probable que el aumento del despliegue de sistemas de guerra avanzados siga siendo una tendencia clave en el mercado.

Análisis del mercado de simuladores de radar

Los principales actores en el ecosistema del mercado global de simuladores de radar incluyen proveedores de materias primas y componentes, fabricantes y desarrolladores de simuladores de radar, integradores de sistemas y usuarios finales. Los proveedores de componentes y hardware ofrecen numerosas piezas y componentes para los fabricantes de simuladores de radar. Se utilizan diferentes tipos de componentes para fabricar simuladores de radar, incluyendo antenas, receptores, generadores de formas de onda y microcontroladores . El suministro oportuno de todos estos componentes es crucial para el funcionamiento eficiente en las plantas de fabricación de simuladores de radar. Por lo tanto, cualquier impacto operativo en estos proveedores de componentes afecta directamente al mercado de simuladores de radar.

Descripción general del mercado de simuladores de radar

Los principales participantes en la cadena de valor son los fabricantes de simuladores de radar y los desarrolladores de software. Ofrecen el producto final integrado a los sectores de uso final. Los principales actores que operan en el mercado incluyen a Collins Aerospace; L3Harris Technologies, Inc.; Mercury Systems, Inc.; Ultra Electronics Holdings plc; y ARI Simulation. Los integradores de sistemas que operan en el mercado integran las soluciones de hardware y software para ofrecer el producto final a los usuarios finales en el mercado global de simuladores de radar.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de simuladores de radar

Aumenta la adquisición de simuladores de radar entre las fuerzas militares

Las preocupaciones por la seguridad en lugares públicos, fronteras nacionales, puertos navales y bases de la fuerza aérea están aumentando continuamente en todo el mundo. Gestionar y controlar eficazmente las amenazas aéreas, navales o terrestres con la ayuda de sistemas de radar se ha convertido en un paradigma importante para las autoridades militares y de seguridad de todas las regiones del mundo. Los sistemas de radar y los simuladores de radar están ganando cada vez más terreno para garantizar la seguridad de las operaciones militares y el personal, así como una formación eficiente para los operadores de radar. Muchos países, como Estados Unidos, China, India, Japón, Australia, Canadá, Alemania, Francia y el Reino Unido, entre otros, están adquiriendo simuladores de radar para fortalecer sus respectivas fuerzas militares y capacitar a los operadores para combatir las amenazas de los ataques aéreos avanzados que ocurren con frecuencia. Los simuladores de radar también ayudan a los oficiales militares a diseñar planes de respuesta en caso de ataques de amenazas no identificadas. La adquisición de simuladores de radar ha aumentado en los sectores militares de varios países y los gobiernos de estos países están proponiendo mayores presupuestos de gasto militar para ayudar a los sectores militar y de defensa a adquirir sistemas de radar y simuladores de radar más avanzados.

La demanda de operadores de radar capacitados y calificados

El auge de las modernas torres de control del tráfico aéreo y las tecnologías militares avanzadas ha creado una creciente demanda de operadores capaces de operar con equipos y tecnología militar modernos relacionados con aeronaves en tierra. Los simuladores de radar manejan grandes volúmenes de datos de señales de radar sin procesar para descubrir amenazas aéreas no identificadas, amenazas navales o cualquier otro objeto dentro de los perímetros definidos. Ha habido un aumento en la adopción de simuladores de radar entre las fuerzas militares y de defensa en varios países, lo que ha desencadenado una gran inversión para el desarrollo e investigación de la tecnología de simulación de radar. Esto ha dado lugar a la demanda de operadores de radar altamente capacitados y calificados en aeropuertos, estaciones base de la fuerza aérea, buques de guerra, buques de carga militares y puertos navales. El hecho de que se espere que esta demanda aumente en los próximos años presenta una enorme oportunidad de crecimiento para los actores clave del mercado, así como para el mercado general de simuladores de radar en los próximos años. Como se espera que los sectores aeroespacial y de defensa crezcan durante el período de pronóstico, se espera que esto impulse aún más la demanda de operadores de radar capacitados, capacitados y experimentados para salvaguardar el espacio aéreo, las vías fluviales y las fronteras terrestres de los países. Por lo tanto, se prevé que la demanda de operadores de radar capacitados y calificados en los sectores de la aviación comercial y de defensa, junto con las fuerzas navales y las fuerzas militares terrestres, impulse el mercado de simuladores de radar durante el futuro previsible.

