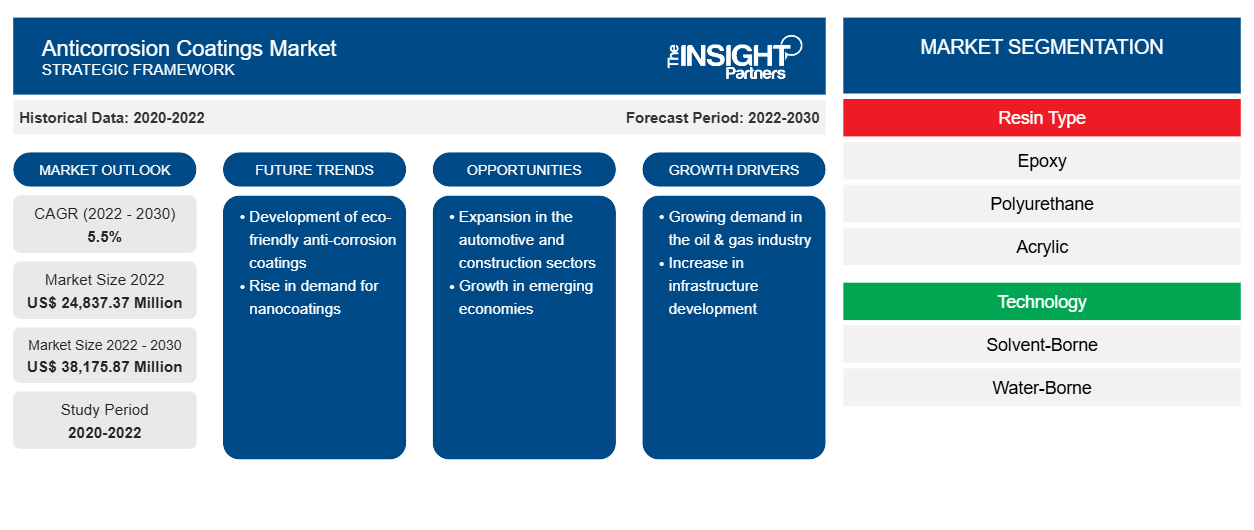

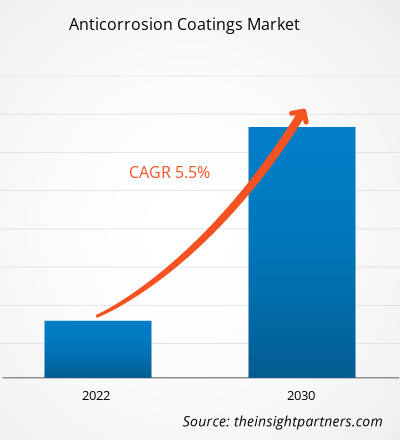

[Research Report] The global anticorrosion coatings market was valued at US$ 24,837.37 million in 2022 and is expected to reach US$ 38,175.87 million by 2030; it is estimated to record a CAGR of 5.5% from 2022 to 2030.

MARKET ANALYSIS

The expanding industrial sector, particularly in oil and gas, petrochemicals, power generation, and water and wastewater treatment, propels the demand for anticorrosion coatings. The oil & gas industry is a major contributor to the growing anticorrosion coatings market. With the presence of large oil reserves in countries such as Saudi Arabia, Iraq, Iran, and the UAE, there is a continuous need for corrosion protection in pipelines, storage tanks, offshore platforms, and refineries. The harsh environmental conditions in the region, such as high temperatures and humidity, further increase the demand for effective anticorrosion coatings. The demand for high-performance coatings has escalated significantly across the global as it is a global hub for oil & gas production. The global anticorrosion coatings market size is likely to surge by 2030 owing to the strong growth of the building & construction industry. Major factors driving the market growth are the strong presence of oil & gas industry and growing demand for anticorrosion coatings from the automotive industry.

The ongoing infrastructure developments across the globe, spanning construction projects and industrial facilities, fuel the need for high-performance anticorrosion coatings. Further, the growing prominence of marine applications, including shipbuilding and offshore structures, has been contributing significantly to the anticorrosion coatings market growth. As the industry evolves, there is a notable shift toward eco-friendly formulations and coatings with advanced functionalities such as self-healing and sensing capabilities.

