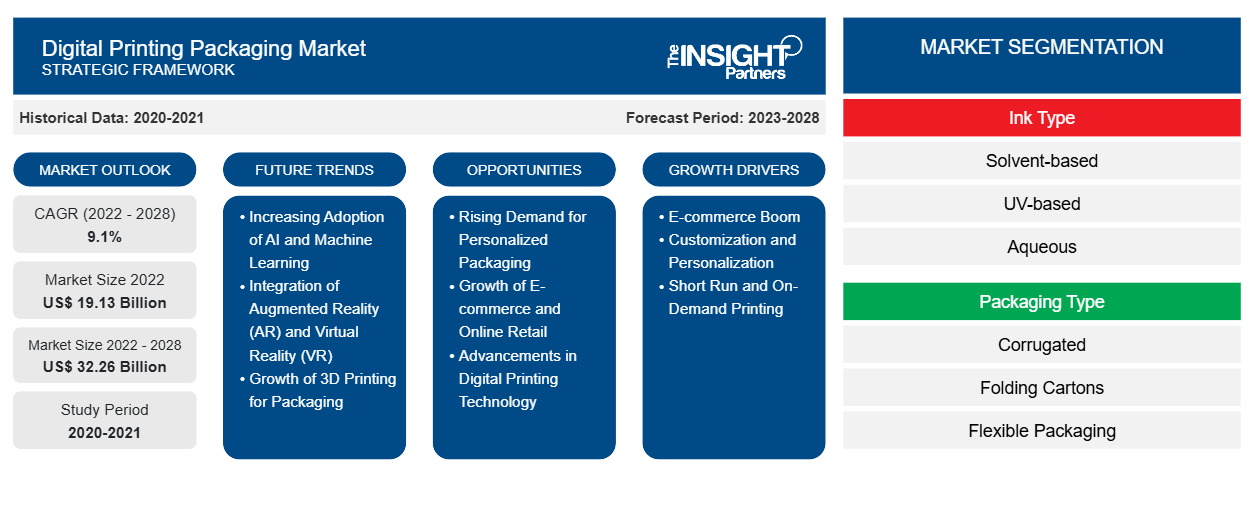

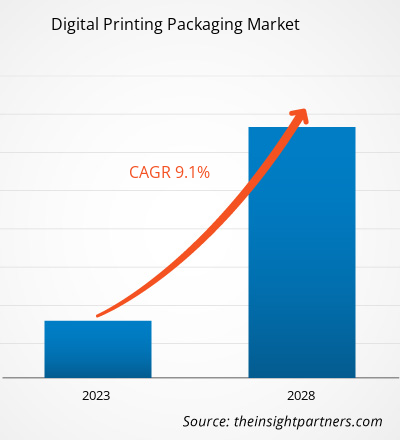

The digital printing packaging market is projected to reach US$ 32,255.60 million by 2028 from US$ 19,131.13 million in 2022. It is expected to register a CAGR of 9.1% from 2022 to 2028.

The digital printing packaging market is bolstering owing to the rising demand for flexible packaging and environmentally friendly printing. Furthermore, the rapid developments in the printing technologies have broadened the scope of flexible packaging, corrugated wrappings, and folding cartons. There is increased demand for attractive digital printing packaging from various end-use industries such as food and beverage, pharmaceuticals, and personal care and cosmetics. Manufacturers are investing in packaging as it attracts consumers and gives all the required information to the consumers.

