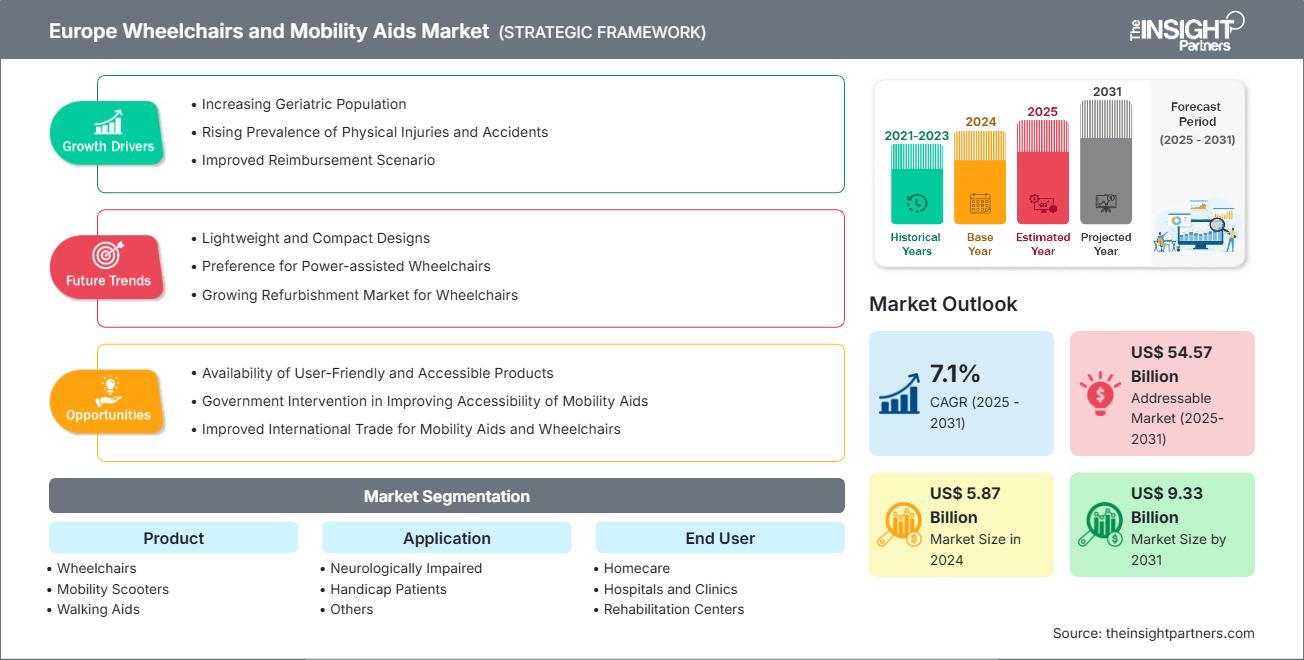

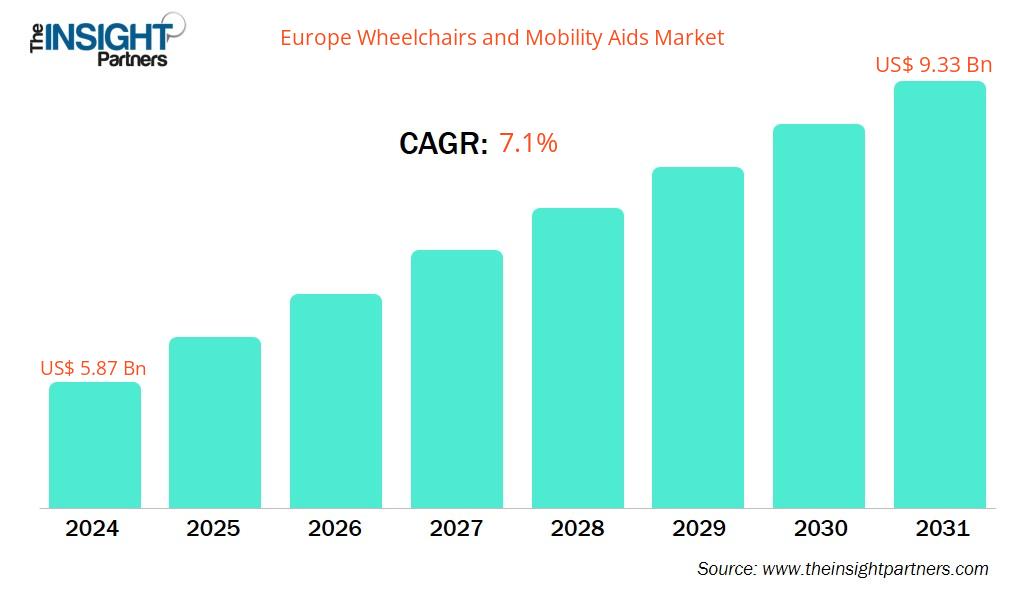

The Europe wheelchairs and mobility scooters Market size is projected to reach US$ 9.33 billion by 2031 from US$ 5.87 billion in 2024. The market is expected to register a CAGR of 7.1% from 2025 to 2031.

Europe Wheelchairs and Mobility Scooters Market Analysis

An aging population, an increase in chronic diseases, and a greater awareness of disabilities are the main factors driving the European market for wheelchairs and mobility aids. Leading manufacturers that prioritize innovation with powered and smart wheelchairs include Invacare, Ottobock, and Sunrise Medical. Consumer trust is increased by strict EU regulations that guarantee high product quality and safety. The market is expanding due to rising demand for specialized, lightweight, and technologically sophisticated mobility solutions. Government reimbursement programs also improve accessibility. The market is competitive, and the dynamics of the industry are shaped by ongoing mergers and acquisitions. In order to satisfy changing mobility needs, the European market places a strong emphasis on quality, innovation, and patient-centered solutions.

Europe Wheelchairs and Mobility Scooters Market Overview

The geographic scope of the Europe wheelchairs and mobility aids market report mainly focuses on five regions: Europe. In terms of revenue, Germany dominated the market in 2024. It is expected to continue its dominance in the Europe market during the forecast period. Germany is the largest European market for wheelchairs and mobility aids, owing to the increasing number of disabled people and rising investments by the government in the development of smart wheelchairs. According to the Observatory of Economic Complexity, Germany exported US$ 154 million worth of wheelchairs in 2022, making it the second-largest exporter worldwide. As per the Statistisches Bundesamt (Destatis), ~7.8 million severely disabled people were living in Germany in 2021. The Federal Government is focused on funding research for