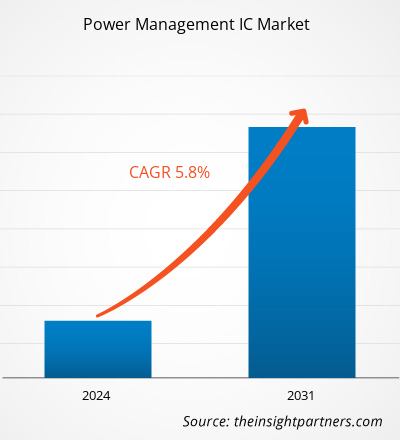

Le marché des circuits intégrés de gestion de l'alimentation devrait atteindre 59,04 milliards USD d'ici 2031, contre 37,73 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 5,8 % au cours de la période 2023-2031. L'augmentation des ventes de produits électroniques grand public et l'intérêt croissant pour les véhicules électriques devraient être les principaux moteurs et tendances du marché.

Analyse du marché des circuits intégrés de gestion de l'alimentation

Le marché des circuits intégrés de gestion de l'alimentation connaît une croissance significative à l'échelle mondiale. Cette croissance est attribuée à l'augmentation des ventes de produits électroniques grand public et à la tendance croissante vers les véhicules électriques. De plus, la demande croissante d'appareils alimentés par batterie et le déploiement de réseaux 5G de nouvelle génération devraient offrir plusieurs opportunités au marché dans les années à venir.

Aperçu du marché des circuits intégrés de gestion de l'alimentation

Les circuits intégrés de gestion de l'alimentation (PMIC), qui intègrent plusieurs régulateurs de tension et circuits de contrôle dans une seule puce, sont d'excellentes options pour mettre en œuvre des solutions d'alimentation complètes. Ils réduisent le nombre de composants et l'espace sur la carte tout en gérant l'alimentation du système de manière simple et économique.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des circuits intégrés de gestion de l'alimentation

L'augmentation des ventes de produits électroniques grand public favorise le marché

Les appareils électroniques grand public, tels que les smartphones, les tablettes, les lunettes intelligentes, les casques de réalité virtuelle, les montres connectées et les bracelets de fitness, sont de plus en plus populaires auprès des consommateurs. Ces appareils servent à diverses fins, notamment le suivi des activités et la surveillance de la santé. La demande en électronique grand public entraîne le besoin de circuits intégrés de gestion de l'alimentation. Les domaines d'application des appareils portables s'étendent au-delà de l'électronique grand public pour inclure les appareils médicaux et les appareils de communication sans fil. Dans le secteur médical, il existe un potentiel de croissance important pour le marché des circuits intégrés de gestion de l'alimentation dans les appareils médicaux portables et les systèmes de surveillance des soins de santé sans fil, car le secteur subit une transformation technologique.

Demande croissante d’appareils alimentés par batterie.

La demande croissante d'appareils alimentés par batterie devrait offrir plusieurs opportunités au marché dans les années à venir. Appareils tels que les téléphones portables, les boîtiers de chargement de batterie de téléphone portable, les ordinateurs portables, les appareils photo, les smartphones, l'électronique, les enregistreurs de données, les PDA contenant des batteries au lithium, les jeux, les tablettes, les montres, etc. Appareils contenant des batteries au lithium métal ou lithium-ion (ordinateurs portables, smartphones, tablettes, etc.) Ces appareils doivent maximiser leur énergie pour prolonger la durée de vie de la batterie. Les PMIC sont essentiels pour optimiser la distribution d'énergie et réduire le gaspillage d'énergie.

Analyse de segmentation du rapport sur le marché des circuits intégrés de gestion de l'alimentation

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des circuits intégrés de gestion de l’alimentation sont le type de produit et l’utilisation finale.

- En fonction du type de produit, le marché des circuits intégrés de gestion de l'alimentation est divisé en régulateurs de tension, contrôle moteur, gestion de batterie , circuits intégrés multicanaux et autres. Le segment des régulateurs de tension devrait détenir une part de marché importante au cours de la période de prévision.

- En fonction de l'utilisation finale, le marché des circuits intégrés de gestion de l'alimentation est divisé en électronique grand public, automobile, santé, informatique et télécommunications, industrie et autres. Le segment de l'électronique grand public devrait détenir une part de marché importante au cours de la période de prévision.

