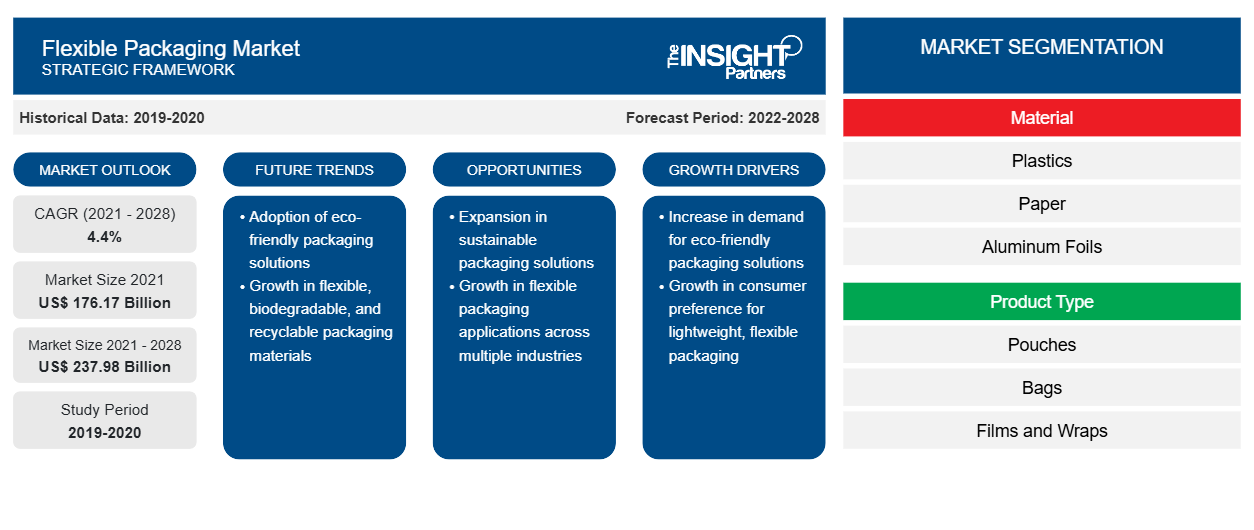

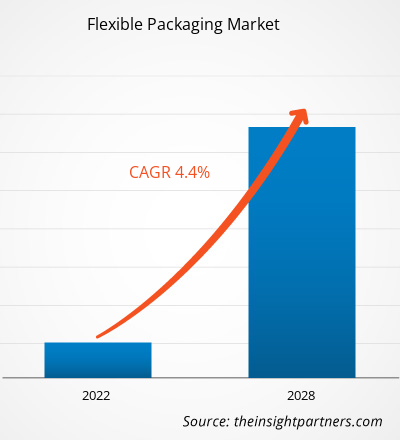

The flexible packaging market is projected to reach US$ 237,975.67 million by 2028 from US$ 176,173.61 million in 2021; it is expected to grow at a CAGR of 4.4% from 2021 to 2028.

Flexible packaging includes liners, pouches, seals, sample packets, and bags. It can be composed of film, plastic, paper, foil, etc. It is used for various food and beverage items, consumer products, music CDs, pharmaceuticals, computer software packages, and nutraceuticals. The durability offered by flexible packaging allows manufacturers to print eye-catching and high-quality custom designs, which increase product visibility in a retail setting.

