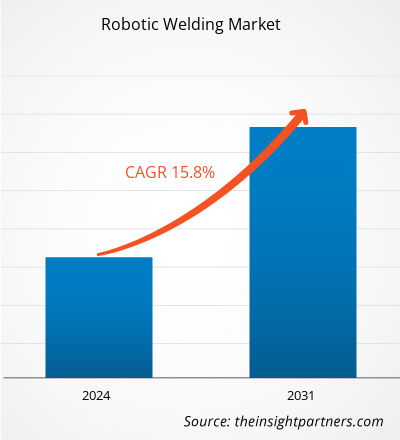

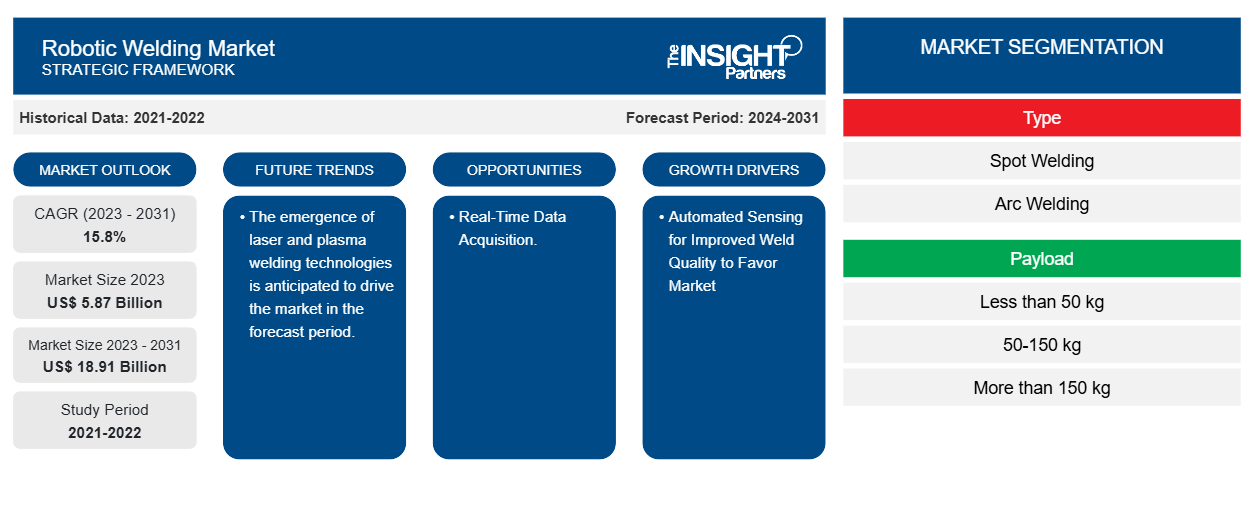

Se proyecta que el tamaño del mercado de soldadura robótica alcance los 18.910 millones de dólares en 2031, frente a los 5.870 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 15,8 % durante el período 2023-2031. Es probable que la industria 4.0 impulse la demanda de robots industriales y la creciente adopción de robots de soldadura en las industrias automotrices sean los impulsores y las tendencias clave del mercado.CAGR del 15,8 % durante 2023-2031. La industria 4.0, que impulsará la demanda de robots industriales, y la creciente adopción de robots de soldadura en las industrias automotrices probablemente sean los principales impulsores y tendencias del mercado.

Análisis del mercado de la soldadura robótica

El mercado de la soldadura robótica está experimentando un crecimiento significativo a nivel mundial. Este crecimiento se atribuye a la iniciativa Industrial 4.0, que impulsa la demanda de robots industriales y la creciente adopción de robots de soldadura en las industrias automotrices. Además, las iniciativas gubernamentales para apoyar la transformación digital en APAC y la aparición de tecnologías de soldadura láser y de plasma son otros factores que impulsan el crecimiento del mercado de la soldadura robótica.La región APAC y el surgimiento de tecnologías de soldadura láser y de plasma se encuentran entre otros factores que impulsan el crecimiento del mercado de soldadura robótica.

