ELISA Diagnostics Tests Market Growth Opportunities and Forecast by 2030

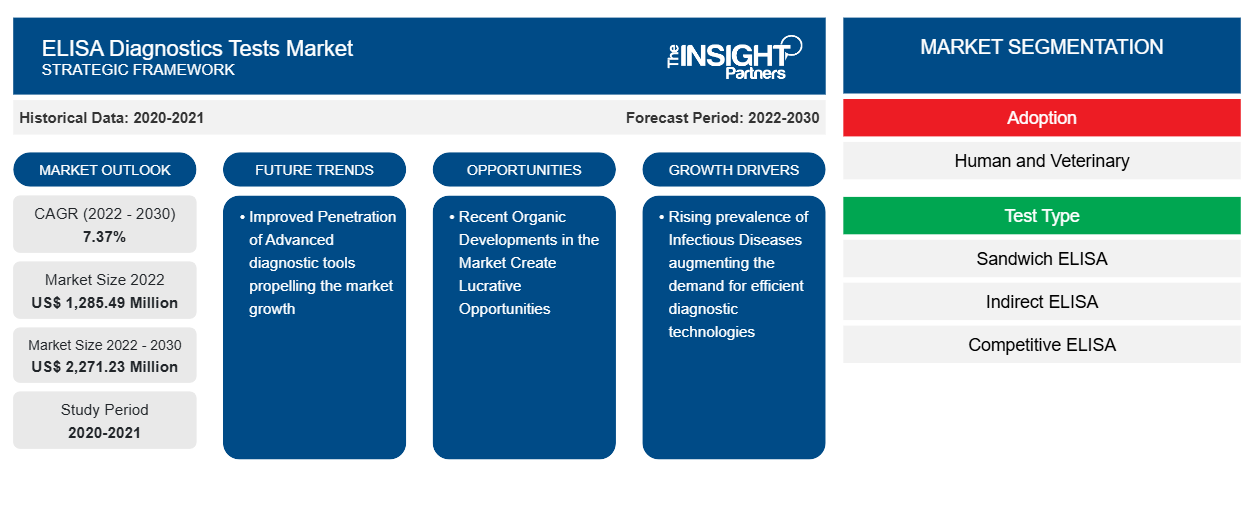

ELISA Diagnostics Tests Market Size and Forecast (2020-2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Adoption (Human and Veterinary), Test Type (Sandwich ELISA, Indirect ELISA, Competitive ELISA, and Multiple & Portable ELISA), Application (Autoimmune Diseases, Infectious Diseases, Cancer Diagnosis, Protein Quantification, and Others), End User (Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, Veterinary Hospitals & Diagnostic Laboratories, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Status : Published

- Report Code : TIPRE00030120

- Category : Life Sciences

- No. of Pages : 199

- Available Report Formats :

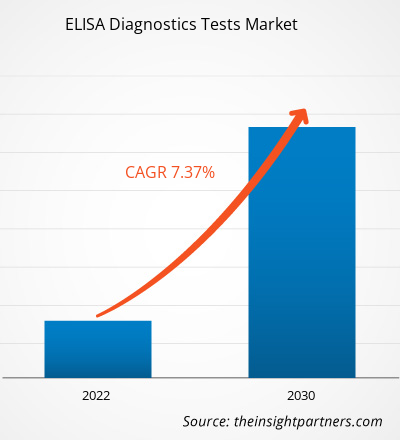

The ELISA diagnostic test market size is expected to grow from US$ 1,285.49 million in 2022 to US$ 2,271.23 million by 2030; it is estimated to register a CAGR of 7.37% from 2022 to 2030. Advancements in ELISA-based procedures resulting in increased accuracy are likely to remain key trends in the market.

ELISA Diagnostics Tests Market Analysis

The rising prevalence of infectious diseases among animals and increasing incidences of human infections are the major factors driving the market growth. According to the Centers for Disease Control and Prevention (CDC) report, enteric diseases linked to animals or environments account for 450,000 cases of illnesses, 5,000 hospitalizations, and 76 deaths among humans in the US alone. Additionally, as per a CDC report published in 2022, every year, 4 in 10 adults in the US have two or more diseases, with 6 in 10 adults having a chronic disease. Moreover, innovative product launches and recent developments in the market are expected to create lucrative opportunities for the ELISA diagnostics test market during 2022-2030.

