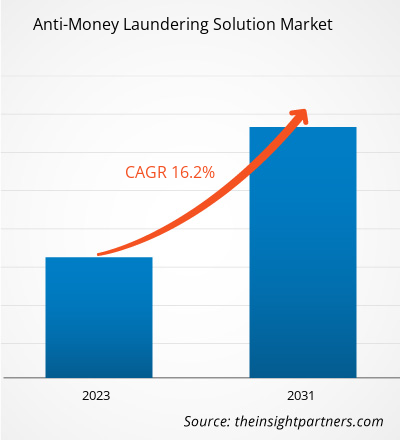

Si prevede che il mercato antiriciclaggio raggiungerà i 13,54 miliardi di dollari entro il 2031, rispetto ai 4,21 miliardi di dollari del 2024. Si prevede che il mercato registrerà un CAGR del 18,3% nel periodo 2025-2031.

Analisi del mercato antiriciclaggio

La crescente pressione normativa, l'aumento dei reati finanziari e l'espansione globale dei servizi bancari digitali e fintech sono fattori chiave che guidano la crescita del mercato antiriciclaggio. Governi e organismi di regolamentazione stanno applicando misure di conformità più rigorose per contrastare il riciclaggio di denaro, il finanziamento del terrorismo e altri reati finanziari, costringendo gli istituti finanziari a investire in solide soluzioni antiriciclaggio. Inoltre, l'integrazione di intelligenza artificiale, apprendimento automatico e analisi dei dati nei sistemi antiriciclaggio migliora il monitoraggio in tempo reale, la valutazione del rischio e l'individuazione di pattern, aumentando così l'efficienza di questi programmi.

Panoramica del mercato antiriciclaggio

L'antiriciclaggio ( AML ) comprende un quadro di leggi, regolamenti e procedure volte a impedire ai criminali di legittimare fondi ottenuti illecitamente. Il suo obiettivo principale è quello di interrompere il processo di riciclaggio di denaro, in cui il "denaro sporco" acquisito illegalmente viene trasformato in "denaro pulito" apparentemente legittimo. Le misure antiriciclaggio sono essenziali per gli istituti finanziari e altre entità regolamentate per individuare, prevenire e segnalare i reati finanziari. L'antiriciclaggio si concentra sulla prevenzione dei criminali dallo sfruttamento del sistema finanziario per riciclare fondi illeciti. Implica il monitoraggio delle transazioni e delle attività dei clienti per rilevare comportamenti sospetti, con gli istituti finanziari tenuti a segnalare tali attività alle autorità. I programmi di conformità antiriciclaggio garantiscono che le organizzazioni rispettino gli obblighi di legge e riducano il rischio di reati finanziari.

Riceverai la personalizzazione gratuita di qualsiasi report, incluse parti di questo report, analisi a livello nazionale, pacchetto dati Excel e potrai usufruire di fantastiche offerte e sconti per start-up e università.

Mercato antiriciclaggio: approfondimenti strategici

-

Scopri le principali tendenze di mercato di questo rapporto.Questo campione GRATUITO includerà analisi dei dati, che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Fattori trainanti e opportunità del mercato antiriciclaggio

Fattori trainanti del mercato:

-

Aumento dei crimini finanziari a livello globale

L'aumento dei casi di riciclaggio di denaro, finanziamento del terrorismo e frode ha determinato un'impennata della domanda di tecnologie AML avanzate per rilevare e prevenire attività finanziarie illecite.

-

Adozione del Digital Banking e Fintech

Il rapido passaggio ai servizi finanziari digitali ha ampliato il panorama dei rischi, determinando una maggiore necessità di strumenti di monitoraggio AML in tempo reale , soprattutto nelle transazioni online e nei mercati delle criptovalute.

-

Progressi tecnologici nell'intelligenza artificiale e nell'analisi

Le innovazioni nell'intelligenza artificiale, nell'apprendimento automatico e nell'analisi dei big data hanno reso possibili soluzioni AML più efficaci ed efficienti , stimolando la crescita del mercato man mano che le aziende modernizzano le loro operazioni di conformità.