the development of smart wheelchair seats. In September 2021, the Federal Ministry of Education and Research (BMBF) in Germany funded a research project by Ottobock with the allocation of nearly US$ 1.08 million. In partnership with TU Dresden University, this research project is aimed at developing an intelligent seat for young wheelchair users. Moreover, the rising prevalence of chronic diseases and increasing population drive the need for robust healthcare infrastructure in Germany, which is expected to support the market progress in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Wheelchairs and Mobility Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Wheelchairs and Mobility Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Wheelchairs and Mobility Scooters Market Drivers and Opportunities

Market Drivers:

- Increasing Geriatric Population: Elderly people are more susceptible to mobility limitations, owing to which medical assistive aids are used for their movement. The proportion of the geriatric population in Europe is expected to increase significantly during the forecast period owing to a decline in the fertility rate and increased life expectancy. According to the World Economic Forum, more than 30% of the EU population will be above 65 and above by 2100. According to the WHO, the population size aged 60 and older in 2021 was 215 million and is projected to reach 247 million by 2030. Reduced muscle strength, joint problems, and balance issues are often observed in older adults, which makes it challenging to move freely. Mobility aids such as scooters, wheelchairs, and walkers are designed to provide support and assistance. These devices aid in preventing falls, reduce the risk of injuries, and enable older adults to remain engaged in their daily activities. Prominent manufacturers operating in the market are developing products for aged adults, with a greater focus on stability and comfort. Thus, the increasing elderly population is a significant driver for the growth of the wheelchair and mobility aids market in Europe.

