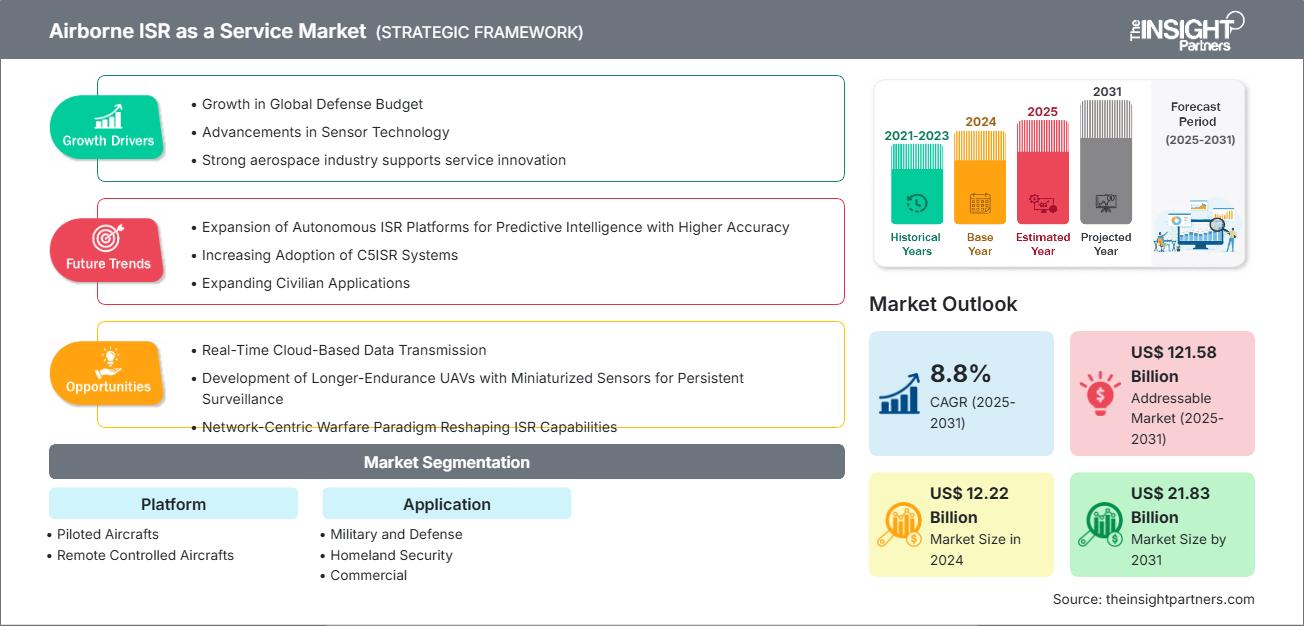

Airborne ISR as a Service Market Size & Emerging Trends by 2031

Airborne ISR as a Service Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Platform (Piloted Aircrafts and Remote-Controlled Aircraft) and Application (Military and Defense, Homeland Security, and Commercial)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00041050