Análisis de segmentación del informe de mercado de simuladores de radar

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de simuladores de radar son componentes, sistemas y aplicaciones.

- Según los componentes, el mercado de simuladores de radar se segmenta en hardware y software. El segmento de hardware tuvo una mayor participación de mercado en 2023.

- Según el sistema, el mercado de simuladores de radar se segmenta en pruebas de sistemas y capacitación de operadores. El segmento de capacitación de operadores tuvo una mayor participación de mercado en 2023.

- Según la aplicación, el mercado de simuladores de radar se segmenta en militar y comercial. El segmento comercial tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de simuladores de radar por geografía

El alcance geográfico del informe de mercado de simuladores de radar se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

América del Norte ha dominado el mercado en 2023, seguida de las regiones de Europa y Asia Pacífico. Además, es probable que Asia Pacífico también sea testigo de la CAGR más alta en los próximos años. Estados Unidos dominó el mercado de simuladores de radar de América del Norte en 2023. Esto se debe principalmente a la adopción temprana de la tecnología de simuladores de radar. Además, Estados Unidos tiene el mayor presupuesto de defensa del mundo y una gran parte del presupuesto se destina a la adopción y adquisición de sistemas de armas mejorados. Esto contribuye a la demanda de simuladores de radar en todo el país. El creciente número de aeronaves en la fuerza aérea y el ejército de Estados Unidos también actúa como un factor de apoyo para el crecimiento del mercado en el país. La creciente utilización de simuladores de radar para simular con precisión el terreno del mundo real, así como los patrones climáticos y los objetivos en todo Estados Unidos, también está impulsando el crecimiento del mercado en el país. La creciente demanda de simuladores de radar nuevos y avanzados en Estados Unidos es un factor importante que impulsa el crecimiento del mercado. Además, los simuladores de radar que ofrecen capacidades para la simulación de radar meteorológico también están ganando popularidad en Estados Unidos. El uso generalizado de simuladores de radar para la formación comercial y la enseñanza de pilotos y personal de apoyo aéreo ha ido en aumento en el país. Además, la adopción de simuladores de radar para crear simulaciones complejas de múltiples radares y múltiples objetivos, lo que permite probar sistemas de datos RADAR, también impulsa el crecimiento del mercado en los EE. UU. La presencia de varios actores clave del mercado, como Cambridge Pixel Ltd (EE. UU.), Harris Corporation (EE. UU.), Buffalo Computer Graphics (EE. UU.), Mercury Systems, Inc. (EE. UU.), Textron Systems (EE. UU.) y Rockwell Collins (EE. UU.), ayuda al crecimiento del mercado en el país.

Perspectivas regionales del mercado de simuladores de radar

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de simuladores de radar durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de simuladores de radar en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de simuladores de radar

Alcance del informe de mercado de simuladores de radar

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 1.910 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | 3.480 millones de dólares estadounidenses |

| CAGR global (2023 - 2031) | 7,8% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de simuladores de radar está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de simuladores de radar son:

- Tecnologías Adacel Limitada

- Simulación ARI

- Gráficos de computadora de Buffalo

- Cambridge Pixel Ltd.

- Tecnologías L3Harris, Inc.

- Sistemas de mercurio inc.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de simuladores de radar

Noticias y desarrollos recientes del mercado de simuladores de radar

El mercado de simuladores de radar se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de simuladores de radar:

- El contrato del simulador de entorno de radar COBRA (CRES) se ha firmado entre HENSOLDT Sensors GmbH y OCCAR en nombre de Alemania y Francia. (Fuente: OCCAR, comunicado de prensa, junio de 2021)

- Micro Nav se enorgullece de anunciar la adjudicación de un contrato de NATS para proporcionar capacidades de simulación de torre y radar BEST en los aeropuertos de Aberdeen, Glasgow y Southampton. El contrato incluye la actualización de los sistemas de torre 2D BEST existentes en los aeropuertos de Aberdeen y Glasgow a la capacidad de simulación de torre 3D y la provisión de un simulador de torre 3D BEST completamente nuevo en el aeropuerto de Southampton. (Fuente: Micro Nav, comunicado de prensa, agosto de 2023)

Informe de mercado sobre simuladores de radar: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de simuladores de radar (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de simuladores de radar y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de simuladores de radar, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado de simuladores de radar que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de simuladores de radar

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de simuladores de radar

Obtenga una muestra gratuita para - Mercado de simuladores de radar