- Rising Mobility Impairment Disorders: Arthritis, Parkinson's disease, and multiple sclerosis are among the most common mobility impairment disorders reported in Europe and Asia Pacific. According to data published in European journal of neurology In Europe, prevalence and incidence rates for Parkinson’s are estimated at approximately 108–257/100 000 per year. These conditions may cause significant mobility limitations, making it challenging for individuals to move independently. Mobility aids devices such as mobility scooters, power wheelchairs, and stairlifts provide patients with the necessary support and assistance to overcome the limitations induced due to mobility impairment. Mobility aids are gaining significant traction with the growing number of mobility-impaired individuals. In July 2023, Sunrise Medical launched QUICKIE QS5 X wheelchair. The company redefines a folding wheelchair through this lowest-weight product in its class. QS5 X requires 40% less force than other folding wheelchairs available in the market and sets the new standard for the ease and efficiency of folding. Companies in the wheelchairs and mobility aids market offer advanced technologies and customizable options to meet the unique needs of each individual. Government initiatives and policies for individuals with mobility impairment issues also contribute to the growth of the wheelchair and mobility aids market. Many countries have implemented disability-friendly guidelines and accessibility regulations that mandate public spaces and transportation to be accessible for individuals with mobility disabilities. Thus, the rising incidence and prevalence of mobility impairment disorders is a crucial factor driving the Europe wheelchair and mobility aids market growth.

- Post-Surgical and Injury Rehabilitation Needs: Growing incidence of surgeries, trauma cases, and orthopedic injuries is strong enough to fuel demand for mobility aids and wheelchairs. Patients undergoing such procedures as joint replacement surgery, spinal surgery, or fractures may need temporary or permanent mobility assistance. With increasing emphasis on early discharge and recovery at home, demand for comfortable, ergonomic, and user-friendly mobility solutions is increasing, thus making this segment an imperative growth driver of the market worldwide.

Market Opportunities:

- Availability of User-Friendly and Accessible Devices with Advanced Technologies: Advanced AI-integrated mobility devices, such as foldable wheelchairs and electric scooters help in improving the transportation accessibility for end users. In March 2023, Drive DeVilbiss Healthcare introduced the UltraFold, a new high-end 4 wheel model created to offer a perfect blend of modern design, safety, comfort, and exceptional performance. The UltraFold Auto Folding Scooter is a top-of-the-range addition to the Drive lineup, offering a range of impressive new features to further enhance the riders' experience. This new remote folding design features a fashionable slimline body, contemporary twin LED headlights, rear LED light and an automatic speed assist that slows down when cornering, giving excellent peace of mind. This advancement enhances user experience and reduces the risk of pressure sores and other issues associated with prolonged use. Thus, technological advancements have the lucrative potential to transform the wheelchair and mobility aids market through significant research and development and the launch of user-friendly accessible devices, allowing market players to cater to a broader range of patients or individuals with mobility impairments.

- Smart & Assistive Technology Integration: Smart and assistive technology integration offers a significant opportunity for the wheelchairs and mobility aids market. Technologies like AI-driven navigation, voice control, fall detection, and health monitoring promote user independence and safety. These technologies are particularly beneficial in homecare and aging-in-place environments. As there is an increase in demand for personalized, connected mobility solutions, manufacturers who invest in smart capabilities can tap into new user segments and differentiate their products in a fast-changing market.

- Expansion in Emerging Markets Emerging markets expansion provides considerable growth opportunity for the mobility aids and wheelchairs industry. Populations across Asia-Pacific, Latin America, and Africa are rapidly aging, with rising incidence of disability and enhanced health infrastructure. Growing awareness, favorable government policies, and rising middle-class incomes are fueling demand for low-cost, long-lasting mobility solutions. Companies entering these markets can leverage untapped needs and build robust brand presence in markets with negligible competition and high growth opportunities.

