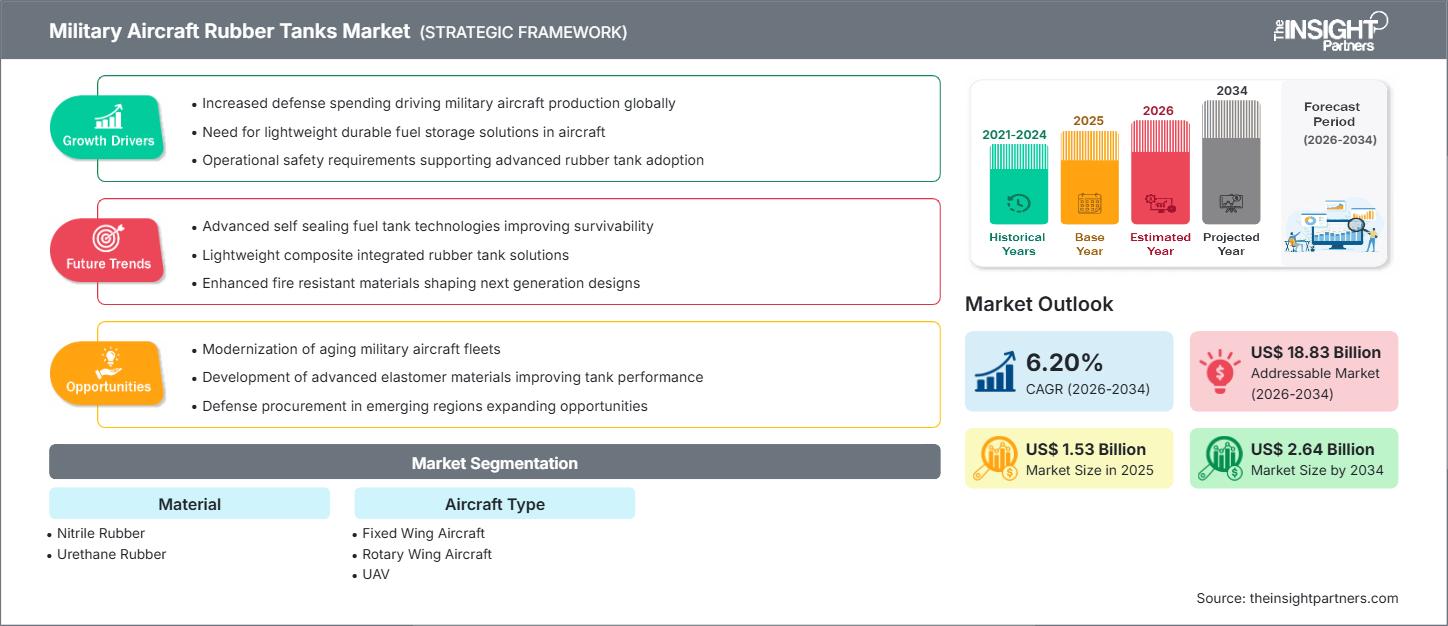

Si prevede che il mercato dei serbatoi in gomma per aerei militari raggiungerà i 2,64 miliardi di dollari entro il 2034, rispetto agli 1,53 miliardi di dollari del 2025. Si prevede che il mercato registrerà un CAGR del 6,20% nel periodo 2026-2034.

Analisi del mercato dei carri armati in gomma per aerei militari

Le previsioni di mercato dei serbatoi in gomma per aerei militari indicano una crescita costante, trainata dall'aumento dei budget per la difesa, dalla modernizzazione delle flotte aeree e dalla crescente domanda di soluzioni di stoccaggio del carburante leggere e durevoli. L'espansione del mercato è supportata dai progressi tecnologici nei materiali elastomerici, dai rigorosi standard di sicurezza e dalla crescente necessità di una maggiore autonomia in missione. Inoltre, l'integrazione di tecnologie autosigillanti, una migliore resistenza alla perforazione e la compatibilità con carburanti avanzati ne accelerano ulteriormente l'adozione. Opportunità strategiche risiedono nello sviluppo di serbatoi per droni e jet da combattimento di nuova generazione, nonché nell'espansione nei mercati emergenti della difesa.

