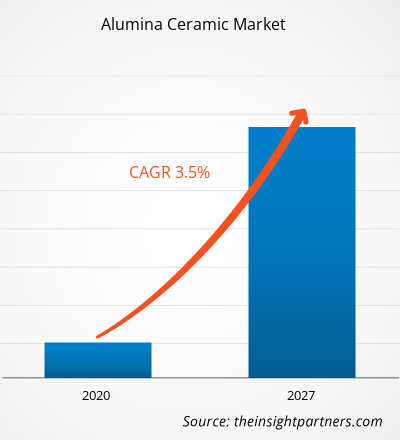

The alumina ceramics market was valued at US$ 4,428.90 million in 2019 and is projected to reach US$ 5,615.27 million by 2027; it is expected to grow at a CAGR of 3.5% from 2020 to 2027.

Alumina ceramic is the most advanced engineering ceramic that provides outstanding electrical insulation properties combined with high hardness and good wear resistance, but with relatively low strength and fracture strength. Alumina ceramics are usually white but can also be pink (with 88% alumina) or brown (with 96% Alumina). High-purity alumina ceramics are ideal for environment where wear resistance and corrosive substances are necessary. It has superior thermal stability, which means that it is commonly used in areas where high-temperature tolerance is important. Alumina ceramic is a material of choice for the alumina wear components. Proven wear and a heat resistance of alumina wear parts make them suitable for the manufacturing of wear-resistant components.

In 2019, Asia Pacific was the largest market for alumina ceramics. Exponential growth in the industrial sectors such as automotive, medical, and others has influenced demand for alumina ceramic. Asia is one of the leading electrical and electronics manufacturing markets. Alumina ceramic has great strength and stiffness, thermal stability, wear resistant, hardness, low dielectric constant, corrosion resistance, excellent dielectric properties, chemical resistance. All these properties are driving the alumina ceramic market in Asia Pacific.

The COVID-19 outbreak was first reported in Wuhan (China) during December 2019. As of January 2021, the US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are among the worst affected countries in terms confirmed cases and reported deaths. According to the latest WHO figures updated on January 2021, there are ~83,322,449 confirmed cases and 1,831,412 total deaths globally. The outbreak is adversely affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global chemicals & materials industry is one of the major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns. For instance, China is the global manufacturing hub and largest raw material supplier for various industries and it is also one of the worst affected countries. The lockdown of various plants and factories in China is restricting the global supply chains and disrupting the manufacturing activities, delivery schedules, and various chemicals & materials sales. Various companies have already announced possible delays in product deliveries and slump in future sales of their products. In addition, the global travel bans imposed by countries in Europe, Asia, and North America are hindering the business collaborations and partnerships opportunities. All these factors are hampering the chemicals & materials industry, and thus act as restraining factors for the growth of various markets related to this industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Alumina Ceramic Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Alumina Ceramic Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Demand for Alumina Ceramic in Automotive and Medical Industries

Alumina ceramic has high electrical insulation, acid and alkali corrosion resistance, and abrasion resistance. Advanced ceramics are used in a range of fields, including automotive and electronic equipment components. The products based on alumina ceramics such as ceramic bearings, mechanical seals, valves, and sensors are used in the automotive sector. For instance, Yttria Stabilized Zirconia—a ceramic material known for its high strength—is suitable for pump components such as fuel injectors and mechanical seals for engines requiring high durability. Further, alumina ceramics are cost-effective and durable than plastics and have found widespread use in the automotive industry, as advanced manufacturing technologies for car components need high-quality materials at an affordable cost. Moreover, ceramics can exhibit a variety of electrical properties, from insulators to resistors to semiconductors. Wide ceramic insulators that carry high-voltage electrical transmission wires are made of alumina. Ceramic insulators, such as alumina, are very strong heat conductors. They can be used as supporting material or as mounting brackets to which other electrical components are connected. For example, electronic devices in a modern car are placed on alumina. When the electronics unit runs, it produces heat, and the backrest of the alumina holds the heat away. This makes it possible for the electronic devices to work efficiently.

Application Insights

Based on application, the alumina ceramics market is segmented into electronics and semiconductors, energy and power, military and defense, automotive, industrial, medical, and others. The electronics and semiconductors segment led the market with the largest share in 2019. Alumina-based ceramics have been used in electrical components for many years due to their high electrical insulation properties. Aluminum ceramics are used for interconnectors, resistors, and capacitors in the electronics industry as it is an inexpensive and robust substrate material for hybrid integrated circuits, surface mounting devices, and sensors. Further, it can also be used for semiconductor applications such as PVD, CVD, and CMP oxide etching, ion implants, and photolithography to name a few. Furthermore, black alumina ceramic substrates are primarily utilized in semiconductor integrated circuits and electronic products due to the high photosensitivity of the majority of electronic goods. Packaging materials need to have strong light-shield properties to ensure the visibility of the digital display. The use of ceramics decreases the effective weight of assembled electronics, fueling ceramics in the electrical and electronics industries. Thus, all these factors drive the growth of the alumina ceramics market for the electronics and semiconductors segment.