Europe Wheelchairs and Mobility Scooters Market Report Segmentation Analysis

The Europe wheelchairs and mobility scooters market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Wheelchairs: The wheelchairs segment is further bifurcated into type and category. Based on type the segment is further divided into Manual, Powered, Power Assisted, and Accessories. Similarly, based on category the segment is further bifurcated into new and refurbished. Manual wheelchairs can offer significant benefits such as promoting independence and quality of life to the aging population, particularly when properly selected and individualized to meet user needs. Ongoing developments and personalization by market players—such as Invacare, Sunrise Medical, and Küschall—are fueling the demand for manual wheelchairs in Europe. In May 2024, Küschall launched the new addition to its product line, Champion SL manual wheelchair. The Champion SL is a super-light (weighing only 5.9 kg) and rigid folding wheelchair that combines the convenience of the original Champion model with the high-performance features of the KSL model. With its enhanced frame rigidity, users can enjoy improved drive and reduced energy loss during propulsion, leading to a smoother and more efficient ride. The folding mechanism simplifies storage and enhances portability without compromising the wheelchair's robust structure, promoting better handling and reducing user fatigue. Powered wheelchairs offered by various manufacturers such as Invacare, Ottobock, Meyra, and Dietz Power, along with brands like Eloflex, ComfyGO, and Karma, help individuals with limited mobility, including the elderly and people with disabilities, move independently. This reduces their reliance on caregivers and allows for greater participation in daily life and social activities.

- Mobility Scooters: Mobility scooters are increasingly assisting populations across Europe by enhancing independent mobility for the elderly and people with disabilities. They reduce reliance on cars and provide a convenient, environmentally friendly alternative for short-distance travel. Scooters are generally more affordable than cars, both in terms of purchase price and operational costs, making them accessible to a wider range of people. In Europe, funding for mobility aid scooters—such as electric scooters and power chairs—is available through a mix of government programs, charitable organizations, and private financing options. For instance, Mobility Aids Grant Scheme is available for individuals with a household’s annual income below €37,500. Eden Mobility offers a wide range of mobility scooters and powered wheelchairs through a government-backed Motability Scheme. Such initiatives aim to make mobility aids more accessible and affordable for individuals with disabilities or limited mobility. Further, market players are launching innovative products in the market, which increases the demand for mobility scooters. For instance, in July 2020, Invacare launched a digital scooter visualiser in Europe.

- Walking Aids: Walking aids such as crutches, canes (walking sticks), and walkers are designed to provide stability and support for individuals with limited mobility. These aids help people maintain balance, reduce weight bearing on lower extremities, and walk more easily. Walking aids are essentially for the elderly, as well as rehabilitation and post-surgery recovery, broadening their use in healthcare settings. Technological innovations are transforming the wheelchairs and mobility aids market. Advancements such as smart walkers, rollators, and walking sticks equipped with sensors and connectivity features are gaining immense popularity, improving both safety and user experience. These innovations are creating lucrative opportunities for market players to expand their product portfolio. In August 2024, Fachhochschule Dortmund announced that the interdisciplinary start-up "STEETS," consisting of three students from Fachhochschule Dortmund, Paderborn University, and Paderborn University of Applied Sciences and Arts, is set to launch the final version of its support system for walking aids at OTWorld, which is the leading trade fair for orthopedic and rehabilitation technology. In November 2024, IM by TotalCare Europe expanded its range of walkers with the introduction of the new Forum model. This innovative walker combines the functionality of a shopping cart with that of a traditional walker and features a double high-capacity basket.

- Others: The "Others" category in the Wheelchairs and Mobility Aids market includes essential supportive devices such as transfer aids, standing aids, and postural support equipment. These products enhance mobility, safety, and independence in daily activities. Transfer aids like boards and hoists assist users in moving between surfaces safely. Standing aids help individuals transition from sitting to standing, crucial for circulation and posture. Postural support equipment including positioning belts, cushions, and trunk supports ensure proper alignment and comfort for long-term wheelchair users. This category plays a vital role in rehabilitation, elderly care, and home-based mobility solutions.

By Application:

- Neurologically Impaired: Neurological conditions such as dementia, Alzheimer, and Parkinson’s have a direct impact on the mobility of the patient. As per the European Academy of Neurology (EAN), ~60% of the European population suffers from neurological diseases. According to Alzheimer Europe, the number of people living with dementia is expected to increase to 14,298,671 in the EU27 by 2050 from the estimated 7,853,705 in 2019. In Europe, dementia is a growing public health concern among the aging populace. Therefore, the growing prevalence of neurological disorders is consequently propelling the demand for wheelchairs.