Panoramica del mercato dei carri armati in gomma per aerei militari

I serbatoi in gomma per aerei militari sono sistemi di stoccaggio del carburante specializzati, progettati per velivoli da combattimento e tattici. Questi serbatoi sono realizzati utilizzando elastomeri avanzati come la gomma nitrilica e uretanica, che offrono flessibilità, resistenza alla perforazione e capacità di autosigillatura per prevenire perdite di carburante durante i danni da combattimento. Svolgono un ruolo fondamentale nel migliorare la sopravvivenza e l'efficienza operativa degli aerei. I serbatoi in gomma sono ampiamente utilizzati negli aerei ad ala fissa, negli elicotteri ad ala rotante e, sempre più, nei droni per missioni di ricognizione e combattimento. Il mercato è influenzato dai programmi di modernizzazione della difesa globale, dalle crescenti tensioni geopolitiche e dalla necessità di sistemi di alimentazione leggeri e ad alte prestazioni.

Personalizza questo report in base alle tue esigenze

Ottieni la PERSONALIZZAZIONE GRATUITAMercato dei serbatoi in gomma per aerei militari: approfondimenti strategici

-

Scopri le principali tendenze di mercato di questo rapporto.Questo campione GRATUITO includerà analisi dei dati, che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei carri armati in gomma per aerei militari

Fattori trainanti del mercato

- Aumento della spesa per la difesa e modernizzazione della flotta: i bilanci della difesa globale stanno aumentando significativamente a causa delle tensioni geopolitiche e della necessità di capacità militari avanzate. Paesi come Stati Uniti, Cina e India stanno investendo massicciamente nell'ammodernamento delle proprie flotte aeree, inclusi jet da combattimento, aerei da trasporto ed elicotteri. I serbatoi in gomma sono parte integrante di questi programmi di modernizzazione perché offrono una maggiore capacità di sopravvivenza grazie alle proprietà autosigillanti, riducendo il rischio di perdite di carburante durante i danni da combattimento. Inoltre, l'ammodernamento di velivoli più vecchi con serbatoi in gomma avanzati garantisce la conformità ai moderni standard di sicurezza, creando una domanda sostenuta.

- Richiesta di sistemi di alimentazione leggeri e ad alta resistenza: i moderni aerei militari danno priorità alla riduzione del peso per migliorare l'efficienza del carburante e ampliare l'autonomia di missione. I serbatoi in gomma, realizzati con elastomeri avanzati come nitrile e uretano, offrono una soluzione leggera ma altamente resistente. Questi serbatoi resistono a temperature estreme, alte quote ed esposizione a carburanti aggressivi, rendendoli ideali per gli ambienti di combattimento. La loro flessibilità consente inoltre di realizzare forme personalizzate per adattarsi a progetti di aeromobili complessi, migliorando ulteriormente l'efficienza operativa.

- Aumento dell'impiego di UAV per missioni tattiche: i velivoli senza pilota (UAV) sono sempre più impiegati per missioni di ricognizione, sorveglianza e combattimento. Queste piattaforme richiedono serbatoi di carburante compatti e leggeri, con elevata affidabilità per supportare lunghe durate di volo. I serbatoi in gomma soddisfano questi requisiti offrendo una maggiore resistenza alla perforazione e adattabilità a fusoliere di piccole dimensioni. Con l'accelerazione dell'adozione di UAV a livello globale, soprattutto nelle operazioni di sorveglianza delle frontiere e di attacco di precisione, si prevede un aumento della domanda di serbatoi in gomma specializzati, progettati su misura per UAV.

Opportunità di mercato

- Integrazione di sistemi di monitoraggio intelligenti: la prossima frontiera dell'aviazione militare riguarda la digitalizzazione e la manutenzione predittiva. I serbatoi in gomma integrati con sensori IoT possono monitorare i livelli di carburante, rilevare perdite e prevedere l'usura in tempo reale. Questa capacità migliora la prontezza della missione e riduce i tempi di fermo, offrendo alle agenzie di difesa una solida proposta di valore. I produttori che investono in tecnologie di serbatoi intelligenti otterranno un vantaggio competitivo nell'aggiudicarsi contratti di difesa a lungo termine.

- Espansione nei mercati emergenti della difesa: regioni in via di sviluppo come l'Asia-Pacifico, l'America Latina e il Medio Oriente stanno assistendo a rapidi programmi di modernizzazione della difesa. Questi mercati offrono significative opportunità ai produttori di carri armati in gomma per stabilire impianti di produzione localizzati o formare partnership strategiche con appaltatori della difesa regionali. Adattare i prodotti alle esigenze locali, come la compatibilità con le piattaforme aeronautiche locali, può sbloccare un potenziale di crescita sostanziale.

