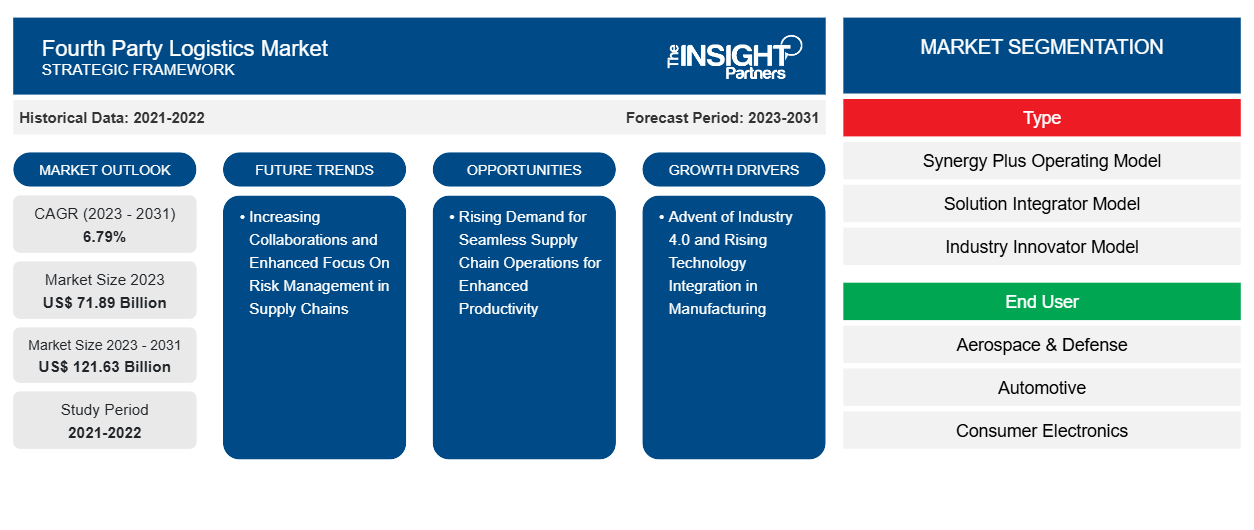

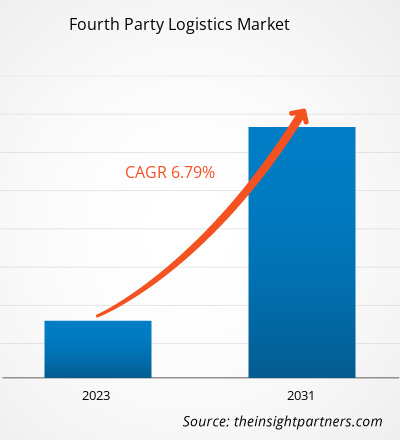

The fourth party logistics market size is projected to reach US$ 121.63 billion by 2031 from US$ 71.89 billion in 2023. The market is expected to register a CAGR of 6.79% in 2023–2031.

The Advent of Industry 4.0 has resulted in the digital transformation of the manufacturing sector. Various players are harnessing the power of such sophisticated digital technologies, which is offering a competitive edge to their client companies by streamlining various supply chain processes.

Fourth Party Logistics Market Analysis

It has been observed that regional demographics have also played a vital role in the growth of the 4PL services market. As an example, the 4PL adoptions is observed by the retail sector, which in-turn has bolstered due to the advent of e-commerce. The market attractiveness for e-commerce industry is very high in the region, as APAC region boasts of more than one-third of the world population. Further, developing economies and rising disposable incomes with individuals have proppeled further the growth in e-commerce industry.

Increasing demand diversities owing to the diverse demographics observed in the region which contributes to the supply chain complexities. Such complex supply chain contributed to the growing needs for 4PL services to be deployed by the shipping companies. Since last decade, the demand in different end-user industry has accelerated significantly with growing adoption of digitalized technologies and further technological enhancements. As leading players in this market continue to expand their addressable market, by broadning current product portfolios, diversifying client bases, and developing new applications and markets, all the prominent players faces an intense level of competition.

