Electronic Contract Assembly Market Dynamics and Trends by 2028

Electronic Contract Assembly Market Forecast to 2028 - Industry Analysis By Service (Electronic Design & Engineering, Electronic Assembly, and Electronic Manufacturing) and End User (Aerospace, Industrial Automation, Semiconductor, IT & Telecom, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : May 2023

- Report Code : TIPRE00009011

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 152

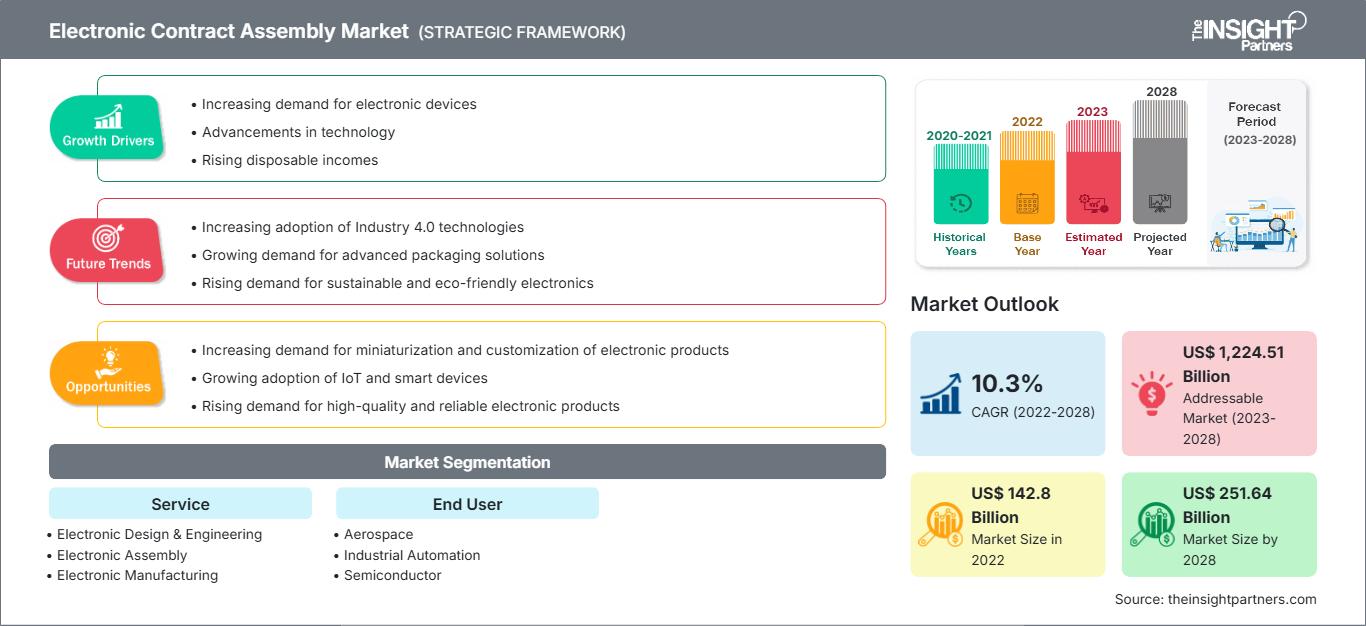

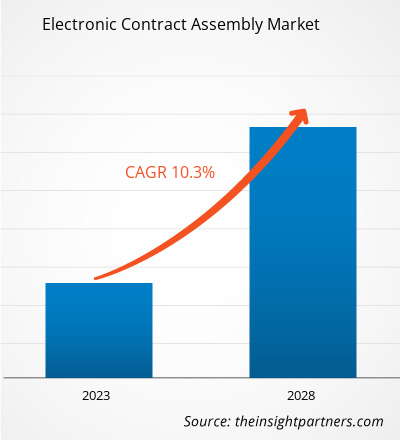

[Research Report] The electronic contract assembly market is expected to grow from US$ 142,795.06 million in 2022 to US$ 251,637.62 million by 2028; it is anticipated to register a CAGR of 10.3% from 2023 to 2028.

The increasing demand for functionalities such as sub-assembly manufacturing, functional testing, and component assembly from various manufacturers is likely to boost the electronic contract assembly market growth during the forecast period. Implementation of advanced technologies by service providers and expansion of their manufacturing capacities are also expected to contribute to electronic contract assembly market growth in the coming years. Rising purchasing power of consumers and growing demand for electronics will also fuel market growth in the future. There is an emerging trend among service providers to invest heavily in research and development activities and adopt advanced technologies to improve their manufacturing capacity and strengthen their market position. According to the Consumer Electronics and Appliances Manufacturers Association (CEAMA), the appliances & consumer electronics industry in India is anticipated to report significant growth by 2026 with an estimated market size increase of more than two-fold, reaching a value of up to US$ 26.81 billion. This industry valuation is expected to create new business opportunities, attract investments, and stimulate economic growth in the country. Growth in the electronic contract assembly market opportunities can be created for its end users such as Apple and IBM to manufacture their components.

