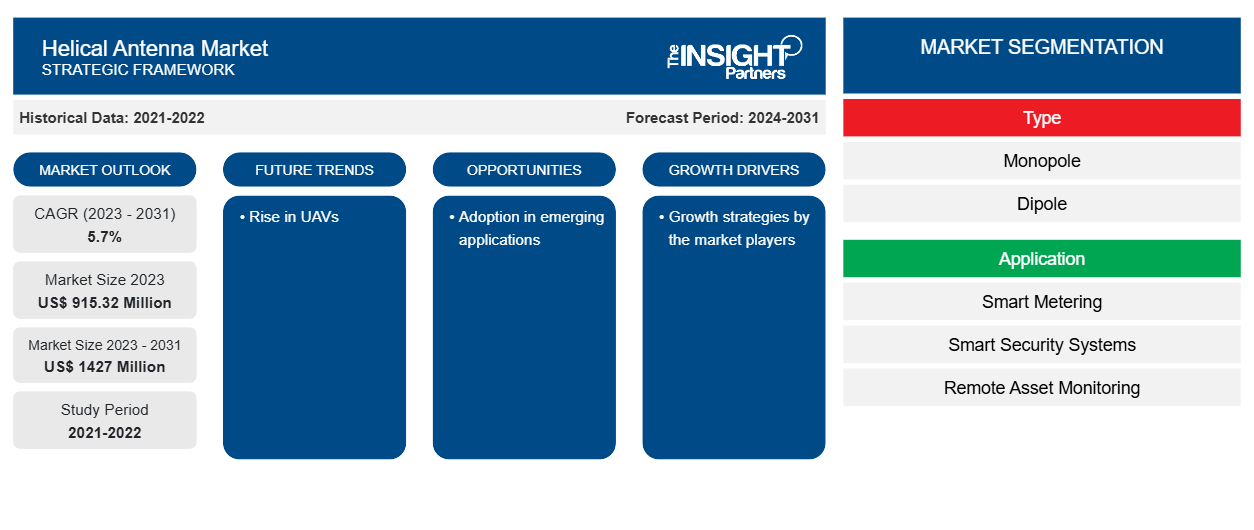

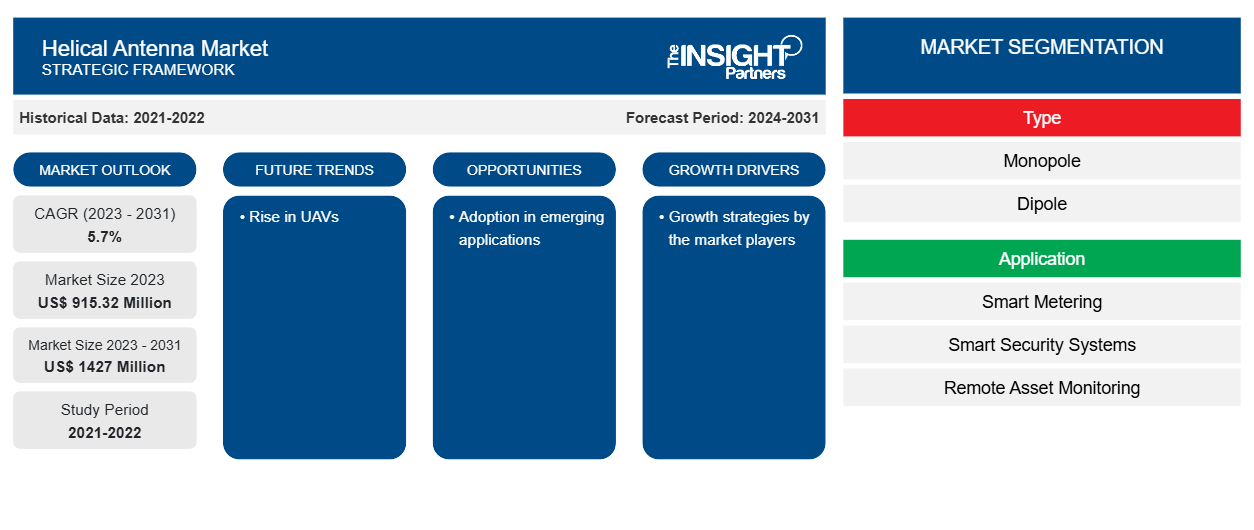

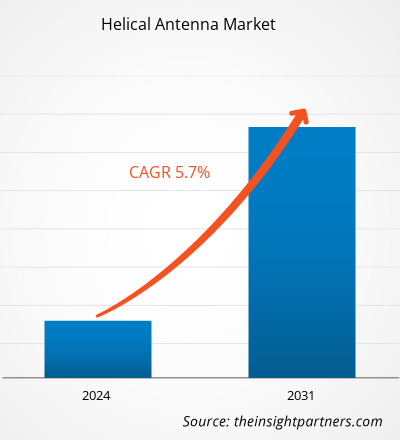

The helical antenna market size is projected to reach US$ 1427 million by 2031 from US$ 915.32 million in 2023. The market is expected to register a CAGR of 5.7% in 2023–2031. The rise in connected devices and growing UAV deployments are likely to remain key helical antenna market trends.