Descripción general del mercado de soldadura robótica

La soldadura robótica es un método que ayuda al sector industrial a automatizar sus procesos, aumentar la precisión, reducir los plazos de entrega y mejorar la seguridad. El proceso de soldadura robótica se considera el más productivo cuando se implementa para tareas repetitivas y de gran volumen. Existen múltiples tipos de procesos de soldadura robótica.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de la soldadura robótica

Detección automatizada para mejorar la calidad de la soldadura en beneficio del mercado

Las tecnologías de detección automatizada permiten a los soldadores robóticos adoptar operaciones según las dimensiones de cada pieza de trabajo. Esto mejora la calidad de cada soldadura al tiempo que aumenta la velocidad de las operaciones y, como resultado, proporciona un mayor rendimiento. La inclusión de estas tecnologías en cada celda de soldadura ayuda a monitorear la operación de soldadura y registrar los detalles para la optimización continua del proceso, ajustar automáticamente los parámetros del robot de soldadura de acuerdo con la pieza de trabajo, monitorear la operación de soldadura y registrar los detalles para la optimización continua del proceso.Dimensiones de la pieza de trabajo . Esto mejora la calidad de cada soldadura al tiempo que aumenta la velocidad de las operaciones y, como resultado, proporciona un mayor rendimiento. La inclusión de estas tecnologías en cada celda de soldadura ayuda a monitorear la operación de soldadura y registrar los detalles para la optimización continua del proceso, ajustar automáticamente los parámetros del robot de soldadura de acuerdo con la pieza de trabajo, monitorear la operación de soldadura y registrar los detalles para la optimización continua del proceso.

Adquisición de datos en tiempo real

Junto con la detección automatizada, la adquisición y el análisis de datos operativos de los sistemas de soldadura robótica avanzan a gran velocidad. Como cada soldadura necesita una inspección específica para calificar el proceso de control de calidad, estas herramientas permiten comprobar la resistencia de la unión, el sellado de cada costura y la penetración de la soldadura durante la operación de soldadura.

Los sistemas de control de seguimiento de arco pueden identificar automáticamente fallas y corregir la operación de soldadura para minimizar el retrabajo que generalmente solo surge durante una inspección secundaria. Además, estos sistemas permiten medir el ancho y el perfil de la junta durante la operación de soldadura, detectar el borde de la junta y rastrear la penetración de la costura durante las soldaduras, controlando la penetración de la soldadura de acuerdo con las especificaciones.

Análisis de segmentación del informe de mercado de soldadura robótica

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de soldadura robótica son el tipo, la carga útil y el usuario final.

- Según el tipo, el mercado de soldadura robótica se divide en soldadura por puntos, soldadura por arco y otros. Se prevé que el segmento de componentes de gestión de energía tenga una participación de mercado significativa en el período de pronóstico.

- Según la carga útil, el mercado de soldadura robótica se divide en menos de 50 kg, 50-150 kg y más de 150 kg. Se prevé que el segmento de menos de 50 kg tenga una participación de mercado significativa en el período de pronóstico.

- Por usuario final, el mercado está segmentado en automoción y transporte, electricidad y electrónica, metal y maquinaria, y construcción. Se prevé que la automoción y el transporte ocupen una cuota de mercado significativa en el período de previsión.

