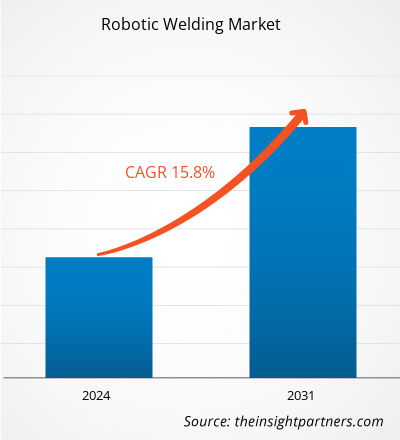

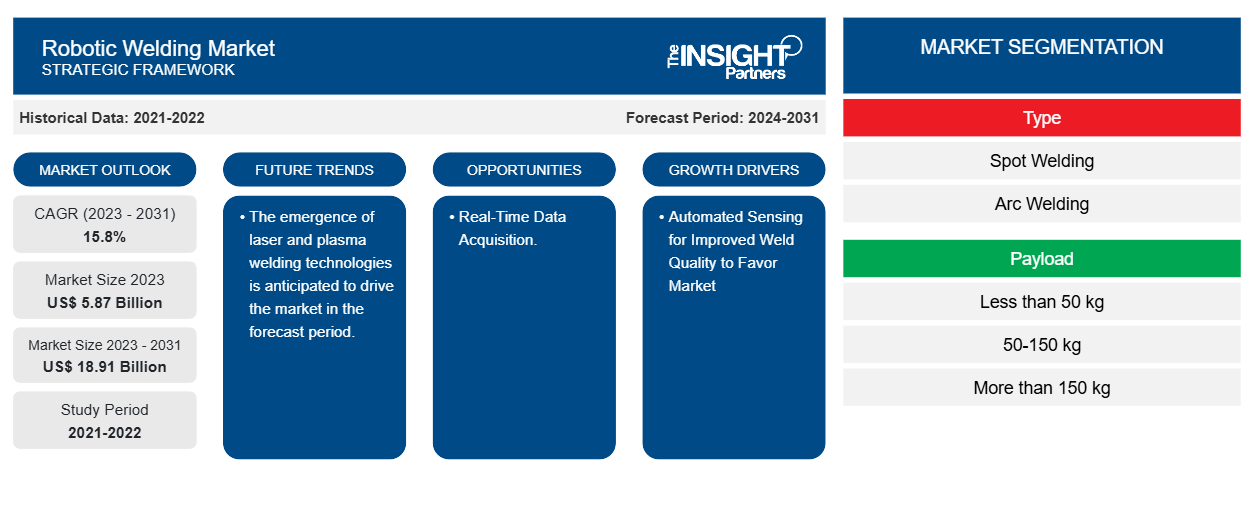

Le marché du soudage robotisé devrait atteindre 18,91 milliards USD d'ici 2031, contre 5,87 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 15,8 % au cours de la période 2023-2031. L'industrie 4.0 pour stimuler la demande de robots industriels et l'adoption croissante de robots de soudage dans l'industrie automobile seront probablement les principaux moteurs et tendances du marché.

Analyse du marché du soudage robotisé

Le marché du soudage robotisé connaît une croissance significative à l'échelle mondiale. Cette croissance est attribuée à l'Industrie 4.0 qui stimule la demande de robots industriels et à l'adoption croissante de robots de soudage dans l'industrie automobile. De plus, les initiatives gouvernementales visant à soutenir la transformation numérique dans la région Asie-Pacifique et l'émergence des technologies de soudage laser et plasma sont parmi les autres facteurs qui soutiennent la croissance du marché du soudage robotisé.

Aperçu du marché du soudage robotisé

Le soudage robotisé est une méthode qui aide le secteur industriel à automatiser ses processus, à augmenter la précision, à réduire les délais et à améliorer la sécurité. Le processus de soudage robotisé est considéré comme le plus productif lorsqu'il est mis en œuvre pour des tâches à volume élevé et répétitives. Il existe plusieurs types de processus de soudage robotisé.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché du soudage robotisé

Détection automatisée pour une meilleure qualité de soudure afin de favoriser le marché

Les technologies de détection automatisées permettent aux soudeurs robotisés d'adapter les opérations en fonction des dimensions de chaque pièce. Cela améliore la qualité de chaque soudure tout en augmentant la vitesse des opérations et, par conséquent, permet un rendement plus élevé. L'inclusion de ces technologies dans chaque cellule de soudage permet de surveiller l'opération de soudage et d'enregistrer les détails pour une optimisation continue du processus, d'ajuster automatiquement les paramètres du robot de soudage en fonction de la pièce, de surveiller l'opération de soudage et d'enregistrer les détails pour une optimisation continue du processus.