Helical Antenna Market Analysis

The features of helical antenna, such as simple design, high directivity, wide bandwidth, robust construction, and use at VHF and HF bands, lead to its adoption. The helical antenna market growth is gaining traction owing to its wide application. These antennas' maximum directivity and circular polarization of transmitted electromagnetic waves make them useful for satellite and space probe communications. It is used for telemetry links through ballistic missiles. Many satellites, including those for weather and data relay, use helical antennas.

Helical Antenna Market Overview

A helical antenna is one of the types of broadband antenna, which is also called a helix antenna. This is one of the most basic, realistic, and uncomplicated antenna designs that uses a conducting wire wound in a helical configuration. These antennas are used widely in ultra-high frequencies and work in VHF & UHF ranges. This antenna is specially designed with a large bandwidth, a high gain, and circular polarization. This antenna operates in the frequency range of 30MHz0-3GHz. This antenna is utilized in radio astronomy, wireless networking, satellite communications, and space communication applications like satellite relays.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helical Antenna Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Helical Antenna Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Helical Antenna Market Drivers and Opportunities

Growth strategies by the market players to Favor Market

The helical antenna finds its application in various communication systems such as satellite & space probe communications. It is also used for satellites at Earth stations and telemetry links through ballistic missiles. Therefore, the helical antenna market players are engaged in various strategic organic and inorganic growth strategies to cater to this rise in demand, which further fosters the helical antenna market. For instance, in May 2023, Calian announced the launch of the dual-band low-profile HC871SXF to its industry-leading line of helical GNSS antennas. The dual-band GNSS HC871SXF helical antenna is ideal for lightweight, unmanned aerial vehicle (UAV) navigation and a wide variety of precision applications.

Rise in UAVs – An Opportunity in the Helical Antenna Market

There has been a significant rise in the proliferation of unmanned aerial vehicles (UAV), also known as drones, across the military and defense sectors. They are employed for both operational and strategic reconnaissance as well as battlefield surveillance. They can also directly intervene on the battlefield by dropping or firing precision-guided munitions themselves or indirectly by designating targets for such munitions to be dropped or fired from manned systems. As helical antenna has high bandwidth, they are widely used for the automated UAV tracking system. It allows the Air Force to use the antenna as a log range GPS UAV ground control station antenna without having the requirement of multiple antennae. Thus, the rise in UAVs generates the demand for helical antennae.

Helical Antenna Market Report Segmentation Analysis

Key segments that contributed to the derivation of helical antenna market analysis are type and application.

- Based on type, the market is segmented into monopole and dipole. The monopole segment held a larger market share in 2023.

- By technology, the market is segmented into smart metering, smart security systems, remote asset monitoring, and others. The smart metering segment held the largest share of the market in 2023.

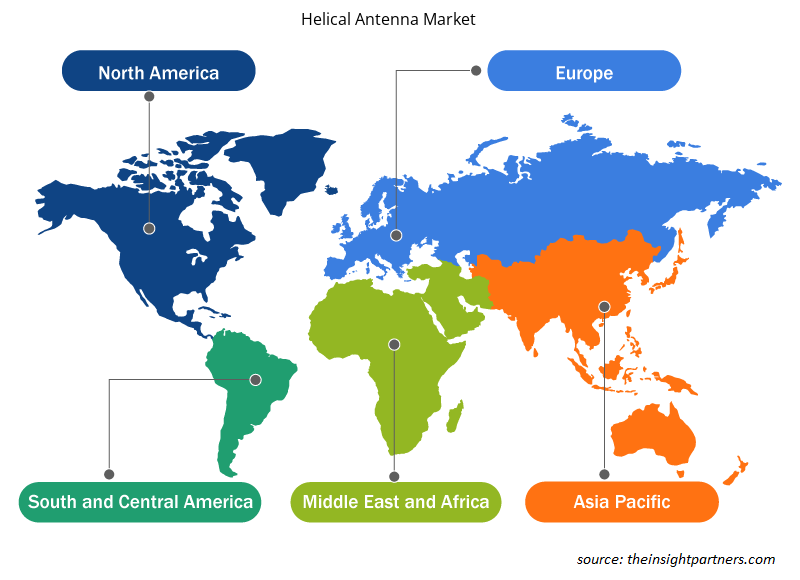

Helical Antenna Market Share Analysis by Geography

The geographic scope of the helical antenna market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, North America accounted for the largest helical antenna market share in 2023. Asia Pacific region is expected to grow with the highest CAGR during the forecast period. APAC has developing countries that are focused on strengthening its military sector. They are engaged to strengthen their communication system, which leads to the demand for the helical antenna which operates in high-frequency bands. They are focused on modernizing its military to compete with other countries and reduce its dependency on Russian-origin equipment. Thus, such focus by the military sector is likely to lead to the development of helical antenna production sites and new entrants in the market.