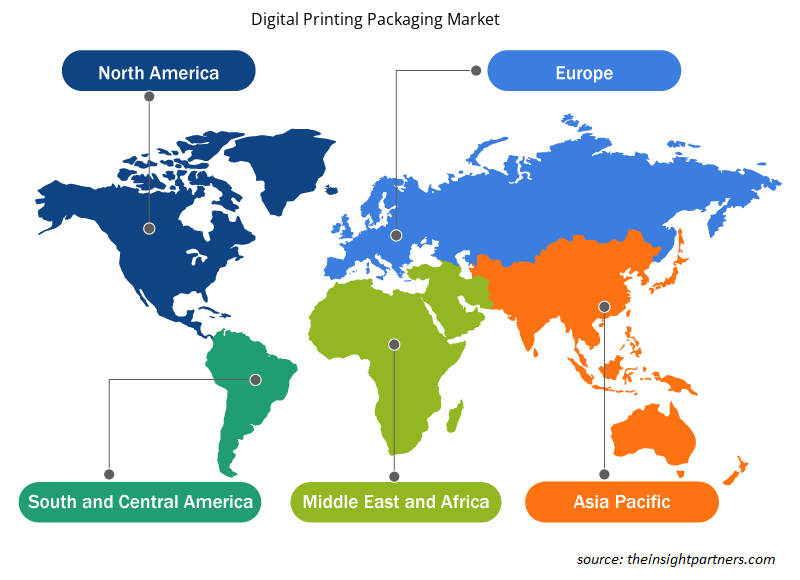

In 2021, Asia Pacific held the largest share of the global digital printing packaging market, and Europe is estimated to register the fastest CAGR during the forecast period. The soaring demand for food packaging and high emphasis on packaged foods labels that share information about the product's storage life, composition, and nutritional content of products are the major reasons boosting the digital printing market in Asia Pacific. In 2021, the Prepared Foodstuffs Product Working Group (PFPWG) of the Association of Southeast Asian Nations (ASEAN) issued guidelines for the control systems for food contact materials (FCM), including materials for active and intelligent packaging within the ASEAN member countries. Such regulations are expected to boost the demand for digital printing packaging in Asia Pacific countries. Furthermore, according to the International Finance Corporation (IFC), a member of the World Bank Group, e-commerce in Southeast Asia tripled in size between 2015 and 2020, growing to a value of US$ 105 billion. Similar trends could lead to another triple value, i.e., US$ 309 billion, by 2025. Therefore, the growth of the e-commerce industry is expected to boost the digital printing packaging market expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Printing Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Digital Printing Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Digital Printing Packaging Market

The outbreak of COVID-19 has affected almost all industries globally. Several manufacturing and development facilities across the world were forced to shut down their operations during the initial stages of the pandemic. State and National Governments globally implemented lockdown measures and ensured social distancing norms to restrict the spread of the virus. In addition, the financial crisis that followed right after the pandemic led to a significant delay in the commercial roll-out of the pharmaceutical and other industries. As a result, several small and medium-scale companies witnessed a substantial drop in income. The industries are considered the backbone of various technology providers and have been trying to recover since the emergence of the COVID-19 pandemic in 2020. As a result, market players faced numerous challenges due to the pandemic's disruptions in the supply chain.

Market Insights

Technological Advancements in Digital Printing Drive Digital Printing Packaging Market

In the field of packaging, printing, and labeling, technological developments are rising rapidly. Digital printing offers packaging personalization, production flexibility, and saves packaging time to market. Due to various equipment improvements and technological developments, brand owners and packaging converters are preferring digital printing. Innovation in digital printing offers solutions for companies to reduce production duration from months to days. Technological advancements in digital printing packaging also help in branding and marketing. Direct prints on packaging provide a unique look to the products.

Digital printing packaging is prominently used in various industries, including food & beverages, pharmaceuticals, and personal care & cosmetics. Owing to significant technological developments in inkjet and electrophotography technologies, digital printing is emerging as one of the cost-effective and easily accessible methods for printing. Digital printing packaging is majorly used to pack food and beverage products. For food and beverages and other consumer goods, the digital printing technology provides high-quality packaging with the benefits of personalization, fast turnaround, reduced waste, and on-the-fly modification to pack designs. In the pharmaceuticals & cannabis sector, manufacturers are increasingly turning to digital printing to accommodate demands for localized packaging, legally required variable data, and quick & frequent changeover. Equipment advancements have made it possible to digitally print various packaging materials and formats, including food wrappers, aluminum beverage cans, and metalized-film pouches. Thus, increasing technological advancements in the digital printing packaging sector are driving the market growth.

Ink Type-Based Insights

Based on ink type, the digital printing packaging market is categorized into solvent-based, UV-based, aqueous, and others. The solvent-based segment held the largest share of the market in 2021 and the aqueous segment is expected to register the highest CAGR during the forecast period. Solvent-based inks are composed of pigment and resin (binder), which forms a solid component of the ink, and solvent as a carrier agent. The solvent-based ink is sprayed on a substrate during the digital printing process, which leads to the evaporation of the solvent, leaving behind a dry layer of ink. Solvent-based inks are relatively inexpensive. It has a wide range of digital print applications on varied substrates such as foils, films, and hard plastics, including biaxially oriented polyropylene (BOPP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), glossy boxes or cardboard, metals, and other high-density polyethylene materials. Solvent-based ink provides durability on BOPP, and other substrates, including PE, PET, aluminum foil, and PVC. Many digital print providers worldwide adhere to international and domestic regulations for packaging printing. It has encouraged ink manufacturers to formulate compliant products to meet customer demand. For instance, in October 2022, Kao Collins Inc. launched Swiss Ordinance compliant solvent-based ink in five colors—red, yellow, blue, green, and violet. These inks are formulated and manufactured according to the EUPIA (Globalan Printing Ink Association) Guidelines on Printing Inks.

Packaging Type-Based Insights

Based on packaging type, the digital printing packaging market is segmented into corrugated, folding cartons, flexible packaging, labels, and others. The corrugated segment held the largest share of the market in 2021 and the flexible packaging segment is projected to register the highest CAGR during the forecast period. The corrugated board contains arches (known as flutes) between two layers, forming a rigid column. This structural design of the corrugated box resists pressure and provides protection against sudden temperature changes. Generally, water-based or aqueous inks, oil-based, and solvent-based inks are utilized for digital printing on corrugated packaging. The upsurge in need for corrugated packaging is witnessed due to an increase in the demand from e-commerce sites. The demand for corrugated packaging is related to e-commerce sales, as corrugated packaging forms a core component of e-commerce supply chain.