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 162

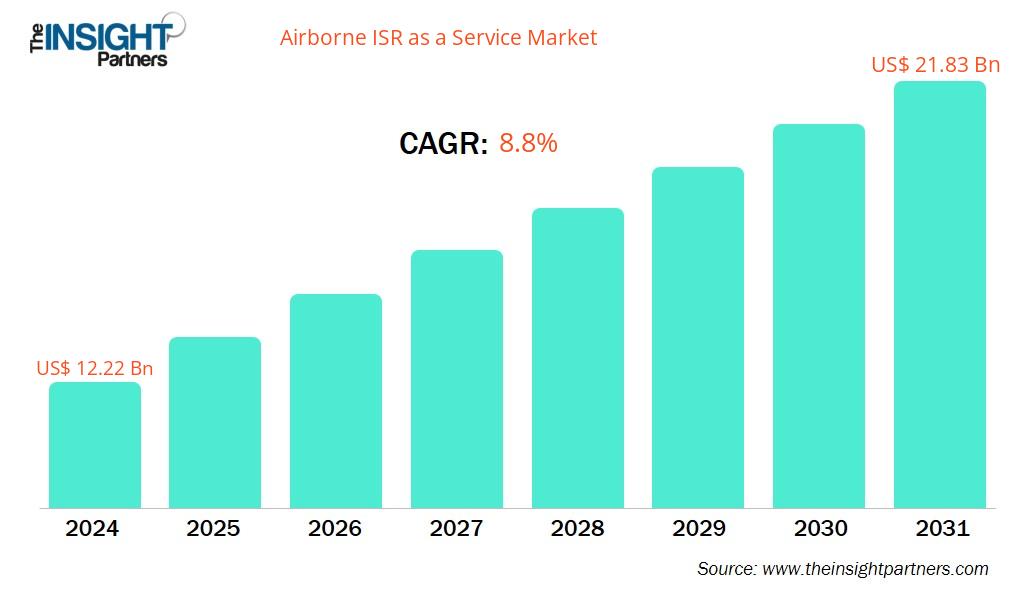

The airborne ISR as a service market size is projected to reach US$ 21.83 billion by 2031 from US$ 12.22 billion in 2024. The market is expected to register a CAGR of 8.8% during 2025–2031.

Airborne ISR as a Service Market Analysis

In the present scenario, the airborne ISR as a service market is expanding steadily due to several drivers, including increasing demand for real-time battlefield intelligence, technological advancements in AI and sensor systems, and rising defense budgets worldwide. Opportunities for growth are emerging through advancements in data analytics, the integration of new sensor technologies, and the broadening use of unmanned ISR platforms for both military and commercial purposes.

Airborne ISR as a Service Market Overview

Airborne ISR as a Service (ISRaaS) is a business model that delivers airborne intelligence, surveillance, and reconnaissance capabilities through subscription or contract-based arrangements, utilizing platforms such as manned aircraft or drones equipped with advanced sensors, communication devices, and electronic warfare systems. These systems collect, process, and transmit high-resolution data to aid security, defense, disaster response, and border protection missions, enhancing situational awareness and operational efficiency.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAirborne ISR as a Service Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airborne ISR as a Service Market Drivers and Opportunities

Market Drivers:

- Growth in Global Defense Budget: Governments across Europe, Asia Pacific, and the Middle East are increasingly prioritizing military modernization and security resilience in response to evolving geopolitical tensions, cross-border threats, and rapid advancements in defense technology.

- Advancements in Sensor Technology: The continuous evolution of sophisticated sensors—ranging from electro-optical and infrared to radar and hyperspectral imaging—has significantly enhanced the ability of airborne platforms to capture, process, and interpret complex data in real time.

- Growing Need for Real-Time Intelligence and Situational Awareness: Modern defense and security operations are increasingly data-driven, requiring immediate access to actionable intelligence for effective mission execution.

- Need for Flexibility and Lower Capital Outlays: Many governments, homeland security agencies, and even large enterprises prefer paying for ISR capabilities on demand rather than investing upfront in owning, operating, and maintaining aircraft/sensor fleets.

- Rising Geopolitical and Security Threats: Increased transnational instability, terrorism, border clashes, maritime boundary disputes, asymmetric warfare, and natural disasters mean that nations and organizations demand near‑constant situational awareness.

Market Opportunities:

- Expansion of Autonomous ISR Platforms for Predictive Intelligence with Higher Accuracy: As military forces, border security agencies, and commercial entities increasingly rely on real-time, data-driven situational awareness, the adoption of autonomous ISR systems is emerging as a strategic necessity.

- Increasing Adoption of C5ISR Systems: As security dynamics evolve and technological interoperability becomes critical, defense forces and government agencies are increasingly prioritizing end-to-end situational awareness and real-time intelligence capabilities.

