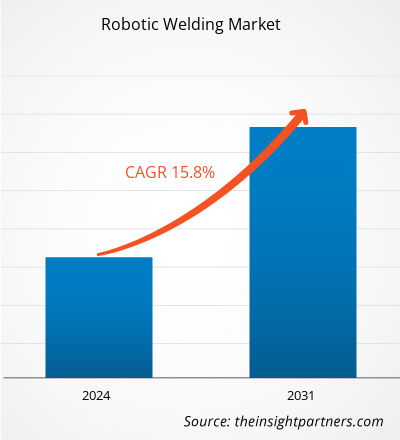

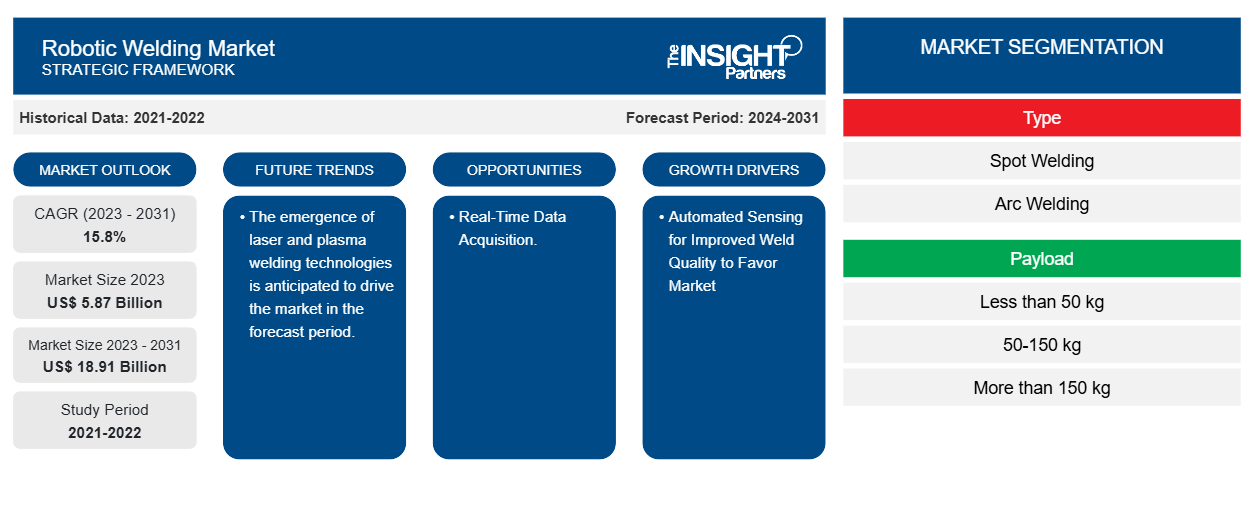

ロボット溶接市場規模は、2023年の58億7,000万米ドルから2031年には189億1,000万米ドルに達すると予測されています。市場は2023年から2031年の間に15.8%のCAGRを記録すると予想されています。産業用ロボットの需要を促進するインダストリアル4.0と自動車産業における溶接ロボットの採用増加が、市場の主要な推進力とトレンドとなる可能性があります。

ロボット溶接市場分析

ロボット溶接市場は世界的に著しい成長を遂げています。この成長は、産業用ロボットの需要を牽引するインダストリアル4.0と、自動車産業における溶接ロボットの導入増加によるものです。さらに、 アジア太平洋地域におけるデジタル変革を支援する政府の取り組みや、レーザーおよびプラズマ溶接技術の出現も、ロボット溶接市場の成長を後押しする要因の1つです。

ロボット溶接市場の概要

ロボット溶接は、産業部門のプロセスの自動化、精度の向上、リードタイムの短縮、安全性の強化に役立つ方法です。ロボット溶接プロセスは、大量かつ反復的なタスクに実装された場合に最も生産性が高くなると考えられています。ロボット溶接プロセスには複数の種類があります。

要件に合わせてレポートをカスタマイズする

このレポートの一部、国レベルの分析、Excelデータパックなど、あらゆるレポートを無料でカスタマイズできます。また、スタートアップや大学向けのお得なオファーや割引もご利用いただけます。

