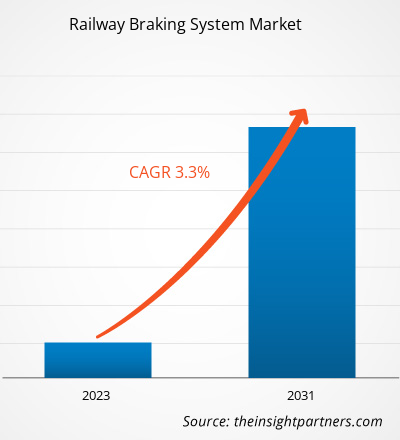

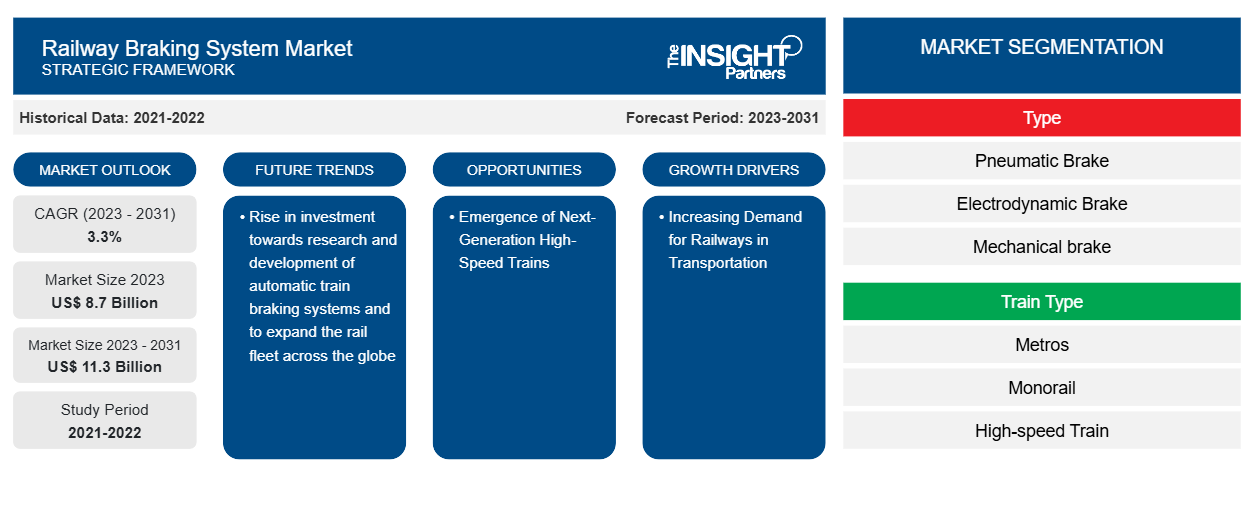

Se prevé que el tamaño del mercado de sistemas de frenado ferroviario alcance los 11 300 millones de dólares en 2031, frente a los 8700 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 3,3 % entre 2023 y 2031. El aumento de la inversión en investigación y desarrollo de sistemas automáticos de frenado de trenes y la expansión de la flota ferroviaria en todo el mundo se encuentran entre las tendencias clave que impulsan el mercado de sistemas de frenado ferroviario.

Análisis del mercado de sistemas de frenado ferroviario

Factores como la creciente demanda de tránsito ferroviario entre las personas como modo de transporte y los crecientes proyectos ferroviarios para construir nuevos ferrocarriles y líneas en metro, monorraíl y trenes de alta velocidad. Los proyectos, junto con la creciente inversión gubernamental para expandir su sector ferroviario, continúan fortaleciendo el sector ferroviario. Con el auge del sector ferroviario , el alcance de la integración de sistemas de seguridad, incluidos los frenos, está recibiendo un gran impulso. Además, la llegada de sistemas de frenado automático de trenes, operaciones ferroviarias automáticas y trenes de alta velocidad de próxima generación en las economías emergentes es otro factor que atrae el crecimiento del mercado de sistemas de frenado. Además, el creciente número de paquetes de volumen y comercio en las naciones está afectando el uso de los ferrocarriles, ya que es el modo de transporte más barato en comparación con las vías aéreas. Por lo tanto, el auge del negocio de carga, el ciclo de desarrollo del ferrocarril de carga también ha aumentado. Con el creciente desarrollo del tren ligero, la integración de los sistemas de frenado también aumentará.