Helical Antenna Market Regional Insights

The regional trends and factors influencing the Helical Antenna Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Helical Antenna Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Helical Antenna Market

Helical Antenna Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 915.32 Million |

| Market Size by 2031 | US$ 1427 Million |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

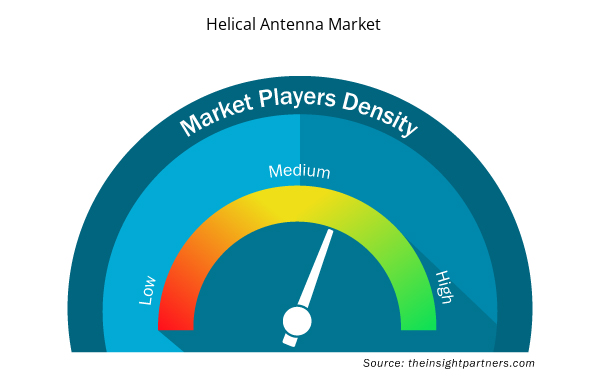

Helical Antenna Market Players Density: Understanding Its Impact on Business Dynamics

The Helical Antenna Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Helical Antenna Market are:

- Mobile Mark, Inc.

- COMSOL, Inc.

- Cobham plc

- Professional Wireless Systems

- Pulse Electronics (Yageo Company)

- PCTEL Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Helical Antenna Market top key players overview

Helical Antenna Market News and Recent Developments

The Helical Antenna Marketis evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In September 2023, Calian broadened its line of Smart GNSS Antennas beyond its current dual feed patch antenna platform to include antennas based on its patented helical GNSS element to target the unmanned aerial vehicle (UAV) market. The HCS885XF/HCS885EXF combines the excellent performance and light weight of the Calian dual-band (GPS/QZSS L1/L5, GLONASS G1/G3, Galileo E1/E5a/b, BeiDou B1/B2/B2a) HC885SXF antenna with the low power consumption and GNSS augmentation capabilities of the u-blox NEO-F9P GNSS receiver. This tightly coupled pairing delivers a high precision RTK/PPP-RTK capable Smart Helical Antenna supporting precise heading, perfect for industrial use UAVs, land survey devices, automotive positioning, and other precise positioning/heading applications. (Source: Calian, Press Release, 2023)

- In December 2023, Raytheon, an RTX (NYSE: RTX) business, announced that they would design, build, and test two high-power microwave antenna systems that will use directed energy to defeat airborne threats at the speed of light. The systems are designed to be rugged and transportable for front-line deployment. Under the three-year, US$ 31.3 million contract from the Naval Surface Warfare Center Dahlgren Division, Raytheon will deliver prototype systems to the US Navy and US Air Force as part of the Directed Energy Front-line Electromagnetic Neutralization and Defeat (DEFEND) program. (Source: Raytheon, Press Release, 2023)

Helical Antenna Market Report Coverage and Deliverables

The “Helical Antenna Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Mexico, Netherlands, Saudi Arabia, Singapore, South Africa, South Korea, Sweden, Switzerland, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the estimated market size for the global helical antenna market in 2023?

The global helical antenna market was estimated to be US$ 915.32 million in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period 2023 - 2031.

What are the driving factors impacting the global helical antenna market?

The rise in connected devices and growing UAV deployments are the major factors that propel the global helical antenna market.

What are the future trends of the global helical antenna market?

Adoption in emerging applications is anticipated to play a significant role in the global helical antenna market in the coming years.

Which are the key players holding the major market share of the global helical antenna market?

The key players holding majority shares in the global helical antenna market are Cobham plc, Professional Wireless Systems, Raltron Electronics Corporation, Taoglas, and Calian GNSS Ltd.

What will be the market size of the global helical antenna market by 2031?

The global helical antenna market is expected to reach US$ 1427 million by 2031.

What is the incremental growth of the global helical antenna market during the forecast period?

The incremental growth expected to be recorded for the global helical antenna market during the forecast period is US$ 511.68 million.

Get Free Sample For

Get Free Sample For