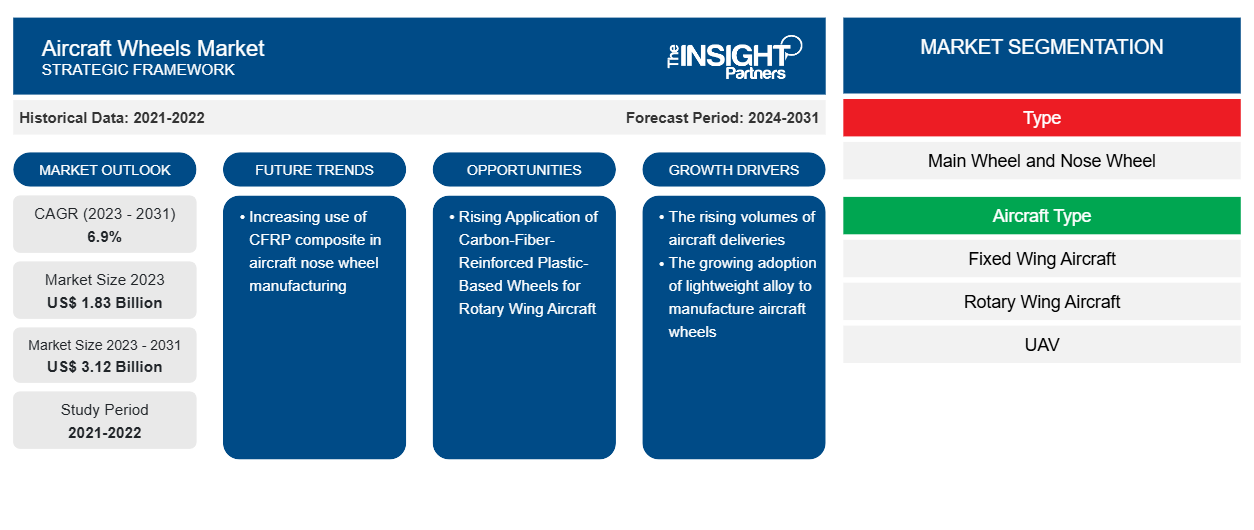

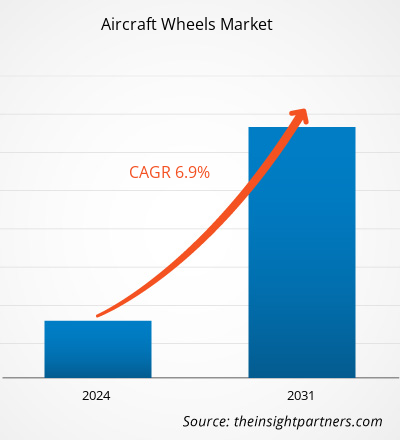

The aircraft wheels market size is projected to reach US$ 3.12 billion by 2031 from US$ 1.83 billion in 2023. The market is expected to register a CAGR of 6.9% during 2023–2031. Increasing use of CFRP composite in aircraft nose wheel manufacturing is expected to remain a key trend in the market.

Aircraft Wheels Market Analysis

Due to the introduction of carbon-fiber-reinforced composite, aircraft wheel manufacturers are extensively using the material to design and manufacture an aircraft nose wheel. The material is known for its high stiffness and strength, which makes it compatible with an aircraft nose wheel. In addition, the composite material is lighter in weight than aluminum and magnesium alloy. Hence, the carbon-fiber-reinforced plastic (CFRP) based wheel is expected to reduce the mass density of an aircraft. This will result in lower fuel consumption and the aircraft can be operated economically. Also, the range or payload can be increased. At present, aircraft wheel manufacturers are developing aircraft wheels made of CFRP composite. For instance, Fraunhofer LBF is using the CFRP composite to develop nose wheels for an Airbus A320 aircraft. Hence, in the coming years, aircraft wheel manufacturers are expected to use CFRP material increasingly to manufacture aircraft nose wheels. Hence, the rise in use of CFRP composite material for manufacturing aircraft nose wheels are anticipated to grow among aircraft wheel manufacturers and become future trend.

