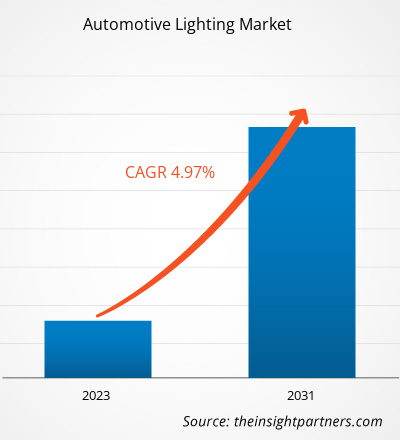

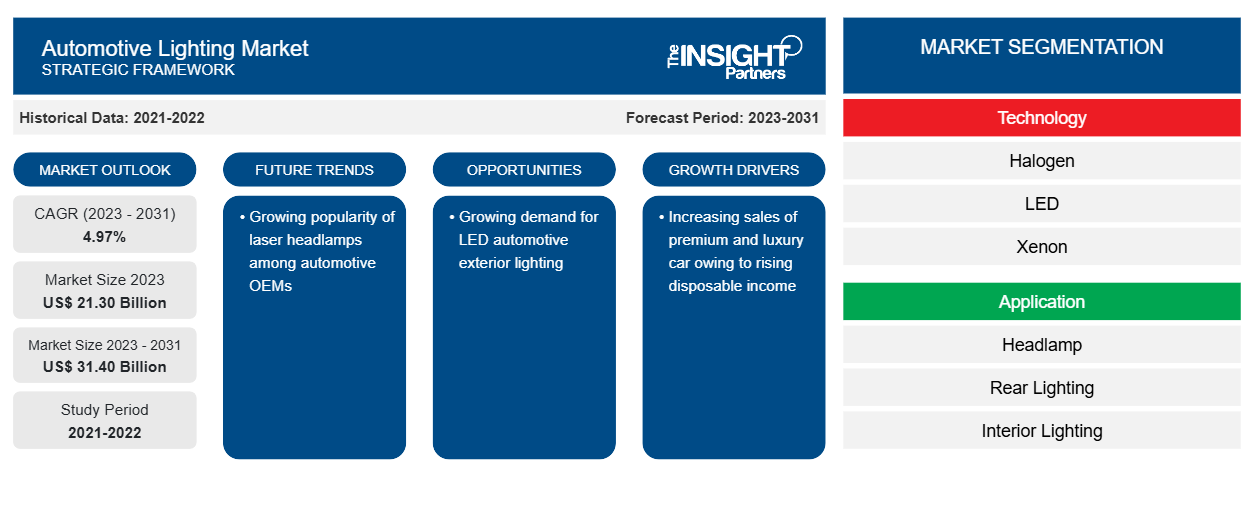

Si prevede che la dimensione del mercato dell'illuminazione per autoveicoli raggiungerà i 31,40 miliardi di dollari entro il 2031, rispetto ai 21,30 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 4,97% nel 2023-2031. L'impennata delle vendite di auto di lusso e di lusso sta guidando il mercato dell'illuminazione per autoveicoli e sta anche offrendo prospettive di crescita ai fornitori di illuminazione.

Analisi del mercato dell'illuminazione automobilistica

L'ecosistema dell'illuminazione automobilistica è costituito dai seguenti principali stakeholder, vale a dire: fornitori di materie prime, produttori/OEM di illuminazione automobilistica e utenti finali. I fornitori di materie prime includono venditori che forniscono componenti chiave di materie prime per l'illuminazione automobilistica come rame , alluminio, LED e diodi laser, tra gli altri. I produttori/OES di illuminazione automobilistica come Osram-Continental, Lumileds, Hella, Valeo e Automotive-Lighting, tra gli altri, integrano e sviluppano l'illuminazione automobilistica per vari tipi di veicoli. Gli OEM automobilistici condividono i fari anteriori, i fanali posteriori e le luci di segnalazione o i progetti specifici del veicolo con i venditori. I venditori elaborano preventivi unici per fare offerte per l'accordo del fornitore. Il venditore che è stato selezionato fornisce quindi i sistemi di illuminazione specifici del veicolo per tutta la durata dell'accordo di gara. Gli OEM integrano questi componenti di illuminazione nel loro veicolo finale.

