Vision Care Market Key Companies and SWOT Analysis by 2028

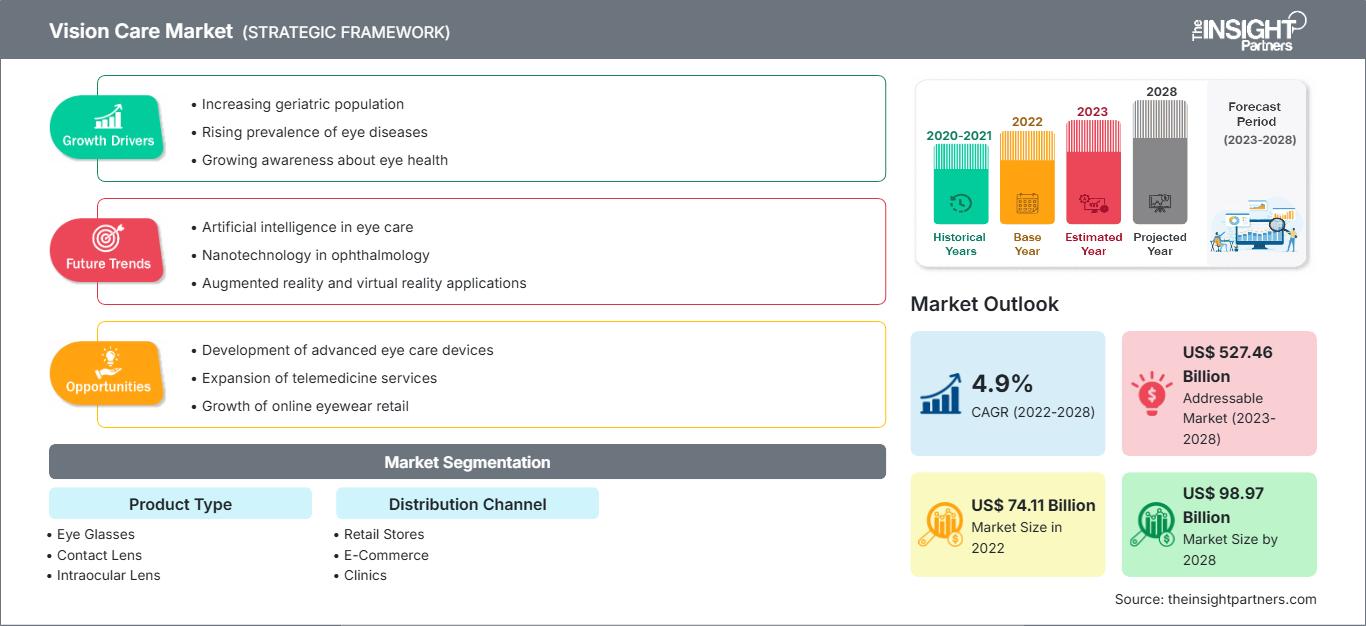

Vision Care Market Forecast to 2028 - Analysis By Product Type (Eye Glasses, Contact Lens, Intraocular Lens, and Others) and Distribution Channel (Retail Stores, E-Commerce, Clinics, and Hospitals)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Feb 2023

- Report Code : TIPRE00011953

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 162

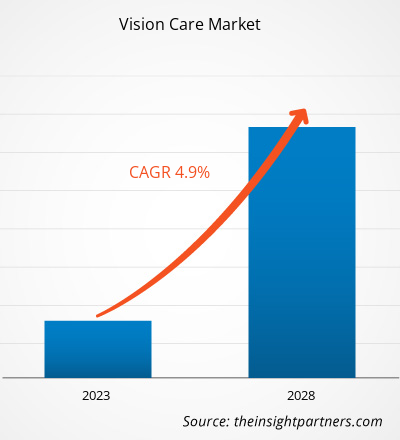

The vision care market is expected to grow from US$ 74,110.14 million in 2022 to US$ 98,968.42 million by 2028; it is estimated to register a CAGR of 4.9% from 2022 to 2028.

Vision care products include eyeglasses contact lenses, intraocular lenses, contact lens solutions, eye drops, and others. The increasing prevalence of eye disorders boosts the development of advanced vision care products. Also, the rising number of vision care awareness programs trigger the adoption of vision care products worldwide.