- Handicap Patients: In Europe, the prevalence of disability varies, with WHO estimates indicating that over 100 million people live with a disability. This accounts for approximately 27% of the EU population aged 16 and older, according to Consilium.europa.eu. The prevalence of disability is on the rise due to factors such as an aging population and an increase in chronic health conditions. Additionally, disability rates differ between countries. For instance, in 2023, Belgium had the highest proportion of people with disabilities among EU countries at 27.8%, while Romania had the lowest at 7.6%, according to Eurostat. Therefore, assistive technologies play a vital role in supporting individuals with disabilities, fostering greater independence and participation in society.

- Others: Other applications include general hospital usage, such as patient movement and assistance for patients with temporary disabilities. According to data from the European Association for Injury Prevention and Safety Promotion, over 33 million individuals seek care annually at Accident and Emergency departments across more than 1,000 acute care hospitals in the European Union.

By End User:

- Homecare: The use of wheelchairs and mobility aids in home care is rapidly growing in Europe, propelled by several key drivers and recent product innovations. The primary factors include aging population, increased prevalence of chronic and post-surgical conditions, and a strong policy push toward aging in place and home-based rehabilitation, particularly evident in countries like Germany, where statutory health insurance supports home rehabilitation with specialized devices. The expansion of e-commerce and robust distribution networks further improves access, while public sector support and reimbursement policies make these devices more affordable for patients. These trends are reinforced by product launches focused on smart wheelchairs with automated navigation and voice control, and long-term care beds with integrated safety features, all designed to enhance independence and quality of life for users in home care settings.

- Hospitals and Clinics: In Europe, wheelchairs are easily accessible in hospitals and clinics for both patients and visitors who may need them. These facilities often offer wheelchair services, typically through referrals from healthcare professionals such as general practitioners (GPs) or physiotherapists. Wheelchairs are designed to accommodate a range of needs, including those that require extra postural support as well as those for general mobility. Urban hospitals and clinics are witnessing high demand, as improved medical care and longer life expectancy are concentrated in cities, resulting in more elderly and chronically ill patients requiring mobility support. European organizations such as Rotherham Wheelchair NHS Clinic and Ashford and St Peter's Hospitals NHS Foundation Trust offer wheelchair assistance, and the infrastructure is suitable for patients using wheelchairs and mobility aids.

- Rehabilitation Centers: The rehabilitation centers refer to the healthcare facility that offers unique and individual programs for the betterment of patients with chronic conditions. According to the WHO, in the European Region, 394 million people—almost half of the population—live with a health condition that requires rehabilitation care. These rehabilitation centers provide services such as physical therapy, rehabilitation, and occupational therapy. In Europe, rehabilitation centers, including Royal Bucks Rehabilitation Centre (UK), offer personalized seating and mobility support, including wheelchair selection and standing aids, along with advanced technology and occupational therapy. Helios Rehab Center (Germany) specializes in neurological rehabilitation for children and young adults, providing tailored rehab plans that may include wheelchairs and mobility devices for conditions like brain injury and cerebral palsy.

- Others: The "Others" category in the Wheelchairs and Mobility Aids market by end user includes ambulatory surgical center (ASC) and institutions and environments outside traditional healthcare and home settings. This segment covers nursing homes, long-term care facilities, elderly care centers, special education schools, community health programs, and NGOs that support mobility-impaired individuals. It may also include public infrastructure settings like airports, malls, and transportation hubs offering rental or shared-use mobility aids. These users prioritize durability, ease of maintenance, and cost-effective solutions. As aging populations rise and public accessibility improves, demand from this diverse category continues to grow, contributing significantly to overall market expansion.