Descripción general del mercado de sistemas de frenado ferroviario

En vista de las megatendencias clave como la sostenibilidad, la urbanización, los vehículos de movilidad y la digitalización, la industria del transporte está experimentando un enorme crecimiento. Las tendencias mencionadas anteriormente beneficiarán al sector ferroviario al brindar oportunidades de crecimiento sostenible a largo plazo para la movilidad futura. Además, debido a los estrictos estándares de seguridad y calidad involucrados en el sector ferroviario, la integración de sistemas y equipos avanzados está aumentando. En el sector ferroviario, las vías con doble sujeción elástica, la conducción automatizada , los cables de alimentación aérea/tercer carril y los sistemas de señalización de control de trenes basados en comunicaciones se encuentran entre las pocas tecnologías que se están integrando en las líneas de metro. La incorporación de estas tecnologías avanzadas en los rieles del metro desempeñará un papel esencial en el aumento del alcance para la integración de los sistemas de frenado de rieles.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de sistemas de frenado ferroviario

La creciente demanda de ferrocarriles en el transporte

El transporte ferroviario se considera un modo de transporte seguro, protegido y económico en comparación con el transporte por carretera. En lo que respecta a factores como la alta precisión y la capacidad de cubrir un área geográfica máxima, la demanda entre los viajeros está creciendo. Para garantizar la seguridad de los trenes, las mercancías y los pasajeros, los sistemas de frenado se encuentran entre los sistemas utilizados en los rieles. Además, los proyectos gubernamentales como el Metro de Dubai Route 2020 para construir nueva infraestructura ferroviaria y aumentar las inversiones para expandir la conectividad ferroviaria están contribuyendo al crecimiento del sector ferroviario. La demanda de ferrocarriles para el transporte de mercancías también está aumentando. Con el aumento del volumen de paquetes y mercancías transportadas a través de los ferrocarriles, el número de trenes está aumentando. El transporte masivo de mercancías a través de ferrocarriles está creando oportunidades lucrativas tanto para los fabricantes de trenes como para otros sistemas relacionados con los trenes. Por lo tanto, este aspecto del aumento del transporte de mercancías y pasajeros por ferrocarril está impulsando el crecimiento del sector ferroviario y motivando a los gobiernos de los países a realizar grandes inversiones en proyectos ferroviarios.

La aparición de trenes de alta velocidad de nueva generación

En una época de constantes avances tecnológicos, la industria ferroviaria mundial está experimentando nuevas tecnologías y sistemas que desempeñan un papel crucial en la transformación de todo el sector. Por ejemplo, en abril de 2024, Corea del Sur presentará un tren bala de alta velocidad de próxima generación. Este tren tiene una velocidad máxima de 320 km/h. Además, en octubre de 2023, Francia presentó sus trenes TGV M de alta velocidad de próxima generación, y se espera que entren en servicio en 2025. Se prevé que este avance tecnológico y la aparición de trenes de alta velocidad en todo el mundo impulsen la demanda del mercado de sistemas de frenado ferroviario durante el período de pronóstico.

Además, la llegada de los frenos de disco neumáticos de última generación está abriendo camino para transformar los raíles. Además, en el sistema de frenado directo, los comandos de frenado se transmiten rápidamente con un retraso de tiempo más corto. Además, Shift2Rail, una empresa conjunta, está trabajando en una solución de prueba de frenos digital, que permitiría a los conductores probar los frenos desde sus cabinas a través de una tableta. Esta solución de prueba de frenos digital ayudaría a ahorrar tiempo y costos de mano de obra al tiempo que mejora la flexibilidad y la seguridad. En el período de la movilidad de próxima generación, la aparición de trenes de alta velocidad, soluciones de frenos de prueba digitales y frenos de próxima generación ayudarían a preparar el sector ferroviario para el futuro. Se proyecta que todos los aspectos mencionados ocuparán una posición significativa en la adopción de sistemas de frenado ferroviario.

