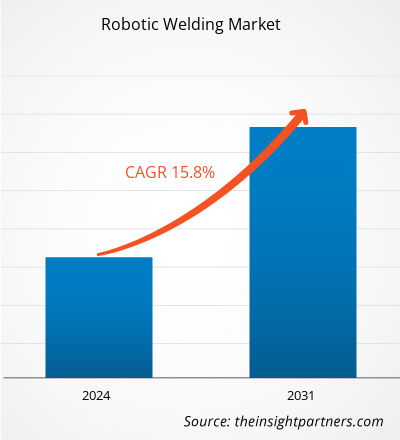

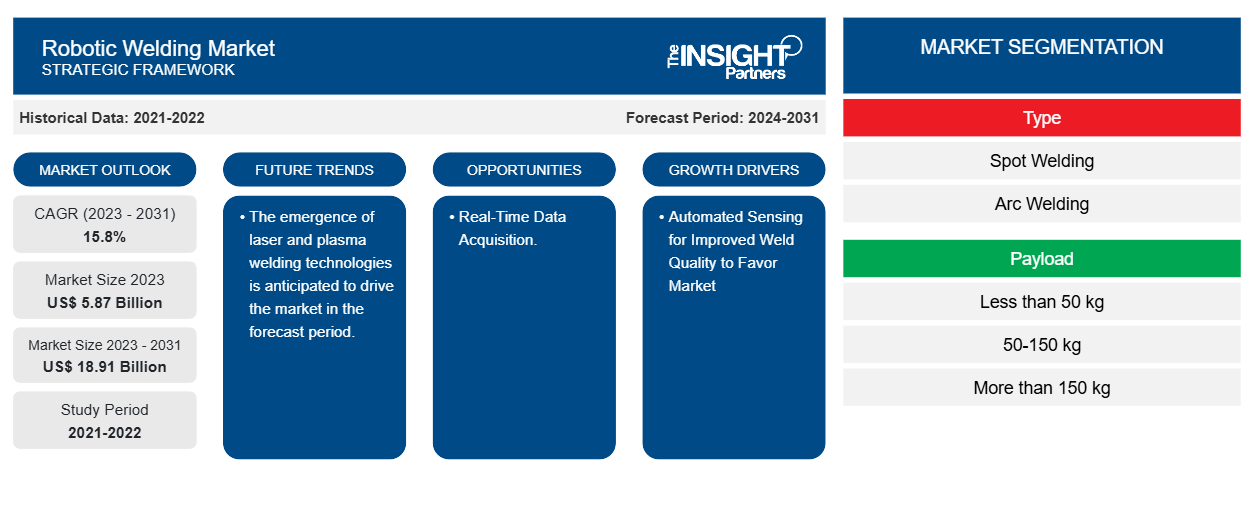

Der Markt für Roboterschweißen soll von 5,87 Milliarden US-Dollar im Jahr 2023 auf 18,91 Milliarden US-Dollar im Jahr 2031 anwachsen. Der Markt wird zwischen 2023 und 2031 voraussichtlich eine durchschnittliche jährliche Wachstumsrate von 15,8 % verzeichnen. Industrie 4.0 als Wachstumsmotor für die Nachfrage nach Industrierobotern und die zunehmende Verbreitung von Schweißrobotern in der Automobilindustrie dürften die wichtigsten Treiber und Trends des Marktes sein.

Roboterschweißen Marktanalyse

Der Markt für Roboterschweißen verzeichnet weltweit ein starkes Wachstum. Dieses Wachstum ist auf die Industrie 4.0 zurückzuführen, die die Nachfrage nach Industrierobotern ankurbelt, sowie auf die zunehmende Verbreitung von Schweißrobotern in der Automobilindustrie. Darüber hinaus sind die staatlichen Initiativen zur Unterstützung der digitalen Transformation in der Region Asien-Pazifik und die Entstehung von Laser- und Plasmaschweißtechnologien weitere Faktoren, die das Wachstum des Marktes für Roboterschweißen fördern.

