Frozen French Fries Market Drivers and Forecasts by 2030

Frozen French Fries Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Regular Fries, Crinkle-Cut Fries, Steak Fries, and Others), Category (Organic and Conventional), and End User (Retail and Foodservice)

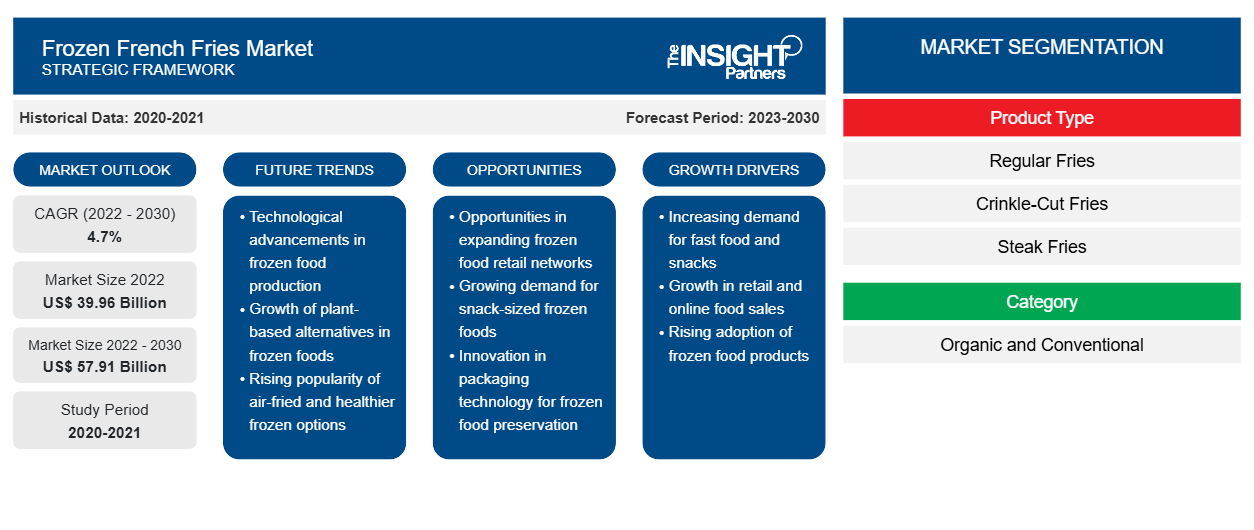

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPRE00030038

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 145

[Research Report] The frozen french fries market is expected to grow from US$ 39,955.11 million in 2022 to US$ 57,910.15 million by 2030; it is expected to record a CAGR of 4.7% from 2022 to 2030.

Market Insights and Analyst View:

Frozen french fries are made from potatoes and are served hot. French fries can be manufactured and served in various shapes, such as waffles, curly, and thin strips, and are eaten as a convenient snack. They are served with ketchup, salsa, and others. French fries can be baked or deep-fried. Moreover, fresh, distinctive seasonings and aromas to french fries help them stand out from the competition and attract customers searching for unexplored culinary experiences. The taste profiles of french fries may be improved by experimenting with various herbs, spices, and seasoning mixes, extending the selection of alternatives available to satisfy a wider variety of consumer picks. The growth of the globalfrozen french fries market is attributed to the rising count of companies delivering online food delivery services, including Food Panda, Swiggy, Uber Eats, and others. They have made ordering food items an easy and suitable task for consumers. In addition, rising product launches by key industry participants are anticipated to push the frozen french fries market forward during the forecast period.

Growth Drivers and Challenges:

The cold chain, which consists of pre-cooling, refrigerated storage, and refrigerated transport, is one of the pillars of the postharvest handling chain. It is regarded as the backbone of any postharvest industry (developed or developing) and an essential set of technologies for reducing food losses. Cold chain logistics have proven critical for any country seeking to enhance its frozen food market share. Cold chain infrastructure has increased significantly in recent years. For instance, according to the International Institute of Refrigeration (IIR) and the Global Cold Chain Alliance (GCCA) report, the total capacity of refrigerated warehouses globally increased to 719 million cubic meters in 2020, 16.7% greater than the capacity reported in 2018.

