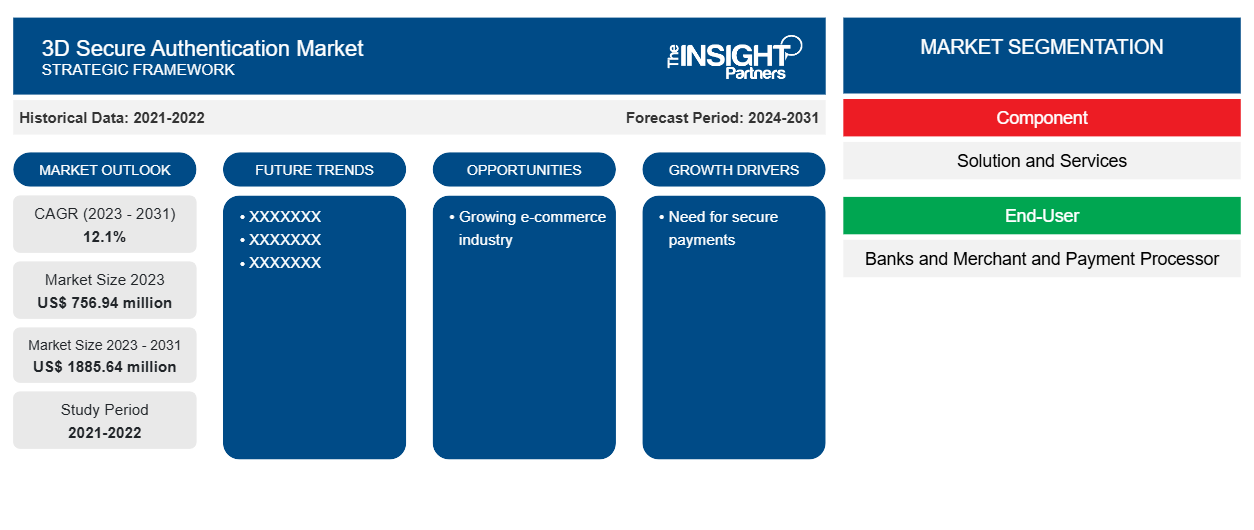

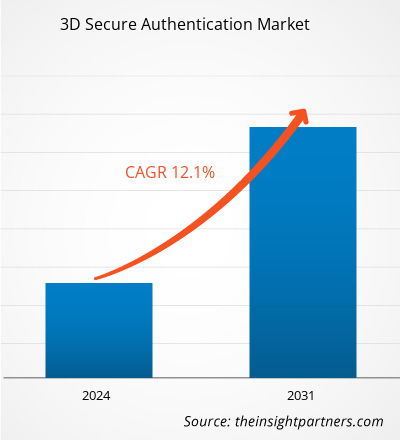

Si prevede che la dimensione del mercato dell'autenticazione 3D Secure raggiungerà i 1885,64 milioni di dollari entro il 2031, rispetto ai 756,94 milioni di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 12,1% nel periodo 2023-2031. È probabile che l'aumento delle transazioni online e dei crescenti attacchi informatici rimangano tendenze chiave nel mercato.

Analisi di mercato dell'autenticazione 3D Secure

L'aumento della penetrazione di Internet, l'aumento del reddito disponibile dei consumatori e l'aumento dell'adozione della digitalizzazione sono alcuni dei fattori che guidano la crescita del mercato. L'industria crescente dell'e-commerce e dell'm-commerce genera la domanda di soluzioni per proteggere le transazioni, portando alla crescita del mercato. Con il crescente numero di transazioni online, le preoccupazioni sulle frodi online guidano il mercato.