GROWTH DRIVERS AND CHALLENGES

Strong presence of the oil & gas industry and growing demand for anticorrosion coatings from the automotive industry contribute to the growing anticorrosion coatings market size. Various regions across the world play a vital role in oil production. Saudi Arabia, Iran, the UAE, and other oil-producing countries in the Middle East & Africa comprise many of the largest oil producers. Presence of oil reserves plays a crucial role in the economic growth of different countries in the region, as most of their income depends on the oil industry. Further, the building & construction industry across the world is growing consistently. In April 2016, Saudi Arabia launched its Vision 2030 to diversify its economy, modernize administration, and introduce bold reforms in many sectors. The country is targeting to increase the contribution of its construction sector to the overall GDP. However, there are various health and safety concerns regarding the anticorrosion coatings which might hinder the market growth. Volatile organic compounds (VOCs) are found in anticorrosion coatings and paints. Their high vapor pressure allows molecules to evaporate into the surrounding air. As a result, humans in close proximity can inhale hazardous vapors or gases.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anticorrosion Coatings Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anticorrosion Coatings Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Anticorrosion Coatings Market Analysis and Forecast to 2030" is a specialized and in-depth study focusing significantly on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of resin type, technology, end-use, and country. The report provides key statistics on the use of anticorrosion coatings across the region, along with their demand in major countries. In addition, it provides a qualitative assessment of various factors affecting the anticorrosion coatings market growth in major countries. It also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global anticorrosion coatings market trends, which helps understand the entire supply chain and various factors influencing the market growth.

SEGMENTAL ANALYSIS

Global anticorrosion coatings market is segmented on the basis of resin type, technology, and end-use. Based on resin type, the market is segmented into epoxy, polyurethane, acrylic, alkyd, vinyl ester, and others. The epoxy segment accounts for the largest anticorrosion coatings market share. Epoxy anticorrosion coatings, formulated with epoxy resins as their primary constituents, belong to the class of thermosetting polymers, imparting robustness and durability to the protective layer they create. Deployed across diverse industries such as oil & gas, maritime, automotive, and infrastructure, epoxy anticorrosion coatings serve as a frontline defense mechanism for metal surfaces. The application process involves the precise amalgamation of epoxy resins with curing agents, resulting in a chemically resistant and adhesive compound. Upon application, these coatings solidify into a tough, impermeable barrier that shields metal surfaces from corrosive agents, preventing oxidation and deterioration over extended periods. Based on technology, the market is segmented into solvent-borne, water-borne, and others. The water-borne segment accounts for the largest market share. Solvent-borne anticorrosion coatings are sophisticated formulations engineered to provide robust protection against the detrimental effects of corrosion, particularly on metallic surfaces. These coatings employ organic solvents as carriers for a meticulously crafted blend of components, each contributing to the coating's effectiveness. The primary constituents include resins, which form the structural backbone of the coating; pigments that impart color and additional barrier properties; and corrosion inhibitors strategically integrated to thwart the corrosive process.

The solvent component plays a pivotal role in the application process, allowing for ease of spreading and ensuring uniform coverage on the substrate. Upon application, the solvents facilitate the even distribution of the coating, penetrating surface irregularities and creating a seamless, protective film. Based on end-use, the market is segmented into marine, oil and gas, power, automotive, building and construction, aerospace and defense, and others. The utilization of anticorrosion coatings in the marine industry is imperative for preserving the structural integrity and longevity of vessels and marine structures subjected to harsh and corrosive marine environments. Seawater, with its high salt content, poses a significant threat to metal components, making corrosion a pervasive challenge. To overcome this, anticorrosion coatings are applied to these components. These coatings are precisely formulated to withstand the corrosive effects of saltwater, moisture, and atmospheric conditions.

In marine applications, anticorrosion coatings find extensive use on ship hulls, offshore platforms, pipelines, and other submerged or exposed metallic structures. The coatings act as protective barriers, preventing direct contact between corrosive elements and the metal surface. The implementation of anticorrosion coatings in the oil & gas industry is critical for safeguarding infrastructure and equipment from the corrosive challenges posed by harsh operating environments. Pipelines, storage tanks, drilling equipment, and various components in the oil & gas sector are constantly exposed to corrosive elements such as moisture, corrosive gases, and chemicals.

REGIONAL ANALYSIS

The report provides a detailed overview of the global anticorrosion coatings market with respect to major regions, including North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America (SAM). Asia Pacific accounted for the largest anticorrosion coatings market share and was valued at ∼US$ 3,000 million in 2022. The Middle East & Africa comprises a significant number of oil & gas manufacturers and is a hub for mid-sized businesses operating in the region. The market in Europe is expected to reach ∼US$ 2,000 million by 2030. The anticorrosion coatings market in the Middle East & Africa is expected to record a CAGR of ~5% from 2022 to 2030. The demand for high-performance coatings has escalated significantly globally as the deployment of oil & gas infrastructure increasing. According to the National Iranian Oil Company, Iran has ~158 billion barrels of crude oil reserves. As per the data from Gachsaran Oil & Gas Production Company, the oil field, which has been in operation since 1930, currently produces 650,000 bpd (Barrel Per Day) of oil.