-

このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

ロボット溶接市場の推進要因と機会

自動センシングによる溶接品質の向上で市場を有利に

自動センシング技術により、ロボット溶接機は個々のワークピースの寸法に応じて操作を行うことができます。これにより、各溶接の品質が向上し、操作速度が上がり、結果としてスループットが向上します。これらの技術を各溶接セルに組み込むと、溶接操作を監視して詳細を記録し、継続的なプロセス最適化を行ったり、ワークピースに応じて溶接ロボットのパラメータを自動的に調整したり、溶接操作を監視して詳細を記録し、継続的なプロセス最適化を行ったりするのに役立ちます。

リアルタイムデータ取得

自動センシングとともに、ロボット溶接システムの運用データの取得と分析は急速に進歩しています。品質管理プロセスに適合するには各溶接に特定の検査が必要であるため、これらのツールを使用すると、溶接操作中に接合部の強度、各継ぎ目の密閉性、溶接の溶け込みを証明することができます。

アーク トラッキング制御システムは、欠陥を自動的に識別して溶接操作を修正し、通常は二次検査でのみ表面化する手直しを最小限に抑えることができます。さらに、これらのシステムは、溶接操作中のジョイント幅とプロファイルの測定、ジョイント エッジの検出、溶接中のシームの溶け込みの追跡を提供し、仕様に従って溶接の溶け込みを制御します。

ロボット溶接市場レポートのセグメンテーション分析

ロボット溶接市場分析の導出に貢献した主要なセグメントは、タイプ、ペイロード、およびエンドユーザーです。

- ロボット溶接市場は、種類別にスポット溶接、アーク溶接、その他に分類されます。電力管理コンポーネント部門は、予測期間中に大きな市場シェアを占めると予想されます。

- ロボット溶接市場は、積載量に基づいて、50 kg未満、50~150 kg、150 kg超に分けられます。50 kg未満のセグメントは、予測期間中に大きな市場シェアを占めると予想されます。

- エンドユーザー別に見ると、市場は自動車・輸送、電気・電子、金属・機械、建設に分類されます。予測期間中、自動車・輸送が大きな市場シェアを占めると予想されます。

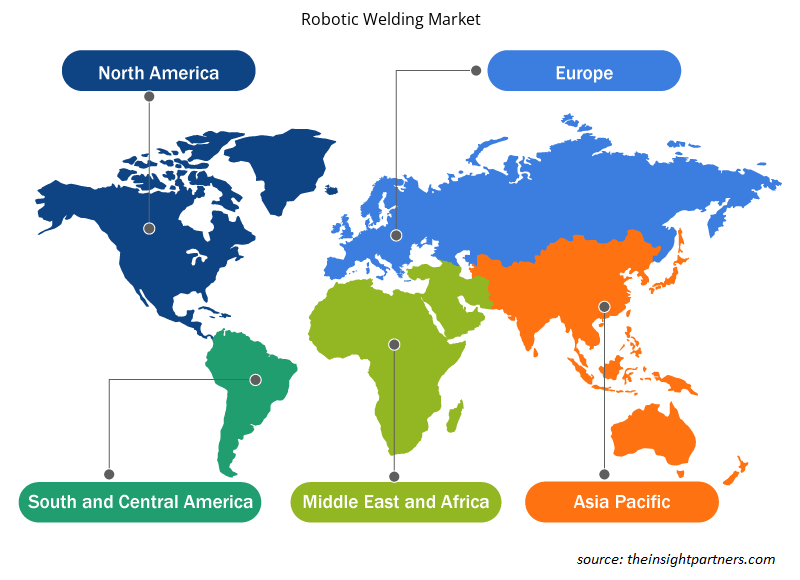

ロボット溶接市場シェアの地域別分析

ロボット溶接市場レポートの地理的範囲は、主に北米、アジア太平洋、ヨーロッパ、中東およびアフリカ、南米および中米の 5 つの地域に分かれています。

北米はロボット溶接市場を支配してきました。北米地域のさまざまな業界でのハイテク採用の傾向が、ロボット溶接市場の成長を後押ししています。デジタルツールの採用の増加や政府機関による多額の技術支出などの要因が、北米のロボット溶接市場の成長を牽引すると予想されています。さらに、米国とカナダの先進国では研究開発に重点が置かれているため、北米のプレーヤーは技術的に高度なソリューションを市場に投入せざるを得ません。さらに、米国にはロボット溶接市場のプレーヤーが多数存在し、革新的なソリューションの開発にますます重点を置いています。これらすべての要因が、この地域のロボット溶接市場の成長に貢献しています。

