Asia Pacific Investor ESG Software Market Analysis and Forecast by Size, Share, Growth, Trends 2031

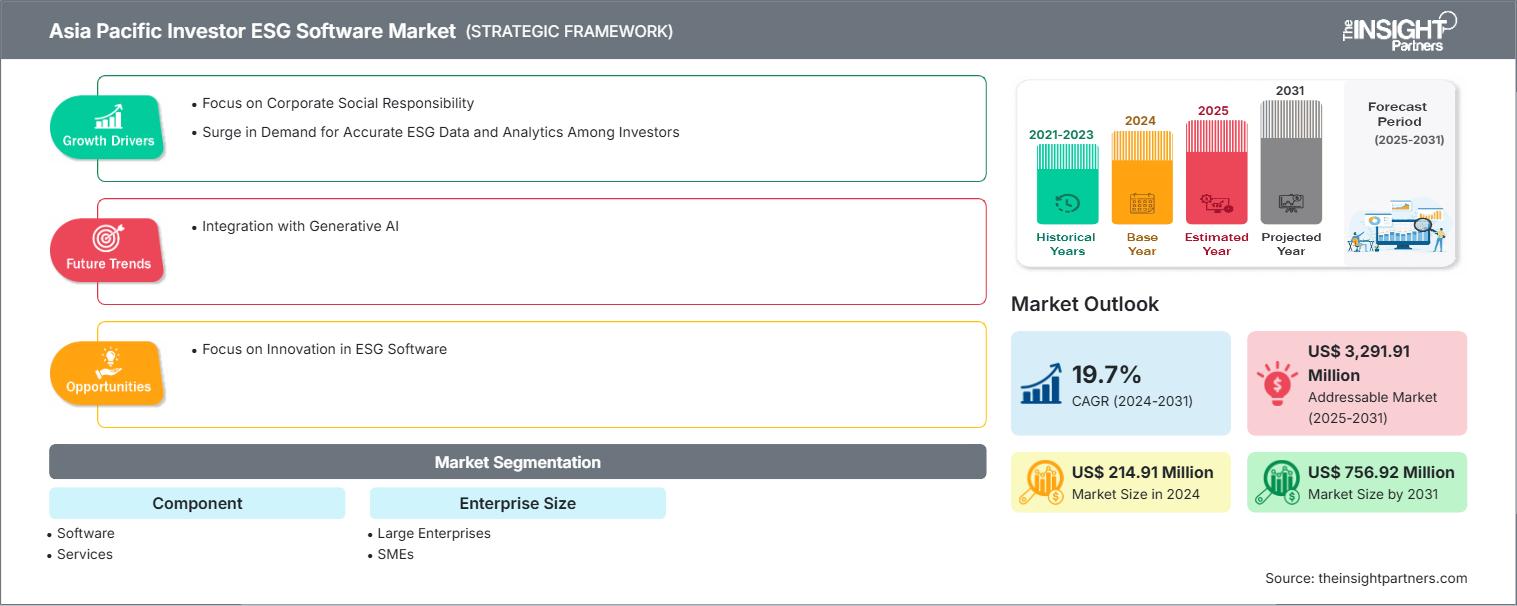

Asia Pacific Investor ESG Software Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Software and Services (Training, Integration, and Other Services)] and Enterprise Size (Large Enterprises and SMEs)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00023473

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 128

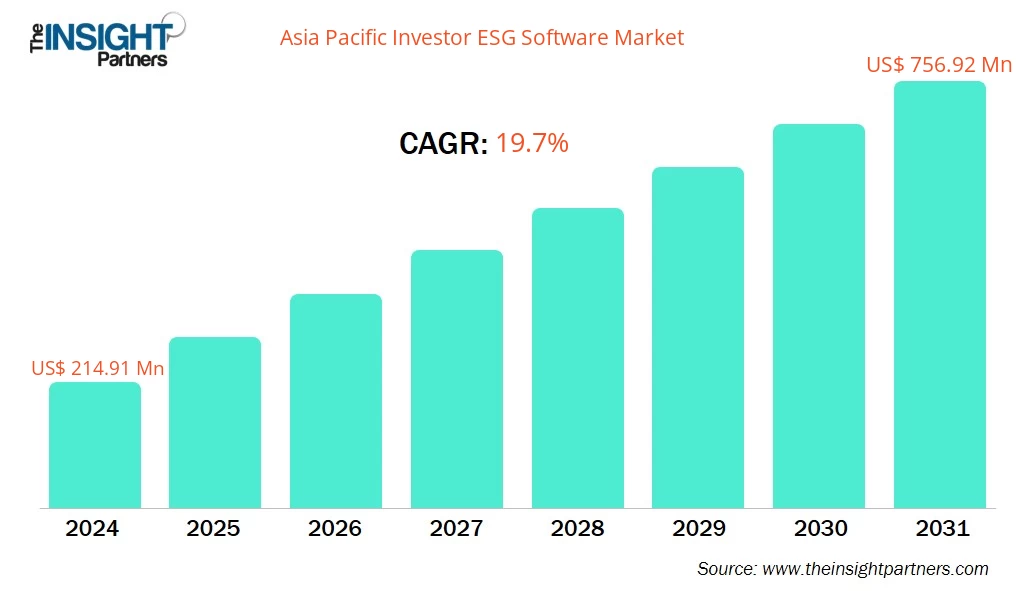

The Asia Pacific investor ESG software market size is expected to reach US$ 756.92 million by 2031 from US$ 214.91 million in 2024. The market is estimated to record a CAGR of 19.7% from 2024 to 2031.

