Hair Loss Prevention Products Market Segments and Growth by 2028

Hair Loss Prevention Products Market Forecast to 2028 - Analysis By Product Type (Shampoos and Conditioners, Oils, Serums, and Others), Category (Natural & Organic, and Conventional), End User (Men, Women, and Unisex), and Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : May 2022

- Report Code : TIPRE00027910

- Category : Consumer Goods

- Status : Published

- Available Report Formats :

- No. of Pages : 189

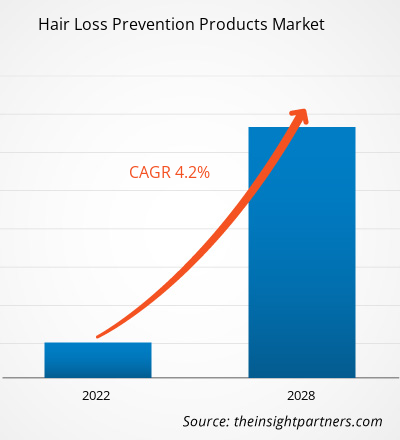

The hair loss prevention products market size was valued at US$ 23,599.87 million in 2021 and is projected to reach US$ 31,524.52 million by 2028. It is expected to grow at a CAGR of 4.2% from 2021 to 2028.

Hair loss is described as a disturbance of the hair growth cycle, or damage to the hair follicle, resulting in a rapid loss of hair relative to the rate of regeneration. A few of the visible symptoms of hair loss are a receding hairline, hair loss in patches, or overall thinning. Further, changing food habits; rising stress levels due to demanding schedules, has resulted in frequent hair loss at a younger age among the population. Increasing disposable income; and a growing emphasis on appearance are among the major factors driving the hair loss prevention products market growth.

Asia Pacific accounted for the largest portion of the global hair loss prevention products market share in 2020 and is expected to register the highest CAGR during the forecast period. The market in the region is further segmented into Australia, India, China, Japan, South Korea, and the Rest of Asia Pacific. Strong customer base, rising hair fall concerns amongst the populace, and changing lifestyles are among the major factors driving the growth of the hair loss prevention products market in Asia Pacific.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHair Loss Prevention Products Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Hair Loss Prevention Products Market Growth

The COVID-19 pandemic had a major impact on operational efficiencies and value chains due to the shutdown of national and international boundaries in 2020. Moreover, research activities were hampered due to the shutdown of laboratories and production plants. However, various industries began gaining momentum as the governments of various countries eased out the previously imposed restrictions with the subsiding of the effects of the global crisis. Resuming operations in manufacturing units and the opening of interstate and international boundaries have favored the hair loss prevention products market growth in the last few quarters. For instance, on April 13, 2022, Forest Essentials, an Ayurveda-based hair care manufacturer in Asia, announced the opening of 12 shops in the UK, which is its first international market. In this development, Estée Lauder would back this luxury Ayurveda skincare brand to expand its business rapidly in the UK by 2025. Thus, the companies started taking the initiative, and adopting growth strategies such as collaborations and expansions to overcome the adversities caused by the COVID-19 pandemic in 2020.

Market Insights

Growing Disposable Income in Developing Countries

The demand for hair loss prevention products is continuously growing in developing economies in Asia Pacific and South & Central America. This can be attributed to the growing disposable incomes of people. Disposable income is the income received by people after the deduction of taxes and social security charges, i.e., the actual amount left with them to spend or save. With the burgeoning concerns about hair loss, consumers in developing countries are highly inclined toward premium-quality hair loss prevention products, such as shampoos & conditioners, oils, and serums, which is encouraging manufacturers to establish production facilities in Asian countries, such as China and India. Low-cost products offered by these companies, specifically for people from cost-sensitive economies, are becoming extremely popular cost-efficient options for surgical hair replacement procedures.

