eSIM Market Size and Growth 2031

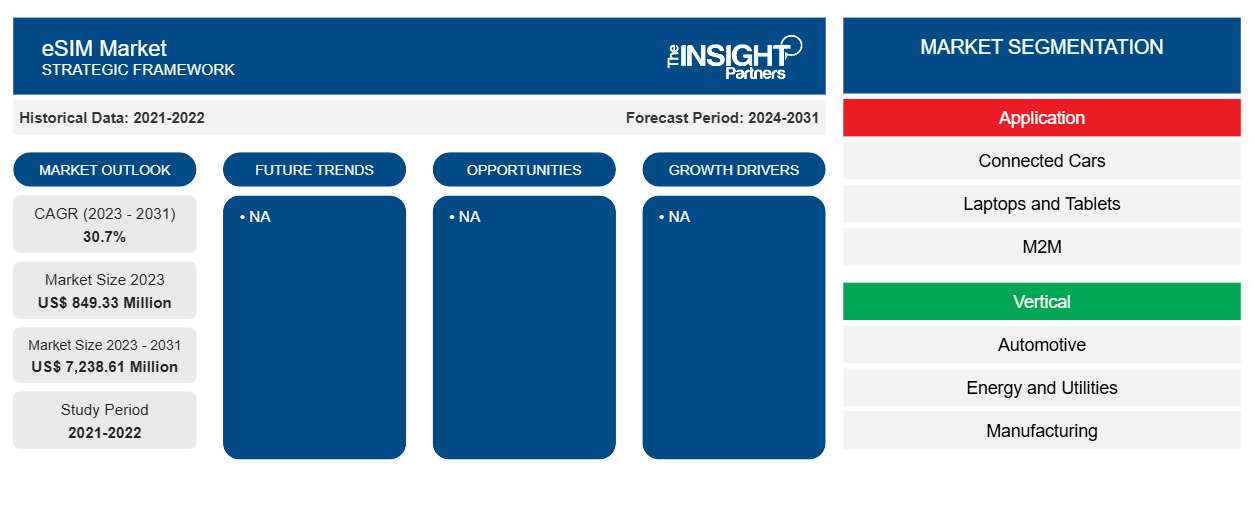

eSIM Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software & Services), Type (Consumer eSIMs, IoT eSIMs, and Travel eSIMs), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPTE00002282

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 210

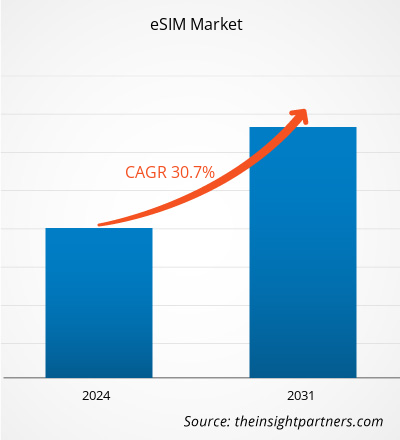

The eSIM market size was valued at US$ 5.51 billion in 2024 and is expected to reach US$ 17.98 billion by 2031. The market is estimated to register a CAGR of 18.7% during 2025–2031. Integration of AI in eSIM connectivity management is likely to bring new market trends in the future.

eSIM Market Analysis

Rising adoption of smartphones and integration of eSIM in the automotive industry, as well as its cost-saving benefits, drive eSIM adoption. The increasing integration of eSIM technology in smartphones is propelling the global eSIM market growth. As leading smartphone manufacturers such as Apple, Samsung, and Google continue to embed eSIM functionality in their latest models, consumer awareness and adoption are rising significantly. This shift marks a departure from traditional SIM cards, offering enhanced flexibility, security, and a seamless user experience. 98% of all smartphone connections in North America will utilize eSIM technology by 2030, as per the estimated data by Telna, Inc. The first eSIM-enabled smartphone, the Google Pixel 2, was launched by Google in 2017. Google is consistently expanding eSIM support across its Pixel series, underscoring its strategic focus on advancing toward an eSIM-only future.

eSIM Market Overview

An embedded SIM (eSIM) is a next-generation digital SIM technology that eliminates the need for a physical SIM card. It is built directly into a device and allows users to download and activate mobile network profiles over the air. This innovation is transforming the telecommunications landscape by enabling greater flexibility, efficiency, and scalability. eSIM simplifies the activation process for end users, facilitates seamless switching between network providers, and supports multiple profiles on a single device. This is particularly valuable for frequent travelers, remote workers, and users of dual-SIM devices seeking cost-effective and uninterrupted connectivity without the hassle of swapping SIM cards. eSIM technology significantly enhances operational efficiency. It streamlines logistics by eliminating the need to distribute and manage physical SIM cards. It is ideal for managing large fleets of connected devices, including smartphones, tablets, wearables, and IoT hardware. Service providers benefit from reduced overhead, improved customer onboarding, and the ability to deliver more personalized, on-demand connectivity services.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONeSIM Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

eSIM Market Drivers and Opportunities

Increasing Integration of eSIM in the Automotive Industry

eSIM technology is rapidly gaining traction within the automotive sector, offering significant advantages over traditional SIM cards. Unlike removable SIMs, eSIMs are embedded directly into vehicles, enabling remote provisioning and centralized connectivity management. This capability allows for continuous vehicle connectivity, supporting real-time traffic updates, navigation to nearby amenities, remote diagnostics, over-the-air (OTA) software updates, and access to emergency services, among others. For global automotive OEMs, automotive-grade eSIMs streamline manufacturing and supply chain processes. A standardized eSIM design can be integrated across all vehicle models, with network profiles provisioned remotely post-production. This eliminates the need for region-specific SIM variants and reduces logistical complexities, enhancing operational efficiency.