Fourth Party Logistics Market Overview

Outsourcing the entire supply chain functionality to a more knowledgeable partner in the supply chain management arena reduces the complexities associated with last-mile deliveries. Some of the intangible benefits achieved through outsourcing logistics include cost savings, human capital savings, no lock-in of working capital, and better access to customer networks.

The emergence of fourth party logistics concept has essentially been a move towards removing all the above-mentioned bottlenecks in the increasingly complex supply chain environment. Fourth-party logistic (4PL) services are also termed as supply-chain-as-a-service, where the 4PL provider integrates themselves with the customer company's logistics department. This empowers the 4PL service provider with a hands-on approach to the entire operations involved in a supply chain ranging from order management to warehousing and compliance regulations to supplier management. A 4PL service provider would act as the single link of interface between the numerous supply chain providers and the client organization. With this, the 4PL provider manages all the operations with sophisticated resources to optimize and deliver value to its customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fourth Party Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fourth Party Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fourth Party Logistics Market Drivers and Opportunities

Advent of Industry 4.0 and Rising Technology Integration in Manufacturing

Emerging digital technologies such as advanced software, cloud computing, and Big Data could be used to great effect by the 4PL service providers for maintaining visibility across the entire supply chain improving visibility, transparency, operations, and productivity. Further, as technologies such as Internet of Things (IoT), automation, and robotics gain more prominence, the needs for deployments of 4PL by the organizations is anticipated to accentuate rapidly.

Rising Demand for Seamless Supply Chain Operations for Enhanced Productivity

In a supply chain, the moving parts are sometimes subject to unforeseeable circumstances like natural disasters, geopolitical tensions, environmental issues, tariff-related complications, and regulations, as well as compliance fluctuations. Further, the fragmented nature of the supply chains leads to a lack of communication and transparency among the involved entities. The current demands from consumers are highly dynamic, and even a small dissatisfaction at the consumer end could have a large impact on the company's bottom lines. The meteoric rise of on-demand delivery of products has propelled today's businesses to shift from the conventional in-house logistic models to a more advanced and cost-efficient outsourced or contract-based logistics model.

Fourth Party Logistics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the fourth party logistics market analysis are type, and end user.

- Based on type, the market has been divided into synergy plus operating model, solution integrator model, and industry innovator model. The solution integrator model segment held a larger market share in 2023.

- Based on end user, the market is segmented into aerospace & defense, automotive, consumer electronics, food & beverages, industrial, healthcare, retail, and others. The retail segment held the largest share of the market in 2023.