Executive Summary and Asia Pacific Investor ESG Software Market Analysis:

The investor ESG software market in Asia Pacific is segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. As global supply networks become more complicated, businesses in the Asia Pacific are becoming more conscious of the importance of managing ESG risks, such as environmental consequences, governance challenges, and human rights violations, prevailing within their supply chains. Firms such as Tata Group (India), Samsung Electronics (South Korea), Toyota Motor Corporation (Japan), and Nestlé (Thailand/ASEAN) have incorporated ESG monitoring operations into their supply chains to maintain visibility throughout supplier chains.

Developments in ESG landscaped in Asia Pacific also indicate a growing emphasis on responsible investment among financial institutions, pension funds, and corporate and institutional investors. A study conducted by the NYU Stern Center for Sustainable Business and Rockefeller Asset Management in 2021 examined the relationship between ESG and financial success across over 1,000 separate studies. It states that while ESG disclosure alone does not drive financial performance, ESG integration outperforms negative screening measures, providing downside protection, particularly over longer time horizons. The rising ESG demand among investors and the adoption of software for these processes attract global software development companies to expand their presence in untapped markets. For instance, in May 2023, Sustaira LLC partnered with ESG-MD Ventures (Singapore) to expand its presence into Asia Pacific.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAsia Pacific Investor ESG Software Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Investor ESG Software Market Segmentation Analysis:

Key segments that contributed to the derivation of the Asia Pacific investor ESG software market analysis are component and enterprise size.

- Based on component, the Asia Pacific investor ESG software market is bifurcated into software and services. The software segment held a larger share of the market in 2024. The services segment is further sub segmented into training, integration, and other service.

- By enterprise size, the Asia Pacific investor ESG software market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 214.91 Million |

| Market Size by 2031 | US$ 756.92 Million |

| CAGR (2024 - 2031) | 19.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Asia Pacific Investor ESG Software Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Investor ESG Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Asia Pacific Investor ESG Software Market top key players overview

Asia Pacific Investor ESG Software Market Outlook

Effective ESG (Environmental, Social, and Governance) reporting is essential for attracting and retaining investors who prioritize sustainability and responsible business practices. Investors are increasingly requiring companies to collect, analyze, and report accurate ESG data in a timely manner to ensure transparency and accountability. Companies face challenges gathering vast amounts of ESG data from various systems (often disconnected) and synthesizing it into clear, reportable metrics. ESG data analytics plays a crucial role in this process by offering deeper insights, facilitating faster reporting, and ensuring data accuracy. Investors require reliable ESG data as they integrate ESG factors into their investment decisions. Advanced ESG analytics tools help investors evaluate the sustainability efforts of businesses, track their progress toward ESG goals, and assess the completeness and reliability of reported data. These analytics also allow internal audit teams to rigorously test the accuracy of reported metrics, ensuring compliance with regulatory requirements. For example, LSEG (London Stock Exchange Group) offers one of the most comprehensive ESG databases in the market. With data covering over 90% of global market capitalization and tracking more than 800 ESG metrics, LSEG's platform provides investors with access to ESG data for nearly 16,000 public and private companies. This volume of data, combined with ESG scores and time series data for public entities and key metrics for private companies, equips investors with precise and actionable insights, allowing them to make informed decisions based on reliable and complete ESG information. As investor demand for transparent, accurate ESG data grows, the role of ESG software in supporting investment strategies becomes increasingly crucial. Thus, the surge in demand for accurate ESG data and analytics among investors fuels the market growth.

Asia Pacific Investor ESG Software Market Country Insights

Based on country, the Asia Pacific investor ESG software market comprises China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The Rest of Asia Pacific held the largest share in 2024.

The Rest of APAC includes Taiwan, Singapore, Malaysia, and Thailand. Many countries in the region are pacing up in the investor ESG software market. These countries are highly involved in implementing advanced solutions for efficient ESG fund data tracking and analysis by large and small enterprises. Further, the government of Malaysia is taking various initiatives in the ESG framework. For instance, in December 2024, the Malaysian government introduced a framework on ESG standards with an aim to assist small and medium sized enterprises (SMEs) with funding and capacity building and to support the transition to renewable energy. Similarly, in January 2024, Thailand's Security and Exchange Commission (SEC) launched the ESG Product Platform to improve openness and promote continuous growth in the financial sector. The platform aims to give capital market participants and the general public convenient access to credible information about sustainability-focused financial products. This project demonstrates the SEC's efforts to create a robust environment encouraging long-term investment in Thailand. Hence, the growing focus on sustainability propels the demand for ESG software that aids in transparency and comprehensive reporting, booting investors ESG software market.

Asia Pacific Investor ESG Software Market Company Profiles

Some of the key players operating in the market include MSCI Inc; Workiva, Inc.; London Stock Exchange Group Plc; Cority Software Inc; SAP SE; Sphera Solutions, Inc.; FactSet Research Systems Inc; Morningstar Inc; Bloomberg LP; and Prophix Software Inc., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Asia Pacific Investor ESG Software Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For