Biologics Market Growth, Trends, and Analysis by 2031

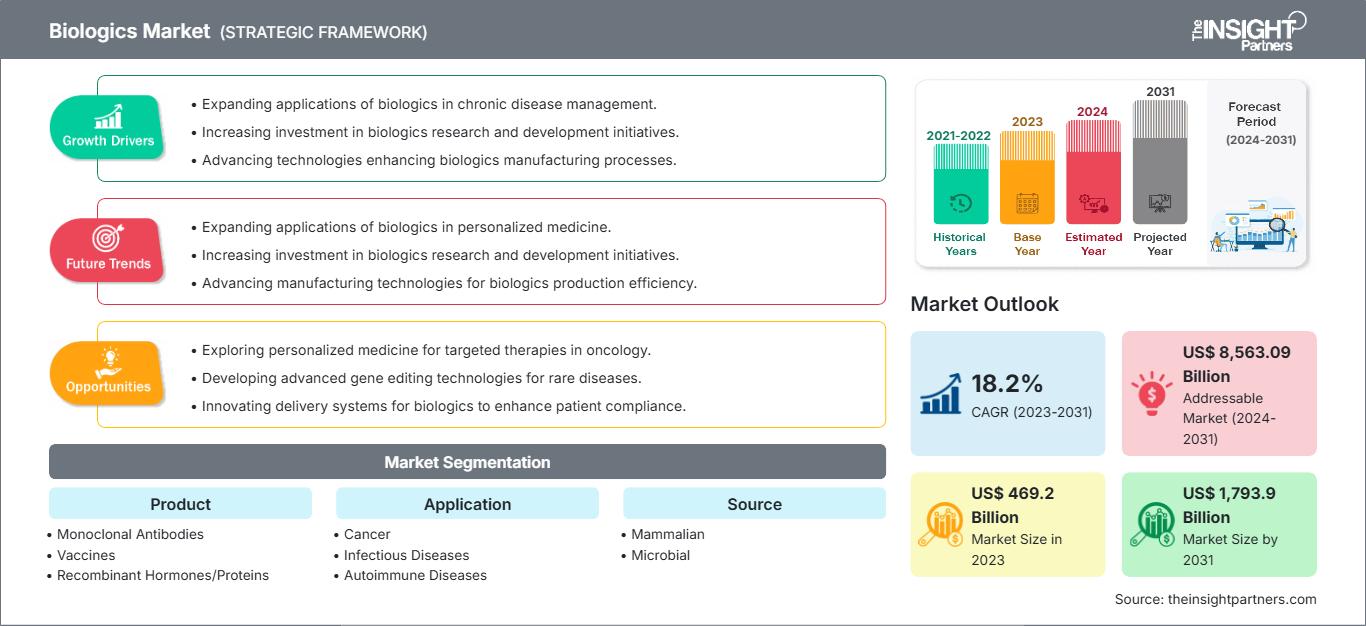

Biologics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Monooclonal Antibodies, Vaccines, Recombinant Hormones/Proteins, Cell and Gene Therapy, and Others), Application (Cancer, Infectius Diseases, Autoimmune Diseases, and Others), Source (Mammalian and Microbial), Manufacturing (Outsourced and In-house), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Aug 2024

- Report Code : TIPRE00002765

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 200

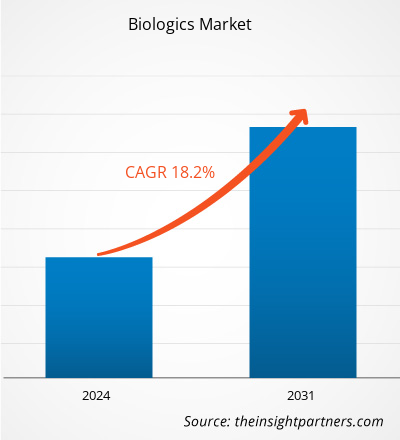

The biologics market size is projected to reach US$ 1,793.9 billion by 2031 from US$ 469.2 billion in 2023. The market is expected to register a CAGR of 18.2% in 2023–2031. Rising research and development (R&D) activities and increasing investments in biologics are likely to act as key trends in the biologics market.

Biologics Market Analysis

The increasing number of cases and diagnoses of chronic diseases triggers the need for sophisticated diagnostic and treatment drugs, which contributes significantly to the global biologics market. Discovery studies involving new compounds are undertaken to explore therapeutic options for patients who do not react to conventional treatments and demonstrate greater protection and effectiveness. Biologics are genetically modified drugs that target the specific site of inflammation that is triggered by the immune system in response to harmful stimuli. Given the emergence of COVID-19, governments in various countries also took measures to boost the healthcare industry and ensure biologics supply. In addition, researchers and scientists are studying various species and expression systems to improve the productivity of biologics. The development of cell lines and reagents to improve the yield of biologics manufacturing processes would further benefit biologics market growth. However, stringent regulations and high drug development costs limit the market growth.