eSIMs provide robust benefits from a safety and security perspective. These are embedded during manufacturing and serve as a secure identifier and encrypt communication during vehicle operation, ensuring data integrity and privacy. The integration of eSIMs as a "root of trust" enhances the reliability of connectivity-based services. Furthermore, key players are driving innovation in eSIMs. For instance, in February 2025, Thales and Cubic announced a strategic collaboration. This partnership aims to strengthen Cubic's eSIM capabilities by leveraging Thales's eSIM management platform, aligned with the latest GSMA standards. The collaboration will enable seamless, scalable connectivity across multiple industries, including automotive, transportation, and agriculture. As the automotive industry embraces software-defined architectures and connected mobility, eSIM technology is emerging as a foundational element, powering secure, flexible, and globally consistent connectivity solutions.

Surge in Travellers eSIM

The adoption of eSIM technology is gaining steady momentum, and it is anticipated to replace physical SIM cards as the primary method of mobile service authentication. Due to its fully digital nature and inherent advantages, eSIM is expected to drive transformational change across multiple industries, notably within the travel sector, during the forecast period. According to Mobilise Global data from 2023, travel operators, especially airlines, have observed a 20% increase in ancillary revenue per passenger when ancillary services are offered during the booking process. Furthermore, in June 2025, Vodafone introduced a new digital travel platform centered around its Travel eSIM, designed to offer affordable and reliable data connectivity to travelers, regardless of their current mobile network provider. With Vodafone's Travel eSIM, users can easily add mobile data while retaining their existing phone number, ensuring seamless connectivity abroad. The onboarding process is simple and quick: before departure, users can download the dedicated app or visit the platform's website, customize or select a pre-built data plan, and install the eSIM within minutes.

Travelers are a key catalyst in accelerating eSIM adoption. In today's digitally connected world, uninterrupted internet access has become a critical factor in travel decisions, with 81% of travelers citing internet availability as crucial when selecting destinations. eSIM technology addresses these needs by enabling travelers to seamlessly connect to reliable local networks without the inconvenience of swapping physical SIM cards, depending on unsecured public Wi-Fi, or facing excessive roaming fees. This seamless connectivity ensures an uninterrupted mobile experience throughout their journey. For travel operators, the digital capabilities of eSIM open new avenues for revenue diversification and enhanced ancillary income. Thus, the rising growth in travelers' eSIM is expected to offer lucrative opportunities for market growth in the coming years.

eSIM Market Report Segmentation Analysis

Key segments that contributed to the derivation of the eSIM market analysis are component and type.

- Based on component, the market is divided into hardware and software & services. The hardware segment dominated the market in 2024.

- In terms of type, the market is segmented into consumer eSIMs, IoT eSIMs, and travel eSIMs. The consumer eSIM segment is further sub segmented into smartphones, laptops and tablets, wearables, connected cars, and others. The consumer eSIMs segment dominated the market in 2024.

eSIM Market Share Analysis by Geography

- The eSIM market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the eSIM market in 2024. Europe is the second-largest contributor to the global eSIM Market, followed by Asia Pacific.

- The eSIM market in North America is categorized into the US, Canada, and Mexico. The eSIM market in North America is growing rapidly due to rising demand for flexible connectivity, digitalization in telecom, and increased cross-border travel. eSIMs eliminate the need for physical SIM cards, offering convenience, security, and cost savings. eTravelSim, Airalo, and others offer affordable, unlimited, or flexible data plans with wide US and international coverage. Consumers prefer digital-first services with instant activation and no physical documentation. Remote SIM provisioning enables users to switch carriers easily and helps businesses streamline device management. As eSIM-compatible devices become more widespread, the market is shifting toward fully digital and efficient mobile connectivity solutions.

eSIM

eSIM Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5.51 Billion |

| Market Size by 2031 | US$ 17.98 Billion |

| Global CAGR (2025 - 2031) | 18.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

eSIM Market Players Density: Understanding Its Impact on Business Dynamics

The eSIM Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

eSIM Market News and Recent Developments

The eSIM market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few key developments in the eSIM market are listed below:

- Infineon Technologies AG has claimed the industry’s smallest GSMA-compliant and first 28-nm eSIM solution with the launch of the OPTIGA Connect Consumer OC1230. It allows up to 50% less energy consumption compared to eSIMs on the market, extending the lifetime of the device’s battery. Targeting mobile consumer devices, such as wearables, tablets, smartphones, and notebooks, the eSIM solution also contributes to greater device functionality.

(Source: Infineon Technologies AG, Press Release, January 2025)

- STMicroelectronics has completed certification of its ST4SIM-300 embedded SIM (eSIM) to GSMA SGP.32 eSIM IoT specification. The ST4SIM-300 is among the first certified eSIMs to support SGP.32, the specification suited to IoT devices with minimal user-interface capabilities or connectivity constraints such as narrowband-only communication. Distinctive features of SGP.32 include bulk provisioning of SIM profiles to simplify managing large fleets of devices, provisioning without SMS, and a lightweight profile template for optimized downloads.

(Source: STMicroelectronics, Press Release, May 2025)

eSIM Market Report Coverage and Deliverables

The "eSIM Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- eSIM market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- eSIM market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- eSIM market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the eSIM market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For