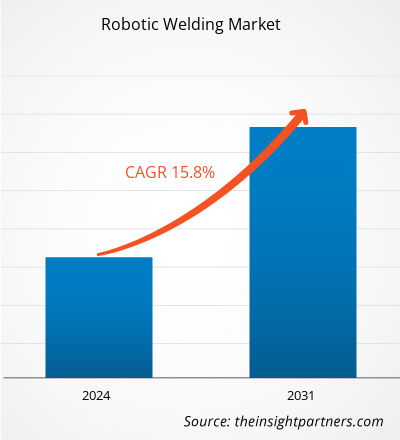

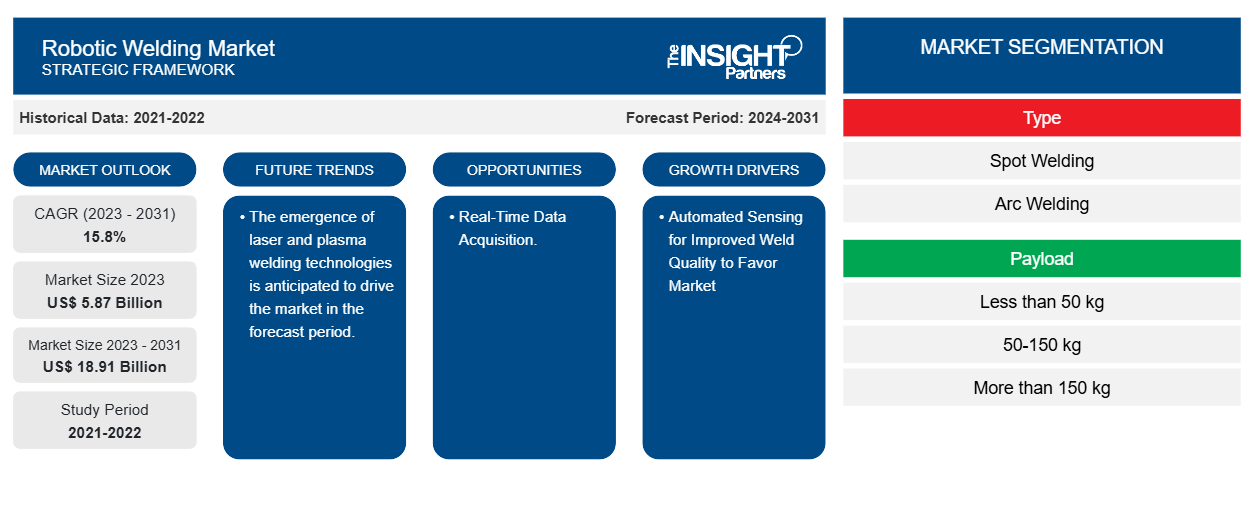

Si prevede che la dimensione del mercato della saldatura robotica raggiungerà i 18,91 miliardi di dollari entro il 2031, rispetto ai 5,87 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 15,8% nel periodo 2023-2031. L'Industrial 4.0 per guidare la domanda di robot industriali e la crescente adozione di robot di saldatura nel settore automobilistico saranno probabilmente i principali driver e tendenze del mercato.

Analisi del mercato della saldatura robotizzata

Il mercato della saldatura robotica sta vivendo una crescita significativa a livello globale. Questa crescita è attribuita all'Industrial 4.0 per guidare la domanda di robot industriali e alla crescente adozione di robot di saldatura nel settore automobilistico. Inoltre, le iniziative governative per supportare la trasformazione digitale nell'APAC e l'emergere di tecnologie di saldatura laser e al plasma sono tra gli altri fattori che rafforzano la crescita del mercato della saldatura robotica.

Panoramica del mercato della saldatura robotizzata

La saldatura robotizzata è un metodo che aiuta il settore industriale ad automatizzare i suoi processi, aumentare la precisione, ridurre i tempi di consegna e migliorare la sicurezza. Il processo di saldatura robotizzata è considerato il più produttivo quando viene implementato per attività ripetitive e ad alto volume. Esistono diversi tipi di processi di saldatura robotizzata.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato della saldatura robotizzata

Rilevamento automatico per una migliore qualità della saldatura a favore del mercato

Le tecnologie di rilevamento automatizzate consentono ai saldatori robotici di adottare operazioni in base alle dimensioni individuali del pezzo in lavorazione. Ciò migliora la qualità di ogni saldatura, aumentando al contempo la velocità delle operazioni e, di conseguenza, garantisce una maggiore produttività. L'inclusione di queste tecnologie in ogni cella di saldatura aiuta a monitorare l'operazione di saldatura e registrare i dettagli per un'ottimizzazione continua del processo, regolare automaticamente i parametri del robot di saldatura in base al pezzo in lavorazione, monitorare l'operazione di saldatura e registrare i dettagli per un'ottimizzazione continua del processo.

Acquisizione dati in tempo reale

Insieme al rilevamento automatico, l'acquisizione e l'analisi dei dati operativi dei sistemi di saldatura robotica stanno avanzando a una velocità elevata. Poiché ogni saldatura necessita di un'ispezione specifica per qualificare il processo di controllo qualità, questi strumenti consentono di dimostrare la resistenza del giunto, la tenuta di ogni cucitura e la penetrazione della saldatura durante l'operazione di saldatura.