Aircraft Wheels Market Overview

The aircraft wheels market ecosystem comprises of following stakeholders- raw material and component providers, aircraft wheels manufacture, aircraft manufacturers, and end-users. The aircraft wheels manufacturers procure raw materials and components such as steel, aluminum, and magnesium alloy and components such as nuts and bolts among others are procured from the raw material and component providers. Aircraft wheels manufacturers assemble raw materials and components and produces into a finished goods. These manufacturers are the key market players of aircraft wheels market and holds a significant amount of share of the given market. Few of the prominent players who are operation in the market are Honeywell International Inc.; Safran S.A; Parker Hannifin Corporation; Raytheon Technologies Corporation; and Matco Manufacturing Inc. among others. Further, these manufacturers supply aircraft wheels to aircraft manufacturers such as Airbus, Boeing, Dassault Aviation, Bombardier, Lockheed Martin Corporation, and others for the line fits of wheels. Also, the aircraft wheel manufacturers sell the wheels to wheel retrofitting providers such as Lufthansa Technik, AAR Corporation, and TP Aerospace among others. These retrofitting providers procures aircraft wheels for airline companies and do wheels retrofit during aircraft’s maintenance, repairing, and overhauling (MRO) services.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Wheels Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Wheels Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Wheels Market Drivers and Opportunities

Growing Adoption of Lightweight Alloy to Manufacture Aircraft Wheels

The conventional aircraft wheels are made of magnesium alloys. However, in modern times, manufacturers are increasingly exploring lightweight materials to manufacture aircraft wheels to attain great durability and low maintenance. Also, an aircraft wheel made of lightweight alloys helps an aircraft manufacturer achieve an optimum fuel efficiency level by reducing some portion of aircraft weight. Thus, in the wake of new technological developments in aircraft wheels, the manufacturers are extensively using various types of aluminum alloys to make the wheels light in weight and with better corrosion resistance. For instance, UTC Aerospace Systems (UTAS) is exploring a silver-based aluminum alloy to develop an aircraft wheel. The strength of new wheels made of silver-based aluminum is expected to increase by about 20%. In addition, the new silver-based aluminum alloy is projected to increase damage tolerance by around 70% owing to its stiffness and improved corrosion resistance. The silver-based aluminum variant is also likely to make the aircraft wheel lighter and reduce maintenance downtime. Hence, the rising adoption of lightweight alloys to manufacture aircraft wheel drives the growth of the aircraft wheels market.

Rising Application of Carbon-Fiber-Reinforced Plastic-Based Wheels for Rotary Wing Aircraft

Presently, the majority of helicopters wheels are made of metallic light-alloy materials, such as aluminum or magnesium. However, wheels made of carbon-fiber-reinforced plastic (CFRP) are ~30%–40% less in weight than aluminum or magnesium alloy wheels. CFRP wheels are expected to offer improved corrosion resistance and noise, vibration, and harshness (NVH) performance. Also, these wheels are stiffer with improved fatigue life, which will extend their life. Manufacturers have already initiated the designing of CFRP-based wheels for rotary wing aircraft. For instance, in January 2021, Carbon ThreeSixty, a UK-based aircraft wheels manufacturing company, began to develop CFRP-based wheels for rotary wing aircraft. The company is expected to complete the wheel designing in the next 18 months. These composite wheels will also be interchangeable with existing wheels to make them suitable for retrofit applications. Hence, with the introduction of carbon-fiber-reinforced plastic-based wheels in rotary wing aircraft, the market is expected to flourish further in the coming years with an opportunity to penetrate the rotary wing aircraft wheels.

Aircraft Wheels Market Report Segmentation Analysis

Key segment that contributed to the derivation of the aircraft wheels market analysis is type, aircraft type, fit type, and end user.

- Based on type, the aircraft wheels market is segmented into main wheel and nose wheel. The main wheel segment held a larger market share in 2023.

- Based on aircraft type, the aircraft wheels market is segmented into fixed wing aircraft, rotary wing aircraft, and UAV. The fixed wing aircraft segment held a larger market share in 2023.

- Based on fit type, the aircraft wheels market is segmented into line fit and retrofit. The line fit segment held a larger market share in 2023.

- Based on end user, the aircraft wheels market is segmented into line commercial and military. The commercial segment held a larger market share in 2023.