Panoramica del mercato dell'illuminazione per autoveicoli

Attualmente, le soluzioni di illuminazione a matrice LED dominano le implementazioni totali di illuminazione per autoveicoli. Si prevede che la tecnologia laser a matrice migliori ulteriormente l'illuminazione stradale grazie alle sue caratteristiche di alta risoluzione. La tecnologia laser a matrice si basa sul LaserSpot per lampade abbaglianti. Con la tecnologia laser a matrice, è diventato possibile far convergere la tecnologia del proiettore nei fari delle autovetture. Il fattore di luminanza dei laser è circa cinque volte maggiore rispetto ad altre fonti di luce disponibili sul mercato e, pertanto, i fari laser forniscono gamme di fascio più elevate ai conducenti dei veicoli. La gamma di fascio di un tipico faro laser supera i 500 m. La BMW i8 e la BMW 7 sono le altre serie di autovetture che presentano fari integrati al laser.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dell'illuminazione automobilistica

Aumento delle vendite di auto di lusso e di alta qualità grazie all'aumento del reddito disponibile

Nei paesi sviluppati in cui i consumatori hanno enormi redditi disponibili, si è visto che con l'aumento della popolazione veicolare, le preferenze dei consumatori per l'acquisto di autovetture differiscono. Di conseguenza, l'efficienza dei costi e dei consumi non sono più i criteri principali per l'acquisto di queste auto; al contrario, gli acquisti dipendono maggiormente dal comfort e dal lusso che offrono. Inoltre, i consumatori stanno valutando sempre di più i sistemi di illuminazione e l'ergonomia dell'auto durante le selezioni.

Crescente domanda di illuminazione esterna a LED per auto

Secondo i dati della National Highway Traffic Safety Administration (NHTSA), nonostante solo il 25% del tempo di guida totale dei veicoli passeggeri di notte, circa il 50% di tutti gli incidenti mortali dei veicoli passeggeri si verifica al buio. Ciò è dovuto principalmente alla visibilità inappropriata e all'illuminazione non idonea sulle strade, nonché all'illuminazione insufficiente fornita dai fari dei veicoli. Le preoccupazioni per la sicurezza hanno spinto le case automobilistiche a cercare un'alternativa più sicura. I fendinebbia LEDriving di OSRAM sono notevoli in termini di innovazione, design e prestazioni. Inoltre, Philips offre le tecnologie AirFlux e AirCool, che aiutano a controllare il calore prodotto dai fendinebbia a LED. Si tratta di sistemi di raffreddamento intelligenti che allontanano il calore dal componente critico della luce, aumentando così la resistenza al calore e prolungando efficacemente la durata dei LED.

Analisi della segmentazione del rapporto di mercato dell'illuminazione automobilistica

I segmenti chiave che hanno contribuito alla derivazione dell'analisi del mercato dell'illuminazione per autoveicoli sono la tecnologia, l'applicazione e il tipo di veicolo.

- In base alla tecnologia, il mercato dell'illuminazione per auto è stato suddiviso in alogeno, LED, xeno e laser. Il segmento LED ha detenuto una quota di mercato maggiore nel 2023.

- In base all'applicazione, il mercato dell'illuminazione per autoveicoli è segmentato in fari, illuminazione posteriore, illuminazione interna, CHMSL, fendinebbia e piccole lampade. Il segmento dei fari ha detenuto la quota maggiore del mercato nel 2023.

- In base al tipo di veicolo, il mercato dell'illuminazione per autoveicoli è stato suddiviso in autovetture, LCV e MCV e HCV. Il segmento delle autovetture ha detenuto una quota di mercato maggiore nel 2023.