Panoramica del mercato dell'autenticazione 3D Secure

3D Secure (3DS) è un metodo di autenticazione e un protocollo di sicurezza adottato dalle aziende per proteggere il loro ecosistema di pagamento . Fornisce un ulteriore livello di sicurezza per le transazioni con carta di credito. Questo processo di autenticazione verifica l'identità del cliente durante il pagamento. La solida regolamentazione di autenticazione PSD2 in Europa e normative simili nel Regno Unito, in India e in Australia promuovono l'adozione di soluzioni di autenticazione 3D Secure per i pagamenti con carta.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato dell'autenticazione 3D Secure: approfondimenti strategici

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità di mercato dell'autenticazione 3D Secure

Necessità di pagamenti sicuri.

Con la crescente digitalizzazione, le aziende stanno adottando soluzioni digitali per gestire in modo efficiente le proprie attività commerciali. Questo fattore porta all'adozione di soluzioni, effettuando e riscuotendo pagamenti tra le aziende. Proteggere l'ecosistema dei pagamenti è la massima priorità di qualsiasi azienda, poiché è importante creare e mantenere la fiducia dei clienti. Per questo, le aziende adottano soluzioni di autenticazione 3D secure per aggiungere un ulteriore livello di sicurezza per prevenire transazioni online non autorizzate.

Crescita del settore dell'e-commerce

Il settore dell'e-commerce sta guadagnando terreno grazie alla crescente penetrazione di Internet, alle vendite di smartphone e al crescente potere d'acquisto dei consumatori. La fattibilità, i prezzi accessibili e l'ampio portafoglio di prodotti sono alcuni dei vantaggi dello shopping online rispetto allo shopping tradizionale. Pertanto, i clienti sono propensi a fare acquisti tramite piattaforme di e-commerce. Ciò ha portato a un aumento dei pagamenti da parte dei clienti, portando al mercato dell'autenticazione 3D Secure. L'autenticazione 3D Secure aiuta le aziende e i clienti a effettuare transazioni online più sicure. L'adozione di questa soluzione riduce il rischio di frode e offre maggiore sicurezza con un ulteriore livello di autenticazione.

Analisi della segmentazione del rapporto di mercato sull'autenticazione 3D Secure

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato dell'autenticazione 3D Secure sono i componenti e l'utente finale.

- In base al componente, il mercato dell'autenticazione 3D secure è suddiviso in soluzioni e servizi. Il segmento delle soluzioni ha detenuto la quota maggiore del mercato nel 2023.

- In base all'utente finale, il mercato dell'autenticazione 3D secure è segmentato in banche e commercianti e processori di pagamento. Il segmento bancario ha detenuto una quota significativa del mercato nel 2023.

Analisi della quota di mercato dell'autenticazione 3D Secure per area geografica

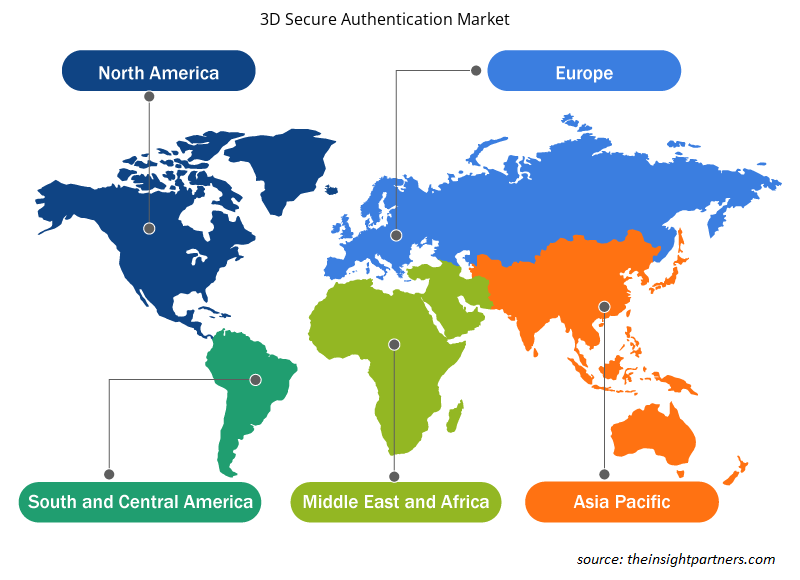

L'ambito geografico del rapporto di mercato sull'autenticazione 3D Secure è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, Sud e Centro America.