Análisis de segmentación del informe de mercado del sistema de frenado ferroviario

Los segmentos clave que contribuyeron a la derivación del análisis del mercado del sistema de frenado ferroviario son el tipo y el tipo de tren.

- Según el tipo, el mercado de sistemas de frenado ferroviario se ha dividido en frenos neumáticos, frenos electrodinámicos, frenos mecánicos y frenos electromagnéticos. El segmento de frenos neumáticos tuvo una mayor participación de mercado en 2023.

- Según el tipo de tren, el mercado de sistemas de frenado ferroviario se ha dividido en metros, monorraíles, trenes de alta velocidad, tranvías y trenes de mercancías. El segmento de líneas de tranvías y trenes ligeros tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de los sistemas de frenado ferroviario por geografía

El alcance geográfico del informe de mercado del sistema de frenado ferroviario se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África y América del Sur.

En 2023, Asia Pacífico dominará el mercado de sistemas de frenado ferroviario. La región de Asia Pacífico incluye Australia, China, Japón, India, Corea del Sur y el resto de Asia Pacífico. Las economías estables y los avances tecnológicos respaldan el crecimiento de una gama diversificada de industrias y mercados en la región. La conectividad de la red ferroviaria regional en la región del Sudeste Asiático está mejorando debido a la implementación de varios proyectos para conectar las rutas existentes bajo la red ferroviaria de Pan Asia. Los nuevos proyectos ferroviarios apoyados y planificados por el gobierno de China garantizarían conexiones entre las principales ciudades del continente del Sudeste Asiático, que se extienden desde Kunming en China hasta Bangkok, Singapur y Kuala Lumpur, con una línea central desde Vientiane en Laos hasta Bangkok; una línea oriental a través de la ciudad de Hanoi y Ho Chi Minh City en Vietnam y Phnom Penh City en Camboya; y una línea occidental a través de Yangon en Myanmar.

Indonesia y Filipinas también han planificado proyectos ferroviarios para conectar ciudades clave con sus principales islas. Los sectores ferroviarios de Filipinas, Tailandia, China e India están realizando enormes inversiones en sus respectivos territorios para fortalecer el tránsito ferroviario mediante la integración de tecnologías avanzadas. Además, Japón se encuentra entre los principales países que están utilizando trenes de alta velocidad para reducir la congestión en las carreteras y ayudar a los pasajeros a ahorrar tiempo y dinero.

Perspectivas regionales del mercado de sistemas de frenado ferroviario

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sistemas de frenado ferroviario durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sistemas de frenado ferroviario en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sistemas de frenado ferroviario

Alcance del informe de mercado del sistema de frenado ferroviario

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 8.7 mil millones |

| Tamaño del mercado en 2031 | US$ 11.3 mil millones |

| CAGR global (2023 - 2031) | 3,3% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas de frenado ferroviario está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sistemas de frenado ferroviario son:

- DAKO-CZ

- Industria de frenos Akebono Co., Ltd.

- Tren Amsted

- Knorr-Bremse AG

- Corporación Nabtesco

- Servicios ferroviarios Sabre Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sistemas de frenado ferroviario

Noticias y desarrollos recientes del mercado de sistemas de frenado ferroviario

El mercado de sistemas de frenado de ferrocarriles se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de sistemas de frenado de ferrocarriles y las estrategias:

- En enero de 2024, Wabtec Corporation encargó un sistema de frenos a Siemens India Private Limited por 157 millones de dólares. Mediante este acuerdo de suministro, Siemens Limited proporcionará sistemas de frenos con un rendimiento operativo, una eficiencia y una seguridad mejorados para la nueva línea de 1200 locomotoras eléctricas.

- En octubre de 2023, Siemens Mobility lanzó un nuevo sistema de frenos sin aire. Este nuevo sistema de frenos permite el control totalmente eléctrico del freno de fricción en vehículos ferroviarios y refuerza la cartera de productos de la empresa.

Informe sobre el mercado de sistemas de frenado ferroviario: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sistemas de frenado ferroviario (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y de país para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles de empresas detallados con análisis FODA

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas de frenado ferroviario

Obtenga una muestra gratuita para - Mercado de sistemas de frenado ferroviario