According to Trading Economics, 2021, the developing country India has recorded $3,202,781, and in 2020, it recorded $2,725,046. According to the National Bureau of Statistics of China, in 2021, the per capita disposable income of residents in China reached $ 5,511.48, reporting a nominal increase of 9.1% over the previous year; the growth rate was 14.3% higher than that in 2019. The average growth rate in two years was 6.9%. The annual household income per capita of Argentina reached $ 3,765.524 in December 2020, compared with the previous value of $ 3,213.336 in December 2019. Hence, a surge in disposable income is adding to the purchasing power of consumers in developing countries, thereby providing lucrative opportunities for the growth of the hair loss prevention products market players.

Category Insights

Based on category, the hair loss prevention products market is segmented into natural & organic and conventional. The conventional segment is expected to account for a larger portion of the hair loss prevention products market share in the coming years. Conventional hair care products often consist of various synthetic substances, such as parabens, sulfates, alcohol, and mineral oil. They are potentially irritating and allergenic components developed in a lab. Further, synthetic chemicals are hazardous to human skin, animals, and plants. The production of traditional hair loss prevention products emits a large amount of pollution, leaving a negative carbon footprint on the earth, further hindering the market growth for this segment. However, most of the conventional hair loss prevention products are less costly than organic products, which is boosting the hair loss prevention products market growth for the conventional segments.

Product Type Insights

Based on product type, the hair loss prevention products market is segmented into shampoos and conditioner, oils, serums, and others. The shampoos and conditioner segment is expected to hold the largest market share during the forecast period. Anti-hair fall shampoos and conditioners replenish and nourish hair, relieve hair tension, relax muscles in the head, fight fungus that causes dandruff, and condition hair texture to prevent hair loss due to breakage. In addition, the market for the shampoos and conditioners segment is growing rapidly due to increasing demand from secondary markets such as India, Brazil, Turkey, and Argentina. Moreover, shampoos and conditioners are the most commonly purchased hair care products globally due to increased awareness, rising hair loss, and overall haircare trends. Thus, both products have gained significant traction among users, which is expected to boost the hair loss prevention products market growth during the forecast period.

Distribution Channel Insights

Based on distribution channel, the hair loss prevention products market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment accounted for the largest market share in 2020, whereas the market for the online retail segment is expected to grow at the fastest rate during the forecast period. The e-commerce boom has effectively increased the online retail sales of hair loss prevention products. Following the commencement of the COVID-19 pandemic, leading manufacturers are actively accessing popular e-commerce platforms with a mix of tempting prices, robust sales and support, and an upgraded shopping experience for consumers. This aspect is expected to help online platforms become one of the fastest-growing distribution channels globally. These factors are driving the growth of the hair loss prevention products market for the online retail channel segment.

Church & Dwight, Inc.; Forest Essentials; Kao Corporation; L'oréal S.A.; Pierre Fabre Group; Procter & Gamble; Shiseido Co., Ltd; Taisho Pharmaceutical Holdings Co., Ltd; Unilever; and Aveda Corp are among the key players operating in the hair loss prevention products market. These players are developing innovative products to meet the consumer demand. Moreover, they are performing mergers & acquisitions, business expansion, and partnerships strategies to expand their business globally.

Hair Loss Prevention Products Market Regional InsightsThe regional trends and factors influencing the Hair Loss Prevention Products Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Hair Loss Prevention Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Hair Loss Prevention Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 23.6 Billion |

| Market Size by 2028 | US$ 31.52 Billion |

| Global CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hair Loss Prevention Products Market Players Density: Understanding Its Impact on Business Dynamics

The Hair Loss Prevention Products Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Hair Loss Prevention Products Market top key players overview

Report Spotlights

- Progressive industry trends in the hair loss prevention products market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the hair loss prevention products market from 2019 to 2028

- Estimation of global demand for hair loss prevention products

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the hair loss prevention products market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the hair loss prevention products market size at various nodes

- Detailed overview and segmentation of the market, as well as the hair loss prevention products industry dynamics

- Size of the hair loss prevention products market in various regions with promising growth opportunities

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For