EMEA Fixed Wing Air Ambulance Services Market Size, Share & Forecast 2025–2031

EMEA Fixed Wing Air Ambulance Services Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Model (Hospital-Based, Government Run and Independent), End User (Domestic and International), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00041053

- Category : Aerospace and Defense

- No. of Pages : 166

- Available Report Formats :

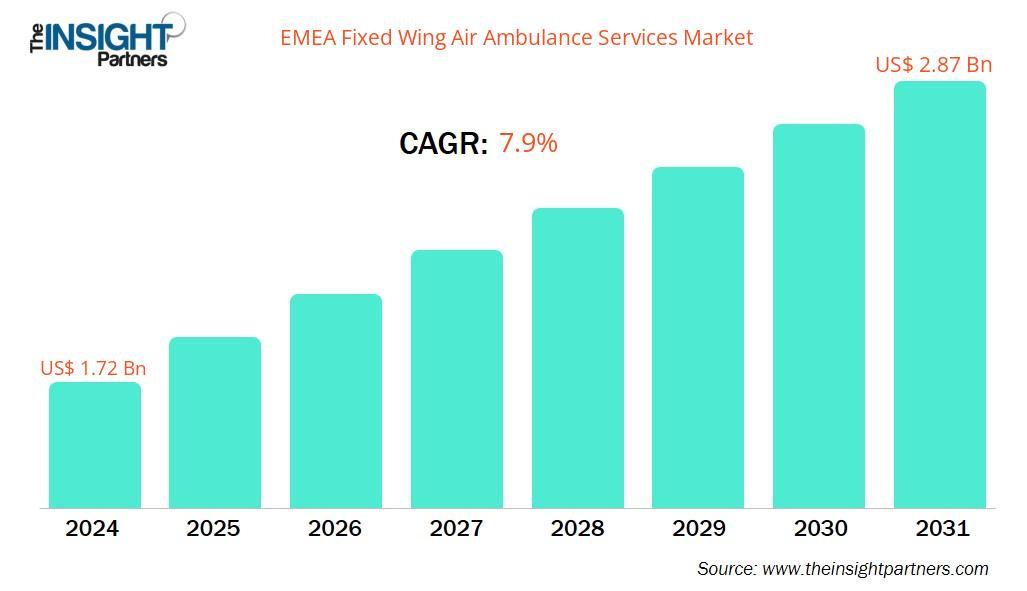

The EMEA Fixed Wing Air Ambulance Services Market size is projected to reach US$ 3.03 billion by 2031 from US$ 1.82 billion in 2024. The market is expected to register a CAGR of 7.9% during 2025–2031.

EMEA Fixed Wing Air Ambulance Services Market Analysis

The fixed-wing air ambulance market is growing due to increasing demand for rapid medical transport, rising cases of chronic and critical conditions, and expanding healthcare access in remote areas. Long-distance transport needs are driving a shift from ground to air ambulances, while advancements in telemedicine and real-time monitoring are enhancing in-flight care and service efficiency.

EMEA Fixed Wing Air Ambulance Services Market Overview

Fixed-wing air ambulances provide rapid, long-distance transport for patients, medical staff, and critical equipment when ground or helicopter options are impractical. Designed for complex medical needs, they support emergencies, inter-facility transfers, organ transport, and repatriation. Their speed, range, and adaptability make them vital for delivering care in remote or underserved areas.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEMEA Fixed Wing Air Ambulance Services Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EMEA Fixed Wing Air Ambulance Services Market Drivers and Opportunities

Market Drivers:

- Rising Incidence of Chronic and Critical Illnesses The growing number of patients suffering from cardiovascular diseases, stroke, trauma, and other time-sensitive conditions is driving demand for fast, long-distance medical transport—making fixed wing air ambulances a vital component of emergency healthcare delivery.

- Increasing Demand for Inter-Facility Patient Transfers Fixed wing air ambulances enable efficient transfers between hospitals, especially from rural or less-equipped centers to advanced medical facilities. This feature is crucial for patients requiring specialized care that is not available locally.

- Advancements in Onboard Medical Equipment Including sophisticated life support systems, ventilators, and telemedicine capabilities in these aircraft enhances the care of patients during transport. It fosters trust in air medical services and encourages wider use and acceptance among healthcare providers.