- Expansion into Non‑Defense Sectors: Civil sectors (infrastructure monitoring, mining, oil & gas, environmental & wildlife monitoring, disaster response) can be early adopters of ISR‑as‑a‑Service. There's a large untapped market.

- Innovative Business Models & Subscription / On‑Demand Services: ISR provider firms can offer tiered services: e.g., per‑hour flights, permission, per area coverage, or even “ISR cloud” where data streams are shared on demand. Such models can open up recurring revenue streams, lower risk for customers, and scale up more easily. Also, bundling ISR with analytics, AI, predictive outputs, etc., adds value.

- Data Link & Communication Improvements (Bandwidth, Secure Transmission, Latency Reduction): Real‑time ISR depends on good communications. Trends include encrypted high bandwidth links, satellite comms, mesh networks, beyond‑line‑of‑sight data relays, better downlink, cloud/edge dispatching. ISR‑as‑a‑Service must ensure data gets delivered timely and securely.

Airborne ISR as a Service Market Report Segmentation Analysis

The airborne ISR as a service market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Platform Type:

- Piloted Aircrafts: Piloted aircraft in the Airborne Intelligence, Surveillance, and Reconnaissance (ISR) as a Service market are primarily segmented by platform into military aircraft and military helicopters.

- Remote Controlled Aircrafts: Remote-controlled aircraft play a crucial role in the Airborne Intelligence, Surveillance, and Reconnaissance (ISR) as a service market, where they are segmented primarily by platform type into military aircraft, military helicopters, and unmanned aerial systems (UAS).

By Application:

- Military and Defense: The "Military and Defense" segment of the Airborne ISR (Intelligence, Surveillance, and Reconnaissance) as a service market is primarily segmented by application into airborne ground surveillance (AGS), airborne early warning (AEW), signals intelligence (SIGINT), search and rescue operations, target acquisition and tracking, and tactical support.

- Homeland Security and Commercial: The "Homeland Security" application within the Airborne ISR as a service market is primarily driven by the necessity for enhanced surveillance, threat detection, and border security, which significantly influence market growth.

- Commercial: Commercial applications utilize airborne ISR capabilities to enhance operational efficiency, improve data collection, and offer real-time situational awareness across various sectors beyond traditional defense and military use.

By Geography:

- Europe

- Asia Pacific

- Middle East & Africa

The airborne ISR as a service market in Asia Pacific is expected to witness the fastest growth. Escalating defense expenditures and complex geopolitical dynamics are likely to drive the market.

Airborne ISR as a Service Market Regional InsightsThe regional trends and factors influencing the Airborne ISR as a Service Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Airborne ISR as a Service Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Airborne ISR as a Service Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 12.22 Billion |

| Market Size by 2031 | US$ 21.83 Billion |

| Global CAGR (2025 - 2031) | 8.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Airborne ISR as a Service Market Players Density: Understanding Its Impact on Business Dynamics

The Airborne ISR as a Service Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Airborne ISR as a Service Market top key players overview

Airborne ISR as a Service Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in the Middle East, and Africa also have many untapped opportunities for airborne ISR as a service providers to expand.

The airborne ISR as a service market grows differently in each region owing to region focus on actively enhancing their airborne ISR capabilities to address territorial disputes, border conflicts, and maritime security imperatives. Below is a summary of market share and trends by region:

1. Europe

- Market Share: Substantial share due to early adoption of digital commerce

-

Key Drivers:

- Rising geopolitical tensions boost ISR requirements.

- Strict regulations promote advanced data security.

- Increasing drone deployment for surveillance missions.

- Trends: Expanding civilian applications enhance market growth.

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Rapid military modernization drives ISR adoption.

- Increasing regional conflicts require continuous monitoring.

- Growing commercial drone industry expands service offerings.

- Trends: Government initiatives boost smart surveillance projects.

4. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Ongoing conflicts increase need for real-time ISR.

- Rising defense spending boosts airborne surveillance.

- Trends: Counterterrorism operations drive ISR service demand.