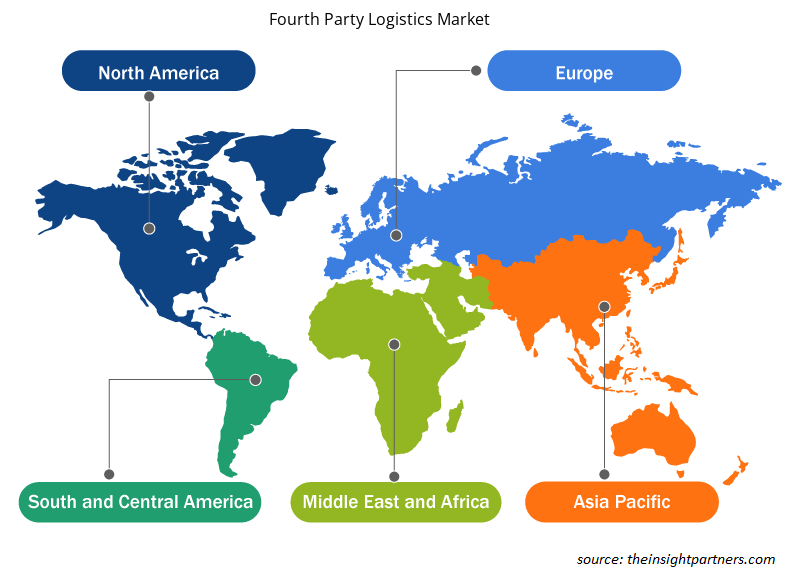

Fourth Party Logistics Market Analysis by Geography

The geographic scope of the fourth party logistics market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The scope of the fourth party logistics market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, APAC dominated the fourth party logistics market share in 2023. Europe is the second-largest contributor to the global fourth party logistics market, followed by North America.

The economically prosperous region of North America constitutes of highly advanced economies of the US and Canada. Industrialization has remained a high priority in the advanced economies of the US and Canada, which has also been the main factor driving the economy over the years. The US is said to boast the world's most technologically advanced automotive, healthcare, aerospace & defense, as well as consumer electronics sectors. High-volume manufacturing and the allied trades carried out with other nations of the world make the North American region a strategic hub for transportation and logistics-based services. Being economically advanced, companies in North America have large budgets to spend on transportation and logistics-based activities and, therefore, contribute to the development of fourth party logistics market. The presence of an established digital infrastructure in North America further accentuates expansions in the horizons pertaining to logistic provisioning services. Type (Synergy Plus Operating Model, Solution Integrator Model, and Industry Innovator Model); End User (Aerospace & Defense, Automotive, Consumer Electronics, Food & Beverages, Industrial, Healthcare, Retail, and Others)

Fourth Party Logistics Market Regional Insights

The regional trends and factors influencing the Fourth Party Logistics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fourth Party Logistics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fourth Party Logistics Market

Fourth Party Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 71.89 Billion |

| Market Size by 2031 | US$ 121.63 Billion |

| Global CAGR (2023 - 2031) | 6.79% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

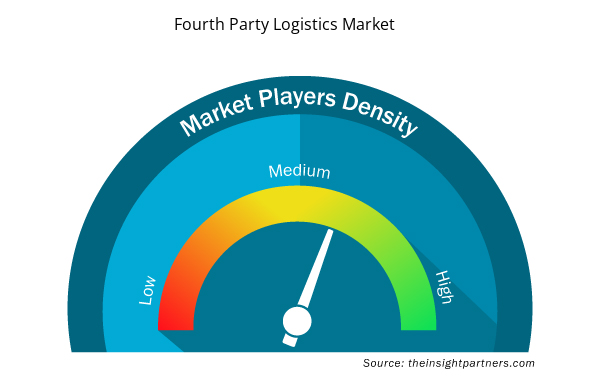

Fourth Party Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Fourth Party Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fourth Party Logistics Market are:

- Allyn International Services

- Inc.

- United Parcel Service

- Inc.

- GEFCO Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fourth Party Logistics Market top key players overview

Fourth Party Logistics Market News and Recent Developments

The fourth party logistics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for fourth party logistics market and strategies:

- On December 2023, XPO (NYSE: XPO), a leading provider of LTL freight transportation in North America, announced that the United States Bankruptcy Court for the District of Delaware has approved the company’s offer to acquire 28 service center locations previously operated by Yellow Corporation. XPO will purchase 26 service centers and assume existing leases for the other two locations. The transaction is expected to close by the end of 2023. (Source: XPO, Press Release/Company Website/Newsletter)

Fourth Party Logistics Market Report Coverage and Deliverables

The “fourth party logistics market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Single-Use Negative Pressure Wound Therapy Devices Market

- Hydrogen Compressors Market

- 3D Audio Market

- Resistance Bands Market

- Sports Technology Market

- Terahertz Technology Market

- Non-Emergency Medical Transportation Market

- GNSS Chip Market

- Visualization and 3D Rendering Software Market

- Blood Collection Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, Spain, Taiwan, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For