- Expansion of Medical Tourism and Cross-Border Care The rise in cross-border medical treatments is fueling demand for reliable and fast patient transport. Fixed wing air ambulances are essential in transporting international patients who require urgent care or post-surgery travel assistance.

- Government and Insurance Support Improved regulatory frameworks and the inclusion of air ambulance services in insurance plans are supporting market growth. Public-private partnerships and subsidies in remote areas help increase accessibility to these life-saving services.

Market Opportunities:

- Untapped Potential in Emerging Economies Emerging markets with limited access to advanced medical infrastructure offer strong opportunities. As healthcare investment increases and aviation networks expand, demand for fixed wing air ambulance services in these regions is expected to rise.

- Integration with Telemedicine and AI Diagnostics Incorporating telemedicine systems and AI-powered diagnostic tools onboard enhances real-time patient assessment during transit, creating a competitive edge for service providers and improving outcomes in critical care situations.

- Fleet Modernization and Green Aviation Solutions There is growing interest in upgrading to fuel-efficient, low-emission aircraft to meet sustainability goals. It creates opportunities for providers to align with green aviation trends while reducing operational costs.

- Customized Services for Elderly and Disabled Travelers With aging populations worldwide, offering specialized medical transport services tailored to elderly or mobility-impaired patients can open new niche markets, especially in areas with significant senior demographics.

- Public-Private Partnerships in Rural Healthcare Delivery Collaborations between governments and private operators to provide air ambulance coverage in rural or hard-to-reach regions represent a key opportunity. These initiatives can improve access to emergency care and expand market presence.

EMEA Fixed Wing Air Ambulance Services Market Report Segmentation Analysis

The EMEA fixed wing air ambulance services market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Hospital-Based: These services provide rapid patient transport as an extension of hospital care, often staffed with the hospital’s medical team.

- Government Run: Managed and funded by government agencies, these services focus on public health emergencies, disaster response, and coverage in remote or underserved areas.

- Independent: Privately owned and operated, independent providers offer flexible, often charter-based air ambulance services that cater to both emergency and non-emergency medical transport needs.

By Capacity:

- Domestic: These services operate within national borders, providing quick and efficient medical transport for patients between cities or regions in the same country.

- International: Focused on cross-border or long-distance medical evacuations, international services cater to patients who need specialized care abroad or repatriation to their home country.

By Geography:

- Europe

- MEA

EMEA Fixed Wing Air Ambulance Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.82 Billion |

| Market Size by 2031 | US$ 3.03 Billion |

| CAGR (2025 - 2031) | 7.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Model

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

EMEA Fixed Wing Air Ambulance Services Market Players Density: Understanding Its Impact on Business Dynamics

The EMEA Fixed Wing Air Ambulance Services Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

EMEA Fixed Wing Air Ambulance Services Market Share Analysis by Geography

The fixed wing air ambulance services market in Europe is expected to witness the fastest growth due to a rise in demand for rapid medical transportation, particularly for critical patients in remote or underserved areas. Additionally, advancements in aviation and onboard medical equipment are making air ambulance services more reliable and accessible. Emerging markets in South America also have many untapped opportunities for fixed wing air ambulance service providers to expand.

The EMEA fixed wing air ambulance services market grows differently in both regions due to a rise in accident cases, CVDs, and the need for air ambulance services. Below is a summary of market share and trends by region:

1. Europe

- Market Share: Accounts for the largest portion of the EMEA market

-

Key Drivers:

- The market expansion is driven by growing cross-border patient transport within the EU, increased government support for emergency medical services (EMS), and rising demand for neonatal and ICU-level patient transport.

- Trends: Focus on fleet modernization and eco-efficient aircraft

2. MEA

- Market Share: Growing steadily with improved healthcare investments

-

Key Drivers:

- The market is supported by government investment, medical tourism, and rising demand for critical care.

- Trends: Increasing collaboration with private hospitals and insurers

EMEA Fixed Wing Air Ambulance Services Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as DRF Luftrettung and FAI Aviation Group. Regional and niche providers, such as UNICAIR GmbH (Germany), Aero-Dienst GmbH (Germany), and Swiss Air-Rescue Rega (Switzerland), contribute to the competitive landscape across regions.

