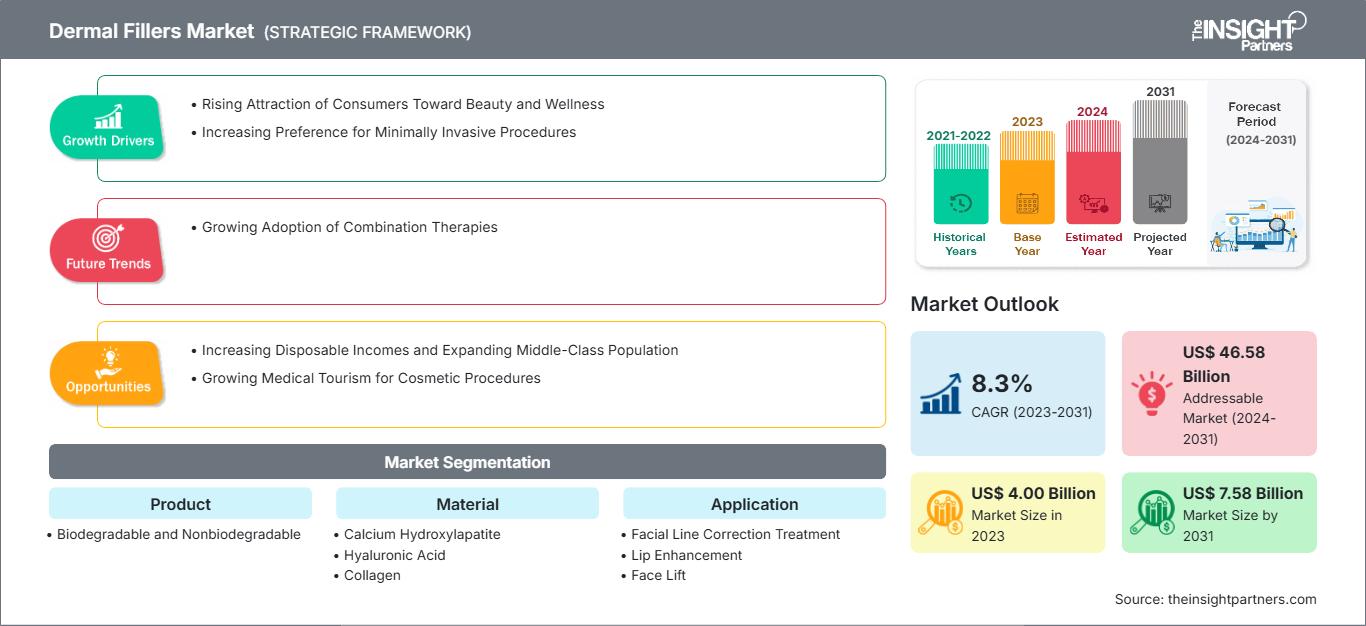

Dermal Fillers Market Segments and Growth by 2031

Dermal Fillers Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Biodegradable and Nonbiodegradable), Material (Calcium Hydroxylapatite, Hyaluronic Acid, Collagen, Poly-L-Lactic Acid, Polmethylmethacrylate, Fat Fillers, and Others), Application (Facial Line Correction Treatment, Lip Enhancement, Face Lift, Scar Treatment, and Others), End User (Multispecialty Hospitals, Dermatology Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2024

- Report Code : TIPRE00002992

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 195

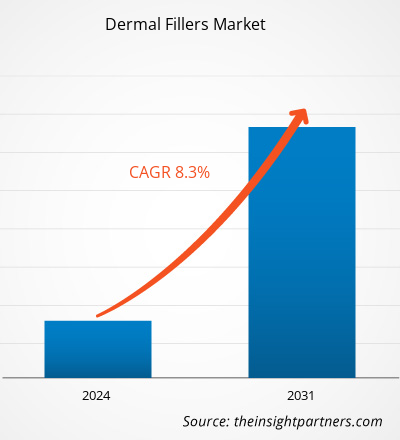

The dermal fillers market size is projected to grow from US$ 4.00 billion in 2023 to US$ 7.58 billion by 2031; the market is estimated to record a CAGR of 8.3% during 2023–2031.