- Sviluppo di tecnologie avanzate autosigillanti e resistenti al fuoco: la sopravvivenza in combattimento è una priorità assoluta per le forze di difesa. Le innovazioni nella chimica degli elastomeri per migliorare le capacità autosigillanti e la resistenza al fuoco attireranno le agenzie di difesa alla ricerca di standard di sicurezza superiori. I serbatoi in grado di sigillare automaticamente le perforazioni dei proiettili e di resistere all'ignizione durante l'esposizione ad alte temperature diventeranno indispensabili nei jet da combattimento e negli aerei ad ala rotante di prossima generazione. I produttori che si concentrano su queste caratteristiche avanzate possono posizionarsi come leader nella sicurezza dell'aviazione militare.

Analisi della segmentazione del rapporto di mercato dei serbatoi in gomma per aerei militari

Per materiale

- Gomma nitrilica: nota per la sua eccellente resistenza al carburante e la sua flessibilità, la gomma nitrilica è ampiamente utilizzata nei serbatoi di velivoli ad ala fissa e rotante. Offre resistenza a temperature estreme e all'esposizione a sostanze chimiche.

- Gomma uretanica: offre una resistenza all'abrasione e un'integrità strutturale superiori, rendendola adatta per applicazioni su aeromobili ad alte prestazioni e UAV.

Per tipo di aeromobile

- Aerei ad ala fissa: includono caccia, aerei da trasporto e bombardieri. Queste piattaforme richiedono serbatoi di grande capacità con tecnologie di tenuta avanzate.

- Aerei ad ala rotante: gli elicotteri utilizzati in missioni di combattimento e soccorso richiedono serbatoi compatti e resistenti alle forature per garantire la sicurezza operativa.

- UAV: carri armati leggeri progettati per garantire resistenza e affidabilità nei sistemi aerei senza pilota, a supporto di missioni a lungo raggio.

Per geografia:

- America del Nord

- Europa

- Asia Pacifico

- America meridionale e centrale

- Medio Oriente e Africa

Approfondimenti regionali sul mercato dei carri armati in gomma per aerei militari

Le tendenze e i fattori regionali che hanno influenzato il mercato dei carri armati in gomma per aerei militari durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la geografia del mercato dei carri armati in gomma per aerei militari in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto di mercato sui carri armati in gomma per aerei militari

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2025 | 1,53 miliardi di dollari USA |

| Dimensioni del mercato entro il 2034 | 2,64 miliardi di dollari USA |

| CAGR globale (2026 - 2034) | 6,20% |

| Dati storici | 2021-2024 |

| Periodo di previsione | 2026-2034 |

| Segmenti coperti |

Per materiale

|

| Regioni e paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato dei carri armati in gomma per aerei militari: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei serbatoi in gomma per aerei militari è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni una panoramica dei principali attori del mercato dei carri armati in gomma per aerei militari

Analisi della quota di mercato dei carri armati in gomma per aerei militari per area geografica

America del Nord

- Quota di mercato: la quota maggiore è dovuta agli ingenti budget destinati alla difesa e all'industria aerospaziale avanzata.

-

Fattori chiave:

- Modernizzazione delle flotte dell'aeronautica e della marina degli Stati Uniti

- Elevata adozione di UAV per missioni tattiche

- Forti investimenti in ricerca e sviluppo in elastomeri avanzati

- Tendenze: integrazione di sensori intelligenti e sistemi di monitoraggio del carburante abilitati all'IoT.

Europa

- Quota di mercato: quota significativa trainata dai programmi di difesa della NATO e dalle collaborazioni transfrontaliere.

-

Fattori chiave:

- Aggiornamenti della flotta nell'ambito delle iniziative del Fondo europeo per la difesa

- Crescente domanda di sistemi di alimentazione leggeri nei jet da combattimento

- Enfasi sulle tecnologie autosigillanti per la sopravvivenza in combattimento

- Tendenze: Sviluppo di elastomeri ecocompatibili e conformità a rigorosi standard di sicurezza.

Asia Pacifico

- Quota di mercato: regione in più rapida crescita grazie all'aumento dei budget per la difesa e ai programmi aeronautici nazionali.

-

Fattori chiave:

- Espansione delle forze aeree in Cina e India

- Aumento dell'impiego di UAV per la sorveglianza delle frontiere

- Iniziative di modernizzazione della difesa guidate dal governo

- Tendenze: Localizzazione della produzione e partnership con fornitori globali.

America Centrale e Meridionale

- Quota di mercato: regione emergente con crescente approvvigionamento di aerei militari.

-

Fattori chiave:

- Modernizzazione della difesa in Brasile e Argentina

- Crescente attenzione agli aerei ad ala rotante per le operazioni nella giungla

- Investimenti in programmi UAV per la sorveglianza

- Tendenze: adozione di soluzioni convenienti per serbatoi in gomma.

