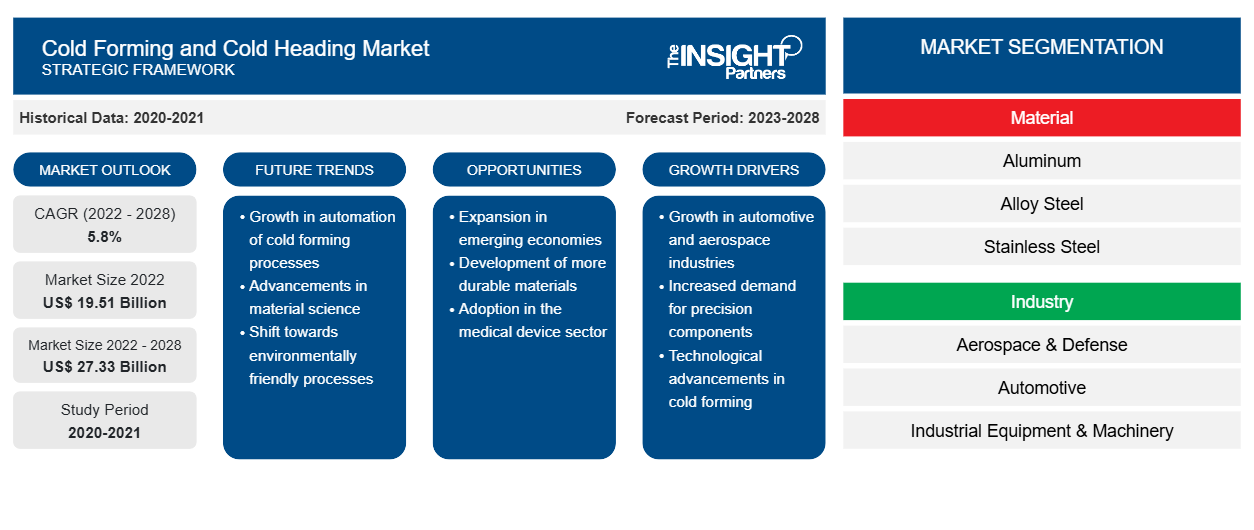

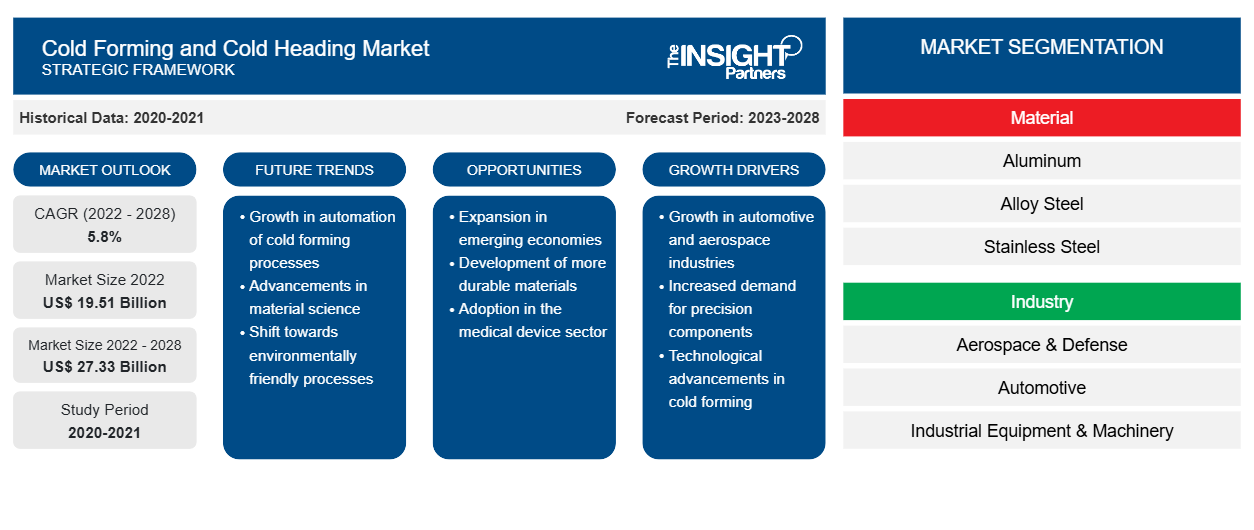

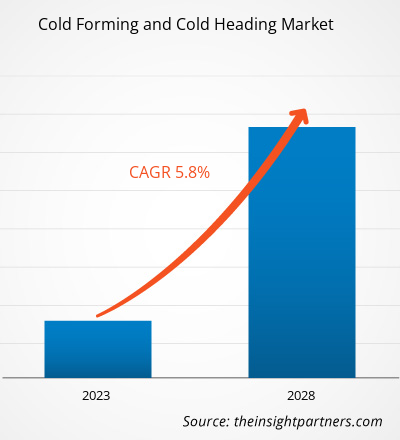

The cold forming and cold heading market are expected to grow from US$ 19,510.15 million in 2022 to US$ 27,332.39 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2022 to 2028.