Anticorrosion Coatings Market Regional Insights

The regional trends and factors influencing the Anticorrosion Coatings Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Anticorrosion Coatings Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Anticorrosion Coatings Market

Anticorrosion Coatings Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 24,837.37 Million |

| Market Size by 2030 | US$ 38,175.87 Million |

| Global CAGR (2022 - 2030) | 5.5% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Anticorrosion Coatings Market Players Density: Understanding Its Impact on Business Dynamics

The Anticorrosion Coatings Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Anticorrosion Coatings Market are:

- RPM International Inc

- The Sherwin-Williams Co

- Akzo Nobel NV

- Jotun AS

- PPG Industries Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Anticorrosion Coatings Market top key players overview

COMPETITIVE LANDSCAPE AND KEY COMPANIES

RPM International Inc, The Sherwin-Williams Co, Akzo Nobel NV, Jotun AS, PPG Industries Inc, 3M Co, The Progressive Center Co for Construction Chemicals Ltd, Nippon Paint Holdings Co Ltd, BASF SE, and HB Fuller Co are among the prominent players profiled in the anticorrosion coatings market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The anticorrosion coatings market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the anticorrosion coatings market are listed below:

In September 2023, H.B. Fuller Company acquired the UK-based Sanglier Limited, one of Europe's largest manufacturers and fillers of sprayable industrial adhesives. The acquisition expands H.B. Fuller's innovation capabilities and product portfolio across the UK and Europe, particularly in Construction Adhesives and Engineering Adhesives businesses. The acquisition complements technologies acquired through Apollo and Fourny acquisitions and spray capabilities developed in the US. A team of nearly 60 employees will operate in H.B. Fuller's existing Construction Adhesives global business unit.

In March 2023, The PPG Industries launched the PPG ENVIROCRON Primeron primer powder portfolio, designed to provide high corrosion resistance for metal substrates, including steel, hot-dip galvanized steel, metalized steel, and aluminum. The products are tested according to the corrosivity categories and approved by the QUALISTEELCOAT international quality label for coated steel. The products include ZINC coating, PRO coating, EDGE coating, and FLEX coating.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Playout Solutions Market

- Small Molecule Drug Discovery Market

- Enteral Nutrition Market

- Portable Power Station Market

- Pressure Vessel Composite Materials Market

- Aerosol Paints Market

- Medical Second Opinion Market

- UV Curing System Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Terahertz Technology Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Resin Type, Technology, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Can you list some of the major players operating in the global anticorrosion coatings market?

The major players operating in the global anticorrosion coatings market are RPM International Inc, The Sherwin-Williams Co, Akzo Nobel NV, Jotun AS, PPG Industries Inc, 3M Co, The Progressive Center Co for Construction Chemicals Ltd, Nippon Paint Holdings Co Ltd, BASF SE, HB Fuller Co.

What are the opportunities for anticorrosion coatings in the global market?

The automotive industry is growing in the Middle East. In Saudi Arabia, the industry is undergoing a transformation with the establishment of local manufacturing plants and the introduction of electric vehicles. The automotive industry in Saudi Arabia is growing owing to the country’s Vision 2030 program and its ambitious goals for clean and autonomous mobility. The industry in the country benefits from the country’s strategic location and investments in advanced technologies.

Based on resin type, why the epoxy segment accounted for the largest revenue share in 2022?

Based on resin type, the anticorrosion coatings market is segmented into epoxy, polyurethane, acrylic, alkyd, vinyl ester, and others. Epoxy anticorrosion coatings, formulated with epoxy resins as their primary constituents, belong to the class of thermosetting polymers, imparting robustness and durability to the protective layer they create. Deployed across diverse industries such as oil & gas, maritime, automotive, and infrastructure, epoxy anticorrosion coatings serve as a frontline defense mechanism for metal surfaces.

What is the largest region of the global anticorrosion coatings market?

Asia Pacific accounted for the largest share of the global anticorrosion coatings market. The Asia Pacific is home to major oil processing companies; the number of oil processing activities has surged notably in this region in the past few years. Developments in technologies that aid in oil exploration and production operations have propelled the risk of oil spills, driving the demand for anticorrosion coatings and services.

What are the key drivers for the growth of the global anticorrosion coatings market?

Various countries in the Middle East play a vital role in global oil production. Saudi Arabia, Iran, the UAE, and other oil-producing countries in the region comprise many of the largest oil producers. Presence of oil reserves plays a crucial role in the economic growth of different countries in the region, as most of their income depends on the oil industry. According to the Organization of the Petroleum Exporting Countries, Saudi Arabia possesses around 17% of the world’s proven petroleum reserves.

Based on the technology, which segment is projected to grow at the fastest CAGR over the forecast period?

Based on technology, the water-borne segment is expected to grow fastest during the forecast period. Water-borne anticorrosion coatings have gained popularity in recent years due to their environmentally friendly nature and improved performance. These coatings are formulated using water as the primary solvent instead of organic solvents, significantly reducing the emission of volatile organic compounds (VOCs) and minimizing the impact on air quality and human health.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Anticorrosion Coatings Market

- RPM International Inc

- The Sherwin-Williams Co

- Akzo Nobel NV

- Jotun AS

- PPG Industries Inc

- 3M Co

- The Progressive Center Co for Construction Chemicals Ltd

- Nippon Paint Holdings Co Ltd

- BASF SE

- HB Fuller Co

Get Free Sample For

Get Free Sample For