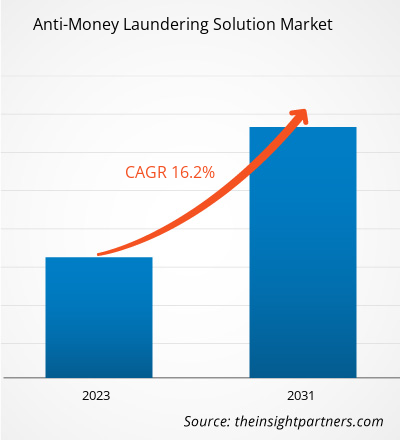

マネーロンダリング対策市場規模は、2024年の42億1,000万米ドルから2031年には135億4,000万米ドルに達すると予測されています。市場は2025年から2031年の間に18.3%のCAGRを記録すると予想されています。

マネーロンダリング対策市場分析

規制圧力の高まり、金融犯罪の増加、そしてデジタルバンキングとフィンテックサービスの世界的な拡大は、マネーロンダリング対策市場の成長を牽引する主要な要因です。政府や規制当局は、マネーロンダリング、テロ資金供与、その他の金融犯罪に対抗するため、より厳格なコンプライアンス措置を施行しており、金融機関は堅牢なマネーロンダリング対策ソリューションへの投資を迫られています。さらに、AI、機械学習、データ分析をマネーロンダリング対策システムに組み込むことで、リアルタイム監視、リスク評価、パターン検出が向上し、これらのプログラムの効率性が向上します。

マネーロンダリング対策市場の概要

マネーロンダリング対策(AML)は、犯罪者が不正に得た資金を合法化するのを防ぐことを目的とした、法律、規制、および手続きの枠組みです。その主な目的は、不正に得た「汚れたお金」を一見正当な「きれいなお金」に変えるマネーロンダリングのプロセスを阻止することです。AML対策は、金融機関やその他の規制対象機関が金融犯罪を検知、防止、報告するために不可欠です。マネーロンダリング対策は、犯罪者が金融システムを悪用して不正資金をロンダリングするのを防ぐことに重点を置いています。これには、取引や顧客の行動を監視して疑わしい行動を検知することが含まれており、金融機関はそのような活動を当局に報告することが義務付けられています。AMLコンプライアンスプログラムは、組織が法的義務を遵守し、金融犯罪のリスクを軽減することを保証します。

このレポートの一部、国レベルの分析、Excelデータパックなど、あらゆるレポートを無料でカスタマイズできます。また、スタートアップや大学向けのお得なオファーや割引もご利用いただけます。

マネーロンダリング対策市場:戦略的洞察

-

このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

マネーロンダリング対策市場の推進要因と機会

市場の推進要因:

-

世界的な金融犯罪の増加

マネーロンダリング、テロ資金供与、詐欺などの事件の増加により、違法な金融活動を検出して防止するための高度なAMLテクノロジーの需要が急増しています。

-

デジタルバンキングとフィンテックの導入

デジタル金融サービスへの急速な移行によりリスク環境が拡大し、特にオンライン取引や暗号通貨市場において、リアルタイムのAML監視ツールの必要性が高まっています。

-

AIと分析における技術の進歩

人工知能、機械学習、ビッグデータ分析の革新により、より効果的で効率的なAMLソリューションが実現し、企業がコンプライアンス業務を近代化するにつれて市場の成長が促進されています。

-

越境取引とグローバリゼーション

国際貿易と国境を越えた金融取引の増加により、取引の監視の複雑さが増し、金融機関は管轄区域を超えて運用される強力なAMLシステムを導入する必要に迫られています。

市場機会:

-

AIと機械学習の統合

AI/ML を活用して疑わしい活動をよりスマートに検出し、誤検知を減らし、リスク プロファイリングを強化して、AML システムの効率と精度を向上させる機会が増えています。

-

新興市場への進出

新興経済国の金融システムが近代化されるにつれ、進化する規制に準拠するための AML ソリューションの需要が高まり、世界的な AML ベンダーに大きな成長の可能性が生まれています。

-

暗号通貨と仮想資産の成長

暗号通貨と分散型金融(DeFi)の台頭により、これらの分野に合わせたAMLツールへのニーズが高まり、専門的なAMLソリューションとサービスの新たなニッチが生まれています。

-

クラウドベースのAMLソリューション

クラウド テクノロジーの採用が拡大するにつれ、特にデジタル変革を目指す中小規模の金融機関の間では、拡張性、コスト効率、柔軟性に優れた AML システムを導入する機会が生まれます。

マネーロンダリング対策市場レポート:セグメンテーション分析

マネーロンダリング対策市場は、その仕組み、成長の可能性、そして最新のトレンドをより明確に把握するために、様々なセグメントに分割されています。以下は、ほとんどの業界レポートで使用されている標準的なセグメント分けのアプローチです。

タイプ別:

-

解決

AMLソリューションとは、マネーロンダリング行為を検知、監視、防止するために設計されたソフトウェアツールおよびプラットフォームを指します。これには、取引監視システム、顧客デューデリジェンスツール、制裁スクリーニングソフトウェアなどが含まれます。