La regione Asia-Pacifico detiene la quota di mercato più grande e si prevede che crescerà con il CAGR più elevato. Paesi come India, Giappone e Cina detengono la maggioranza della quota di mercato Asia-Pacifico. L'adozione di tecnologie digitali sta alimentando la crescita del mercato nella regione. Il crescente settore dell'e-commerce sta contribuendo alla crescita del mercato dell'autenticazione 3D secure.

Approfondimenti regionali sul mercato dell'autenticazione 3D Secure

Le tendenze regionali e i fattori che influenzano il mercato dell'autenticazione 3D Secure durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dell'autenticazione 3D Secure in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato dell'autenticazione 3D Secure

Ambito del rapporto di mercato sull'autenticazione 3D Secure

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 756,94 milioni di dollari USA |

| Dimensioni del mercato entro il 2031 | 1885,64 milioni di dollari USA |

| CAGR globale (2023-2031) | 12,1% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per componente

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato dell'autenticazione 3D Secure: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dell'autenticazione 3D Secure sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dell'autenticazione 3D Secure sono:

- Netcetera

- Società a responsabilità limitata

- GRUPPO ASEE

- Asiapay limitata

- Modifico

- Msignia, Inc.

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dell'autenticazione 3D Secure

Notizie di mercato e sviluppi recenti sull'autenticazione 3D Secure

Il mercato dell'autenticazione 3D Secure viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato dell'autenticazione 3D Secure:

- Everlink ha annunciato il completamento della certificazione 3D Secure e il lancio del suo servizio di autenticazione 3D Secure tramite il servizio di autenticazione dei consumatori VISA (VCAS) per i prodotti di carte Visa e Mastercard. Con l'accelerazione dell'eCommerce in tutto il mondo, le aziende sono tenute a prevenire le frodi e garantire che le transazioni vengano approvate senza problemi. Attualmente, oltre il 79% di tutte le frodi avviene tramite transazioni con carta non presente. L'autenticazione 3D Secure offre un ulteriore livello di sicurezza per i consumatori, offrendo un'esperienza del titolare della carta migliorata e più flessibile per le transazioni con carta non presente su più dispositivi. (Fonte: Everlink, comunicato stampa, gennaio 2022)

- PayU, il principale fornitore di soluzioni di pagamenti online in India, ha annunciato il lancio di 3D Secure 2.0 SDK, che offre un checkout nativo completo e un'esperienza cliente superiore per tutte le transazioni con carta. I commercianti PayU possono fornire un'esperienza cliente ottimizzata rispettando i principali aggiornamenti della rete di carte, tra cui Visa e Mastercard, ottenendo al contempo una migliore sicurezza e protezione dalle frodi. Il leggero 3DS 2.0 SDK di PayU offre una latenza ridotta e una riduzione del 40% del tempo di checkout. PayU ha sviluppato questa offerta certificata EMVCo in collaborazione con Wibmo, una società PayTech globale full stack di proprietà di PayU. (Fonte: Procurato, comunicato stampa, febbraio 2023)

Copertura e risultati del rapporto di mercato sull'autenticazione 3D Secure

Il rapporto "Dimensioni e previsioni del mercato dell'autenticazione sicura 3D (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dell'autenticazione 3D Secure a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato dell'autenticazione 3D Secure e dinamiche di mercato come driver, restrizioni e opportunità chiave

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato dell'autenticazione 3D Secure che copre le principali tendenze di mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato dell'autenticazione 3D Secure

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dell'autenticazione 3D Secure

Ottieni un campione gratuito per - Mercato dell'autenticazione 3D Secure