Medio Oriente e Africa

- Quota di mercato: mercato in via di sviluppo con elevato potenziale di crescita.

-

Fattori chiave:

- Aumento della spesa per la difesa nei paesi del Golfo

- Domanda di sistemi di alimentazione avanzati negli aerei da combattimento

- Crescente utilizzo di UAV per missioni di ricognizione

- Tendenze: integrazione di tecnologie ignifughe e autosigillanti.

Densità degli attori del mercato dei carri armati in gomma per aerei militari: comprendere il suo impatto sulle dinamiche aziendali

Il mercato è moderatamente concentrato, con operatori globali focalizzati su innovazione, scienza dei materiali e conformità agli standard militari. Le strategie di differenziazione includono:

- Tecnologie avanzate di autosigillatura e resistenza al fuoco

- Progetti leggeri per applicazioni UAV

- Integrazione di sistemi di monitoraggio intelligenti

Opportunità e mosse strategiche:

- Partnership con OEM della difesa e agenzie governative

- Espansione nei mercati emergenti con produzione localizzata

- Investimenti nella ricerca e sviluppo degli elastomeri per una maggiore durata

Le principali aziende che operano nel mercato dei serbatoi in gomma per aerei militari sono:

- Aero Tec Laboratories, Inc.

- Produzione di gomma per aeromobili (sistemi di sicurezza per il carburante)

- Amfuel FFC, Inc.

- Magam Safety Ltd.

- Meggitt PLC

- MERIN

- Musthane

- PFW Aerospace GmbH

Disclaimer: le aziende elencate sopra non sono classificate in alcun ordine particolare

Notizie e sviluppi recenti sul mercato dei carri armati in gomma per aerei militari

- Nel novembre 2025, Parker Hannifin Corporation, leader mondiale nelle tecnologie di movimento e controllo, ha annunciato di aver stipulato un accordo definitivo per l'acquisizione di Filtration Group Corporation su base cash-free e debt-free per un prezzo di acquisto in contanti di 9,25 miliardi di dollari, pari a 19,6 volte l'EBITDA rettificato stimato di Filtration Group per l'anno solare 2025, ovvero 13,4 volte incluse le sinergie di costo previste. Il prezzo di acquisto sarebbe stato finanziato con nuovo debito e liquidità disponibile. La transazione era soggetta alle consuete condizioni di chiusura, tra cui l'ottenimento delle approvazioni normative applicabili, e si prevedeva che si sarebbe conclusa entro sei-dodici mesi. Questa acquisizione ha rafforzato la divisione aerospaziale di Parker Hannifin, consentendo all'azienda di integrare tecnologie di filtrazione avanzate nei suoi sistemi di contenimento del carburante, inclusi i serbatoi in gomma per aerei militari, per migliorare la durata, la sicurezza e le prestazioni delle piattaforme di difesa di nuova generazione.

- Nell'agosto 2025, Aero Tec Laboratories Ltd (ATL), leader mondiale nella tecnologia avanzata di contenimento dei liquidi, ha esposto la sua gamma di sistemi di alimentazione e soluzioni bladder di livello mondiale al DSEI 2025 di Londra, evidenziando le sue capacità all'avanguardia per i settori della difesa, dei droni, della marina e dell'aerospaziale. Con decenni di innovazione, frutto delle estreme esigenze del motorsport e della difesa, ATL ha progettato e prodotto sistemi di alimentazione flessibili, realizzati e stampati, che hanno offerto prestazioni, sicurezza e affidabilità ineguagliabili negli ambienti più difficili. Queste soluzioni includevano avanzati serbatoi in gomma per aerei militari, progettati per offrire una durata superiore e proprietà autosigillanti per velivoli da combattimento e tattici.

Copertura e risultati del rapporto sul mercato dei carri armati in gomma per aerei militari

Il rapporto "Dimensioni e previsioni del mercato dei serbatoi in gomma per aeromobili militari (2021-2034)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dei carri armati in gomma per aerei militari a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato dei carri armati in gomma per aerei militari, nonché dinamiche di mercato quali fattori trainanti, vincoli e opportunità chiave

- Analisi PEST e SWOT dettagliate

- Analisi di mercato dei carri armati in gomma per aerei militari che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa termica, i principali attori e gli sviluppi recenti nel mercato dei carri armati in gomma per aerei militari

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei carri armati in gomma per aerei militari

Ottieni un campione gratuito per - Mercato dei carri armati in gomma per aerei militari