This high level of competition urges companies to stand out by offering:

- Enhanced Patient Safety and Security Features

- Value-Added Medical and Operational Services

- Flexible and Competitive Pricing Models

- Robust Customer Support and Medical Coordination

Opportunities and Strategic Moves

- Air ambulance operators are increasingly forming partnerships with hospitals, private healthcare networks, and insurance providers to expand service coverage and streamline patient transfer protocols, particularly in high-demand or remote regions.

- Some service providers are offering bundled packages that include medical staff, advanced onboard equipment, real-time monitoring, and post-transfer care coordination—shifting toward comprehensive, outcome-based healthcare transport solutions.

- Vendors are focusing on scalable and modular aircraft interior designs that allow quick reconfiguration based on patient needs, enabling efficient use of space while meeting varied medical transport requirements.

Other companies analyzed during the course of research:

- JET EXECUTIVE INTERNATIONAL CHARTER GMBH & CO. KG

- Swiss Air Ambulance

- Luxembourg Air Rescue

- Tyrol Air Ambulance GmbH

- S.O.S Air. Tüm Hakları Saklıdır.

- AirMed International

- Air Methods

- REACH

- Life Flight Network

- PHI Air Medical

- REVA, Inc.

- Humancare World Wide

- EMSOS

- Gnext Technologies

- European Air Ambulance (EAA)

EMEA Fixed Wing Air Ambulance Services Market News and Recent Developments

- FAI Air Ambulance achieves accreditation for its Dubai medical escort service FAI rent-a-jet GmbH’s Air Ambulance Division announced it has received Commercial Airline Medical Escort (CAME) accreditation from the European Aeromedical Institute (EURAMI) for its Dubai-based medical escort service. It follows FAI’s accreditation as an approved EURAMI provider in early 2023.

- Babcock launches enhanced static winch trainers to support Ambulance Victoria HEMS operations Babcock Australasia (Babcock) introduced three upgraded static winch trainers into its Victorian aviation operations, as part of its commitment to safety and advanced air crew training. The winch trainers provide Babcock Air Crew Officers (ACO) and Air Ambulance Victoria MICA Flight Paramedics opportunities to practice and refine their winch rescue skills in simulated conditions.

- Aero-Dienst GmbH and Engine Assurance Program (EAP) sign a framework agreement for engine and APU maintenance in Europe Aero-Dienst GmbH, the Nuremberg full-service provider for business aviation and air ambulance services, signed a framework agreement with Dallas, Texas-based engine services provider EAP. The goal of this agreement is to optimize and expand maintenance and repair services for engines and APUs in Europe, with a focus on Honeywell TFE731 engines.

EMEA Fixed Wing Air Ambulance Services Market Report Coverage and Deliverables

The "EMEA Fixed Wing Air Ambulance Services Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- EMEA fixed wing air ambulance services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- EMEA Fixed Wing Air Ambulance Services Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- EMEA Fixed Wing Air Ambulance Services Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the EMEA Fixed Wing Air Ambulance Services Market

- Detailed company profiles

Frequently Asked Questions

1. Europe: Market growth is driven by strong EMS systems, cross-border transfers, advanced healthcare, and demand for long-distance critical care.

2 MEA: Growth is fueled by expanding healthcare infrastructure, government investment, rising need for critical care transport, and improved aviation networks.

1. Domestic: Focuses on timely intra-country patient transfers, ensuring rapid access to specialized care across cities and regions.

2. International: Provides cross-border medical evacuations and repatriations, supporting global medical tourism and emergency transport needs.

1. Rising Incidence of Chronic and Critical Illnesses

Growing cases of time-sensitive conditions are increasing the need for rapid medical transport.

2. Increasing Demand for Inter-Facility Patient Transfers

Fixed-wing ambulances support efficient transfers to advanced care centers, especially from rural areas.

3. Advancements in Onboard Medical Equipment

Enhanced onboard systems improve in-transit care and boost confidence in air medical services.

1. High Operational and Maintenance Costs: Advanced care capabilities come with significant costs for equipment, personnel, and regulatory compliance, potentially limiting accessibility and slowing market growth.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For