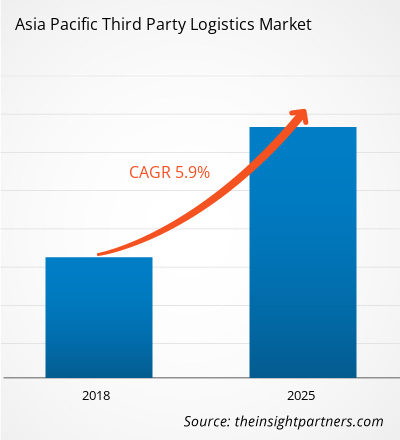

Third Party Logistics market in Asia Pacific is expected to grow from US$ 298.7 Bn in 2017 to US$ 467.5 Bn by the year 2025. This represents a CAGR of 5.9% from the year 2018 to 2025.

Reducing overall operational cost and focus on managing timely delivery is fueling the Asia Pacific Third Party Logistics market. Logistics is the core area of the third party logistics (3PL) firms and their proficiency in this areas is always superior to that of the core companies. 3PL firms have the expertise to keep IT systems updated and deliver the logistic services more time & cost effectively along with this they own the ability to meet the technical requirements. Moreover, 3PL firms also help to reduce inventory cost and can strategize to reduce a company’s overall shipping & delivery costs as well. The core companies may not have that time or expertise to keep logistic services and systems updated. The company often face challenges meeting timely delivery of products during high business growth, thereby driving the third party logistics market in APAC. This factor has created a potential market space for Asia Pacific Third Party Logistics market.

The mounting application of software solutions is anticipated to fuel the Asia Pacific Third Party Logistics market growth. Logistic is the complex process which involves flow of multiple goods and information across network of suppliers, carriers, and warehouse. This complexities can be handled using software systems which allows to analyze real time and real-world data. This implementation of software systems improve lead times, reduce excess inventory levels, help in resolving warehousing issues, and decrease inventory costs. Increased competitiveness in the industry is the major reason for the third party investing in automation and digitization. In coming years, the 3PL firms are expected to shift towards mobile technology in order to reduce the paper records. For instance, Kuehne + Nagel introduced KN SwiftLOG, which a digital platform is made for for e-fulfilment centres, omni-channel fulfilment. And first execution in China. These initiative by the market player are enhancing the growth of Asia Pacific Third Party Logistics market.

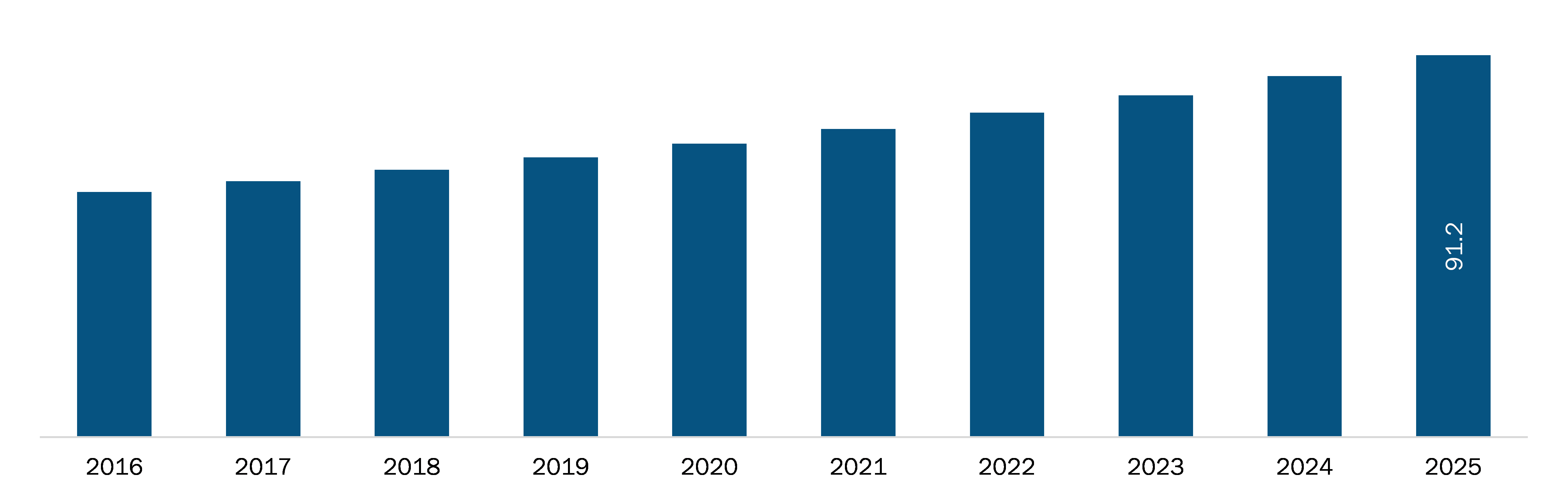

China is anticipated to leads the third party logistics market across the APAC region through the forecast period. China is the important automobile markets in APAC. Further, the country occupies the lion's share in the third party logistics market. The factors such as continual urbanization, strong economic growth, and growth in middle-class population supported the growth in domestic consumption of fast-moving consumer goods for everyday consumption, personal automobiles, household items, and luxury items. This in turn increases the retail sales and makes Asia-Pacific the leading market for logistics service consumer. This bolster the Asia Pacific Third Party Logistics market on the forecast period. The figure given below highlights the revenue share of Russia in the Asia Pacific Third Party Logistics market in the forecast period:

Rest of Asia Pacific Third Party Logistics Market Revenue and Forecasts to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ASIA PACIFIC THIRD PARTY LOGISTICS – MARKET SEGMENTATION

Asia Pacific Third Party Logistics - By Mode of Transport

- Roadways

- Railways

- Waterways

- Airways

Asia Pacific Third Party Logistics - By Services

- International Transportation

- Warehousing

- Domestic Transportation

- Inventory Management

- Others

Asia Pacific Third Party Logistics - By End User

- Automotive

- Healthcare

- Retail

- Consumer Goods

- Others

Asia Pacific Third Party Logistics - By Customer

- Small & Medium Enterprises

- Large Enterprises

Asia Pacific Third Party Logistics - By Country

- Australia

- China

- India

- Japan

- Rest of APAC

Companies Mentioned

- Deutsche Post AG

- Kuehne + Nagel International AG

- Nippon Express Co., Ltd.

- DB Schenker

- C.H. Robinson Worldwide, Inc.

- DSV A/S

- XPO Logistics, Inc.

- Sinotrans Co., Ltd.

- Geodis

- UPS Supply Chain Solutions

Asia Pacific Third Party Logistics Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 298.7 Billion |

| Market Size by 2025 | US$ 467.5 Billion |

| Global CAGR (2018 - 2025) | 5.9% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Mode of Transport

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Asia Pacific Third Party Logistics Market

1. DEUTSCHE POST AG

2. KUEHNE + NAGEL INTERNATIONAL AG

3. NIPPON EXPRESS CO., LTD.

4. DB SCHENKER

5. C.H. ROBINSON WORLDWIDE, INC.

6. DSV A/S

7. XPO LOGISTICS, INC.

8. SINOTRANS CO., LTD.

9. GEODIS

10. UPS SUPPLY CHAIN SOLUTIONS

Get Free Sample For

Get Free Sample For