Dermal fillers are anti-aging products injected into patients' skin to enhance volume. Dermal fillers help in transforming sagging skin or skin that has wrinkled due to aging into smooth and plump skin. They are also called injectable facial, injectable cosmetic, or soft tissue fillers. The factors driving the growth of the dermal fillers market include the increasing preference for minimally invasive procedures and the rising attraction of consumers toward beauty and wellness. Growing medical tourism for cosmetic procedures is likely to generate lucrative opportunities for the market. Further, the growing adoption of combination therapies is likely to bring new dermal fillers market trends.

Growth Drivers:

There has been a noticeable shift in societal attitudes toward self-care, aesthetics, and overall well-being in recent years. People increasingly invest time and resources into maintaining and enhancing their physical appearance, leading to a surge in the demand for cosmetic procedures such as dermal fillers. One of the key reasons for the increasing adoption of dermal fillers is the increasing emphasis on beauty standards and youthfulness in modern society. With the rise of social media platforms and the prevalence of celebrity culture, people are constantly exposed to images of flawless skin, perfect features, and idealized beauty standards. This exposure has created a desire among many individuals to achieve similar aesthetic goals and maintain a youthful appearance.

Moreover, the aging population worldwide is another factor contributing to the growing interest in cosmetic procedures. As people age, they may experience changes in their facial structure, such as volume loss, wrinkles, and sagging skin. Dermal fillers offer a noninvasive solution to address these signs of aging and restore a more youthful and rejuvenated look. This appeal to older demographics seeking to maintain a more youthful appearance has further fueled the popularity of dermal fillers. Additionally, the increasing acceptance and normalization of cosmetic procedures in society have made people more open to exploring options for enhancing their appearance. Nonsurgical treatments such as dermal fillers are often perceived as less intimidating and risky than traditional surgical procedures, making them more accessible and appealing to a wider audience.

Furthermore, advancements in technology and techniques have made dermal fillers safer, more effective, and longer lasting than ever before. Consumers are increasingly drawn to these innovative solutions that offer natural-looking results with minimal downtime and side effects. Overall, the rising attraction of consumers toward beauty and wellness is a key factor driving the dermal fillers market growth. As people continue to prioritize self-care, aesthetics, and maintaining a youthful appearance, the demand for cosmetic procedures, including dermal fillers, is expected to continue to rise in the future.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDermal Fillers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The dermal fillers market analysis has been carried out by considering the following segments: product, material, application, end-user, and geography. In terms of product, the market is bifurcated into biodegradable and non-biodegradable. In terms of material, the market is classified into calcium hydroxylapatite, hyaluronic acid, collagen, poly-l-lactic acid, polymethylmethacrylate, fat fillers, and others. Based on application, the market is categorized into facial line correction treatment, lip enhancement, facelift, scar treatment, and others. By end user, the market is segmented into multispecialty hospitals, dermatology clinics, ambulatory surgical centers, and others. The scope of the dermal fillers market report covers North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The dermal fillers market, by product, is bifurcated into biodegradable and nonbiodegradable. In 2023, the biodegradable segment held a larger share of the market and is expected to register a higher CAGR in the market during 2023–2031.

In terms of material, the dermal fillers market is classified into calcium hydroxylapatite, hyaluronic acid, collagen, poly-l-lactic acid, polymethylmethacrylate, fat fillers, and others. In 2023, the hyaluronic acid segment held a significant dermal fillers market share and is expected to grow at the highest CAGR during the forecast period. Hyaluronic acid (HA) is a naturally occurring substance secreted in human skin. It keeps skin moisturized and plump. The majority of HA fillers are soft and gel-like. The effects are only brief, lasting 6–12 months or longer before the body naturally absorbs the particles. Many HA fillers contain lidocaine, which helps reduce pain during and after treatment. The FDA-approved HA fillers include Juvéderm products: VOLBELLA, VOLLURE, Juvéderm XC, and VOLUMA; Restylane products: Restylane, Restylane Refyne, Restylane Defyne, Restylane Kysse, Restylane Silk, Restylane Lyft, Restylane Contour; Belotero Balance; Revanesse Versa; and The RHA collection: RHA 2, RHA 3, and RHA 4.