The process of forging metals at room temperature is referred to as cold forming. Metal wires are cut into small segments to form multiple die progression in a cold heading machine. Every step of the process imparts specific geometrical features to the design of the product being manufactured, such as automotive, industrial equipment, and medical equipment, that offers manufacturability and a long-term production life cycle. The cold forming process has zero processing scrap, which is one of the major reasons it is preferred over traditional metal machining.

Cold forming and cold heading solutions are applied for commercial and military aircraft production. It helps in building the structure of aircraft bodies. The rising air passenger traffic across the globe is increasing the demand for aircraft fleets operated by major airlines across developed and developing countries. The rise in demand for military aircraft from the defense industry has also boosted aircraft manufacturing. For instance, in July 2022, Voyager Aviation Holdings, LLC (VAH) announced a purchase agreement of US$ 300 million to work with a blue-chip aircraft leasing firm for 7 new and in-production aircraft. Similarly, in November 2021, Indigo partner portfolios announced the procurement of 255 additional A321neo aircraft. Additionally, in September 2021, the Indian government announced the procurement of 56 Airbus C-295 military aircraft worth US$ 2.5 billion. Thus, the above-mentioned contracts would increase aircraft manufacturing activities, thereby propelling the demand for cold forming and cold heading solutions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cold Forming and Cold Heading Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

– Cold Forming and Cold Heading Market

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cold Forming and Cold Heading Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Cold Forming and Cold Heading Market

North America is significantly influenced by the strong presence of the US, owing to its considerable penetration of passenger vehicles per capita and large presence of automobile manufacturing capabilities in the region. Though the US witnessed a notable surge in the number of COVID-19 cases, the lack of stringent government measures and restrictions minimally impacted the overall automotive industry; hence, the cold forming and cold heading market share witnessed a moderate impact from the COVID-19 pandemic. However, the ongoing US and China trade war influenced the availability of materials and components for various automotive OEMs, which affected the market following the pandemic. Further, Mexico and Canada witnessed a decline in the demand for automotive sales and a notable decline in their overall market growth for various automotive components, including cold forming and cold heading and its related components.

Market Insights – Cold Forming and Cold Heading Market

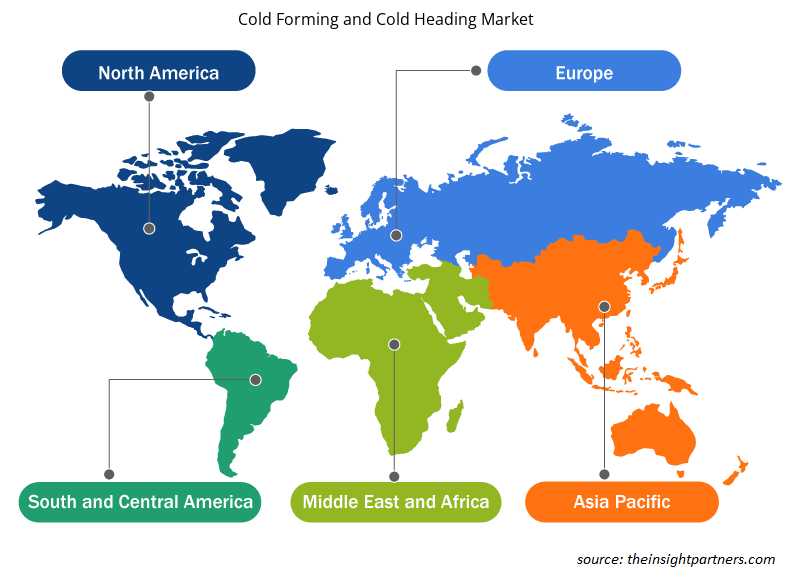

APAC accounted for the largest share of the global cold forming and cold heading market size in 2021, followed by Europe, North America, the MEA, and SAM. APAC adopted a rising number of government initiatives to promote the manufacturing sector. Government bodies across countries, including China and India, have started initiatives such as Made in China and Made in India, which is influencing the local manufacturing of industrial equipment, medical equipment, and automobile. These factors are contributing to the APAC cold forming and cold heading market growth.

North America is expected to register the highest CAGR during the forecast period. The increase in investment by manufacturers across the region to set up production plants and research & development centers is further increasing the demand for cold forming and cold heading solutions. In December 2021, Toyota Motor announced the opening of its new automotive battery plant in the US. Similarly, in April 2022, General Motors started manufacturing electric cars in Mexico. These factors are constantly propelling the demand for cold forming and cold heading solutions, thereby augmenting the cold forming and cold heading market growth in North America.