Market Insights

Growing Prevalence of Eye Diseases Drives Vision Care Market Growth

A wide variety of eye diseases, including cataracts, glaucoma, and refractive errors, are prevalent across the world. According to an article published by the World Health Organization (WHO) in 2022, ~2.2 billion people in the world have a near vision impairment or a distance vision impairment. The leading causes of vision impairment are cataracts (~94 million cases) and uncorrected refractive errors (~88.4 million cases). The other causes of vision impairment are glaucoma, corneal opacities, diabetic retinopathy, and trachoma with ~7.7 million, 4.2 million, 3.9 million, and 2 million cases, respectively. According to data provided by the Centers for Disease Control and Prevention (CDC), ~12 million people in the US, aged 40 and above, suffered from vision impairment in 2022, out of which 3 million had vision impairment after correction and 8 million suffered from vision impairment due to uncorrected refractive index. The increasing incidences of diabetes and other chronic diseases are responsible for such a high prevalence of vision impairment in the US population. According to the results of the Canadian Health Measures Survey conducted over 2016–2019, 50.4% of adults aged 40–64 and 71.6% of seniors aged 65–79 indicated they had visited an eye care professional in the past year. Moreover, per the Royal National Institute of Blind People in 2021, in the UK, ~2 million people were living with vision loss. In 2021, the count of blind or partially blind people was recorded at ~340,000 in the UK. According to the data provided by the Government of India, ~57 lakh cataract surgeries were conducted in 2021–2022, whereas ~36 lakh cataract surgeries were carried out in 2020–2021.

Further, the increasing age of populations and workforces in different countries, and the increased visual demands of modern occupations underline the impact of low vision and blindness on economies. Thus, a high prevalence of vision impairment and blindness in different parts of the world boosts the growth of the vision care market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONVision Care Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Increasing Awareness of Vision Care Offers Ample Opportunities for Market

In recent years, various measures and efforts have been taken to create awareness and educate people regarding eye diseases, prompting patients to access suitable medications and treatments for such conditions. In 2017, the National Eye Institute (NEI) in the US initiated “Write the Vision,” a new eye health awareness program, specifically for African-American consumers. Write the Vision offers monthly resources to a large number of organizations, allowing them to promote healthy vision, and prevent vision loss and blindness in the communities they serve. Per the National Eye Health Education Program, a part of the NEI, African-Americans are more prone to eye diseases. It can further lead to loss of vision, if not treated in time. Hence, the Write the Vision program was launched to increase awareness about eye health.

Sightsavers—an international nongovernmental organization—works in developing countries to treat and prevent eye diseases. A large population in India resides in rural areas, having limited or no awareness of eye ailments. Sightsavers aims to create awareness with its Rural Eye Health Programme, provide high-quality eye health services, and eradicate avoidable blindness in the rural population. In addition, the WHO launched the Universal Health Coverage and Eye Care: Promoting Country Action, an event to provide practical, step-by-step, guidance to support Member States of the WHO in planning and implementing the recommendations of the WHO’s World report on vision. The WHO launched this event with the goal to provide integrated people-centered eye care services. Thus, the rising number of such eye health awareness programs is creating growth opportunities for the vision care market.

Product Type-Based Insights

Based on product type, the vision care market is segmented into eyeglasses, contact lens, intraocular lens, and others. The eyeglasses segment held the largest market share in 2021 and the same is likely grow at the highest CAGR during the forecast period.

Distribution Channel-Based Insights

Based on distribution channel, the vision care market is segmented into retail stores, e-commerce, clinics, and hospitals. The retail stores segment accounted for the largest share of the market in 2021, and the e-commerce segment is expected to register the highest CAGR of 9.5% during the forecast period.

Vision Care

Vision Care Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 74.11 Billion |

| Market Size by 2028 | US$ 98.97 Billion |

| Global CAGR (2022 - 2028) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Vision Care Market Players Density: Understanding Its Impact on Business Dynamics

The Vision Care Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Companies in the vision care market adopt inorganic and organic strategies such as mergers and acquisitions. A few recent key market developments are listed below:

- In March 2022, Alcon Inc launched the Clareon family of IOLs in the US. Using Alcon’s most advanced IOL material, Clareon can deliver consistent visual outcomes and exceptional clarity that lasts.

- In January 2022, Alcon launched the DAILIES TOTAL1 for Astigmatism, the first and only Water Gradient contact lens for patients with astigmatism.

- In June 2022, CooperVision acquired EnsEyes, a leading supplier of orthokeratology (ortho-k) and scleral contact lenses in the Nordic region. The company will operate within the Cooper Vision Specialty EyeCare group.

- In February 2021, Johnson & Johnson Vision Inc. received CE Mark for its Acuvue Oasys multifocal contact lens with pupil-optimized design for European people. It will be used to treat patients with presbyopia.

Company Profiles

- Alcon Inc

- Bausch Health Companies Inc

- Carl Zeiss AG

- Cooper Companies Inc

- Essilorluxottica SA

- Johnson And Johnson Services Inc.

- Hoya Corporation

- Rodenstock Gmbh

- Menicon Co. Ltd

- Rayner Intraocular Lenses Limited

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For