ロボット溶接市場の地域別分析

予測期間を通じてロボット溶接市場に影響を与える地域的な傾向と要因は、Insight Partners のアナリストによって徹底的に説明されています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東、アフリカ、南米、中米にわたるロボット溶接市場のセグメントと地理についても説明します。

- ロボット溶接市場の地域別データを入手

ロボット溶接市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2023年の市場規模 | 58億7千万米ドル |

| 2031年までの市場規模 | 189.1億米ドル |

| 世界のCAGR(2023年~2031年) | 15.8% |

| 履歴データ | 2021-2022 |

| 予測期間 | 2024-2031 |

| 対象セグメント |

タイプ別

|

| 対象地域と国 |

北米

|

| 市場リーダーと主要企業プロフィール |

|

ロボット溶接市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

ロボット溶接市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認識の高まりなどの要因により、エンドユーザーの需要が高まり、急速に成長しています。需要が高まるにつれて、企業は提供を拡大し、消費者のニーズを満たすために革新し、新たなトレンドを活用し、市場の成長をさらに促進しています。

市場プレーヤー密度とは、特定の市場または業界内で活動している企業または会社の分布を指します。これは、特定の市場スペースに、その市場規模または総市場価値に対してどれだけの競合相手 (市場プレーヤー) が存在するかを示します。

ロボット溶接市場で事業を展開している主要企業は次のとおりです。

- パナソニック株式会社

- 安川電機株式会社

- ABB社

- ファナック株式会社

- IGM ロボットシステム

- 川崎重工業株式会社

免責事項:上記の企業は、特定の順序でランク付けされていません。

- ロボット溶接市場のトップキープレーヤーの概要を入手

ロボット溶接市場のニュースと最近の動向

ロボット溶接市場は、主要な企業出版物、協会データ、データベースなどの一次調査と二次調査後の定性的および定量的データを収集することによって評価されます。ロボット溶接市場の動向のいくつかを以下に示します。

- Kemppi は、新しいロボット溶接機 AX MIG 溶接機を発売しました。Kemppi AX MIG 溶接機のご紹介 – シームレスな統合、使いやすいインターフェース、最新の溶接技術を備えた強力なロボット溶接機です。AX MIG 溶接機は、高強度の 24 時間 365 日自動溶接環境向けに特別に設計されました。400 A または 500 A の電力とロボットワイヤフィーダーを備え、困難なタスクを実行し、厳しい生産目標を達成できるように設計されています。(出典: Kemppi 社の Web サイト、2023 年 4 月)

- 米国最大の女性所有の溶接ワイヤ専門ブランドである NS ARC と、業界で 100 年以上の経験を持つロボット溶接技術のパイオニアである CLOOS North America は、戦略的提携を誇りを持って発表します。(出典: NS ARC 企業 Web サイト、2024 年 7 月)

ロボット溶接市場レポートの対象範囲と成果物

「ロボット溶接市場の規模と予測(2021〜2031年)」レポートでは、以下の分野をカバーする市場の詳細な分析を提供しています。

- ロボット溶接市場の規模と予測は、対象範囲に含まれるすべての主要な市場セグメントについて、世界、地域、国レベルで示されます。

- ロボット溶接市場の動向、および推進要因、制約、主要な機会などの市場動向。

- 詳細な PEST/ポーターの 5 つの力と SWOT 分析。

- 主要な市場動向、世界および地域の枠組み、主要プレーヤー、規制、最近の市場動向を網羅したロボット溶接市場分析。

- 市場集中、ヒートマップ分析、主要プレーヤー、ロボット溶接市場の最近の動向を網羅した業界の状況と競争分析。

- 詳細な企業プロフィール。

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

最新レポート

お客様の声

購入理由

- 情報に基づいた意思決定

- 市場動向の理解

- 競合分析

- 顧客インサイト

- 市場予測

- リスク軽減

- 戦略計画

- 投資の正当性

- 新興市場の特定

- マーケティング戦略の強化

- 業務効率の向上

- 規制動向への対応

無料サンプルを入手 - ロボット溶接市場

無料サンプルを入手 - ロボット溶接市場