Analyse des parts de marché des circuits intégrés de gestion de l'alimentation par zone géographique

La portée géographique du rapport sur le marché des circuits intégrés de gestion de l’alimentation est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

L'Amérique du Nord domine le marché des circuits intégrés de gestion de l'énergie. Les tendances d'adoption de haute technologie dans diverses industries de la région nord-américaine ont alimenté la croissance du marché des circuits intégrés de gestion de l'énergie. Des facteurs tels que l'adoption accrue d'outils numériques, les dépenses technologiques élevées des agences gouvernementales, l'augmentation des ventes de produits électroniques grand public et l'inclinaison croissante vers les véhicules électriques devraient stimuler la croissance du marché nord-américain des circuits intégrés de gestion de l'énergie. De plus, l'accent mis sur la recherche et le développement dans les économies développées des États-Unis et du Canada oblige les acteurs nord-américains à apporter des solutions technologiquement avancées sur le marché. En outre, les États-Unis comptent de nombreux acteurs du marché des circuits intégrés de gestion de l'énergie qui se concentrent de plus en plus sur le développement de solutions innovantes. Tous ces facteurs contribuent à la croissance du marché des circuits intégrés de gestion de l'énergie dans la région.

Aperçu régional du marché des circuits intégrés de gestion de l'alimentation

Les tendances et facteurs régionaux influençant le marché des circuits intégrés de gestion de l'alimentation tout au long de la période de prévision ont été expliqués en détail par les analystes d'Insight Partners. Cette section traite également des segments et de la géographie du marché des circuits intégrés de gestion de l'alimentation en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des circuits intégrés de gestion de l'alimentation

Portée du rapport sur le marché des circuits intégrés de gestion de l'alimentation

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 37,73 milliards de dollars américains |

| Taille du marché d'ici 2031 | 59,04 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 5,8% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type de produit

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des circuits intégrés de gestion de l'alimentation : comprendre son impact sur la dynamique des entreprises

Le marché des circuits intégrés de gestion de l'alimentation connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des circuits intégrés de gestion de l'alimentation sont :

- Semi-conducteurs NXP

- Appareils Analogiques Inc.

- Infineon Technologies AG

- ROHM CO, Ltée

- Microchip Technologie Inc.

- Vishay Intertechnology, Inc.

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des circuits intégrés de gestion de l'alimentation

Actualités et développements récents du marché des circuits intégrés de gestion de l'alimentation

Le marché des circuits intégrés de gestion de l'alimentation est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché des circuits intégrés de gestion de l'alimentation sont répertoriés ci-dessous :

- Nordic Semiconductor a annoncé le lancement de son PMIC (circuit intégré de gestion de l'alimentation) nPM1300. Avec ses deux convertisseurs abaisseurs, ses deux commutateurs de charge/convertisseurs à faible chute de tension (LDO) et son chargeur de batterie intégré, le nPM1300 est idéal pour les applications alimentées par batterie. (Source : site Web de Nordic Semiconductor Company, juin 2023)

- Magnachip Semiconductor Corporation a annoncé le lancement de son premier circuit intégré de gestion de l'alimentation (PMIC) pour les appareils informatiques équipés d'écrans OLED. (Source : site Web de la société Magnachip Semiconductor Corporation/novembre 2023)

Rapport sur le marché des circuits intégrés de gestion de l'alimentation : couverture et livrables

Le rapport « Taille et prévisions du marché des circuits intégrés de gestion de l’alimentation (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des circuits intégrés de gestion de l’alimentation aux niveaux mondial, régional et national pour tous les segments de marché clés couverts dans le cadre.

- Tendances du marché des circuits intégrés de gestion de l’alimentation ainsi que dynamique du marché telles que les moteurs, les contraintes et les opportunités clés.

- Analyse détaillée des cinq forces de PEST/Porter et SWOT.

- Analyse du marché des circuits intégrés de gestion de l’alimentation couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché.

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents sur le marché des circuits intégrés de gestion de l'alimentation.

- Profils d'entreprise détaillés.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des circuits intégrés de gestion de l'alimentation

Obtenez un échantillon gratuit pour - Marché des circuits intégrés de gestion de l'alimentation