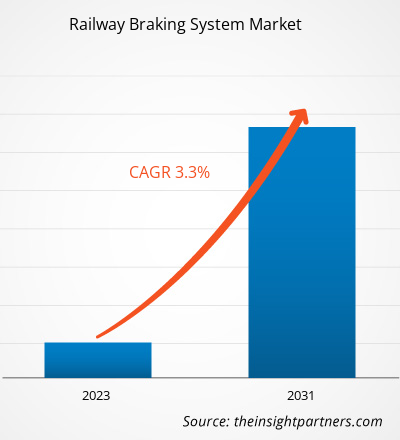

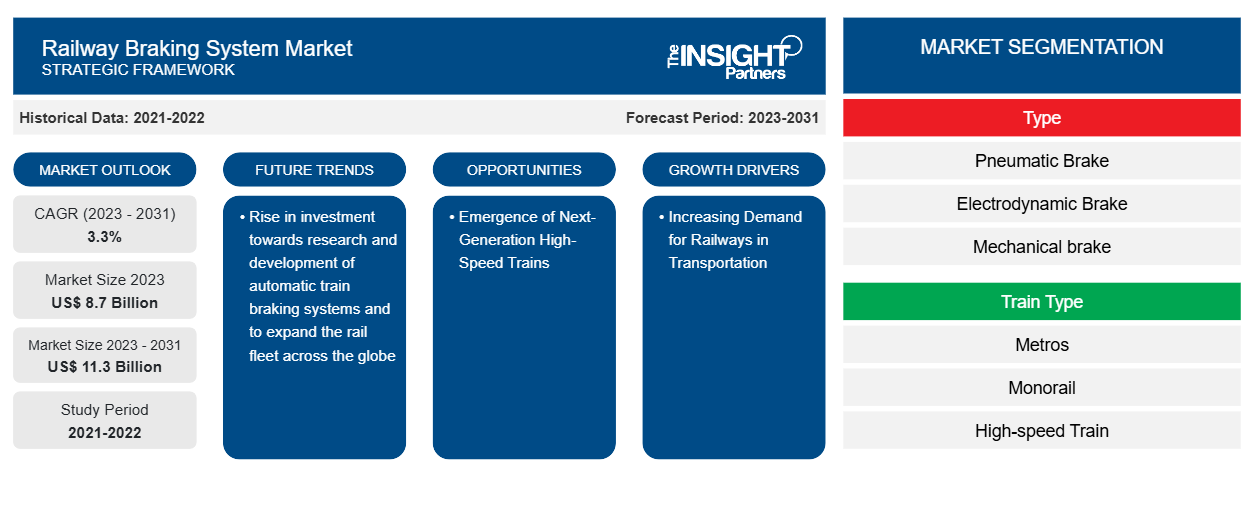

Le marché des systèmes de freinage ferroviaire devrait atteindre 11,3 milliards USD d'ici 2031, contre 8,7 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 3,3 % en 2023-2031. L'augmentation des investissements dans la recherche et le développement de systèmes de freinage automatique des trains et l'expansion du parc ferroviaire à travers le monde font partie des principales tendances qui stimulent le marché des systèmes de freinage ferroviaire.

Analyse du marché des systèmes de freinage ferroviaire

Français Facteurs tels que la demande croissante de transport ferroviaire parmi les particuliers en tant que mode de transport et la croissance des projets ferroviaires pour la construction de nouvelles voies ferrées et de lignes de métro, de monorail et de train à grande vitesse. Les projets associés à l'augmentation des investissements gouvernementaux pour l'expansion de leur secteur ferroviaire continuent de renforcer le secteur ferroviaire. Avec l'essor du secteur ferroviaire , la portée de l'intégration des systèmes de sécurité, y compris les freins, reçoit un élan important. En outre, l'arrivée des systèmes de freinage automatique des trains, des opérations ferroviaires automatiques et des trains à grande vitesse de nouvelle génération dans les économies émergentes est un autre facteur qui attire la croissance du marché des systèmes de freinage. De plus, le nombre croissant de colis de volume et d'échanges dans les nations a un impact sur l'utilisation des chemins de fer, car c'est le mode de transport le moins cher par rapport aux voies aériennes. Par conséquent, le secteur du fret est en plein essor, le cycle de développement du fret ferroviaire a également augmenté. Avec le développement croissant du métro léger, l'intégration des systèmes de freinage va également augmenter.

