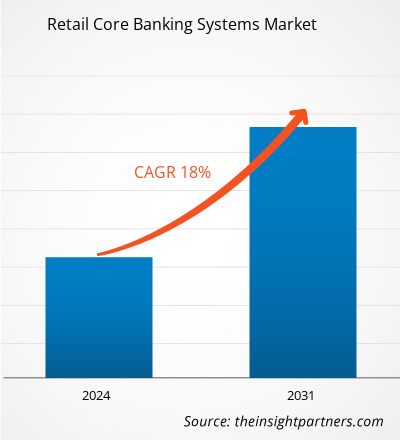

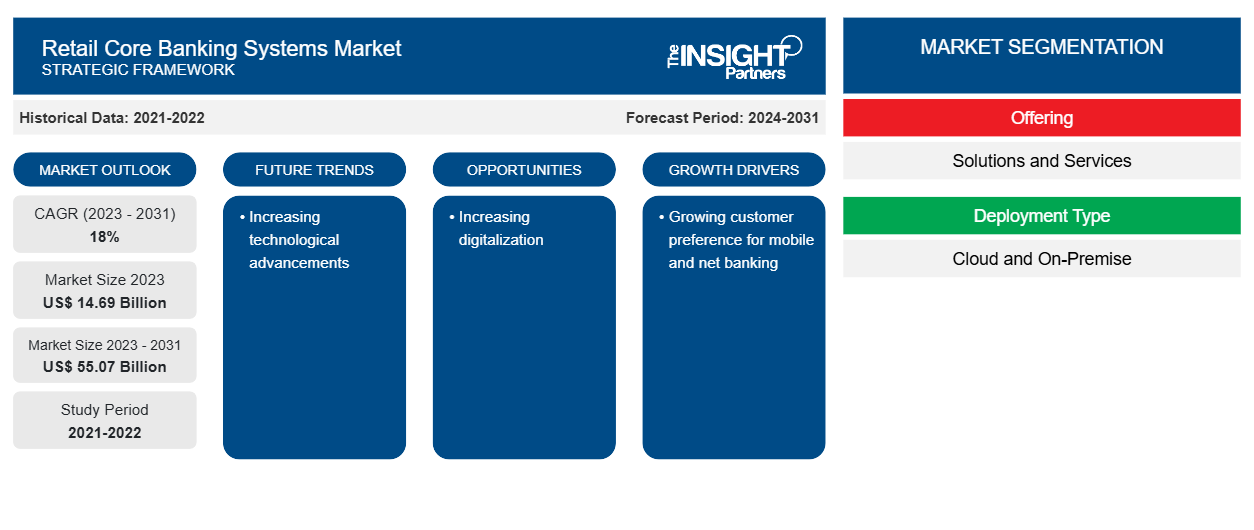

Se proyecta que el tamaño del mercado de sistemas bancarios básicos minoristas alcance los 55.070 millones de dólares estadounidenses para 2031, desde los 14.690 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 18 % entre 2023 y 2031.Es probable que los crecientes avances tecnológicos sigan siendo tendencias clave en el mercado de sistemas bancarios básicos minoristas.

Análisis del mercado de sistemas bancarios básicos para minoristas

Debido a la rápida adopción de tecnología de vanguardia por parte del sistema bancario, el mercado global de soluciones de banca central minorista está creciendo significativamente y se prevé que siga creciendo en el futuro. Un sistema bancario central es una red de sucursales bancarias que permite a los clientes acceder a una variedad de servicios financieros y controlar sus cuentas desde cualquier lugar del mundo.

Además, los bancos y las empresas de tecnología financiera están aplicando la tecnología de la información (TI) para mejorar la sostenibilidad y el crecimiento de sus respectivos negocios. La tecnología bancaria básica ofrece formas de satisfacer a los clientes, mejorar el rendimiento de las transacciones bancarias y adaptarse rápidamente a las cambiantes necesidades comerciales. La tecnología también permite a los bancos agilizar los procesos, reducir los retrasos, mejorar los informes y el cumplimiento normativo y proporcionar a los clientes un acceso sencillo.

Descripción general del mercado de sistemas bancarios básicos para minoristas

Los sistemas bancarios básicos minoristas brindan a los bancos las herramientas que necesitan para brindar un mejor servicio a sus clientes a través de canales digitales para la banca personal o de consumo. Al permitir que los clientes accedan al crédito y transfieran dinero de manera segura, estas tecnologías mejoran la gestión del dinero de los clientes. El uso de sistemas bancarios minoristas ayuda a los bancos a recaudar capital a bajo costo, establecer una clientela estable y mantener una gestión eficaz de las relaciones con los clientes (CRM), todo lo cual se prevé que impulse el mercado de los sistemas bancarios básicos minoristas. Además, la creciente demanda de los consumidores de banca móvil y por Internet está respaldando la expansión del mercado.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de los sistemas bancarios básicos para minoristas

Creciente preferencia de los clientes por la banca móvil y por Internet

El crecimiento futuro del mercado de soluciones de banca básica para minoristas se atribuirá en gran medida a la creciente demanda de servicios bancarios móviles y por Internet por parte de los clientes. Con la ayuda de la banca móvil, los clientes pueden acceder y gestionar sus cuentas bancarias, así como realizar otras tareas financieras mediante sus dispositivos portátiles, como teléfonos inteligentes o tabletas. Un servicio bancario conocido como "banca por Internet" permite a los usuarios acceder a una variedad de recursos bancarios y realizar transacciones financieras a través de Internet. Para garantizar operaciones de canal más fluidas, la solución de banca básica para minoristas se utiliza para vincular los servicios de banca por Internet con los canales operativos convencionales del banco.