Marktübersicht für Roboterschweißen

Roboterschweißen ist eine Methode, die dem Industriesektor hilft, seine Prozesse zu automatisieren, die Genauigkeit zu erhöhen, die Vorlaufzeit zu verkürzen und die Sicherheit zu verbessern. Das Roboterschweißverfahren gilt als das produktivste Verfahren, wenn es für großvolumige und sich wiederholende Aufgaben eingesetzt wird. Es gibt mehrere Arten von Roboterschweißverfahren.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Treiber und Chancen auf dem Markt für Roboterschweißen

Automatisierte Sensorik für verbesserte Schweißqualität kommt dem Markt zugute

Automatisierte Sensortechnologien ermöglichen es Schweißrobotern, Vorgänge entsprechend den individuellen Werkstückabmessungen anzupassen. Dies verbessert die Qualität jeder Schweißnaht, erhöht die Arbeitsgeschwindigkeit und sorgt infolgedessen für einen höheren Durchsatz. Die Integration dieser Technologien in jede Schweißzelle hilft dabei, den Schweißvorgang zu überwachen und die Details für eine kontinuierliche Prozessoptimierung aufzuzeichnen, die Parameter des Schweißroboters automatisch entsprechend dem Werkstück anzupassen, den Schweißvorgang zu überwachen und die Details für eine kontinuierliche Prozessoptimierung aufzuzeichnen.

Echtzeit-Datenerfassung

Neben der automatischen Sensorik schreitet auch die Erfassung und Analyse von Betriebsdaten von Roboterschweißsystemen rasant voran. Da jede Schweißnaht einer spezifischen Prüfung bedarf, um den Qualitätskontrollprozess zu qualifizieren, ermöglichen diese Werkzeuge die Überprüfung der Verbindungsfestigkeit, der Dichtheit jeder Naht und der Schweißdurchdringung während des Schweißvorgangs.

Lichtbogenverfolgungs-Kontrollsysteme können Fehler automatisch erkennen und den Schweißvorgang korrigieren, um Nacharbeiten zu minimieren, die normalerweise erst bei einer zweiten Prüfung ans Licht kommen. Darüber hinaus ermöglichen diese Systeme die Messung von Nahtbreite und -profil während des Schweißvorgangs, die Erkennung von Nahtkanten und die Verfolgung der Nahtdurchdringung während des Schweißens, wodurch die Schweißdurchdringung gemäß den Spezifikationen gesteuert wird.

Segmentierungsanalyse des Marktberichts zum Roboterschweißen

Wichtige Segmente, die zur Ableitung der Marktanalyse für Roboterschweißen beigetragen haben, sind Typ, Nutzlast und Endbenutzer.

- Der Markt für Roboterschweißen wird nach Typ in Punktschweißen, Lichtbogenschweißen und andere unterteilt. Das Segment der Energiemanagementkomponenten dürfte im Prognosezeitraum einen erheblichen Marktanteil halten.

- Basierend auf der Nutzlast ist der Markt für Roboterschweißen in weniger als 50 kg, 50-150 kg und mehr als 150 kg unterteilt. Das Segment unter 50 kg wird im Prognosezeitraum voraussichtlich einen erheblichen Marktanteil halten.

- Nach Endverbraucher ist der Markt in die Bereiche Automobil und Transport, Elektrik und Elektronik, Metall und Maschinenbau sowie Bauwesen unterteilt. Es wird erwartet, dass die Bereiche Automobil und Transport im Prognosezeitraum einen erheblichen Marktanteil halten werden.

Roboterschweißen Marktanteilsanalyse nach Geografie

Der geografische Umfang des Marktberichts zum Roboterschweißen ist hauptsächlich in fünf Regionen unterteilt: Nordamerika, Asien-Pazifik, Europa, Naher Osten und Afrika sowie Süd- und Mittelamerika.