-

Transazioni transfrontaliere e globalizzazione

L'aumento del commercio internazionale e dei flussi finanziari transfrontalieri ha accresciuto la complessità del monitoraggio delle transazioni, spingendo gli istituti finanziari ad adottare sistemi AML solidi che operino in tutte le giurisdizioni.

Opportunità di mercato:

-

Integrazione di intelligenza artificiale e apprendimento automatico

Esiste una crescente opportunità di sfruttare l'intelligenza artificiale e l'apprendimento automatico per un rilevamento più intelligente delle attività sospette, riducendo i falsi positivi e migliorando la profilazione del rischio, migliorando sia l'efficienza che l'accuratezza nei sistemi AML.

-

Espansione nei mercati emergenti

Con la modernizzazione dei sistemi finanziari nelle economie emergenti, aumenta la domanda di soluzioni AML conformi alle normative in continua evoluzione, offrendo un potenziale di crescita significativo per i fornitori AML globali.

-

Crescita delle criptovalute e degli asset virtuali

Con l'ascesa delle criptovalute e della finanza decentralizzata (DeFi), c'è una forte necessità di strumenti AML su misura per questi settori, creando nuove nicchie per soluzioni e servizi AML specializzati.

-

Soluzioni AML basate su cloud

La crescente adozione della tecnologia cloud rappresenta un'opportunità per sistemi AML scalabili, convenienti e flessibili, soprattutto tra le piccole e medie istituzioni finanziarie che puntano alla trasformazione digitale.

Analisi della segmentazione del rapporto di mercato antiriciclaggio

Il mercato antiriciclaggio è suddiviso in diversi segmenti per offrire una visione più chiara del suo funzionamento, del suo potenziale di crescita e delle ultime tendenze. Di seguito è riportato l'approccio di segmentazione standard utilizzato nella maggior parte dei report di settore:

Per tipo:

-

Soluzione

Le soluzioni AML si riferiscono a strumenti software e piattaforme progettati per rilevare, monitorare e prevenire le attività di riciclaggio di denaro. Tra questi rientrano sistemi di monitoraggio delle transazioni , strumenti di due diligence della clientela e software di screening delle sanzioni.

-

Servizi

I servizi AML includono il supporto di esperti come consulenza, integrazione di sistemi, formazione e gestione della conformità. Questi servizi aiutano le organizzazioni a implementare, gestire e ottimizzare i sistemi AML e a garantire la conformità normativa.

Per soluzione:

-

In sede

Le soluzioni AML on-premise vengono installate ed eseguite localmente sui server e sull'infrastruttura di un'organizzazione, offrendo il controllo completo sui dati e sulla sicurezza. -

Basato su cloud

Le soluzioni AML basate su cloud sono ospitate su server remoti e accessibili tramite Internet, garantendo scalabilità, flessibilità e costi iniziali ridotti.

Per dimensione aziendale:

- Grandi imprese

- Piccole e medie imprese

Per settore di utilizzo finale:

- Banche e istituzioni finanziarie

- Assicurazione

- Gioco d'azzardo e gioco d'azzardo

- Altri

Per geografia:

- America del Nord

- Europa

- Asia Pacifico

- Medio Oriente e Africa

- America meridionale e centrale

Si prevede che il mercato antiriciclaggio nella regione Asia-Pacifico registrerà la crescita più rapida. La rapida ascesa del digital banking, dei pagamenti mobili e delle startup fintech nell'area APAC ha creato la necessità di soluzioni AML robuste per monitorare e proteggere gli ecosistemi finanziari digitali.

Soluzione antiriciclaggio

Approfondimenti regionali sul mercato antiriciclaggio

Le tendenze e i fattori regionali che hanno influenzato il mercato antiriciclaggio durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione analizza anche i segmenti e la distribuzione geografica del mercato antiriciclaggio in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto di mercato antiriciclaggio

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2024 | 4,21 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 13,54 miliardi di dollari USA |

| CAGR globale (2025 - 2031) | 18,3% |

| Dati storici | 2021-2023 |

| Periodo di previsione | 2025-2031 |

| Segmenti coperti |

Per offerte

|

| Regioni e paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato antiriciclaggio: comprendere il suo impatto sulle dinamiche aziendali

Il mercato antiriciclaggio è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni una panoramica dei principali attori del mercato antiriciclaggio

Analisi della quota di mercato antiriciclaggio per area geografica

Si prevede che la regione Asia-Pacifico crescerà più rapidamente nei prossimi anni. Anche i mercati emergenti in America meridionale e centrale, Medio Oriente e Africa offrono numerose opportunità di espansione per i fornitori di servizi antiriciclaggio.