In 2020, Asia Pacific held the largest revenue share of the global flexible packaging market. According to Asia-Pacific Economic Cooperation, Australia is one of the developed countries in APAC. The food & beverage sector is Australia’s largest manufacturing industry, accounting for 32% of the country’s total manufacturing turnover. According to the Australian Food and Grocery Council’s 2019 State of the Industry Report, the food & beverage, grocery, and fresh produce sector is worth USD$ 85.32 billion. The industry is made up of 15,000 businesses of all sizes that employ over 273,000 people. The growing food & beverage industry drives the flexible packaging market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flexible Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Flexible Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Flexible Packaging Market

Impact of COVID-19 Pandemic on Flexible Packaging Market

The shutdown of manufacturing units, difficulty in the procurement of raw materials, restriction on logistics has had a negative impact on the flexible packaging market. However, COVID-19 created massive spikes in online grocery delivery. In addition, packaged food and beverage industries are witnessing an upsurge in demand for shelf-stable foods and beverages, including milk products, as consumers rush to stock the pantries. Millions of households started buying groceries online for pickup or home delivery, and many will continue using e-commerce options after the crisis passes. Furthermore, the increasing demand for processed food products such as convenience-oriented foods that generally use high-barrier, premium packaging materials for higher shelf life is poised to encourage the need for flexible packaging.

Market Insights

Increased Consumption of Processed Food & Beverage

According to Anu Food Brazil report, the Brazilian food retail sector’s total revenue was US$ 96 billion in 2019. The food & beverage industry in Brazil achieved growth of 6.7% in 2019 and 12.8% in 2020. The frozen food market is prospering in Brazil. The frozen food market is prospering in Brazil due to the expansion of the middle class, rise in purchasing power, and an increase in the number of people working full time. Hence, the increasing consumer preference toward convenience foods drives the flexible packaging market.

Material Industry Insights

Based on material, the global flexible packaging market is segmented into plastics, paper, aluminum foils, others. The plastics segment held the largest share of the global flexible packaging market in 2020. Flexible plastic packaging involves various types of plastic material used for the packaging of different products. The type of material used in packaging depends upon the application and type of product to be packaged. Generally, plastic materials, such as polyethylene, polypropylene, polystyrene, and polyvinyl chloride, are used in flexible plastic packaging. Flexible packaging is considered the most convenient and economical way to preserve, distribute and package food items, beverages, pharmaceutical products and several consumables.

A few of the key players operating in the global flexible packaging market include Amcor plc, Huhtamaki, Mondi, Berry Global Inc., Sealed Air, Sonoco Products Company, Coveris, Constantia Flexibles, Flexpak services, and Transcontinental Inc. Players operating in the market are highly focused on the development of high-quality and innovative product offerings to fulfill the customer’s requirements.

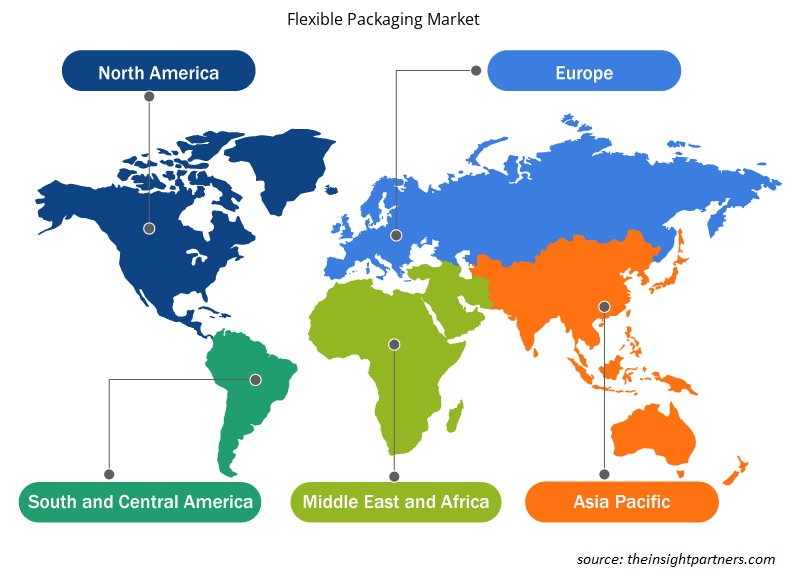

Flexible Packaging Market Regional Insights

The regional trends and factors influencing the Flexible Packaging Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Flexible Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Flexible Packaging Market

Flexible Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 176.17 Billion |

| Market Size by 2028 | US$ 237.98 Billion |

| Global CAGR (2021 - 2028) | 4.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Flexible Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Flexible Packaging Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Flexible Packaging Market are:

- Amcor plc

- Huhtamaki

- Mondi

- Berry Global Inc.

