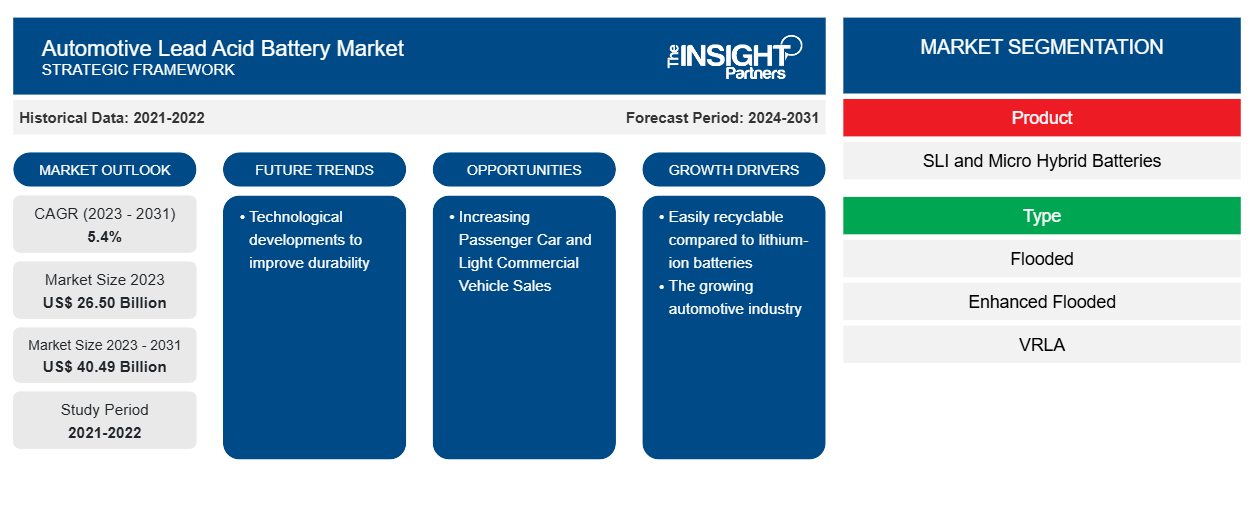

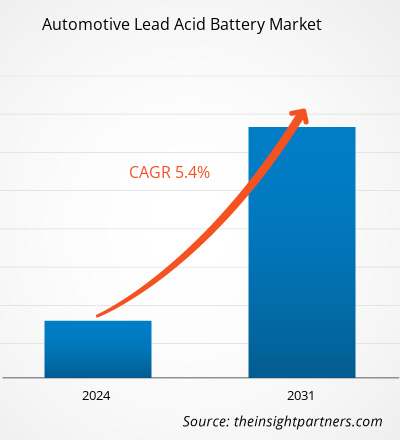

The automotive lead acid battery market is projected to grow from US$ 26.50 billion in 2023 to US$ 40.49 billion by 2031; it is expected to expand at a CAGR of 5.4% from 2023 to 2031. Technological development to improve durability is anticipated to be a key trend in the market.

Automotive Lead Acid Battery Market Analysis

Compared to other types of rechargeable batteries, lead-acid batteries are less expensive. This battery's self-discharge rate is around 40% per year. A lead-acid battery performs effectively at both hot and low temperatures. The technology employed in these batteries is mature. A lead-acid battery, when properly used, can endure a long time and provide reliable service. Lead-acid batteries may provide large surge currents, making them ideal for applications requiring a fast burst of power, such as automotive starting batteries. Thus, the demand for automotive lead acid batteries is expected to grow during the forecast period.

Automotive Lead Acid Battery Market Industry Overview

An automotive lead-acid battery is a rechargeable device that stores electrical energy as chemical energy. It is made up of many series-connected cells, each of which contains a series of lead dioxide and sponge lead plates immersed in a sulfuric acid solution. Lead-acid batteries work effectively in a variety of climate situations. They have a high cranking power, giving adequate starting current even in harsh temperatures. This feature makes lead-acid batteries an excellent choice for automobiles in both cold and hot climates. Thus, the demand for lead-acid batteries is expected to grow during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Lead Acid Battery Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Lead Acid Battery Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Lead Acid Battery Market Driver and Opportunities

Lead acid Batteries are Easily Recyclable Compared to Lithium Ion Battery to Favor Market Growth.

Battery recycling entails carefully removing and neutralizing sulfuric acid from used batteries. This procedure limits the discharge of hazardous sulfuric acid into the environment, lowering the danger of soil and water contamination. Lithium-ion batteries contain no toxic chemicals, while lead-acid batteries do. Both of these battery types are recyclable. However, lead-acid batteries are more easily recycled in most places of the world than lithium-ion batteries. Approximately 95% of the materials in lead-acid batteries are recyclable, making them an environmentally responsible choice. Thus, the demand for lead-acid batteries is expected to grow during the forecast period.

Increasing Passenger Car and Light Commercial Vehicle Sales

According to the article published in the Economic Times, passenger car wholesales in India achieved a new high of 42,18,746 units in the fiscal year 2023-24. Further, according to the China Association of Automobile Manufacturers, China's commercial vehicle exports reached 74,000 units in January 2024. Lead acid batteries are preferred for starting, lighting, and ignition (SLI) in an automobile. Thus, increasing sales of passenger and light commercial vehicles is expected to boost the demand for lead-acid batteries during the forecast period.

Automotive Lead Acid Battery Market Report Segmentation Analysis

The key segments that contributed to the derivation of the automotive lead acid battery market analysis are product and end-user.

- Based on the product, the market is divided into SLI and micro-hybrid batteries.

- based on type, the market is segmented into flooded, enhanced flooded, and VRLA)

- Based on end-users, the market is segmented into passenger cars, LCVs, MCVs, and HCVs.