Il mercato antiriciclaggio cresce in modo diverso in ogni regione. Ciò è dovuto a fattori come la trasformazione digitale, la regolamentazione governativa, l'andamento dei reati finanziari e le transazioni transfrontaliere, tra gli altri. Di seguito è riportato un riepilogo delle quote di mercato e delle tendenze per regione:

1. Nord America

-

Quota di mercato:

Detiene una quota significativa del mercato globale -

Fattori chiave:

- Rigorosi requisiti di applicazione e conformità normativa

- Elevato volume di transazioni finanziarie digitali e transfrontaliere

- Adozione avanzata dell'intelligenza artificiale e dell'analisi nelle istituzioni finanziarie

-

Tendenze:

Crescente utilizzo di strumenti AML basati sull'intelligenza artificiale, crescente attenzione al monitoraggio delle transazioni in tempo reale e crescente domanda di soluzioni di conformità basate sul cloud

2. Europa

-

Quota di mercato:

Quota sostanziale dovuta a rigidi quadri normativi -

Fattori chiave:

- Quadri normativi rigorosi come le direttive antiriciclaggio dell'UE

- Forte presenza di banche e istituzioni finanziarie internazionali

- Crescente attenzione alla prevenzione del finanziamento del terrorismo e dell’evasione fiscale

-

Tendenze:

Maggiore adozione di servizi KYC centralizzati e crescente enfasi sul monitoraggio delle transazioni transfrontaliere negli stati membri dell'UE

3. Asia Pacifico

-

Quota di mercato:

Emerge come una delle regioni in più rapida crescita nel mercato globale AML -

Fattori chiave:

- Rapida trasformazione digitale e crescita della tecnologia finanziaria e dei pagamenti digitali

- Rafforzare le normative AML nelle principali economie come Cina e India

- L’aumento del commercio transfrontaliero e dei flussi di rimesse aumenta la necessità di conformità

-

Tendenze:

Adozione di strumenti AML basati sull'intelligenza artificiale, espansione dei processi KYC digitali e crescente collaborazione tra governi e istituzioni finanziarie per migliorare la conformità normativa

4. America meridionale e centrale

-

Quota di mercato:

Mercato AML in costante crescita con crescente attenzione normativa in tutta la regione -

Fattori chiave:

- Aumento dei livelli di criminalità finanziaria, tra cui il traffico di droga e il riciclaggio di denaro legato alla corruzione

- La necessità di sistemi di pagamento sicuri e flessibili

-

Tendenze:

Maggiore adozione di soluzioni di conformità AML da parte di banche e fintech locali, collaborazioni regionali per un migliore allineamento normativo e crescente domanda di strumenti AML accessibili e basati su cloud

5. Medio Oriente e Africa

-

Quota di mercato:

Sviluppo del mercato AML con crescenti investimenti nelle infrastrutture di conformità -

Fattori chiave:

- Crescenti riforme normative per allinearsi agli standard internazionali AML

- Crescenti minacce derivanti dal finanziamento del terrorismo e dalle attività finanziarie transfrontaliere illecite

-

Tendenze:

Adozione graduale della tecnologia AML nelle banche e negli istituti finanziari, modernizzazione dei sistemi di conformità guidata dal governo e crescente interesse per gli strumenti AML basati sull'intelligenza artificiale per la mitigazione del rischio.

Densità degli attori del mercato antiriciclaggio: comprendere il suo impatto sulle dinamiche aziendali

Elevata densità di mercato e concorrenza

La concorrenza è forte a causa della presenza di attori affermati come Accenture Plc; ACI Worldwide Inc; BAE Systems Plc; EastNets; Open Text Corp; Oracle Corp; Nasdaq Inc; SAS Institute Inc; NICE Ltd; LexisNexis Risk Solutions Group; Assent Business Technology, Inc.; Ascent Technologies, Inc.; e Fiserv Inc. che contribuiscono anch'essi al panorama competitivo in diverse regioni.

