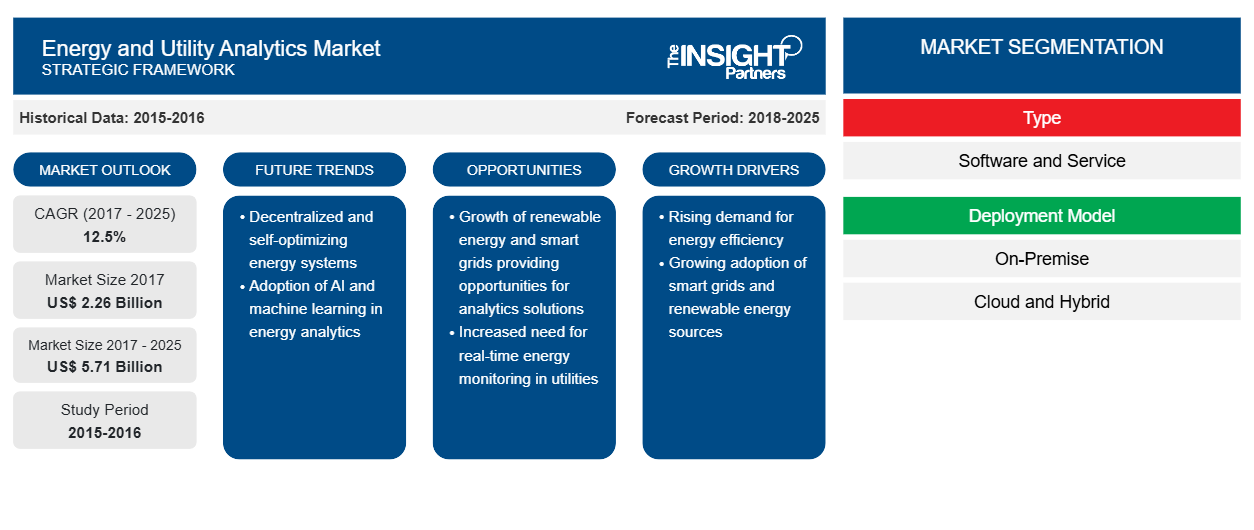

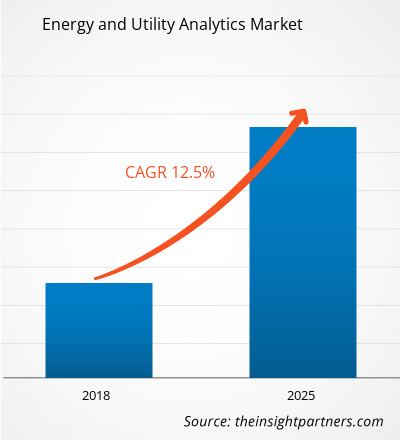

The energy & utility analytics market accounted for US$ 2,260.0 Mn in 2017 and is expected to grow at a CAGR of 12.5% during the forecast period 2017 – 2025, to account for US$ 5,713.3 Mn in 2025.

Owing to the rising advent of smart meters, smart sensors and IoT based technologies the energy and utility industry has experienced a major transformation, particularly in terms of data generation. This transformation has further driven the implementation of analytical solutions for the data generated by utility grids, oil wells, generation stations, and energy production sectors. With the help of these analytical solutions the distributed generations have gained the capability to derive meaningful insights that can be used in operational decision making. Further, the analytics in the energy and utility industry provides an unprecedented knowledge into real-time demand and supply gaps, asset utilization and downtimes.

As analytics enables the energy and utility industry to realize the full potential of their intelligent networks and improve overall ROI on capital investments, the widespread adoption and implementation of smart devices are anticipated to drive the demand for analytics in global energy and utility industry.

In addition, the analytics also play a critical role in transforming enormous amount of data from the information assets, such as meters, sensors, and SCADA into actionable insights, which further facilitates into prediction and prescription of critical decision making, particularly for analysing Quality of Service, outage management and preventive maintenance activities. The myriad advantages offered by the analytics is therefore expected to exponentially drive the energy and utility analytics market for the coming years.

Market Insights

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Energy and Utility Analytics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Energy and Utility Analytics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Data sharing will be a widespread trend

Until now the companies were obstructive towards sharing their data, due to persisting security threat among the major industries of energy and utility sector. The oil & gas industry, in particular, was most restrictive towards data sharing as the loss of operational data can enable the unlocking of their competitive advantage, which can hinder its future growth.