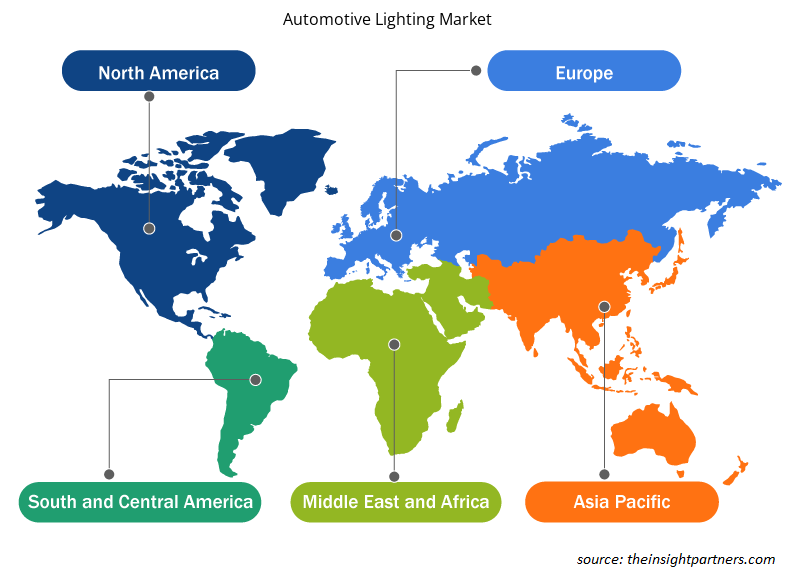

Analisi del mercato dell'illuminazione automobilistica per area geografica

L'ambito geografico del rapporto sul mercato dell'illuminazione per autoveicoli è suddiviso principalmente in cinque regioni: Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America.

L'ambito del rapporto sul mercato dell'illuminazione per autoveicoli comprende Nord America (Stati Uniti, Canada e Messico), Europa (Spagna, Regno Unito, Germania, Francia, Italia e resto d'Europa), Asia Pacifico (Corea del Sud, Cina, India, Giappone, Australia e resto dell'Asia Pacifico), Medio Oriente e Africa (Sudafrica, Arabia Saudita, Emirati Arabi Uniti e resto del Medio Oriente e Africa) e Sud e Centro America (Brasile, Argentina e resto del Sud e Centro America). In termini di fatturato, l'APAC ha dominato la quota di mercato dell'illuminazione per autoveicoli nel 2023. L'Europa è il secondo maggiore contributore al mercato globale dell'illuminazione per autoveicoli, seguita dal Nord America.

Approfondimenti regionali sul mercato dell'illuminazione automobilistica

Le tendenze regionali e i fattori che influenzano il mercato dell'illuminazione automobilistica durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dell'illuminazione automobilistica in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato dell'illuminazione automobilistica

Ambito del rapporto sul mercato dell'illuminazione automobilistica

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 21,30 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 31,40 miliardi di dollari USA |

| CAGR globale (2023-2031) | 4,97% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2023-2031 |

| Segmenti coperti |

Per tecnologia

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato dell'illuminazione automobilistica: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dell'illuminazione per autoveicoli sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dell'illuminazione per autoveicoli sono:

- Illuminazione automobilistica LLC

- Hella GmbH & Co. KGaA

- Azienda manifatturiera Koito

- Società anonima

- Società per azioni Lumileds Holding BV

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dell'illuminazione automobilistica

Notizie e sviluppi recenti sul mercato dell'illuminazione automobilistica

Il mercato dell'illuminazione per autoveicoli viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato dell'illuminazione per autoveicoli e delle strategie:

- A luglio 2023, Marelli, insieme ad ams OSRAM, lancia un'innovazione rivoluzionaria nell'illuminazione anteriore per autoveicoli, introducendo il modulo microLED h-Digi®, ora in produzione in serie. Questa soluzione di illuminazione digitale, basata su un nuovo tipo di LED multipixel intelligente, consente il funzionamento dei fari e la proiezione delle immagini completamente adattivi e dinamici, pur essendo una tecnologia conveniente, disponibile per una gamma più ampia di veicoli. (Fonte: Marelli, comunicato stampa/sito Web aziendale/newsletter)

- A dicembre 2023, OLEDWorks ha annunciato che presenterà l'ultima tecnologia di illuminazione OLED per il settore automobilistico e ridefinirà il panorama con il lancio di un nuovo entusiasmante marchio al CES 2024. Il team OLEDWorks, composto da esperti tecnici OLED e strateghi di soluzioni per i clienti, attende con ansia di accogliere i partecipanti allo stand n. 3225 nella West Hall del Las Vegas Convention Center, dove potranno sperimentare le innovazioni all'avanguardia che plasmeranno il futuro dell'illuminazione automobilistica. (Fonte: OLEDWorks, comunicato stampa/sito Web aziendale/newsletter)

Copertura e risultati del rapporto sul mercato dell'illuminazione automobilistica

Il rapporto "Dimensioni e previsioni del mercato dell'illuminazione automobilistica (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze di Porter

- Analisi di mercato globale e regionale che copre le principali tendenze di mercato, i principali attori, le normative e gli sviluppi recenti del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati con analisi SWOT

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dell'illuminazione automobilistica

Ottieni un campione gratuito per - Mercato dell'illuminazione automobilistica