Questo elevato livello di concorrenza spinge le aziende a distinguersi offrendo:

- Monitoraggio delle transazioni basato sull'intelligenza artificiale e valutazione del rischio in tempo reale

- Soluzioni personalizzabili su misura per le esigenze di conformità specifiche del settore

- Integrazione con i sistemi bancari e le piattaforme normative esistenti

- Opzioni di distribuzione scalabili basate sul cloud

Opportunità e mosse strategiche

- Ampliare le partnership con gli enti di regolamentazione e gli istituti finanziari per rafforzare le reti di conformità

- Investire in intelligenza artificiale, apprendimento automatico e blockchain per migliorare l'accuratezza e la velocità dei processi AML

- Prendere di mira i mercati sottoserviti e le PMI con soluzioni AML cloud-native ed economiche

Le principali aziende che operano nel mercato antiriciclaggio sono:

- ACI Worldwide Inc. (Stati Uniti)

- BAE Systems Plc (Londra)

- EastNets (Emirati Arabi Uniti)

- Oracle Corp (Stati Uniti)

- Nasdaq Inc. (Stati Uniti)

- SAS Institute Inc. (Stati Uniti)

- NICE Ltd. (Israele)

- LexisNexis Risk Solutions Group (Stati Uniti)

- Ascent Technologies, Inc. (Stati Uniti)

- Fiserv Inc. (Stati Uniti)

Disclaimer: le aziende elencate sopra non sono classificate in un ordine particolare.

Altre aziende analizzate nel corso della ricerca:

- ComplyAdvantage

- Verafin

- Shufti Pro

- Conosci il tuo cliente (Conformità)

- Servizi finanziari Oracle

- Fenergo

- Analisi delle catene

- Feedzai

- Temenos

- Analisi di Moody's

- LexisNexis Risk Solutions

- Fiserv

- ACI nel mondo

- NetReveal

- HAWK.AI

- Lucinity

- Napier

- Ondato

- Scanner delle sanzioni

- Unità 21

Notizie di mercato e sviluppi recenti in materia di antiriciclaggio

-

ACI Worldwide ha annunciato una partnership con NationsBenefits

ACI Worldwide, un innovatore originale nella tecnologia dei pagamenti globali, ha annunciato una partnership con NationsBenefits, la piattaforma fintech per l'assistenza sanitaria, i benefit supplementari e i risultati, per migliorare la connettività dei rivenditori, ampliare le opzioni di pagamento e migliorare la sicurezza e la conformità per i commercianti che accettano la carta prepagata Benefits Mastercard Flex di NationsBenefits. -

Fiserv, Inc. e PayPal Holdings, Inc. hanno annunciato una partnership per creare una futura interoperabilità tra FIUSD e PayPal USD (PYUSD)

Fiserv, Inc. e PayPal Holdings, Inc. hanno annunciato una partnership per sviluppare la futura interoperabilità tra FIUSD e PayPal USD (PYUSD), consentendo a consumatori e aziende di trasferire fondi a livello nazionale e internazionale. Combinando la portata globale di Fiserv e PayPal nei pagamenti bancari, ai consumatori e ai commercianti, l'interoperabilità consentirà a entrambe le aziende di espandere ulteriormente l'uso di stablecoin e pagamenti programmabili in tutto il mondo.

Copertura e risultati del rapporto sul mercato antiriciclaggio

Il rapporto "Dimensioni e previsioni del mercato antiriciclaggio (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato antiriciclaggio a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato antiriciclaggio, nonché dinamiche di mercato quali fattori trainanti, restrizioni e opportunità chiave

- Analisi PEST e SWOT dettagliate

- Analisi del mercato antiriciclaggio che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa termica, i principali attori e gli sviluppi recenti per il mercato antiriciclaggio

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato antiriciclaggio

Ottieni un campione gratuito per - Mercato antiriciclaggio