However, as the technology companies raise their standards to mitigate the security risks, the energy and utility organizations are projected to realize the myriad advantages offered by data sharing. Some of these advantages include the monitoring capabilities attained by the equipment providers, which subsequently would enable these equipment providers to assess the maintenance issues on the real-time basis. Further, the data sharing would also cater as the foundation for equipment as a services trend that would allow the energy and utility industries to switch from purchasing of the equipment to investing into leasing of the equipment.

The emergence of data sharing will also generate adoption opportunities for analytical solutions such as robust demand response networks, supply chain optimization and other programs that would make a significant contribution to the smart cities growth. Although the data sharing is at present limited to only certain developed economies of the world, the trend is expected to spur in the near future. This free flow of information would further accelerate the demand for analytical capabilities for more efficient decision-making capabilities.

Type Market Insights

Smart revolution has resulted in increasing operational complexities for Energy & Utility companies across the globe. Additionally, there is a tremendous growth in the volume, diversity, as well as complexity of data. With the increasing competition and highly regulated environment, the companies operating in the energy and utility industry are implementing analytical capabilities for efficiently competing in the market place. The type segment of energy and utility analytics market is categorized into solutions and services.

Services Market Insight

The service segment of energy and utility analytics is bifurcated into managed services and professional services. Rapid technology advancements have stressed the necessity to comprehend the complexities of the IT environment and assure that the technology is synchronized with the business objectives of energy and utility companies. Integrating multiple IT systems that serve different departments, functions, and stages in product lifecycles have been a key challenge faced by organizations today on their growth path. Thus, organizations are seeking for implementing technology-driven business models to attain a competitive advantage.

Deployment Model Market Insight

The Global Energy and Utility Analytics market is segmented on basis of deployment type is categorized into on-premise, cloud, and hybrid. In the present scenario, the need for analytics solutions by the energy and utility companies is increasing. However, the threat of cybercrimes always remains a challenge for companies adopting the analytics software. Thus, many companies select on-premise deployment model in order to protect their data and keep their data within their reach.

Application Market Insight

The global energy and utility market by application is further segmented into load forecasting, customer analytics, grid analytics, asset management, smart meter analytics and others. Demand forecasting of electricity is an integral and central process for strategizing facility expansion and periodical operations in the energy & power sector. And as demand patterns of different sectors are nearly very complex because of deregulations among the energy markets, selecting a suitable forecasting model for a particular electricity network has become a relatively tough task for the energy and utility industries. Although there are various forecasting methods present in the market, none can be generalized for all demand patterns.

Vertical Market Insight

The industry vertical segment of Global Energy and Utility analytics market is segmented into oil & gas, nuclear power, renewable energy, utility, and others. The oil & gas companies are rigorously adopting analytics solutions as the industry continues to seek risk management on several frontages. In addition, the increasing cost of extraction and drilling is also expected to create a challenge for companies operating in oil & gas industry. Thus, the companies are embedding analytics for reservoir characterization, forecasting production, drilling optimization, and improve reservoir characterization complexities among other such benefits. Further, with the government initiatives towards renewable energy production, the renewable energy installations are also expected to notice a significant growth globally.

The players operating in the enterprise content management market focus on strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In April 2018, BuildingIQ entered into a partnership with Cypress Envirosystems, to enhance the productivity and a step towards saving energy. BuildingIQ is to combine its predictive optimization with the Envirosystems’ advanced thermostats provided by Cypress. The partnership aims to provide old buildings with the AI-driven solutions to offer better insight about the system. Also, it would also allow the old buildings to lower electrical energy usage by 30%.

- In February 2018, EnergySavvy and Snohomish County Public Utility District introduced the PUD's new Home Energy Profile which is an online assessment tool that enables customers to save the energy of their homes.