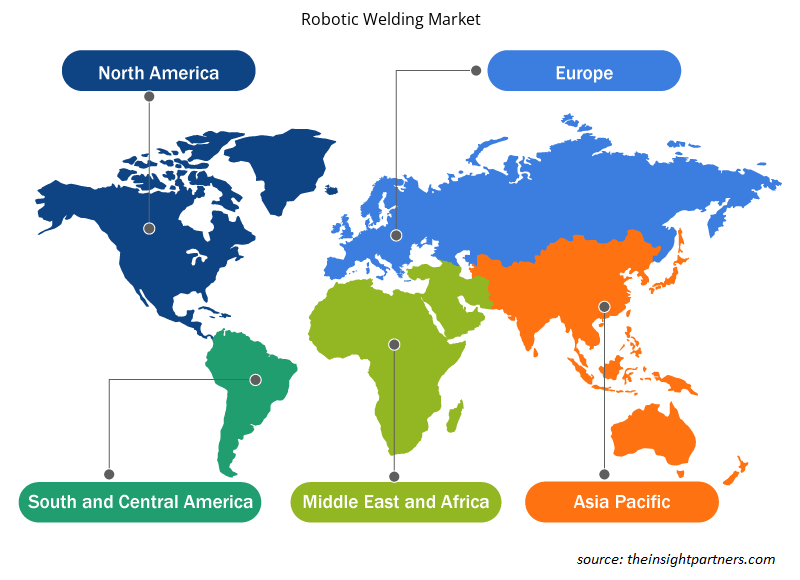

Análisis de la cuota de mercado de la soldadura robótica por geografía

El alcance geográfico del informe del mercado de soldadura robótica se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

América del Norte ha dominado el mercado de la soldadura robótica. Las tendencias de adopción de alta tecnología en varias industrias de la región de América del Norte han impulsado el crecimiento del mercado de la soldadura robótica. Se espera que factores como la mayor adopción de herramientas digitales y el alto gasto tecnológico por parte de las agencias gubernamentales impulsen el crecimiento del mercado de la soldadura robótica en América del Norte. Además, un fuerte énfasis en la investigación y el desarrollo en las economías desarrolladas de los EE. UU. y Canadá está obligando a los actores norteamericanos a traer soluciones tecnológicamente avanzadas al mercado. Además, Estados Unidos tiene una gran cantidad de actores del mercado de la soldadura robótica que se han centrado cada vez más en el desarrollo de soluciones innovadoras. Todos estos factores contribuyen al crecimiento del mercado de la soldadura robótica en la región.

Perspectivas regionales del mercado de soldadura robótica

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de soldadura robótica durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de soldadura robótica en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de soldadura robótica

Alcance del informe de mercado de soldadura robótica

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 5.870 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 18,91 mil millones |

| CAGR global (2023 - 2031) | 15,8% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de soldadura robótica: comprensión de su impacto en la dinámica empresarial

El mercado de la soldadura robótica está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de soldadura robótica son:

- Corporación Panasonic

- Corporación eléctrica Yaskawa

- TEJIDO

- Corporación Fanuc

- SISTEMA ROBOTER IGM

- Industrias pesadas Kawasaki, Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de soldadura robótica

Noticias y desarrollos recientes del mercado de soldadura robótica

El mercado de la soldadura robótica se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de la soldadura robótica:

- Kemppi lanzó una nueva máquina de soldadura robótica, la soldadora AX MIG. Presentamos la soldadora AX MIG de Kemppi, una potente soldadora robótica con una integración perfecta, una interfaz fácil de usar y la última tecnología de soldadura. La soldadora AX MIG fue diseñada específicamente para entornos de soldadura automatizada de alta intensidad las 24 horas del día, los 7 días de la semana. Con una potencia de 400 o 500 A y un alimentador de alambre robótico, está diseñada para realizar tareas difíciles y cumplir con los exigentes objetivos de producción. (Fuente: sitio web de la empresa Kemppi, abril de 2023)

- NS ARC, la marca de alambres de soldadura propiedad de mujeres más grande de los EE. UU., y CLOOS North America, una empresa pionera en tecnología de soldadura robótica con más de 100 años de experiencia en la industria, anuncian con orgullo su alianza estratégica. (Fuente: Sitio web de la empresa NS ARC, julio de 2024)

Informe sobre el mercado de soldadura robótica: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de soldadura robótica (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño y pronóstico del mercado de soldadura robótica a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance.

- Tendencias del mercado de soldadura robótica, así como dinámica del mercado, como impulsores, restricciones y oportunidades clave.

- Análisis detallado PEST/Cinco fuerzas de Porter y FODA.

- Análisis del mercado de soldadura robótica que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y la competencia que cubre la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes en el mercado de soldadura robótica.

- Perfiles detallados de empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de soldadura robótica

Obtenga una muestra gratuita para - Mercado de soldadura robótica