Aperçu du marché des systèmes de freinage ferroviaire

À la lumière des grandes tendances clés telles que la durabilité, l'urbanisation, les véhicules de mobilité et la numérisation, le secteur des transports connaît une croissance énorme. Les tendances mentionnées ci-dessus profiteront au secteur ferroviaire en offrant des opportunités de croissance durable à long terme pour la mobilité future. En outre, en raison des normes strictes de sécurité et de qualité en vigueur dans le secteur ferroviaire, l'intégration de systèmes et d'équipements avancés augmente. Dans le secteur ferroviaire, les voies à double fixation élastique, la conduite automatisée , les câbles électriques aériens/troisième rail et les systèmes de signalisation de contrôle des trains basés sur les communications font partie des rares technologies qui sont intégrées aux lignes de métro. L'intégration de ces technologies avancées dans les rails du métro jouera un rôle essentiel dans l'augmentation des possibilités d'intégration des systèmes de freinage ferroviaire.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des systèmes de freinage ferroviaire

Demande croissante de transport ferroviaire

Le transport ferroviaire est considéré comme un mode de transport sûr, sécurisé et économique par rapport au transport routier. En ce qui concerne des facteurs tels que la haute précision et la capacité à couvrir une zone géographique maximale, la demande des voyageurs augmente. Pour assurer la sécurité des trains, du fret et des passagers, les systèmes de freinage font partie des systèmes utilisés dans les rails. En outre, les projets gouvernementaux tels que le métro de Dubaï Route 2020 pour la construction de nouvelles infrastructures ferroviaires et l'augmentation des investissements pour étendre la connectivité ferroviaire contribuent à la croissance du secteur ferroviaire. La demande de chemins de fer pour le transport de marchandises augmente également. Avec l'augmentation du volume de colis et de marchandises transportés par chemin de fer, le nombre de trains augmente. Le transport massif de marchandises par chemin de fer crée des opportunités lucratives pour les fabricants de trains et d'autres systèmes liés aux trains. Ainsi, cet aspect de l'augmentation du transport de marchandises et des passagers ferroviaires stimule la croissance du secteur ferroviaire et motive les gouvernements des pays à investir massivement dans des projets ferroviaires.

L'émergence des trains à grande vitesse de nouvelle génération

À l’heure des avancées technologiques constantes, l’industrie ferroviaire mondiale fait l’expérience de nouvelles technologies et de nouveaux systèmes qui jouent un rôle crucial dans la transformation de l’ensemble du secteur. Par exemple, en avril 2024, la Corée du Sud a dévoilé un train à grande vitesse de nouvelle génération. Ce train a une vitesse maximale de 320 km/h. De plus, en octobre 2023, la France a dévoilé ses trains à grande vitesse TGV M de nouvelle génération, qui devraient être en service en 2025. Ces avancées technologiques et l’émergence de trains à grande vitesse dans le monde entier devraient stimuler la demande pour le marché des systèmes de freinage ferroviaire au cours de la période de prévision.

L'avènement des freins à disque pneumatiques de nouvelle génération ouvre la voie à la transformation des rails. De plus, dans le système de freinage direct, les commandes de freinage sont transmises rapidement avec un délai plus court. En outre, Shift2Rail, une entreprise commune, travaille sur une solution de test de frein numérique, qui permettrait aux conducteurs de tester les freins depuis leur cabine via une tablette. Cette solution de test de frein numérique permettrait d'économiser du temps et des coûts de main-d'œuvre tout en améliorant la flexibilité et la sécurité. À l'ère de la mobilité de nouvelle génération, l'émergence des trains à grande vitesse, des solutions de test de freinage numérique et des freins de nouvelle génération contribuerait à préparer le secteur ferroviaire pour l'avenir. Tous les aspects mentionnés devraient occuper une place importante dans l'adoption des systèmes de freinage ferroviaire.

Analyse de segmentation du rapport sur le marché des systèmes de freinage ferroviaire

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des systèmes de freinage ferroviaire sont le type et le type de train.

- En fonction du type, le marché des systèmes de freinage ferroviaire a été divisé en freins pneumatiques, freins électrodynamiques, freins mécaniques et freins électromagnétiques. Le segment des pouces de freins pneumatiques détenait une part de marché plus importante en 2023.