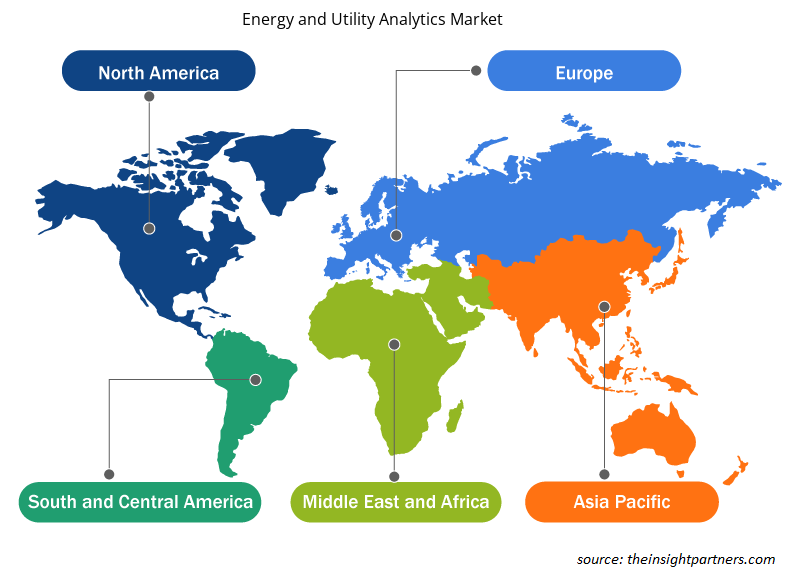

Energy and Utility Analytics Market Regional Insights

The regional trends and factors influencing the Energy and Utility Analytics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Energy and Utility Analytics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Energy and Utility Analytics Market

Energy and Utility Analytics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 2.26 Billion |

| Market Size by 2025 | US$ 5.71 Billion |

| Global CAGR (2017 - 2025) | 12.5% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Energy and Utility Analytics Market Players Density: Understanding Its Impact on Business Dynamics

The Energy and Utility Analytics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Energy and Utility Analytics Market are:

- Atos SE

- BUILDINGIQ, INC.

- CAPGEMINI SE

- IBM Corporation

- Infosys Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Energy and Utility Analytics Market top key players overview

Global Energy & utility analytics Market Segments:

Energy & utility analytics Market – Type

- Solutions

- Services

Energy & utility analytics Market – Service

- Professional Services

- Managed Services

Energy & utility analytics Market – Deployment Model

- On-Premise

- Cloud

- Hybrid

Energy & utility analytics Market – Application

- Load Forecasting

- Customer Analytics

- Grid analytics

- Asset Management

- Smart Meter Analytics

- Others

Energy & utility analytics Market – By Vertical

- Oil & Gas

- Renewable Energy

- Nuclear Power

- Electricity

- Water

- Others

Energy & utility analytics Market – By Geography

North America

- U.S.

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- Rest of APAC

Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

South America (SAM)

- Brazil

- Rest of SAM

Companies

- International Business Machines Corporation

- Oracle Corporation

- BuildingIQ, Inc.

- Capgemini SE

- EnergySavvy Inc.

- Infosys Limited

- SAP SE

- SAS Institute Inc.

- WegoWise, Inc.

- Wipro Limited

Frequently Asked Questions

Which type-based segment is expected to dominate the market in the forecast period?

The energy and utility analytics market is led by software segment with highest share in 2019, and service segment is expected to dominate the market on the basis of highest CAGR. The dominance of software segment is mainly because the energy and utility industry is still into implementation phase of the analytics, however in the coming years as the penetration of cloud based solutions increases majority of the solution providers would shift to analytics as a services, contributing to the services sector in energy and utility market.

What are reasons behind energy and utility analytics market growth?

The growth of the energy and utility analytics market growth is primarily attributed to the advanced decision making capabilities offered by analytics solutions. Moreover, the enhanced customer service capabilities and increasingly complicating oil & gas industry to drive the demand for robust analytical solutions, thereby substantially driving the energy and utility analytics market.

What are market opportunities for energy and utility analytics market?

Increasing infrastructure development and smart cities is expected to create significant opportunity for the energy and utility analytics market growth. The emerging smart cities and infrastructural development across the developing countries such as India and China have been creating the excessive opportunities in the digital analytics market. Implementation of green industrialization and use of renewable energy has been promoted by developed countries. In this era of modernization, use of smart devices and IoT technology has been raising for the real-time accessibility, effectiveness, control and easy managing. Smart cites technologies has gained momentum around the globe and set for rapid transformation. It also includes intelligent transport systems, smart waste management and robust information technology that will improve the quality of living, employment opportunities and urban services. Thereby, analytics solutions would be used for analyzing the essential decision making for the smart cities and for industrial development, as there is the requirement for monitoring and analyzing the expensive assets, manage price fluctuations and reduced operational cost.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Energy & Utility Analytics Market

- Atos SE

- BUILDINGIQ, INC.

- CAPGEMINI SE

- IBM Corporation

- Infosys Ltd.

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- WegoWise, Inc.

- Wipro Limited

Get Free Sample For

Get Free Sample For