Anti-Money Laundering Solution Market Dynamics and Trends by 2031

Anti-Money Laundering Market Forecast (2021-2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Offerings (Solution and Services), Deployment Mode (Cloud and On-Premise), Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End Use Industry (Banks and Financial Institutions, Insurance, Gaming and Gambling, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00010790

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 220

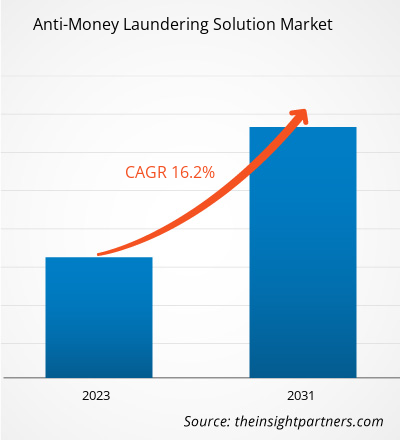

The Anti-Money Laundering Market size is projected to reach US$ 13.54 billion by 2031 from US$ 4.21 billion in 2024. The market is expected to register a CAGR of 18.3% during 2025–2031.

Anti-Money Laundering Market Analysis

The increasing regulatory pressure, rising financial crimes, and the global expansion of digital banking and fintech services are key factors driving anti-money laundering market growth. Governments and regulatory bodies are enforcing stricter compliance measures to combat money laundering, terrorist financing, and other financial crimes, compelling financial institutions to invest in robust anti-money laundering solutions. Additionally, incorporating artificial intelligence, machine learning, and data analytics into anti-money laundering systems improves real-time monitoring, risk evaluation, and pattern detection, thereby boosting the efficiency of these programs.

Anti-Money Laundering Market Overview

Anti-Money Laundering (AML) encompasses a framework of laws, regulations, and procedures intended to prevent criminals from legitimizing illicitly obtained funds. Its primary goal is to disrupt the process of money laundering, where illegally acquired "dirty money" is transformed into seemingly legitimate "clean money." AML measures are essential for financial institutions and other regulated entities to detect, prevent, and report financial crimes. Anti-money laundering focuses on preventing criminals from exploiting the financial system to launder illicit funds. It involves monitoring transactions and customer activities to detect suspicious behavior, with financial institutions required to report such activities to authorities. AML compliance programs ensure organizations meet legal obligations and reduce the risk of financial crime.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAnti-Money Laundering Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Anti-Money Laundering Market Drivers and Opportunities

Market Drivers:

- Rise in Global Financial Crimes Increasing incidents of money laundering, terrorism financing, and fraud have prompted a surge in demand for advanced AML technologies to detect and prevent illicit financial activities.

- Adoption of Digital Banking & Fintech The rapid shift to digital financial services has expanded the risk landscape, leading to greater need for real-time AML monitoring tools, especially in online transactions and cryptocurrency markets.

- Technological Advancements in AI & Analytics Innovations in artificial intelligence, machine learning, and big data analytics have enabled more effective and efficient AML solutions, driving market growth as firms modernize their compliance operations.

- Cross-Border Transactions & Globalization Increased international trade and cross-border financial flows have heightened the complexity of monitoring transactions, pushing financial institutions to adopt robust AML systems that operate across jurisdictions.

Market Opportunities:

- Integration of AI and Machine Learning There's a growing opportunity to leverage AI/ML for smarter detection of suspicious activities, reducing false positives, and enhancing risk profiling—improving both efficiency and accuracy in AML systems.

- Expansion into Emerging Markets As financial systems in emerging economies modernize, there's rising demand for AML solutions to comply with evolving regulations, offering significant growth potential for global AML vendors.

- Growth of Cryptocurrency and Virtual Assets With the rise of crypto and decentralized finance (DeFi), there's a strong need for AML tools tailored to these sectors, creating new niches for specialized AML solutions and services.

- Cloud-Based AML Solutions Increasing adoption of cloud technology presents an opportunity for scalable, cost-effective, and flexible AML systems, especially among small and mid-sized financial institutions seeking digital transformation.

Anti-Money Laundering Market Report Segmentation Analysis

The Anti-Money Laundering market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Solution AML solutions refer to software tools and platforms designed to detect, monitor, and prevent money laundering activities. These include transaction monitoring systems, customer due diligence tools, and sanctions screening software.

- Services AML services involve expert support such as consulting, system integration, training, and compliance management. These services help organizations implement, maintain, and optimize AML systems and ensure regulatory compliance.

By Solution:

- On-Premise On-premise AML solutions are installed and run locally on an organization's own servers and infrastructure, offering full control over data and security.

- Cloud-based Cloud-based AML solutions are hosted on remote servers and accessed via the internet, providing scalability, flexibility, and reduced upfront costs.

By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

By End Use Industry:

- Banks and Financial Institutions

- Insurance

- Gaming and Gambling

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South and Central America

The Anti-Money Laundering market in Asia Pacific is expected to witness the fastest growth. The rapid rise of digital banking, mobile payments, and fintech startups across APAC has created a need for robust AML solutions to monitor and secure digital financial ecosystems..

Anti-Money Laundering Solution

Anti-Money Laundering Market Regional InsightsThe regional trends and factors influencing the Anti-Money Laundering Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Anti-Money Laundering Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Anti-Money Laundering Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4.21 Billion |

| Market Size by 2031 | US$ 13.54 Billion |

| Global CAGR (2025 - 2031) | 18.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Anti-Money Laundering Market Players Density: Understanding Its Impact on Business Dynamics

The Anti-Money Laundering Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Anti-Money Laundering Market top key players overview

Anti-Money Laundering Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for Anti-Money Laundering providers to expand.