ELISA Diagnostics Tests Market Overview

The rising prevalence of infectious disease among animals and increasing incidences of human infections are the major factors driving the market growth. North America accounts for the major market share closely followed by Europe. The US holds the major market share owing the increasing prevalence of infectious diseases among humans and animals leads to the increased use of ELISA diagnostics test followed by the new product launches by major market players headquartered in the country. Asia Pacific is anticipated to register a significant growth rate owing to the rising animal-associated infection to humans is a standalone factor responsible for the influential market growth in Asia Pacific region. China is one of the major countries where ecology poses a risk for emerging, re-emerging, and novel diseases that could threaten China and the Rest of world owing to the vast population of ~ 1.4 billion and 50% of the world’s livestock. However, The ELISA diagnostic test market in India is expected to flourish during the forecast period owing to increasing government funding, rising healthcare costs, and growing adoption of technologically advanced diagnostic equipment in healthcare organizations.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONELISA Diagnostics Tests Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ELISA Diagnostics Tests Market Drivers and Opportunities

Increasing incidence of Human infections to Favor Market

According to the CDC report published in 2022, every year, 4 in 10 adults in the US have two or more diseases, with 6 in 10 adults having a chronic disease. Among the chronic diseases, over 1.7 million cancer diagnoses are conducted, and nearly 600,000 cancer deaths are recorded every year in the US. Additionally, more than 34 million people in the US (10.5%) have diabetes, with 88 million adults (more than 1 in 3) having prediabetes, resulting in an increase in the risk of suffering from type 2 diabetes. The healthcare expenditure on death and disability due to chronic diseases accounts for US$ 4.1 trillion annually in the US alone.

In humans, ELISA test is used as a biomarker to detect cancer, infectious diseases, autoimmunity, endocrinology diagnosis, immunology & cytokines, cell adhesion molecules (CAMs), and others. ELISA testing helps detect cancer at the early stage of diagnostic processes, offering a better chance for patient survival and getting appropriate treatment initially. Therefore, demand for ELISA testing is high across the world resulting in market growth during the forecast period.

Recent Developments in the Market Create Lucrative Opportunities

ELISA is one of the most widely used immunoassay tests owing to its various advantages such as flexibility, sensitivity, and easy-to-use features. Additionally, the low cost of ELISA test kit and multifaceted applicability associated with high-throughput testing make it an ideal solution for various research and IVD requirements. With low-cost applicability, product innovations in the test kits increase the demand for human and animal research led to the new product launches in the market. For instance, in June 2022, EUROIMMUN launched two CE marked assays – the Anti-SARS-CoV-2 RBD ChLIA (IgG) and the Anti-SARS-CoV-2 Omicron ELISA (IgG). Both test systems enable the detection of IgG antibodies formed against SARS-CoV-2 and are available to laboratories in countries that accept the CE mark. Additionally, in May 2022, Agdia, Inc. commercialized its assays for detection of Rhizoctonia solani on ELISA and ImmunoStrip platforms.

ELISA Diagnostics Tests Market Report Segmentation Analysis

Key segments that contributed to the derivation of the ELISA diagnostics tests market analysis are adoption, test type, application, and end user.

- Based on adoption, the ELISA diagnostics tests market is bifurcated into human and veterinary. The human segment held a larger market share in 2022.

- By test type, the market is segmented into sandwich ELISA, indirect ELISA, competitive ELISA, and multiple & portable ELISA. The indirect ELISA segment held the largest share of the market in 2022.

- In terms of application, the market is segmented into autoimmune diseases, infectious disease, cancer diagnosis, protein quantification, and others. The infectious disease segment held a significant share of the market in 2022.

- Based on end user, the market is classified into hospitals & diagnostic centers, pharmaceutical & biotechnology companies, veterinary hospital & diagnostic laboratories, and others. The hospitals & diagnostic centers segment held a significant share of the market in 2023.

ELISA Diagnostics Tests Market Share Analysis by Geography

The geographic scope of the ELISA diagnostics tests market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market owing to the rising infectious diseases among humans, acting as a standalone factor positively influencing the growth of the market. Additionally, technological advancements in ELISA diagnostic kits further enhance the overall market growth during 2022-2030. The US accounts for the major market share owing to the rising incidences of infectious diseases among humans due to high zoonotic disease cases boosting the adoption of ELISA diagnostic tests in the US. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

ELISA Diagnostics Tests Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,285.49 Million |

| Market Size by 2030 | US$ 2,271.23 Million |

| Global CAGR (2022 - 2030) | 7.37% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Adoption

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

ELISA Diagnostics Tests Market Players Density: Understanding Its Impact on Business Dynamics

The ELISA Diagnostics Tests Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

ELISA Diagnostics Tests Market News and Recent Developments

The ELISA diagnostics tests market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the ELISA diagnostics tests market are listed below:

- Charles River Laboratories International, Inc. launched its first Enzyme-Linked Immunosorbent Assay (ELISA) Kit for the detection and quantitation of residual host cell proteins (HCP) in CHO-based biotherapeutics. (Source: Charles River, Company Website, February 2023)

- Neogen Corporation launched its innovative Veratox VIP assay for the detection of walnut, the third assay in Neogen's Veratox VIP line of enhanced quantitative ELISA products. (Source: Neogen Corporation, Press Release, November 2023)

- Quest Diagnostics has been granted breakthrough device designation from the U.S. Food and Drug Administration (FDA) for AAVrh74 ELISA assay (CDx). (Source: Quest Diagnostics, Newsletter, September 2023)

ELISA Diagnostics Tests Market Report Coverage and Deliverables

The “ELISA Diagnostics Tests Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- ELISA diagnostics tests market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- ELISA diagnostics tests market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- ELISA diagnostics tests market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the ELISA diagnostics tests market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For