Aircraft Wheels Market Share Analysis by Geography

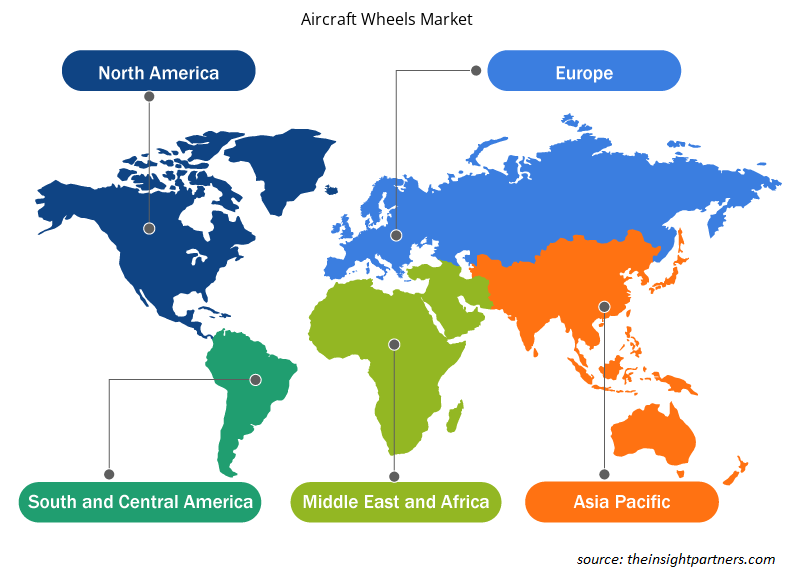

The geographic scope of the aircraft wheels market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Asia Pacific and Europe regions. Further, Asia Pacific is likely to witness highest CAGR in the coming years. Also, the Asia Pacific is likely to surpass the North American aircraft wheels market in the coming years. China accounted for the largest market share in Asia Pacific aircraft wheels market in 2023; whereas India is likely to witness highest CAGR in the coming years. The swift growth of the aviation industry and increased demand for passenger airline services have fueled the commercial airline services in the country. Thus, there is huge potential and enormous opportunities to create joint ventures and collaboration in the aerospace sector in India for forming MRO facilities. Thus, a major focus on aircraft manufacturing and rising commercial airline services across India is expected to propel the growth of the aircraft wheels market across the country in the coming years.

Aircraft Wheels Market Regional Insights

The regional trends and factors influencing the Aircraft Wheels Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Wheels Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Wheels Market

Aircraft Wheels Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.83 Billion |

| Market Size by 2031 | US$ 3.12 Billion |

| Global CAGR (2023 - 2031) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

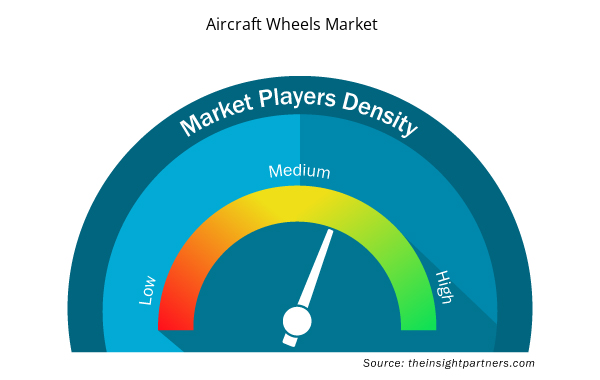

Aircraft Wheels Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Wheels Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Wheels Market are:

- Raytheon Technologies Corporation

- Honeywell International Inc

- Parker Hannifin Corporation

- Safran Group

- Beringer Aero Usa

- Lufthansa Technik

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Wheels Market top key players overview

Aircraft Wheels Market News and Recent Developments

The aircraft wheels market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aircraft wheels market are listed below:

- Safran Landing Systems inaugurated, on its Vélizy-Villacoublay site (France), an entirely revamped laboratory dedicated to testing its wheels and carbon brakes, and equipped with a new test bench. The company will have invested a total of 10 million euros to carry out this ambitious project. (Source: Safran, Press Release, April 2024)

- Bauer, the world-leader in aircraft component test and support equipment, announced the establishment of a wheel & brake equipment business unit. (Source: Bauer Inc, Press Release, April 2024)

Aircraft Wheels Market Report Coverage and Deliverables

The “Aircraft Wheels Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Aircraft wheels market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft wheels market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST analysis

- Aircraft wheels market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aircraft wheels market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which region dominated the aircraft wheels market in 2023?

North America region dominated the aircraft wheels market in 2023.

What are the driving factors impacting the aircraft wheels market ?

The rising volumes of aircraft deliveries and the growing adoption of lightweight alloy to manufacture aircraft wheels are some of the factors driving the growth for aircraft wheels market.

What are the future trends of the aircraft wheels market ?

Increasing use of CFRP composite in aircraft nose wheel manufacturing is one of the major trends of the market.

Which are the leading players operating in the aircraft wheels market ?

Raytheon Technologies Corporation, Honeywell International Inc, Parker Hannifin Corporation, Safran Group, Beringer Aero Usa, Lufthansa Technik, Tae Aerospace, Bauer Inc, and Matco Manufacturing Inc are some of the key players profiled under the report.

What would be the estimated value of the aircraft wheels market by 2031?

The estimated value of the aircraft wheels market by 2031 would be around US$ 3.12 billion.

What is the expected CAGR of the aircraft wheels market ?

The aircraft wheels market is likely to register of 6.9% during 2023-2031.

Get Free Sample For

Get Free Sample For