The Anti-Money Laundering market grows differently in each region. This is because of factors like digital transformation, government regulation, financial crime trends, cross-border transaction, among others . Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Strong regulatory enforcement and compliance requirements

- High volume of digital and cross-border financial transactions

- Advanced adoption of AI and analytics in financial institutions

- Trends: Growing use of AI-driven AML tools, increasing focus on real-time transaction monitoring, and rising demand for cloud-based compliance solutions

2. Europe

- Market Share: Substantial share due to strict regulatory frameworks

-

Key Drivers:

- Strict regulatory frameworks such as the EU Anti-Money Laundering Directives

- Strong presence of international banks and financial institutions

- Rising focus on preventing terrorist financing and tax evasion

- Trends: Increased adoption of centralized KYC utilities and growing emphasis on cross-border transaction monitoring across EU member states

3. Asia Pacific

- Market Share: Emerging as one of the fastest-growing regions in the global AML market

-

Key Drivers:

- Rapid digital transformation and growth of fintech and digital payments

- Strengthening AML regulations across major economies like China and India

- Increasing cross-border trade and remittance flows raising the need for compliance

- Trends: Adoption of AI-powered AML tools, expansion of digital KYC processes, and growing collaboration between governments and financial institutions to enhance regulatory compliance

4. South and Central America

- Market Share: Steadily growing AML market with increasing regulatory focus across the region

-

Key Drivers:

- Rising levels of financial crime, including drug trafficking and corruption-related money laundering

- A need for safe and flexible payment systems

- Trends: Increased adoption of AML compliance solutions by local banks and fintechs, regional collaborations for improved regulatory alignment, and growing demand for affordable, cloud-based AML tools

5. Middle East and Africa

- Market Share: Developing AML market with rising investment in compliance infrastructure

-

Key Drivers:

- Growing regulatory reforms to align with international AML standards

- Increasing threats from terrorism financing and illicit cross-border financial activities

- Trends: Gradual adoption of AML technology across banks and financial institutions, government-led modernization of compliance systems, and rising interest in AI-powered AML tools for risk mitigation.

Anti-Money Laundering Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Accenture Plc; ACI Worldwide Inc; BAE Systems Plc; EastNets; Open Text Corp; Oracle Corp; Nasdaq Inc; SAS Institute Inc; NICE Ltd; LexisNexis Risk Solutions Group; Assent Business Technology, Inc.; Ascent Technologies, Inc.; and Fiserv Inc.are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- AI-powered transaction monitoring and real-time risk scoring

- Customizable solutions tailored to industry-specific compliance needs

- Integration with existing banking systems and regulatory platforms

- Scalable cloud-based deployment options

Opportunities and Strategic Moves

- Expanding partnerships with regulatory bodies and financial institutions to strengthen compliance networks

- Investing in AI, machine learning, and blockchain to enhance the accuracy and speed of AML processes

- Targeting underserved markets and SMEs with cost-effective, cloud-native AML solutions

Major Companies operating in the Anti-Money Laundering Market are:

- ACI Worldwide Inc. (US)

- BAE Systems Plc (London)

- EastNets (UAE)

- Oracle Corp (US)

- Nasdaq Inc. (US)

- SAS Institute Inc. (US)

- NICE Ltd. (Israel)

- LexisNexis Risk Solutions Group (US)

- Ascent Technologies, Inc. (US)

- Fiserv Inc. (US)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- ComplyAdvantage

- Verafin

- Shufti Pro

- Know Your Customer (Pliance)

- Oracle Financial Services

- Fenergo

- Chainalysis

- Feedzai

- Temenos

- Moody’s Analytics

- LexisNexis Risk Solutions

- Fiserv

- ACI Worldwide

- NetReveal

- HAWK.AI

- Lucinity

- Napier

- Ondato

- Sanction Scanner

- Unit21

Anti-Money Laundering Market News and Recent Developments

- ACI Worldwide announced a partnership with NationsBenefits ACI Worldwide, an original innovator in global payments technology, announced a partnership with NationsBenefits, the healthcare fintech, supplemental benefits, and outcomes platform, to enhance retailer connectivity, expand payment options, and improve security and compliance for merchants accepting NationsBenefits' Benefits Mastercard Prepaid Flex Card.

- Fiserv, Inc. and PayPal Holdings, Inc., announced partnership to build future interoperability between FIUSD and PayPal USD (PYUSD) Fiserv, Inc. and PayPal Holdings, Inc., announced partnership to build future interoperability between FIUSD and PayPal USD (PYUSD), to allow consumers and businesses to move funds domestically and internationally. Combining the global reach of Fiserv and PayPal across banking, consumer, and merchant payments, interoperability will allow both firms to expand further the use of stablecoins and programmable payments around the globe.

Anti-Money Laundering Market Report Coverage and Deliverables

The "Anti-Money Laundering Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Anti-Money Laundering Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Anti-Money Laundering Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Anti-Money Laundering Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Anti-Money Laundering Market

- Detailed company profiles

Frequently Asked Questions

2. Real-Time Monitoring: Enables continuous transaction monitoring and instant flagging of potentially illicit activities for faster response.

3. Improved Customer Risk Profiling: ML models dynamically assess and update customer risk scores based on behavior and transaction history.

4. Automation of Routine Tasks: Automates data collection, KYC verification, and reporting processes, freeing up human resources for more strategic work.

2. Greater Use of Cloud and SaaS Models: Cloud-based AML platforms will grow due to their scalability, cost-effectiveness, and ease of deployment, especially for SMEs.

3. Expansion into Emerging Technologies: Integration with blockchain analytics and biometric authentication will strengthen AML frameworks.

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For