Based on application, the dermal fillers market is categorized into facial line correction treatment, lip enhancement, facelift, scar treatment, and others. The lip enhancement segment held a significant dermal fillers market share in 2023 and is estimated to register the highest CAGR during 2023–2031. Lip enhancement includes a suite of procedures that add or restore volume to the lips and smooth vertical lines around the lips and mouth. Dermal fillers can be used to define the lip border, add volume to the lips, and correct asymmetry. Lip fillers are often made from hyaluronic acid as it helps retain moisture and create fullness. Lip enhancement with dermal fillers is an effective way to achieve plumper, more defined lips without the need for surgery. Compared to other surgical products, cost advantage will further promote the adoption in the review period. For instance, lip fillers may be under US$ 400, while other procedures, such as fat grafts, can range up to US$ 5,000.

Based on end user, the market is segmented into multispecialty hospitals, dermatology clinics, ambulatory surgical centers, and others. The dermatology clinics segment held the largest share of the market in 2023 and is expected to register the highest CAGR in the market during 2023–2031.

Regional Analysis:

Geographically, the dermal fillers market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2023, North America captured a significant share of the market. The market growth in North America is attributed to the increasing focus of market players in the US and Canada and the presence of renowned beauty brands in the region. Moreover, the region has a huge population base willing to get wrinkle-free and acne-free skin, backed up by the launch of new beauty procedures. In 2023, the US held the largest share of the market in the region. The US has been at the forefront of cosmetics innovation, entrepreneurship, and regulations since its earliest days. Consumers in the country have registered an increasing average annual expenditure on aesthetic procedures over the years, contributing to the market growth. The growing Hispanic population and rising demand for the removal of wrinkles, scars, skin smoothening, lip enhancement, and other procedures in the US would further support demand for derma fillers in the coming years. Factors such as an increase in awareness and consumer knowledge about the benefits of new technologies through digital media and social media are also contributing to the growth of the dermal fillers market in this country.

Additionally, the demand for dermal filler treatment is likely to rise with the growing geriatric population in the country, especially to treat facial aging signs. In the US, dermal fillers have gained acceptance as an excellent cosmetic treatment option owing to the continued demand for more effective, minimally invasive cosmetic procedures. According to the statistics from the Aesthetic Society, 649,176 filler procedures were performed in the US in 2022, and dermal filler procedures accounted for 14% of the total nonsurgical revenue in the US in 2022. Thus, the high prevalence of skin conditions in the US population has the potential to drive the demand for dermal filler products and services. Thus, the factors mentioned above foster the dermal fillers market growth in the region.

Dermal Fillers Market Regional InsightsThe regional trends and factors influencing the Dermal Fillers Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Dermal Fillers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Dermal Fillers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.00 Billion |

| Market Size by 2031 | US$ 7.58 Billion |

| Global CAGR (2023 - 2031) | 8.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Dermal Fillers Market Players Density: Understanding Its Impact on Business Dynamics

The Dermal Fillers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Dermal Fillers Market top key players overview

Industry Developments and Future Opportunities:

The dermal fillers market report includes company positioning and concentration to evaluate the performance of competitors in the market. As per company press releases, below are a few initiatives taken by key players operating in the market:

- In September 2023, Merz Aesthetics received the US Food and Drug Administration (FDA) approval for Belotero Balance (+) for volume augmentation for the improvement of the infraorbital hollow in adults above the age of 21, further increasing the usage and capability of Belotero Balance (+), and addressing consumer under-eye concerns.

- In June 2023, Galderma received the US FDA approval for its Restylane Eyelight. Restylane Eyelight can be used to treat undereye hollows in adults aged 21 and above. Restylane Eyelight, an undereye hyaluronic acid dermal filler, is the first and only product in the US formulated with NASHA technology for volume loss under the eyes, giving patients natural-looking results.

Competitive Landscape and Key Companies:

The dermal fillers market forecast can help stakeholders plan their growth strategies. AbbVie Inc, Galderma SA, Merz Pharma GmbH & Co KGaA, Suneva Medical, Bioxis Pharmaceuticals, Bioplus Co. Ltd., Teoxane Laboratories, Bioha Laboratories, Prollenium Medical Technologies, and Sinclair Pharma Ltd are among the prominent players in the market. The market players focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For