- En fonction du type de train, le marché des systèmes de freinage ferroviaire a été divisé en métros, monorails, trains à grande vitesse, tramways légers et trains de marchandises. Le segment des lignes de tramways légers détenait une part de marché plus importante en 2023.

Analyse des parts de marché des systèmes de freinage ferroviaire par géographie

La portée géographique du rapport sur le marché des systèmes de freinage ferroviaire est principalement divisée en cinq régions : Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique et Amérique du Sud.

L'Asie-Pacifique dominera le marché des systèmes de freinage ferroviaire en 2023. La région Asie-Pacifique comprend l'Australie, la Chine, le Japon, l'Inde, la Corée du Sud et le reste de l'Asie-Pacifique. Des économies stables et des avancées technologiques soutiennent la croissance d'une gamme diversifiée d'industries et de marchés dans la région. La connectivité du réseau ferroviaire régional dans la région de l'Asie du Sud-Est s'améliore en raison de la mise en œuvre de plusieurs projets visant à connecter les itinéraires existants dans le cadre du réseau ferroviaire panasiatique. De nouveaux projets ferroviaires soutenus et planifiés par le gouvernement chinois assureraient des connexions entre les principales villes du continent de l'Asie du Sud-Est, s'étendant de Kunming en Chine à Bangkok, Singapour et Kuala Lumpur, avec une ligne centrale de Vientiane au Laos à Bangkok ; une ligne orientale à travers la ville de Hanoi et Ho Chi Minh-Ville au Vietnam et la ville de Phnom Penh au Cambodge ; et une ligne occidentale à travers Yangon au Myanmar.

L’Indonésie et les Philippines ont également prévu des projets ferroviaires pour relier les principales villes à leurs principales îles. Les secteurs ferroviaires des Philippines, de la Thaïlande, de la Chine et de l’Inde réalisent d’énormes investissements sur leurs territoires respectifs pour renforcer le transport ferroviaire en intégrant des technologies de pointe. En outre, le Japon fait partie des principaux pays qui utilisent le train à grande vitesse pour réduire la congestion sur les routes et aider les passagers à économiser du temps et de l’argent.

Aperçu régional du marché des systèmes de freinage ferroviaire

Les tendances et facteurs régionaux influençant le marché des systèmes de freinage ferroviaire tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des systèmes de freinage ferroviaire en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des systèmes de freinage ferroviaire

Portée du rapport sur le marché des systèmes de freinage ferroviaire

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 8,7 milliards de dollars américains |

| Taille du marché d'ici 2031 | 11,3 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 3,3% |

| Données historiques | 2021-2022 |

| Période de prévision | 2023-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des systèmes de freinage ferroviaire connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des systèmes de freinage ferroviaire sont :

- DAKO-CZ

- Akebono Brake Industry Co., Ltd.

- Train d'Amsted

- Knorr-Bremse AG

- Société Nabtesco

- Sabre Rail Services Ltd

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des systèmes de freinage ferroviaire

Actualités et développements récents du marché des systèmes de freinage ferroviaire

Le marché des systèmes de freinage ferroviaire est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Voici une liste des développements sur le marché des systèmes de freinage ferroviaire et des stratégies :

- En janvier 2024, Wabtec Corporation a commandé un système de freinage d'une valeur de 157 millions de dollars américains à Siemens India Private Limited. Grâce à cet accord de fourniture, Siemens Limited fournira des systèmes de freinage offrant des performances opérationnelles, une efficacité et une sécurité améliorées pour la nouvelle gamme de 1 200 locomotives électriques.

- En octobre 2023, Siemens Mobility a lancé un nouveau système de freinage sans air comprimé. Ce nouveau système de freinage permet un contrôle entièrement électrique du frein à friction des véhicules ferroviaires et renforce le portefeuille de produits de l'entreprise.

Rapport sur le marché des systèmes de freinage ferroviaire : couverture et livrables

Le rapport « Taille et prévisions du marché des systèmes de freinage ferroviaire (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de Porter

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés avec analyse SWOT

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des systèmes de freinage ferroviaire

Obtenez un échantillon gratuit pour - Marché des systèmes de freinage ferroviaire