I sistemi di controllo del tracciamento dell'arco possono identificare automaticamente i guasti e correggere l'operazione di saldatura per ridurre al minimo le rilavorazioni che solitamente emergono solo durante un'ispezione secondaria. Inoltre, questi sistemi forniscono la misurazione della larghezza e del profilo del giunto durante l'operazione di saldatura, il rilevamento del bordo del giunto e il tracciamento della penetrazione della cucitura durante le saldature, controllando la penetrazione della saldatura in base alle specifiche.

Analisi della segmentazione del rapporto di mercato sulla saldatura robotizzata

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato della saldatura robotizzata sono tipologia, carico utile e utente finale.

- In base al tipo, il mercato della saldatura robotica è suddiviso in saldatura a punti, saldatura ad arco e altri. Si prevede che il segmento dei componenti di gestione dell'alimentazione detenga una quota di mercato significativa nel periodo di previsione.

- In base al carico utile, il mercato della saldatura robotica è suddiviso in meno di 50 kg, 50-150 kg e più di 150 kg. Si prevede che il segmento inferiore a 50 kg detenga una quota di mercato significativa nel periodo di previsione.

- In base all'utente finale, il mercato è segmentato in automotive e trasporti, elettrico ed elettronico, metallo e macchinari e costruzioni. Si prevede che automotive e trasporti deterranno una quota di mercato significativa nel periodo di previsione.

Analisi della quota di mercato della saldatura robotizzata per area geografica

L'ambito geografico del rapporto sul mercato della saldatura robotizzata è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, Sud e Centro America.

Il Nord America ha dominato il mercato della saldatura robotica. Le tendenze di adozione di tecnologie elevate in vari settori della regione nordamericana hanno alimentato la crescita del mercato della saldatura robotica. Si prevede che fattori come l'adozione crescente di strumenti digitali e l'elevata spesa tecnologica da parte delle agenzie governative guideranno la crescita del mercato della saldatura robotica nordamericana. Inoltre, una forte enfasi sulla ricerca e sviluppo nelle economie sviluppate degli Stati Uniti e del Canada sta costringendo gli operatori nordamericani a portare sul mercato soluzioni tecnologicamente avanzate. Inoltre, gli Stati Uniti hanno un gran numero di operatori del mercato della saldatura robotica che si sono sempre più concentrati sullo sviluppo di soluzioni innovative. Tutti questi fattori contribuiscono alla crescita del mercato della saldatura robotica nella regione.

Approfondimenti regionali sul mercato della saldatura robotizzata

Le tendenze regionali e i fattori che influenzano il mercato della saldatura robotica durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato della saldatura robotica in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato della saldatura robotizzata

Ambito del rapporto sul mercato della saldatura robotizzata

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 5,87 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 18,91 miliardi di dollari USA |

| CAGR globale (2023-2031) | 15,8% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato della saldatura robotizzata: comprendere il suo impatto sulle dinamiche aziendali

Il mercato della saldatura robotica sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato della saldatura robotizzata sono:

- Società Panasonic

- Società elettrica Yaskawa

- ABB

- Società Fanuc

- IGM ROBOTERSYSTEME

- Kawasaki Heavy Industries, Ltd

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato della saldatura robotizzata

Notizie e sviluppi recenti del mercato della saldatura robotizzata

Il mercato della saldatura robotica viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato della saldatura robotica:

- Kemppi ha lanciato una nuova macchina per saldatura robotizzata, AX MIG Welder. Ecco Kemppi AX MIG Welder, una potente saldatrice robotizzata con integrazione perfetta, un'interfaccia facile da usare e la più recente tecnologia di saldatura. AX MIG Welder è stata appositamente costruita per ambienti di saldatura automatizzati ad alta intensità, 24 ore su 24, 7 giorni su 7. Con una potenza di 400 o 500 A e un alimentatore di filo robotizzato, è progettata per svolgere attività difficili e soddisfare obiettivi di produzione esigenti. (Fonte: sito Web aziendale Kemppi, aprile 2023)

- NS ARC, il più grande marchio di fili per saldatura di proprietà femminile negli Stati Uniti, e CLOOS North America, pioniere nella tecnologia di saldatura robotizzata con oltre 100 anni di esperienza nel settore, annunciano con orgoglio la loro alleanza strategica. (Fonte: sito Web aziendale NS ARC, luglio 2024)

Copertura e risultati del rapporto sul mercato della saldatura robotizzata

Il rapporto "Dimensioni e previsioni del mercato della saldatura robotica (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato della saldatura robotizzata a livello globale, regionale e nazionale per tutti i principali segmenti di mercato trattati nell'ambito dell'indagine.

- Tendenze del mercato della saldatura robotizzata e dinamiche di mercato, quali fattori trainanti, limiti e opportunità chiave.

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT.

- Analisi del mercato della saldatura robotizzata che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato.

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa termica, i principali attori e gli sviluppi recenti nel mercato della saldatura robotizzata.

- Profili aziendali dettagliati.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato della saldatura robotizzata

Ottieni un campione gratuito per - Mercato della saldatura robotizzata