By Distribution Channel:

- Online: Online stores offer better pricing than offline stores, with increased access, lower transaction and product costs, convenience, and greater anonymity for consumers. They offer accessibility to people with limited mobility and those residing in remote areas. Online distribution channels focus specifically on wheelchairs and related mobility aids, often providing a wide selection and expert advice. Various online retailers and manufacturers specialize in these products, providing options for purchase or rental, and some even offer services like assessment and fitting. For instance, manufacturers such as Karman Healthcare and Invacare sell their products directly to consumers through their websites. Platforms like eBay and Craigslist allow individuals to buy and sell used wheelchairs and mobility aids.

- Offline: In Europe, offline distribution of wheelchairs and mobility aids primarily through physical stores and healthcare providers remains the dominant channel, accounting for a significant portion of sales. This preference stems from the ability of users to physically assess the comfort and features of the devices, which is especially important for first-time users or those requiring specialized seating and positioning. Offline channels facilitate hands-on evaluations of wheelchairs, ensuring a proper fit and functionality tailored to individual needs. For many, purchasing from a physical store or provider offers a sense of trust and reliability. Various specialized medical supply stores and pharmacies across Europe provide a wide range of wheelchairs and mobility aids, allowing customers to browse and test different models before making a decision. For instance, in June 2024, Ottobock UK launched the Juvo B7 power wheelchair, designed for all-day comfort and control. This wheelchair is distributed through authorized dealers and rehabilitation centers to guarantee proper fitting and user training.

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The Europe wheelchairs and mobility scooters market in North America is expected to hold a significant share of the market. increasing geriatric population and rising mobility impairment disorders by the market players are factors likely to drive the market.

Europe Wheelchairs and Mobility Aids Market Report Scope

Report Attribute

Details

Market size in 2024

US$ 5.87 Billion

Market Size by 2031

US$ 9.33 Billion

CAGR (2025 - 2031) 7.1%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Product - Wheelchairs

- Mobility Scooters

- Walking Aids

- Others

By Application - Neurologically Impaired

- Handicap Patients

- Others

By End User - Homecare

- Hospitals and Clinics

- Rehabilitation Centers

- Others

By Distribution Channel - Online

- Offline

Regions and Countries Covered

Europe - Germany

- The UK

- France

- Italy

- Spain

- Norway

- Denmark

- Sweden

- Poland

- Belgium

- The Netherlands

- Rest of Europe

Market leaders and key company profiles

- Invacare Corp

- Ottobock SE & Co KGaA

- Sunrise Medical

- Permobil, HOGGI GmbH

- Karma Medical Products Co LTD

- Drive Devilbiss Healthcare Ltd

- MEYRA GMBH

- Ostrich Mobility Instruments Pvt Ltd

- Glide Products

Europe Wheelchairs and Mobility Aids Market Players Density: Understanding Its Impact on Business Dynamics

Europe Wheelchairs and Mobility Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5.87 Billion |

| Market Size by 2031 | US$ 9.33 Billion |

| CAGR (2025 - 2031) | 7.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

|

Europe Wheelchairs and Mobility Aids Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Wheelchairs and Mobility Aids Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Europe Wheelchairs and Mobility Aids Market top key players overview

Europe Wheelchairs and Mobility Scooters Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in Latin America, the Middle East, and Africa also have many untapped opportunities for Europe wheelchairs and mobility scooters providers to expand.

The Europe wheelchairs and mobility scooters market grows differently in each region. This is because of factors like increasing geriatric population and rising mobility impairment disorders. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- Growing prevalence of age-related disabilities and chronic mobility conditions.

- Favorable reimbursement policies for mobility aids with strong healthcare infrastructure

- Technological advancements in powered and smart wheelchairs

- Trends: Growing adoption of AI-integrated and voice-controlled mobility devices for personalized support and smart navigation.

2. Europe

- Market Share: Substantial share due to early adoption of technologically advanced products

- Key Drivers:

- Aging population and increasing government support for assistive mobility devices

- High investment in rehabilitation services across private and public healthcare systems

- Trends: Growing preference for customizable and ergonomic wheelchair designs catering to aesthetics, comfort, and enhanced mobility

3. Asia Pacific

- Market Share: Fastest-growing region with rising market share every year

- Key Drivers:

- Increase in aging population in countries like China, Japan, and South Korea.