Airborne ISR as a Service Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Quantum Fuel Systems, Hexagon Composites ASA, and Worthington Enterprises. Regional and niche providers such as PACCAR Inc (US), T.L. Wood's (US), and SMTR Group (Turkey) are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Durable and compact designs optimized for limited cab space and harsh environments

- Customization options for specific vehicle configurations and OEM requirements

- Competitive pricing models to meet the cost-sensitive demands of fleet operators

- Strong technical support and streamlined logistics to ensure fast deployment and minimal downtime

Opportunities and Strategic Moves

- Fleet operators and OEMs are increasingly partnering with telematics and power management solution providers to enhance vehicle performance, emissions compliance, and driver comfort, especially in long-haul and vocational truck segments.

- Vendors are transitioning to integrated, connected systems by bundling telematics, battery management, and auxiliary power units (APUs) with real-time monitoring and predictive maintenance capabilities, often delivered through subscription-based or performance-based models.

- Modular and retrofit-friendly designs are gaining traction, allowing fleets to upgrade specific components (e.g., electric APUs, inverter systems) without replacing the entire back-of-cab infrastructure—supporting easier integration with mixed or aging fleets.

Major Companies operating in the Airborne ISR as a Service Market are:

- DEA Aviation

- EASP Air

- Asman Technology

- PAL Aerospace

- Elevated Technologies

- MAG Aerospace

- CAFG Group

- Airtec

- QinetiQ Group Plc

- CAE Aviation

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- BAE Systems pl

- Thales

- Saab

- Hensoldt AG

- Airbus

- Quantum-Systems GmbH

- Elbit Systems Ltd

- Rheinmetall AG

- Leidos, Inc.

- Hanwha System

- CADG

- AIRTEC, Inc.

- North Sea Aviation Services

- LMO Fly

- Kav Madaida

- GEOFIT Group

- AeroVironment Inc

- Cubic Corp

- GeoDrones

Airborne ISR as a Service Market News and Recent Developments

- DEA Aviation Opens New Office in Hamish Falconer : DEA Aviation, a technology-led aerial data acquisition company, opens a new office in Lincoln marked by a visit from the MP for Lincoln, Hamish Falconer. The new state-of-the-art facility is designed to support the research and development of critical technologies to enhance DEA’s intelligence, surveillance and reconnaissance (ISR) capabilities. The Retford-based technology company has expanded into Lincolnshire, within the envelope of the Greater Lincolnshire Defence and Security Cluster, as a key milestone in its growth ambitions.

- Teledyne FLIR Defense Delivered UltraFORCE 380X-HDc multi-spectral imaging systems to NL EASP AIR : Teledyne FLIR Defense, part of Teledyne Technologies Incorporated (NYSE: TDY), has announced that it will be delivering its UltraFORCE 380X-HDc multi-spectral imaging systems to NL EASP AIR, the first sale of Teledyne FLIR’s newly launched surveillance gimbal specially designed for customers outside the United States. NL EASP AIR will install the systems on its three fixed-wing Dornier DO328-110 multi-mission maritime patrol aircraft. The company will deploy UltraFORCE 380X’s advanced imaging technology in support of its Search and Rescue (SAR), maritime patrol, and Intelligence, Surveillance and Reconnaissance (ISR) missions.

Airborne ISR as a Service Market Report Coverage and Deliverables

The "Airborne ISR as a Service Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Airborne ISR as a Service Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Airborne ISR as a Service Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Airborne ISR as a Service Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Back of Cab Market

- Detailed company profiles

Frequently Asked Questions

2. Increasing Adoption of C5ISR Systems

1. Real-Time Cloud-Based Data Transmission

2. Development of Longer-Endurance UAVs with Miniaturized Sensors for Persistent Surveillance

3. Network-Centric Warfare Paradigm Reshaping ISR Capabilities

1. Military and Defense

2. Homeland Security

3. Commercial

1. Growing Research and Developmental Costs

2. Operational Complexities and Challenges in Integrating Multi-Sensor and AI Technologies

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For