Acquisition de données en temps réel

Parallèlement à la détection automatisée, l'acquisition et l'analyse des données opérationnelles des systèmes de soudage robotisés progressent à un rythme rapide. Comme chaque soudure nécessite une inspection spécifique pour qualifier le processus de contrôle qualité, ces outils permettent de prouver la résistance du joint, l'étanchéité de chaque joint et la pénétration de la soudure pendant l'opération de soudage.

Les systèmes de contrôle de suivi d'arc peuvent identifier automatiquement les défauts et corriger l'opération de soudage afin de minimiser les retouches qui n'apparaissent généralement que lors d'une inspection secondaire. De plus, ces systèmes permettent de mesurer la largeur et le profil des joints pendant l'opération de soudage, de détecter les bords des joints et de suivre la pénétration du joint pendant les soudures, contrôlant ainsi la pénétration de la soudure conformément aux spécifications.

Analyse de segmentation du rapport sur le marché du soudage robotisé

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché du soudage robotisé sont le type, la charge utile et l’utilisateur final.

- Selon le type, le marché du soudage robotisé est divisé en soudage par points, soudage à l'arc et autres. Le segment des composants de gestion de l'énergie devrait détenir une part de marché importante au cours de la période de prévision.

- En fonction de la charge utile, le marché du soudage robotisé est divisé en moins de 50 kg, 50-150 kg et plus de 150 kg. Le segment des moins de 50 kg devrait détenir une part de marché importante au cours de la période de prévision.

- En termes d'utilisateur final, le marché est segmenté en automobile et transport, électricité et électronique, métallurgie et machines, et construction. L'automobile et le transport devraient détenir une part de marché importante au cours de la période de prévision.

Analyse des parts de marché du soudage robotisé par zone géographique

La portée géographique du rapport sur le marché du soudage robotisé est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

L'Amérique du Nord domine le marché du soudage robotisé. Les tendances d'adoption de haute technologie dans diverses industries de la région nord-américaine ont alimenté la croissance du marché du soudage robotisé. Des facteurs tels que l'adoption accrue d' outils numériques et les dépenses technologiques élevées des agences gouvernementales devraient stimuler la croissance du marché nord-américain du soudage robotisé. De plus, l'accent mis sur la recherche et le développement dans les économies développées des États-Unis et du Canada oblige les acteurs nord-américains à introduire des solutions technologiquement avancées sur le marché. En outre, les États-Unis comptent un grand nombre d'acteurs du marché du soudage robotisé qui se concentrent de plus en plus sur le développement de solutions innovantes. Tous ces facteurs contribuent à la croissance du marché du soudage robotisé dans la région.

Aperçu régional du marché du soudage robotisé

Les tendances et facteurs régionaux influençant le marché du soudage robotisé tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché du soudage robotisé en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché du soudage robotisé

Portée du rapport sur le marché du soudage robotisé

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 5,87 milliards de dollars américains |

| Taille du marché d'ici 2031 | 18,91 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 15,8% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché du soudage robotisé : comprendre son impact sur la dynamique commerciale

Le marché du soudage robotisé connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché du soudage robotisé sont :

- Société Panasonic

- Société d'électricité Yaskawa

- ABB

- Société Fanuc

- SYSTÈME ROBOT IGM

- Kawasaki Heavy Industries, Ltée

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché du soudage robotisé

Actualités et développements récents du marché du soudage robotisé

Le marché du soudage robotisé est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements du marché du soudage robotisé sont énumérés ci-dessous :

- Kemppi a lancé une nouvelle machine de soudage robotisée, l'AX MIG Welder. Présentation de l'AX MIG Welder de Kemppi - un puissant soudeur robotisé avec une intégration transparente, une interface facile à utiliser et la dernière technologie de soudage. L'AX MIG Welder a été spécialement conçu pour les environnements de soudage automatisés à haute intensité, 24h/24 et 7j/7. Avec une puissance de 400 ou 500 A et un dévidoir de fil robotisé, il est conçu pour effectuer des tâches difficiles et atteindre des objectifs de production exigeants. (Source : site Web de la société Kemppi, avril 2023)

- NS ARC, la plus grande marque de fils à souder dédiée aux femmes aux États-Unis, et CLOOS North America, un pionnier de la technologie de soudage robotisé avec plus de 100 ans d'expérience dans l'industrie, annoncent fièrement leur alliance stratégique. (Source : site Web de la société NS ARC, juillet 2024)

Rapport sur le marché du soudage robotisé : couverture et livrables

Le rapport « Taille et prévisions du marché du soudage robotisé (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché du soudage robotisé aux niveaux mondial, régional et national pour tous les segments de marché clés couverts dans le cadre.

- Tendances du marché du soudage robotisé ainsi que dynamique du marché telles que les moteurs, les contraintes et les opportunités clés.

- Analyse détaillée des cinq forces de PEST/Porter et SWOT.

- Analyse du marché du soudage robotisé couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché.

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents sur le marché du soudage robotisé.

- Profils d'entreprise détaillés.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché du soudage robotisé

Obtenez un échantillon gratuit pour - Marché du soudage robotisé