- In 2023, the SLI segment accounted for a prominent market share. SLI battery is a rechargeable lead acid battery, and it is extensively used in different automobiles.

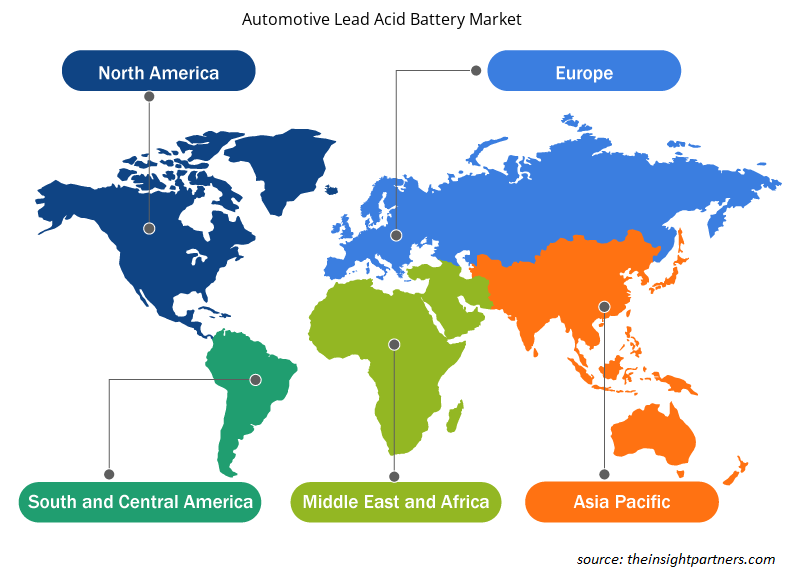

Automotive Lead Acid Battery Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Europe's strong foothold in automotive innovation and environmental measures has a considerable impact on the automotive lead-acid battery industry. Germany, the United Kingdom, and France are expected to be the key countries in the European automotive lead-acid battery market. On the other hand, Asia-Pacific is expected to be the most profitable market over the projection period due to the growth of the automotive sector in the region.

Automotive Lead Acid Battery Market Regional Insights

The regional trends and factors influencing the Automotive Lead Acid Battery Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Lead Acid Battery Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Lead Acid Battery Market

Automotive Lead Acid Battery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 26.50 Billion |

| Market Size by 2031 | US$ 40.49 Billion |

| Global CAGR (2023 - 2031) | 5.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

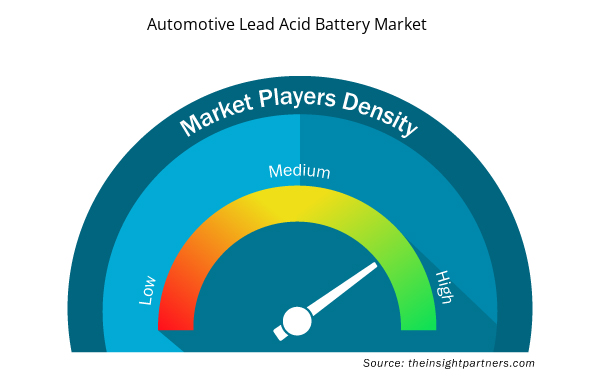

Automotive Lead Acid Battery Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Lead Acid Battery Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Lead Acid Battery Market are:

- Clarios

- CSB Energy Technology Co., Ltd.

- EnerSys

- East Penn Manufacturing Company

- Exide Industries Limited

- GS Yuasa International Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Lead Acid Battery Market top key players overview

Automotive Lead Acid Battery Market News and Recent Developments

The automotive lead acid battery market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive lead acid battery are listed below:

- GS Yuasa Corporation announced that India-based Tata AutoComp GY Batteries Private Ltd. (“TGY”), an equity-method affiliate of subsidiary GS Yuasa International Ltd. (“GS Yuasa”), aims to double its annual production capacity for motorcycle lead-acid batteries to 8.4 million units. In addition, TGY will strengthen its production of automotive lead-acid batteries, with a focus on high-performance lead-acid batteries for environment-friendly vehicles, such as start & stop vehicles, demand for which is expected to continue growing in the years ahead. (Source: GS Yuasa Corporation, Press Release, December 2021)

Automotive Lead Acid Battery Market Report Coverage & Deliverables

The automotive lead acid battery market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Automotive Lead Acid Battery Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Automotive lead acid battery market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive Lead Acid Battery Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Automotive lead acid battery market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Automotive Lead Acid Battery Market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product , Type , and End-user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

What would be the estimated value of the automotive lead acid battery market by 2031?

The automotive lead acid battery market size is projected to reach US$ 40.49 billion by 2031.

Which region dominated the automotive lead acid battery market in 2023?

North America is expected to dominate the automotive lead acid battery market with the highest market share in 2023.

What are the future trends of the automotive lead acid battery market?

Technological developments to improve durability to play a significant role in the global automotive lead acid battery market in the coming years.

Which are the leading players operating in the automotive lead acid battery market?

The leading players operating in the automotive lead acid battery market are Clarios, CSB Energy Technology Co., Ltd., EnerSys, East Penn Manufacturing Company, Exide Industries Limited, GS Yuasa International Ltd., Johnson Controls, Inc., leach International Technology Limited Inc., and Panasonic Corporation.

What are the driving factors impacting the global automotive lead acid battery market?

Easily recyclable compared to lithium-ion batteries and the growing automotive industry are the major factors driving the Automotive Lead Acid Battery market.

What is the expected CAGR of the automotive lead acid battery market?

The global automotive lead acid battery market is expected to grow at a CAGR of 5.4 % during the forecast period 2024 - 2031.

Get Free Sample For

Get Free Sample For