In addition, the expansion of cold chain capacity in emerging countries differs for each country. In most countries, such as South Africa, Mexico, and Kenya, the cold chain is concentrated in urban areas and transportation terminals, such as airports, where exporters may be situated. Further, major market service providers are constantly improving their technologies to stay ahead of the competition and maintain efficiency, integrity, and safety across the globe. For instance, vendors have implemented Hazard Analysis and Critical Control Points (HACCP) and Radio Frequency Identification (RFID) technology to improve efficiency with smaller shipments. In addition, they are expanding their multi-compartment refrigerated vehicle fleets to provide additional services to consumers. Thus, advancements in cold chain infrastructure are expected to offer lucrative opportunities for the frozen French fries market players, further drive the frozen french fries market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFrozen French Fries Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Frozen French Fries Market” is segmented on the basis of product type, category, end user, and geography. Based on product type, the market is segmented into regular fries, crinkle-cut fries, steak fries, and others. Based on category, the market is bifurcated into organic and conventional. Based on end user, the frozen french fries market is segmented into retail and foodservice. The frozen french fries market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product type, the frozen french fries market is segmented into regular fries, crinkle-cut fries, steak fries, and others. The regular fries segment held the largest share of the frozen french fries market in 2022 and is expected to register a significant growth rate during the forecast period. Regular french fries in the frozen french fries market are a popular side dish in fast-food restaurants, burger joints, and homes. Regular French fries are thinner than steak fries, usually cut into pieces between 1/8 and 1/4 inch thick. They are often salted and may be served with ketchup, vinegar, mayonnaise, tomato sauce, or other local specialties.

Regional Analysis:

Based on geography, the frozen french fries market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global frozen french fries market was dominated by North America and was estimated to be around US$ 35,000 million in 2022. Europe is a second major contributor, holding more than 25% share of the market. The frozen french fries market in North America is segmented into the US, Canada, and Mexico. The North America frozen French fries market is segmented into the US, Canada, and Mexico. The region is one of the major markets for frozen French fries due to the well-established food processing industry and rising trends of takeaway, dine-in, and on-the-go consumption. Many significant frozen French fries manufacturers, such as H.J. Heinz Company, J.R. Simplot Company, and McCain Foods Limited, operate actively in the region. These companies have expanded their business across the region and hold significant market share. They have a widespread distribution network in the region, which helps them cater to many customers. Thus, all the above mentioned factors propel the frozen french fries market growth.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the frozen french fries market are listed below:

- In September 2020, Aviko B.V. acquired a potato plant in Germany from consumer goods giant Unilever. This plant processes potatoes into branded products such as mash, dumplings, gnocchi, and instant snacks.

- In October 2022, Lamb Weston Holdings, Inc. announced that it has entered into an agreement to purchase the remaining equity interests in its European joint venture Meijer Frozen Foods B.V. for US$ 763.58 million.

- In July 2021, Lamb Weston upgraded its Idaho fries plant with an investment of US$ 415 million. This processing line will enable the Idaho fries plant to produce more than 350 million pounds of frozen French fries and other potato products per year.

- In March 2023, McCain announced a substantial investment in Coaldale, doubling the size of its facility and output in Coaldale, Alberta. The investment will reflect McCain’s strong business growth.

Frozen French Fries

Frozen French Fries Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 39.96 Billion |

| Market Size by 2030 | US$ 57.91 Billion |

| Global CAGR (2022 - 2030) | 4.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frozen French Fries Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen French Fries Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

COVID-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel bans, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) negatively affected the growth of various industries, including the food & beverages industries. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and non-essential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in Europe, Asia, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold.

Competitive Landscape and Key Companies:

Bart's Potato Company, Aviko B.V., Agristo NV., Lamb Weston Holdings Inc, McCain, Farm Frites International B.V., Rairandev Golden Fries Pty Ltd, Himalaya Food International Ltd, J.R. Simplot Company, and The Kraft Heinz Co are among the prominent players operating in the global frozen french fries market. These frozen french fries manufacturers offer cutting-edge snacking options with innovative shapes to deliver a superior experience to consumers.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For