- Government initiatives improving accessibility and affordability of mobility aids.

- Trends: Increased production and adoption of affordable manual wheelchairs for urban and rural geriatric populations.

4. South and Central America

- Market Share: Growing market with steady progress

- Key Drivers:

- Growing aging population and increasing cases of injury-related disabilities

- Growth of private rehab and home care facilities

- Trends: Rising adoption of imported powered wheelchairs through private healthcare and retail channels.

5. Middle East and Africa

- Market Share: Although small, but growing quickly

- Key Drivers:

- Gradual improvement in healthcare infrastructure and disability care programs

- Increasing prevalence of diabetes, stroke, and injury-related disabilities

- Trends: Growing distribution of low-cost, rugged mobility solutions designed for durability in harsh environments.

Europe Wheelchairs and Mobility Scooters Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Invacare Corp, Ottobock SE & Co KGaA, Sunrise Medical, Permobil, HOGGI GmbH, Karma Medical Products Co LTD, Drive Devilbiss Healthcare Ltd, MEYRA GMBH, Ostrich Mobility Instruments Pvt Ltd, and Glide Products are also adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Advanced Products

- Value-added services like customization and sustainable solutions

- Competitive pricing models

- Complaince with regulatory guidelines

Opportunities and Strategic Moves

- Rising demand for AI-powered, sensor-integrated wheelchairs, and voice-controlled opens new markets in tech-driven homecare and rehabilitation.

- Groeing aging populations and rising disability awareness in Asia, Africa, and Latin America present growth potential for affordable mobility solutions.

- Increasing preference for aging-in-place and post-surgical home recovery drives demand for compact, user-friendly mobility aids.

Major Companies operating in the Europe Wheelchairs and Mobility Scooters Market are:

- Invacare Corp

- Ottobock SE & Co KGaA

- Sunrise Medical

- Permobil

- HOGGI GmbH

- Karma Medical Products Co LTD

- Drive Devilbiss Healthcare Ltd

- MEYRA GMBH

- Ostrich Mobility Instruments Pvt Ltd

- Glide Products

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Meyra Group

- Vermeiren Group

- B+B Mobility

- DPI (Disability Products International)

- TiLite Europe

- RGK Wheelchairs

- Etac AB

- Merits Europe

- Rea Sp. z o.o.

- Kuschall AG

- Medi GmbH

- B+B Rollstuhltechnik GmbH

- HME (Healthcare Mobility Equipment)

- Nexe Group

- Lynx Mobility

- Ki Mobility Europe

- Etac AB

- Bios Medicals

- Novis Healthcare

- Smile Rehab UK Ltd

Europe Wheelchairs and Mobility Scooters Market News and Recent Developments

- IM by TotalCare Europe launches the Kittos Magnesium In May 2025, IM by TotalCare Europe launches the Kittos Magnesium, the first folding electric wheelchair made of magnesium, marking a turning point in the mobility sector. This new model joins the prestigious Kittos family, known for its reliability, innovation, and sales leadership.

- Invacare, a leading designer and manufacturer of mobility solutions, announced the launch of Move for Mobility. In April 2024, Invacare, a leading designer and manufacturer of mobility solutions, announced the launch of Move for Mobility, a global fundraising initiative in collaboration with its partner, Free Wheelchair Mission, located in Irvine, California, USA. The Invacare fundraiser will take place this May, across twenty participating countries.

Europe Wheelchairs and Mobility Scooters Market Report Coverage and Deliverables

The "Europe Wheelchairs And Mobility Scooters Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe wheelchairs and mobility scooters Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Europe wheelchairs and mobility scooters Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Europe wheelchairs and mobility scooters Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe wheelchairs and mobility scooters Market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the Europe wheelchairs and mobility scooters market in 2024?

Which are the leading players operating in the Europe wheelchairs and mobility scooters market?

What are the factors driving the Europe wheelchairs and mobility scooters market?

What would be the estimated value of the Europe wheelchairs and mobility scooters market by 2031?

What is the expected CAGR of the Europe wheelchairs and mobility scooters market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For