-

サービス

AMLサービスには、コンサルティング、システム統合、トレーニング、コンプライアンス管理といった専門家によるサポートが含まれます。これらのサービスは、組織がAMLシステムの導入、維持、最適化を行い、規制遵守を確保できるよう支援します。

解決策:

-

オンプレミス

オンプレミスの AML ソリューションは、組織独自のサーバーとインフラストラクチャにローカルにインストールされて実行され、データとセキュリティを完全に制御できます。 -

クラウドベース

クラウドベースの AML ソリューションはリモート サーバーでホストされ、インターネット経由でアクセスされるため、拡張性、柔軟性が向上し、初期コストが削減されます。

企業規模別:

- 大企業

- 中小企業

最終用途産業別:

- 銀行および金融機関

- 保険

- ゲームとギャンブル

- その他

地理別:

- 北米

- ヨーロッパ

- アジア太平洋

- 中東・アフリカ

- 南米と中央アメリカ

アジア太平洋地域のマネーロンダリング対策市場は、最も急速な成長が見込まれています。アジア太平洋地域におけるデジタルバンキング、モバイル決済、フィンテックスタートアップの急速な台頭により、デジタル金融エコシステムの監視とセキュリティ確保のための堅牢なAMLソリューションの必要性が高まっています。

マネーロンダリング対策ソリューション

マネーロンダリング対策市場の地域別分析

予測期間を通じてアンチマネーロンダリング市場に影響を与える地域的な傾向と要因は、The Insight Partnersのアナリストによって徹底的に解説されています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東・アフリカ、中南米におけるアンチマネーロンダリング市場のセグメントと地域についても解説します。

マネーロンダリング対策市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| 2024年の市場規模 | 42億1000万米ドル |

| 2031年までの市場規模 | 135億4000万米ドル |

| 世界のCAGR(2025年~2031年) | 18.3% |

| 履歴データ | 2021-2023 |

| 予測期間 | 2025~2031年 |

| 対象セグメント |

提供物によって

|

| 対象地域と国 |

北米

|

| 市場リーダーと主要企業の概要 |

|

マネーロンダリング対策市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

マネーロンダリング対策市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認知度の高まりといった要因によるエンドユーザーの需要増加に牽引され、急速に成長しています。需要の高まりに伴い、企業は提供内容を拡大し、消費者ニーズを満たすための革新を進め、新たなトレンドを捉えることで、市場の成長をさらに加速させています。

- マネーロンダリング対策市場における主要プレーヤーの概要

地域別マネーロンダリング対策市場シェア分析

アジア太平洋地域は今後数年間で最も急速に成長すると予想されています。南米、中米、中東、アフリカの新興市場にも、マネーロンダリング対策プロバイダーにとって未開拓のビジネスチャンスが数多く存在します。

マネーロンダリング対策市場は、地域によって成長の度合いが異なります。これは、デジタルトランスフォーメーション、政府規制、金融犯罪の動向、国境を越えた取引といった要因によるものです。以下は、地域別の市場シェアと動向の概要です。

1. 北米

-

市場占有率:

世界市場の大きな部分を占めている -

主な推進要因:

- 強力な規制執行とコンプライアンス要件

- 大量のデジタルおよび国境を越えた金融取引

- 金融機関におけるAIと分析の高度な導入

-

トレンド:

AIを活用したAMLツールの利用増加、リアルタイム取引監視への注目の高まり、クラウドベースのコンプライアンスソリューションの需要増加

2. ヨーロッパ

-

市場占有率:

厳格な規制枠組みによる大きなシェア -

主な推進要因:

- EUマネーロンダリング防止指令などの厳格な規制枠組み

- 国際的な銀行や金融機関の強力な存在

- テロ資金供与と脱税の防止への関心の高まり

-

トレンド:

集中型KYCユーティリティの採用増加とEU加盟国間の国境を越えた取引の監視への重点化

3. アジア太平洋

-

市場占有率:

世界のAML市場で最も急速に成長している地域の一つとして台頭 -

主な推進要因:

- 急速なデジタル変革とフィンテックおよびデジタル決済の成長

- 中国やインドなどの主要経済国におけるAML規制の強化

- 国境を越えた貿易と送金の流れの増加によりコンプライアンスの必要性が高まっている

-

トレンド:

AIを活用したAMLツールの導入、デジタルKYCプロセスの拡大、規制遵守強化に向けた政府と金融機関の連携強化

4. 南米と中央アメリカ

-

市場占有率:

地域全体で規制の注目が高まる中、AML市場は着実に成長しています。 -

主な推進要因:

- 麻薬密売や汚職関連のマネーロンダリングを含む金融犯罪の増加

- 安全で柔軟な決済システムの必要性

-

トレンド:

地元の銀行やフィンテックによるAMLコンプライアンスソリューションの採用の増加、規制の整合性を改善するための地域的な協力、手頃な価格のクラウドベースのAMLツールの需要の増加

5. 中東およびアフリカ

-

市場占有率:

コンプライアンスインフラへの投資増加によるAML市場の発展 -

主な推進要因:

- 国際的なAML基準に沿う規制改革の拡大

- テロ資金供与と違法な国境を越えた金融活動による脅威の増大

-

トレンド:

銀行や金融機関全体で AML テクノロジーが段階的に導入され、政府主導でコンプライアンス システムが近代化され、リスク軽減のための AI を活用した AML ツールへの関心が高まっています。

マネーロンダリング対策市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

高い市場密度と競争

Accenture Plc、ACI Worldwide Inc、BAE Systems Plc、EastNets、Open Text Corp、Oracle Corp、Nasdaq Inc、SAS Institute Inc、NICE Ltd、LexisNexis Risk Solutions Group、Assent Business Technology、Inc.、Ascent Technologies、Inc.、Fiserv Inc. などの大手企業の存在により競争は激しく、さまざまな地域で競争環境も激化しています。

この高いレベルの競争により、企業は次のようなものを提供して差別化を図ろうとしています。

- AIを活用した取引監視とリアルタイムのリスクスコアリング

- 業界固有のコンプライアンスニーズに合わせてカスタマイズ可能なソリューション

- 既存の銀行システムおよび規制プラットフォームとの統合

- スケーラブルなクラウドベースの展開オプション

機会と戦略的動き

- 規制当局や金融機関とのパートナーシップを拡大し、コンプライアンスネットワークを強化

- AI、機械学習、ブロックチェーンへの投資により、AMLプロセスの精度とスピードを向上

- コスト効率の高いクラウドネイティブAMLソリューションで、サービスが行き届いていない市場や中小企業をターゲットに

マネーロンダリング対策市場で事業を展開している主要企業は次のとおりです。

- ACIワールドワイド社(米国)

- BAEシステムズ(ロンドン)

- イーストネッツ(UAE)

- オラクル社(米国)

- ナスダック(米国)

- SAS Institute Inc.(米国)

- NICE Ltd.(イスラエル)

- レクシスネクシスリスクソリューションズグループ(米国)

- アセントテクノロジーズ社(米国)

- Fiserv Inc.(米国)

免責事項:上記の企業は、特定の順序でランク付けされているわけではありません。

調査の過程で分析した他の企業:

- コンプライアドバンテージ

- ベラフィン

- シュフティプロ

- 顧客を知る(コンプライアンス)

- オラクル・ファイナンシャル・サービス

- フェネルゴ

- チェイナリシス

- フィードザイ

- テメノス

- ムーディーズ・アナリティクス

- レクシスネクシスリスクソリューションズ

- フィサーブ

- ACIワールドワイド

- ネットリビール

- HAWK.AI

- ルシニティ

- ネイピア

- オンダト

- 制裁スキャナー

- ユニット21

マネーロンダリング対策市場のニュースと最近の動向

-

ACIワールドワイドはネイションズベネフィットとの提携を発表した。

グローバル決済テクノロジーの先駆者である ACI Worldwide は、ヘルスケア フィンテック、補足給付、成果プラットフォームである NationsBenefits との提携を発表しました。これにより、NationsBenefits の Benefits Mastercard Prepaid Flex Card を受け入れている小売業者との接続性を強化し、決済オプションを拡張し、セキュリティとコンプライアンスを向上させることができます。 -

Fiserv, Inc.とPayPal Holdings, Inc.は、FIUSDとPayPal USD(PYUSD)間の将来の相互運用性を構築するための提携を発表しました。

Fiserv, Inc.とPayPal Holdings, Inc.は、FIUSDとPayPal USD(PYUSD)間の将来的な相互運用性を構築するための提携を発表しました。これにより、消費者と企業は国内外で資金を移動できるようになります。FiservとPayPalの銀行、消費者、そして加盟店決済におけるグローバルなリーチを組み合わせることで、相互運用性を実現し、両社は世界中でステーブルコインとプログラマブル決済の利用をさらに拡大することができます。

マネーロンダリング対策市場レポートの対象範囲と成果物

「マネーロンダリング対策市場の規模と予測(2021〜2031年)」レポートでは、以下の分野を網羅した市場の詳細な分析を提供しています。

- マネーロンダリング対策市場の規模と予測(対象範囲に含まれるすべての主要市場セグメントの世界、地域、国レベル)

- マネーロンダリング対策市場の動向、推進要因、制約、主要な機会などの市場動向

- 詳細なPEST分析とSWOT分析

- 主要な市場動向、世界および地域の枠組み、主要プレーヤー、規制、最近の市場動向を網羅したマネーロンダリング対策市場分析

- マネーロンダリング対策市場の市場集中度、ヒートマップ分析、主要プレーヤー、最近の動向を網羅した業界の展望と競争分析

- 詳細な企業プロフィール

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

最新レポート

お客様の声

購入理由

- 情報に基づいた意思決定

- 市場動向の理解

- 競合分析

- 顧客インサイト

- 市場予測

- リスク軽減

- 戦略計画

- 投資の正当性

- 新興市場の特定

- マーケティング戦略の強化

- 業務効率の向上

- 規制動向への対応

無料サンプルを入手 - マネーロンダリング対策市場

無料サンプルを入手 - マネーロンダリング対策市場