Aumento de la digitalización

El crecimiento futuro del mercado de soluciones de banca central minorista se atribuye en gran medida a la creciente digitalización de la industria bancaria. En el sector de banca, servicios financieros y seguros (BFSI), la "transformación digital" se refiere a la integración de tecnologías y tácticas digitales para mejorar las experiencias de los clientes, agilizar los procesos comerciales e impulsar la competitividad de la industria. La banca multicanal está respaldada por soluciones de banca central minorista, que brindan a los usuarios acceso a servicios a través de una variedad de canales, incluidos cajeros automáticos, aplicaciones móviles , banca en línea y más. Por lo tanto, se anticipa que la creciente digitalización presentará nuevas oportunidades para los actores del mercado de sistemas bancarios centrales minoristas durante el período de pronóstico.

Análisis de segmentación del informe de mercado de sistemas bancarios básicos minoristas

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de sistemas bancarios básicos minoristas son el tipo de oferta y de implementación.

Oferta (soluciones y servicios), tipo de implementación (nube y local) y geografía

- En función de la oferta, el mercado de sistemas bancarios básicos minoristas se bifurca en soluciones y servicios.

- Por tipo de implementación, el mercado se segmenta en nube y en instalaciones locales. El segmento de la nube tuvo la mayor participación del mercado en 2023.

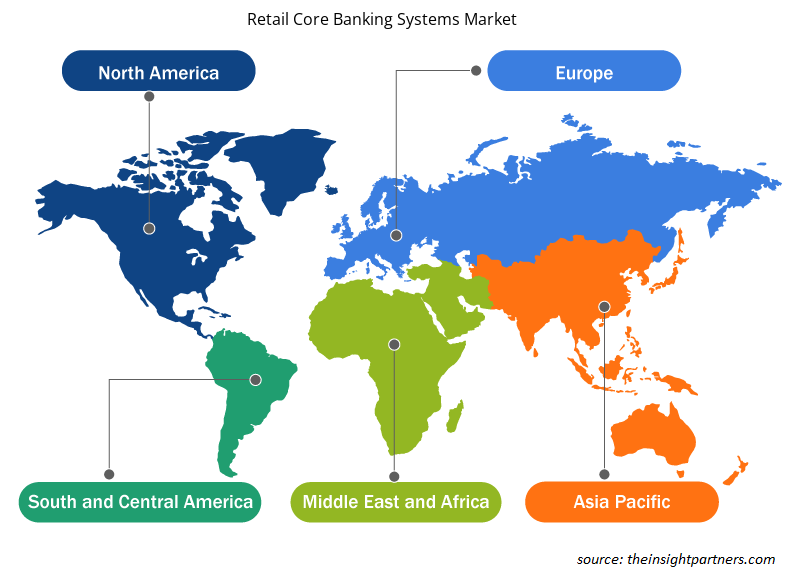

Análisis de la cuota de mercado de los sistemas bancarios básicos para minoristas por geografía

El alcance geográfico del informe de mercado de sistemas bancarios básicos minoristas se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur/América del Sur y Central. En términos de ingresos, América del Norte representó la mayor participación de mercado de sistemas bancarios básicos minoristas. Debido a los importantes avances tecnológicos en curso en soluciones bancarias básicas y la adopción por parte de empresas importantes, como Canadian Western Bank y HSBC Holdings plc, se espera que el dominio persista durante el período proyectado.

Perspectivas regionales del mercado de sistemas bancarios básicos para minoristas

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sistemas bancarios básicos minoristas durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sistemas bancarios básicos minoristas en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sistemas bancarios básicos minoristas

Alcance del informe de mercado de sistemas bancarios básicos para minoristas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 14,69 mil millones |

| Tamaño del mercado en 2031 | US$ 55.07 mil millones |

| CAGR global (2023 - 2031) | 18% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Al ofrecer

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas bancarios básicos para minoristas está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sistemas bancarios básicos minoristas son:

- Corporación Oracle

- SAP SE

- Servicios de consultoría Tata Limited

- Finastra Internacional Limitada

- Soluciones de banca de capital

- EdgeVerve Systems Limited

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sistemas bancarios básicos minoristas

Noticias y desarrollos recientes del mercado de sistemas bancarios básicos para minoristas

El mercado de sistemas bancarios básicos para minoristas se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de trastornos del habla y el lenguaje y las estrategias:

- En abril de 2023, Oracle FS estaba actualizando el software bancario central de OMO Bank, con sede en Etiopía, en colaboración con Profinch, socio de implementación de FLEXCUBE de Oracle, e incorporando nuevas tecnologías de prevención de fraude y contra el lavado de dinero (AML).

(Fuente: Oracle, Nota de prensa)

- En octubre de 2023, una startup de tecnología financiera llamada Sopra Banking Software (SBS) presentó una plataforma bancaria central de software como servicio (SaaS) de vanguardia. Esta plataforma es una solución totalmente nativa de la nube y habilitada para inteligencia artificial que opera en tiempo real.

Informe sobre el mercado de sistemas bancarios básicos para minoristas: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sistemas bancarios básicos minoristas (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas bancarios centrales para minoristas

Obtenga una muestra gratuita para - Mercado de sistemas bancarios centrales para minoristas