Biologics Market Overview

Biologics is emerging as a dynamic and promising therapeutic segment in the pharmaceutical industry, offering a unique approach to treating various diseases and medical conditions. The biologics market is growing continuously owing to enormous spending by pharmaceutical and biotechnology companies on improving their production facilities. The geriatric population is at high risk of developing chronic diseases such as cancer and autoimmune diseases, reflecting a need for biologics and drugs for treatment. Biologics such as monoclonal antibodies (MAbs), vaccines, recombinant proteins, antisense, RNAi, and molecular therapies are being studied for their potential to treat these medical conditions. MAbs are gaining popularity in therapeutic applications due to their specificity and effectiveness in targeting specific antigens. Therefore, the growing demand for therapies and the preference for outsourcing provide impetus to the biologics market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBiologics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Biologics Market Drivers and Opportunities

Increasing Prevalence of Chronic Diseases Favor Biologics Market

According to a study titled "Chronic Disease: A Bio-Logical Approach," published in Ellerston Capital Limited, 41 million people worldwide die from chronic diseases every year, accounting for 74% of all deaths worldwide. Cancer was responsible for almost 10 million deaths in 2020, i.e., 1 in every 6 deaths. According to GLOBOCAN, 19.3 million cancer cases were registered worldwide in 2020, and the number is estimated to rise to 24.6 million by 2030. In addition, the prevalence of autoimmune diseases increases annually by 3–9%. The count of Alzheimer's disease cases is expected to reach 78 million by 2030 and 139 million by 2050. According to the World Health Organization (WHO), every year, ~17 million people across the world succumb to death due to noncommunicable diseases before the age of 70.

Biologics such as antibodies and vaccines offer more targeted treatment because they are designed to interact with the immune system in specific ways to deliver a therapeutic or prophylactic effect. Biological drugs have the promising potential to treat a few chronic autoimmune diseases by blocking the overactive components (proteins in many cases) of the immune system, which damage joints, skin, and other body parts. The treatment of cancer with biologics involves using the body's immune cells to kill cancerous cells; cytokines such as interferons, interleukins, and mAbs are the most commonly used biological therapies employed to treat cancer. Therefore, the increasing prevalence of chronic diseases drives the growth of the biologics market.

Evolution of Biotechnology Industry in Developing Regions to Create Opportunities for Biologics Market Growth

Antibodies are required in numerous applications in modern biotechnology, from fundamental research to innovative medical therapeutic approaches. The development of therapeutic antibodies has opened new avenues in treating various diseases, demonstrating the transformative ability of these particles. Antibodies are also crucial in diagnostics as they provide accurate and reliable approaches to disease identification. Growing support from governments, rising public–private partnerships, continuously changing disease profiles, and increasing funding activities are widely enhancing the performance of biotechnology industries in regions such as Asia Pacific, South & Central America, and the Middle East & Africa. Countries such as the UAE, Saudi Arabia, Oman, Muscat, Bahrain, Taiwan, Malaysia, India, China, Singapore, and Japan are among the most lucrative markets for the biotechnology industry. Advancements in biotechnology, genetics, and cell biology have contributed to the identification of several potential therapeutics for targeted treatments. Biotechnology is a strategic sector for China. The Made in China 2025 initiative emphasizes on research capabilities supporting the manufacturing of high-tech products, including innovative medicines. The plan introduced Chinese pharmaceutical companies to target areas to spur biotechnology innovation and enhance exports. Asian countries are more focused on using genomics, proteomics, and biomarker advancements for diagnostic and therapeutic applications. Therefore, the ongoing developments in the biotechnology industry in developing regions are expected to create opportunities for the biologics market in the coming years.

Biologics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the biologics market analysis are product, application, source, and manufacturing.

- Based on product, the biologics market is divided into monoclonal antibodies, vaccines, recombinant hormones/proteins, cell and gene therapy, and others. The monoclonal antibodies segment held the largest share of the market in 2023, and it is further anticipated to register the highest CAGR during the forecast period.

- By application, the market is segmented into cancer, infectious diseases, autoimmune diseases, and others. The cancer segment held the largest share of the market in 2023; it is further anticipated to register the highest CAGR during 2023–2031.

- Based on source, the biologics market is divided into mammalian and microbial. The microbial segment held a larger share of the market in 2023. The mammalian segment is anticipated to register a higher CAGR during the forecast period.

- In terms of manufacturing, the market is bifurcated into outsourced and in-house. The outsourced segment held a larger share of the market in 2023, and it is estimated to register a higher CAGR during 2023–2031.

Biologics Market Share Analysis by Geography

The geographic scope of the biologics market report is mainly divided into five regions: North America, Asia Pacific, Europe, and the Middle East & Africa.

North America dominates the biologics market. Market growth in the region is attributed to the high prevalence of chronic diseases, numerous leading biopharmaceutical companies, favorable reimbursement policies, and significant investments in research and development. According to an article published in the JAMA Network, biologics R&D spending accounted for 37% of total drug R&D spending in the US. The number of prescriptions written for biologics and investments in the development of targeted drugs are on the rise in the country. Additionally, the approval of several novel biological drugs such as antisense, gene therapy, and RNAi therapeutics is expected to further drive the market growth. Asia Pacific is anticipated to record the highest CAGR during 2023–2031.

Biologics Market Regional Insights

The regional trends and factors influencing the Biologics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Biologics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Biologics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 469.2 Billion |

| Market Size by 2031 | US$ 1,793.9 Billion |

| Global CAGR (2023 - 2031) | 18.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Biologics Market Players Density: Understanding Its Impact on Business Dynamics

The Biologics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Biologics Market top key players overview

Biologics Market News and Recent Developments

The biologics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Samsung Biologics, a global contract development and manufacturing organization (CDMO), announced a partnership agreement with LegoChem Biosciences, a biotech company pioneering the research and development of antibody-drug conjugate (ADC) programs. Under the terms of the deal, Samsung Biologics will provide antibody development and drug substance manufacturing services as a part of LegoChem Biosciences' ADC program designed to treat solid tumors. (Samsung Biologics, Press Release, February 2024)

- Selvita S.A. announced a strategic initiative to significantly expand its services portfolio and enter the field of biologic drug discovery and development by adding comprehensive therapeutic antibody discovery and development capabilities to its portfolio. (Selvita, Press Release, March 2024)

Biologics Market Report Coverage and Deliverables

The "Biologics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Biologics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Biologics market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Biologics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the biologics market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For