A few key market players operating in the alumina ceramics market are Saint Gobain S.A; Xiamen Innovacera Advanced Materials Co., Ltd.; Ceramtec; Sentro Tech; LSP Industrial Ceramics, Inc; Morgan Advanced Materials; Kyocera Corporation; Dynamic Ceramic; BMW Steels Ltd; and Ferrotech Holdings Corporation. Major players in the market are focusing on strategies such as mergers and acquisitions and product launches to expand the geographical presence and consumer base globally.

Alumina Ceramic Market Regional Insights

The regional trends and factors influencing the Alumina Ceramic Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Alumina Ceramic Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Alumina Ceramic Market

Alumina Ceramic Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 4.43 Billion |

| Market Size by 2027 | US$ 5.62 Billion |

| Global CAGR (2019 - 2027) | 3.5% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

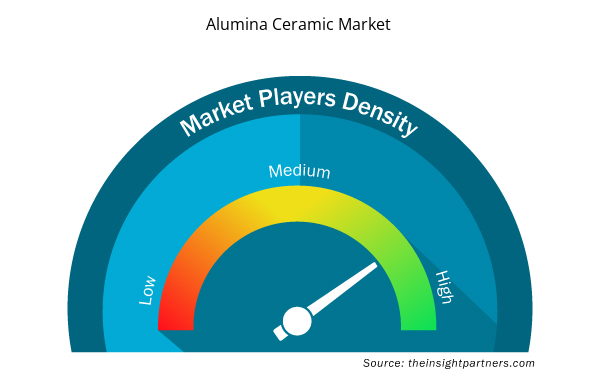

Alumina Ceramic Market Players Density: Understanding Its Impact on Business Dynamics

The Alumina Ceramic Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Alumina Ceramic Market are:

- Saint Gobain S.A

- Xiamen Innovacera Advanced Materials Co., Ltd.

- Ceramtec

- Sentro Tech

- LSP Industrial Ceramics, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Alumina Ceramic Market top key players overview

Report Spotlights

- Progressive industry trends in the global alumina ceramics market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global alumina ceramics market from 2017 to 2027

- Estimation of the demand for alumina ceramics across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for alumina ceramics

- Market trends and outlook coupled with factors driving and restraining the growth of the alumina ceramics market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global alumina ceramics market growth

- Alumina ceramics market size at various nodes of market

- Detailed overview and segmentation of the global Alumina Ceramics market as well as its dynamics in the industry

- Alumina ceramics market size in various regions with promising growth opportunities

Alumina Ceramics Market, by Application

- Electronics and Semiconductors

- Energy and Power

- Military and Defense

- Automotive

- Industrial

- Medical

- Others

Company Profiles

- Saint Gobain S.A

- Xiamen Innovacera Advanced Materials Co., Ltd.

- Ceramtec

- Sentro Tech

- LSP Industrial Ceramics, Inc

- Morgan Advanced Materials

- Kyocera Corporation

- Dynamic Ceramic

- BMW Steels Ltd

- Ferrotech Holdings Corporation

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- MEMS Foundry Market

- Joint Pain Injection Market

- Malaria Treatment Market

- Energy Recovery Ventilator Market

- Trade Promotion Management Software Market

- Redistribution Layer Material Market

- Fill Finish Manufacturing Market

- Small Molecule Drug Discovery Market

- Bio-Based Ethylene Market

- Social Employee Recognition System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on application, why electronics and semiconductors segment accounted for the largest share in the global alumina ceramic market?

The electronics and semiconductors segment had a significant market share, and this trend is expected to continue over the forecast period. Alumina-based ceramics have been used in electrical components for many years due to their high electrical insulation properties. Aluminum ceramics are used for interconnectors, resistors, and capacitors in the electronics industry as it is an inexpensive and robust substrate material for hybrid integrated circuits, surface mounting devices, and sensors. Further, it can also be used for semiconductor applications such as PVD, CVD, and CMP oxide etching, ion implants, and photolithography to name a few. Furthermore, black alumina ceramic substrates are primarily utilized in semiconductor integrated circuits and electronic products due to the high photosensitivity of the majority of electronic goods. Packaging materials need to have strong light-shield properties to ensure the visibility of the digital display.

Can you list some of the major players operating in the global alumina ceramic market?

The major players operating in the global alumina ceramic market are Saint Gobain S.A., Xiamen Innovacera Advanced Materials Co., Ltd., Ceramtec, Sentro Tech, LSP Industrial Ceramics, Inc, Morgan Advanced Materials, Kyocera Corporation, Dynamic Ceramic, BMW Steels Ltd., and Ferrotech Holdings Corporation, among others.

Which region held the largest share of the global alumina ceramic market?

In 2019, Asia Pacific was the largest market for alumina ceramics. Exponential growth in the industrial sectors such as automotive, medical, and others has influenced demand for alumina ceramic. Asia is one of the leading electrical and electronics manufacturing markets. Alumina ceramic has great strength and stiffness, thermal stability, wear resistant, hardness, low dielectric constant, corrosion resistance, excellent dielectric properties, chemical resistance. All these properties are driving the alumina ceramic market in Asia Pacific.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Alumina Ceramics Market

- Saint Gobain S.A

- Xiamen Innovacera Advanced Materials Co., Ltd.

- Ceramtec

- Sentro Tech

- LSP Industrial Ceramics, Inc

- Morgan Advanced Materials

- Kyocera Corporation

- Dynamic Ceramic

- BMW Steels Ltd

- Ferrotech Holdings Corporation

Get Free Sample For

Get Free Sample For