The rising consumption of consumer electronics, computing technology, data storage technology, and wireless devices is contributing to the semiconductor industry's growth. According to the Semiconductor Industry Association (SIA), in the second half of 2022, global semiconductor sales were valued at US$ 574 billion, a 3.3% increase over 2021 sales. Semiconductors play an essential role in a wide range of products across all segments of the global economy as a key technology enabler. As a result, various governments are focusing on enhancing their semiconductor production capabilities. For instance, in December 2021, the Indian government announced a US$ 10 billion incentive plan to boost the semiconductor chip manufacturing of the country. The government offered support of up to 50% of the project cost to eligible companies under this incentive plan. Such government initiatives are attracting global market players to expand their manufacturing facilities in India. For instance, in September 2022, Foxconn, a Taiwanese multinational electronics contract manufacturer, and Vedanta, a local conglomerate of India, announced a US$ 19.5 billion investment to set up a semiconductor and display production facility in India. Thus, the growing semiconductor industry is contributing to the growth and different electronic contract assembly market opportunities.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectronic Contract Assembly Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Electronic Contract Assembly Market

Various European countries imposed strict lockdowns and restrictions on human movement in 2020. The supply chain industry experienced major disruptions during the COVID-19 pandemic. However, the pandemic has positively impacted the automation technology market due to the increased demand of electronic devices. There are several prominent players in the automation industry, such as Siemens, ABB, and Schneider Electric which are taking initiatives to drive automation market. The Netherlands/Belgium, the UK, the Nordics, and DACH are European automation hotspots. According to World Economic Forum, in 2021, Western Europe's automation and integration technology market grew by 16%. The growth of the automation industry will provide several opportunities to the electronic contract assembly market as the use of automation in electronic devices is increasing immensely Therefore, the growing automation industry may contribute to the growth of the electronic contract assembly market.

Market Insights – Electronic Contract Assembly Market

The electronic contract assembly market in North America is sub segmented into the US, Canada, and Mexico. Electronic products are increasingly adopted in industries such as automation, semiconductors, and IT & telecom. According to Semiconductor Industry Association (SIA), in 2022, the region registered the highest increase in semiconductor production to date. Semiconductor companies in the US invest nearly one-fifth of their annual revenues in R&D; collectively, they recorded an investment of US$ 50.2 billion in R&D in 2021.

In technology, semiconductors are vital to powering everything, such as toys, cars, smartphones, and thermostats. Semiconductors have also contributed to the proliferation of the electronics industry and the introduction of breakthrough technologies such as machine learning and artificial intelligence. In May 2021, chip makers, tech giants, and cloud companies in the US partnered to push semiconductor funding for launching new semiconductor products. The availability of such robust funding for semiconductor chips would help the US build the surplus capacity required to have sturdier supply chains to ensure access to different technologies when needed.

Electronic Contract Assembly

Electronic Contract Assembly Market Regional InsightsThe regional trends influencing the Electronic Contract Assembly Market have been analyzed across key geographies.

Electronic Contract Assembly Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 142.8 Billion |

| Market Size by 2028 | US$ 251.64 Billion |

| Global CAGR (2022 - 2028) | 10.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Service

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electronic Contract Assembly Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Contract Assembly Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Based on geography, the electronic contract assembly market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). Creation Technologies LP, Precision Manufacturing Company Inc, Benchmark Electronics Inc, Celestica Inc, Compal Electronics Inc, Fabrinet Co Ltd, Flex Ltd, Matric Group Inc, Jabil Inc, and Filtronic Plc are key electronic contract assembly market players.

Electronic contract assembly market players mainly focus on tailor-made solutions to create customer value.

- In April 2023, Benchmark Electronics' launched new Precision Technologies facility in Mesa, Arizona, which is a strategic move to support the semiconductor industry's growth in the United States. The company is investing US$20 million in providing engineering and manufacturing solutions for semiconductor capital equipment building blocks and solutions.

- In May 2020, Celestica, a company specializing in design, manufacturing, and supply chain solutions, was awarded a contract to produce 7,500 ventilators for StarFish Medical, a Canadian medical device manufacturer.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For