Nordamerika dominiert den Markt für Roboterschweißen. Der Trend hin zu hochtechnologischen Lösungen in verschiedenen Branchen in Nordamerika hat das Wachstum des Marktes für Roboterschweißen vorangetrieben. Faktoren wie die zunehmende Nutzung digitaler Tools und hohe Technologieausgaben von Regierungsbehörden dürften das Wachstum des nordamerikanischen Marktes für Roboterschweißen vorantreiben. Darüber hinaus zwingt eine starke Betonung von Forschung und Entwicklung in den entwickelten Volkswirtschaften der USA und Kanadas die nordamerikanischen Akteure dazu, technologisch fortschrittliche Lösungen auf den Markt zu bringen. Darüber hinaus gibt es in den USA eine große Anzahl von Akteuren auf dem Markt für Roboterschweißen, die sich zunehmend auf die Entwicklung innovativer Lösungen konzentrieren. All diese Faktoren tragen zum Wachstum des Marktes für Roboterschweißen in der Region bei.

Regionale Einblicke in den Markt für Roboterschweißen

Die regionalen Trends und Faktoren, die den Markt für Roboterschweißen im gesamten Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie für Roboterschweißen in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Erhalten Sie regionale Daten zum Roboterschweißmarkt

Umfang des Marktberichts zum Roboterschweißen

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2023 | 5,87 Milliarden US-Dollar |

| Marktgröße bis 2031 | 18,91 Milliarden US-Dollar |

| Globale CAGR (2023 - 2031) | 15,8 % |

| Historische Daten | 2021-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente |

Nach Typ

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Marktdichte von Roboterschweißgeräten: Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für Roboterschweißen wächst rasant, angetrieben durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Markt für Roboterschweißen tätigen Unternehmen sind:

- Panasonic Corporation

- Yaskawa Electric Corporation

- ABB

- Fanuc Corporation

- IGM ROBOTERSYSTEME

- Kawasaki Heavy Industries, Ltd

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für Roboterschweißen

Nachrichten und aktuelle Entwicklungen zum Roboterschweißen

Der Markt für Roboterschweißen wird durch die Erhebung qualitativer und quantitativer Daten nach Primär- und Sekundärforschung bewertet, die wichtige Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken umfasst. Nachfolgend sind einige der Entwicklungen auf dem Markt für Roboterschweißen aufgeführt:

- Kemppi hat ein neues Roboterschweißgerät auf den Markt gebracht: den AX MIG Welder. Wir stellen den Kemppi AX MIG Welder vor – ein leistungsstarkes Roboterschweißgerät mit nahtloser Integration, einer benutzerfreundlichen Schnittstelle und der neuesten Schweißtechnologie. Der AX MIG Welder wurde speziell für hochintensive, rund um die Uhr betriebene automatisierte Schweißumgebungen entwickelt. Mit 400 oder 500 A Leistung und einem Roboterdrahtvorschub ist er für schwierige Aufgaben und das Erreichen anspruchsvoller Produktionsziele ausgelegt. (Quelle: Kemppi-Unternehmenswebsite, April 2023)

- NS ARC, die größte Schweißdrahtmarke in Frauenbesitz in den USA, und CLOOS North America, ein Pionier der Roboterschweißtechnologie mit über 100 Jahren Erfahrung in der Branche, geben stolz ihre strategische Allianz bekannt. (Quelle: NS ARC Company Website, Juli 2024)

Marktbericht zum Roboterschweißen – Umfang und Ergebnisse

Der Bericht „Marktgröße und Prognose für Roboterschweißen (2021–2031)“ bietet eine detaillierte Analyse des Marktes, die die folgenden Bereiche abdeckt:

- Marktgröße und Prognose für Roboterschweißen auf globaler, regionaler und Länderebene für alle abgedeckten wichtigen Marktsegmente.

- Markttrends für Roboterschweißen sowie Marktdynamik wie treibende Faktoren, Einschränkungen und wichtige Chancen.

- Detaillierte PEST/Porters Five Forces- und SWOT-Analyse.

- Marktanalyse für Roboterschweißen, die wichtige Markttrends, globale und regionale Rahmenbedingungen, wichtige Akteure, Vorschriften und aktuelle Marktentwicklungen umfasst.

- Branchenlandschaft und Wettbewerbsanalyse, einschließlich Marktkonzentration, Heatmap-Analyse, prominenten Akteuren und aktuellen Entwicklungen auf dem Markt für Roboterschweißen.

- Detaillierte Firmenprofile.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für Roboterschweißen

Kostenlose Probe anfordern für - Markt für Roboterschweißen