End-Use Industry-Based Insights

Based on end-use industry, the digital printing packaging market is segmented into food and beverage, pharmaceuticals, personal care and cosmetics, and others. The food and beverage segment accounted for the largest market share in 2020. The digital printing packaging industry has undergone a dramatic shift over the past few years owing to the increased use of digital printing labels and packaging solutions by manufacturers and brand owners. Nowadays, competitive price is no longer enough in the digital printing packaging market to choose the product, as consumers are looking for a better product experience. Consumers are much more concerned about value addition and differentiation in the food & beverages industry, and they demand security of the food and beverage products. Consumers in Global demand flexible packaging solutions for food and beverages they consume, along with informative labels without compromising the food's quality or safety. Hence, manufacturers are adopting solvent-based inks for digital printing packaging for food & beverage industry. Solvent-based inks contain less harmful chemicals. They are safer and more environmentally friendly than UV, solvent, or liquid toner inks. All these factors have changed the digital printing packaging paradigm. Manufacturers are extensively focusing on technological innovations in manufacturing digital and 3D printing packaging.

The major players operating in the digital printing packaging market include HP, Inc.; Xerox Holdings Corp.; Reel Appeal Ltd.; Mondi Plc; DuPont De Nemours, Inc.; Xeicon BV; Quantum Print and Packaging Ltd.; Weber Packaging Solutions, Inc.; and DS Smith Plc. These companies are emphasizing on new product launches and geographical expansions to meet the growing consumer demand worldwide. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share. These market players focus heavily on new product launches and regional expansions to increase their product range in specialty portfolios.

Digital Printing Packaging Market Regional Insights

The regional trends and factors influencing the Digital Printing Packaging Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Digital Printing Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Printing Packaging Market

Digital Printing Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 19.13 Billion |

| Market Size by 2028 | US$ 32.26 Billion |

| Global CAGR (2022 - 2028) | 9.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Ink Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Digital Printing Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Printing Packaging Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Printing Packaging Market are:

- HP Inc

- Xerox Holdings Corp

- Reel Appeal Ltd

- Mondi Plc

- Dupont De Nemours Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Printing Packaging Market top key players overview

Report Spotlights

- Progressive industry trends in the digital printing packaging market to help companies develop effective long-term strategies

- Business growth strategies adopted by the digital printing packaging market players in developed and developing countries

- Quantitative analysis of the market from 2020 to 2028

- Estimation of global demand for digital printing packaging

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the digital printing packaging market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the digital printing packaging market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the digital printing packaging market at various nodes

- A detailed overview and digital printing packaging industry dynamics

- Size of the digital printing packaging market in various regions with promising growth opportunities

Frequently Asked Questions

What are the key drivers for the growth of the global digital printing packaging market?

Technological advancements in digital printing is driving the digital printing packaging market. Digital printing offers packaging personalization, production flexibility, and saves packaging time to market. Due to various equipment improvements and technological developments, brand owners and packaging converters are opting for digital printing.

Based on the packaging type, which segment is projected to grow at the fastest CAGR over the forecast period?

Based on the packaging type, flexible packaging segment is projected to grow at the fastest CAGR over the forecast period. Digital printing on flexible packaging negates the need for labels and cardboard inserts. Therefore, this results in a significant reduction of waste, lower inventory requirements, and faster speed to market dynamics.

What is the largest region of the global digital printing packaging market?

Asia Pacific accounted for the largest share of the global digital printing packaging market. China, Japan, and India are the major consumers in the digital printing packaging market due to the high demand for food and beverage products in these countries. The soaring demand for food packaging and high emphasis on packaged foods labels that share information about the product's storage life, composition, and nutritional content of products are the major reasons boosting the digital printing market in Asia Pacific.

Based on the ink type, why does the solvent-based segment have the largest revenue share?

Solvent-based inks are composed of pigment and resin (binder), which forms a solid component of the ink, and solvent as a carrier agent. The solvent-based ink is sprayed on a substrate during the digital printing process, which leads to the evaporation of the solvent, leaving behind a dry layer of ink. Solvent-based inks are relatively inexpensive. It has a wide range of digital print applications on various substrates.

Can you list some of the major players operating in the global digital printing packaging market?

The major players operating in the global digital printing packaging market are HP Inc, Xerox Holdings Corp, Reel Appeal Ltd, Mondi Plc, Dupont De Nemours Inc, Quad/Graphics Inc, Xeikon Bv, Quantum Print And Packaging Ltd, Weber Packaging Solutions Inc, and DS Smith Plc.

What are the opportunities for digital printing packaging in the global market?

Rising demand for sustainable packaging is expected to provide potential market opportunities in the coming years in the digital printing packaging. Consumers across the globe are shifting toward convenient and sustainable packaging material.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Digital Printing Packaging Market

- HP Inc

- Xerox Holdings Corp

- Reel Appeal Ltd

- Mondi Plc

- Dupont De Nemours Inc

- Quad/Graphics Inc

- Xeikon Bv

- Quantum Print and Packaging Ltd

- Weber Packaging Solutions Inc

- DS Smith Plc

Get Free Sample For

Get Free Sample For