Industry-Based Insights

Based on industry, the cold forming and cold heading market size is segmented into aerospace & defense, automotive, industrial equipment & machinery, and others. The automotive segment is expected to dominate the market during the forecast period. The automobile industry is constantly growing. Therefore, there is a rising need for metal fasteners, such as rivets and bolts, in the industry. France is working to produce clean vehicles, along with a few of the government's actions taken in different regions to overcome the damage caused by the COVID-19 pandemic. It will increase the production of electric and hybrid vehicles to over 1 million units annually over the next five years and plan to rescue the US$ 9.7 billion automotive industry. Thus, the automotive sector is growing rapidly.

The cold forming and cold heading market is segmented on the basis of material, industry, and geography. Based on material, the cold forming and cold heading market is segmented into aluminum, alloy steel, stainless steel, and others. Based on industry, the cold forming and cold heading market is segmented into aerospace & defense, automotive, industrial equipment & machinery, and others. By geography, the cold forming and cold heading market is primarily segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America.

Cold Forming and Cold Heading Market Regional Insights

The regional trends and factors influencing the Cold Forming and Cold Heading Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cold Forming and Cold Heading Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cold Forming and Cold Heading Market

Cold Forming and Cold Heading Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 19.51 Billion |

| Market Size by 2028 | US$ 27.33 Billion |

| Global CAGR (2022 - 2028) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

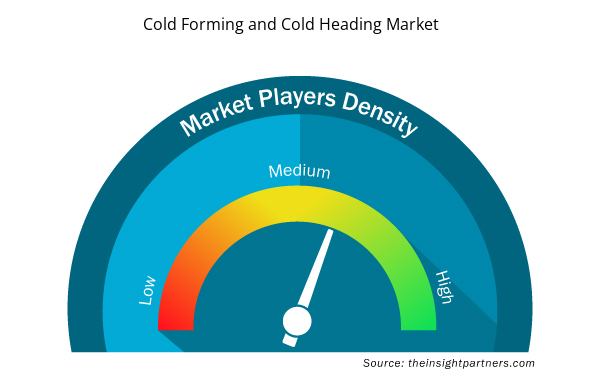

Cold Forming and Cold Heading Market Players Density: Understanding Its Impact on Business Dynamics

The Cold Forming and Cold Heading Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cold Forming and Cold Heading Market are:

- STANLEY

- Altra Industrial Motion Corp.

- KALYANI FORGE

- Bharat Forge

- Cold-Flow Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cold Forming and Cold Heading Market top key players overview

Stanley, Kalyani Forge, Altra Industrial Motion Corp, Deringer-Ney Inc, and Cold Formed Products are among the key cold forming and cold heading market players considered in the research study.

The cold forming and cold heading market players are mainly focused on the development of advanced and efficient products.

- In 2022, Altra Industrial Motion Corp., a leading global manufacturer and supplier of motion control, power transmission, and automation products, acquired Nook Industries LLC, a pioneer in the engineered linear motion market based in Cleveland, Ohio .

- In 2021, Deringer-Ney Inc., a world leader in precious metal alloys, micro manufactured parts (MICROmfg), electrical contacts, and precision components for medical devices, acquired Hoyt Corporation, a top supplier of electrical contacts, copper extrusions, and contact assemblies.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the global market size for the cold forming and cold heading market in 2022?

The global market size for the cold forming and cold heading market is US$ 19,510.15 million in 2022.

Which are the key players holding the major market share of the cold forming and cold heading market?

The major companies in the cold forming and cold heading market include Stanley; Kalyani Forge; Altra Industrial Motion Corp; Deringer-Ney Inc; and Cold Formed Products.

What are the driving factors impacting the cold forming and cold heading market?

Growing Demand Cold Forming and Cold Heading in Aerospace Industry

Increasing Demand for Cold Forming and Cold Heading in Automotive Industry

Which is the fastest-growing region in the cold forming and cold heading market?

APAC is expected to witness the fastest growing CAGR in the cold forming and cold heading market over the forecast period.

What are the trends of the cold forming and cold heading market?

Advancements in Cold Forming and Cold Heading

What is the global market size for the cold forming and cold heading market in 2028?

The global market size for the cold forming and cold heading market is US$ 27,332.39 million in 2028.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Cold Forming and Cold Heading Market

- STANLEY

- Altra Industrial Motion Corp.

- KALYANI FORGE

- Bharat Forge

- Cold-Flow Corporation

- Deringer-Ney Inc

- Buchanan Metal Forming Inc

- Fukui Byora Co., Ltd.

- Cold Heading Company

- Cold Formed Products

Get Free Sample For

Get Free Sample For