- Sealed Air

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Flexible Packaging Market top key players overview

Report Spotlights

- Progressive trends in the flexible packaging industry to help players develop effective long-term strategies

- Business growth strategies adopted by the market players in developed and developing countries

- Quantitative analysis of the flexible packaging market from 2019 to 2028

- Estimation of global demand for flexible packaging

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the flexible packaging market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the flexible packaging market at various nodes

- Detailed overview and segmentation of the market, as well as the industry dynamics

- Size of the flexible packaging market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Product Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, UAE, UK, US

Frequently Asked Questions

The major players operating in the global flexible packaging market are Amcor plc; Huhtamaki; Mondi; Berry Global Inc.; Sealed Air; Sonoco Products Company; Coveris; Constantia Flexibles; Flexpak services; Transcontinental Inc.

In 2020, Asia-Pacific accounted for the largest share of the global flexible packaging market. The market for flexible packaging across Asia-Pacific has witnessed notable growth owing to the rapidly expanding packaging industry, growth of the food retail sector, and rising consumer awareness about sustainable packaging solutions across the region. The foodservice sector in Asia-Pacific is rapidly expanding owing to rapid economic growth, growth of the tourism sector, improving lifestyles of consumers, and rising disposable income levels. The region's food & beverage market is witnessing significant growth due to ample availability of various varieties of functional food and drinks and their growing demand among the millennial population. According to The Annual Report on Catering Industry Development of China 2019 (ARCIDC), China is the second-largest food and beverage economy across the world. The food and beverage revenue in China was over US$ 620 billion in 2018. The report further states that the online sales of food and beverages increased by US$ 44 billion from 2011 to 2017. Hence the growing demand for food & beverage in the region drives the flexible packaging market.

In 2020, the plastics segment accounted for the largest market share. Flexible plastic packaging delivers a wide range of protective properties while ensuring a minimum amount of material being used. It is made from high-grade polymers such as PVC, polyamide, polypropylene, and polyethylene. These polymers are FDA-approved and are contaminant-free. They can take on extreme temperatures and pressures. Furthermore, they also act as a protective layer for the food and beverage by protecting it from micro-organisms, UV rays, moisture, and dust.

The bags segment held the largest share of the market in 2020. These are commonly made of metal foil, plastic, and occasionally, paper. These bags are used in various packaging applications including food products, confectionery products, biscuits, coffee, powdered milk, snacks, etc. Also, these bags are easy for transport, material savings, and repeated use.

In 2020, Asia-Pacific is the fastest-growing region in the global flexible packaging market. According to Asia-Pacific Economic Cooperation, Australia is one of the developed countries in APAC. The food & beverage sector is Australia’s largest manufacturing industry, accounting for 32% of the country’s total manufacturing turnover. According to the Australian Food and Grocery Council’s 2019 State of the Industry Report, the food & beverage, grocery, and fresh produce sector is worth $122 billion. The industry is made up of 15,000 businesses of all sizes that employ over 273,000 people. The growing food & beverage industry drives the flexible packaging market.

The food and beverages segment held the largest share of the market in 2020. Flexible packaging is widely used for packaging food products such as eggs, fresh fruits and vegetables, and salad, among others. Flexible packaging protects products from moisture, UV rays, mold, dust, and other environmental contaminants that can negatively affect the product, thereby maintaining its quality and extending its shelf life. Also, with the growth of online food delivery channels the demand for flexible, affordable, and recyclable packaging is also on a rise.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Flexible Packaging Market

- Amcor plc

- Huhtamaki

- Mondi

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- Coveris

- Constantia Flexibles

- Flexpak services

- Transcontinental Inc.

Get Free Sample For

Get Free Sample For